Form 8843 Instruction

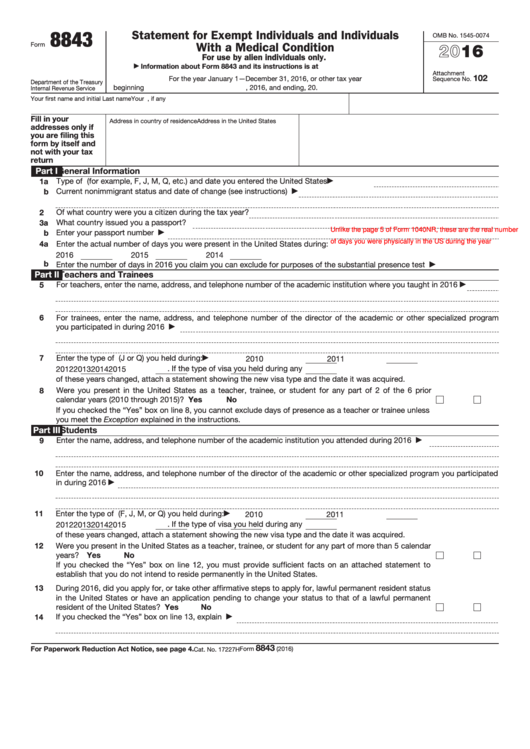

Form 8843 Instruction - It should be filled out for every nonresident present in the u.s. Deadlines, filing instructions, penalty for not filing form 8843. If you have dependent family • present in the u.s. Below are instructions to fill out and submit form 8843 and supporting documents to the u.s. It is a straightforward form with simple instructions outlined below. Web instructions for form 8843. This guide has been created to assist you in completing the form 8843. Web form 8843 filing instructions. The irs also has additional guidance on completing form 8843.

Below are instructions to fill out and submit form 8843 and supporting documents to the u.s. • present in the u.s. For any day during 2021. It is a straightforward form with simple instructions outlined below. Web if you did not receive any taxable income last year, you can file the 8843 form by hand. For foreign nationals who had no u.s. Alien individuals use form 8843 to explain excluded days of presence in the u.s. For more information, please refer to irs instructions for form 8843 It is an informational statement required by the irs for nonresidents for tax purposes. 3a what country or countries issued you a passport?

Web form 8843 filing instructions. Web instructions for form 8843. If you have dependent family The irs also has additional guidance on completing form 8843. Web if you did not receive any taxable income last year, you can file the 8843 form by hand. It should be filled out for every nonresident present in the u.s. For any day during 2021. Source income in the prior calendar year, year, this is the only form needed. Web information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent updates, related forms, and instructions on how to file. Below are instructions to fill out and submit form 8843 and supporting documents to the u.s.

What is Form 8843 and How Do I File it? Sprintax Blog

Web what is form 8843 and who should file it with the irs? For the substantial presence test. The purpose of form 8843 is to demonstrate to the u.s. Web form 8843 is not a u.s. Web instructions for form 8843.

8843 Form Tutorial YouTube

Web form 8843 must be filed if an individual is: Web form 8843 filing instructions. For more information, please refer to irs instructions for form 8843 How do i complete form 8843? Web instructions for form 8843.

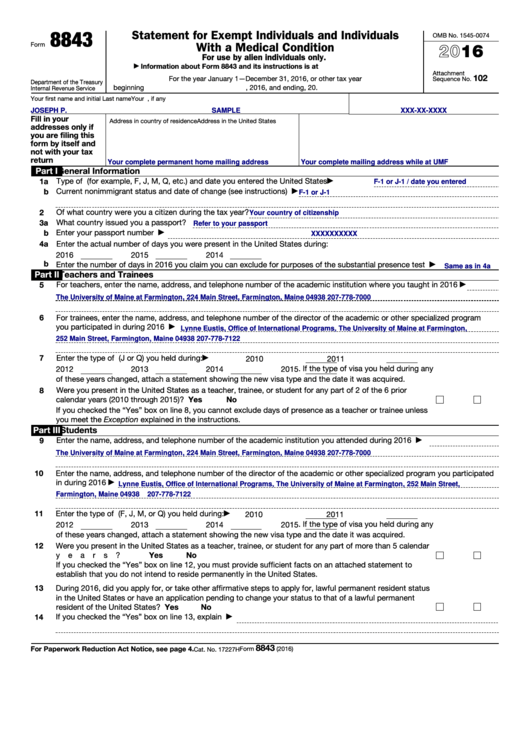

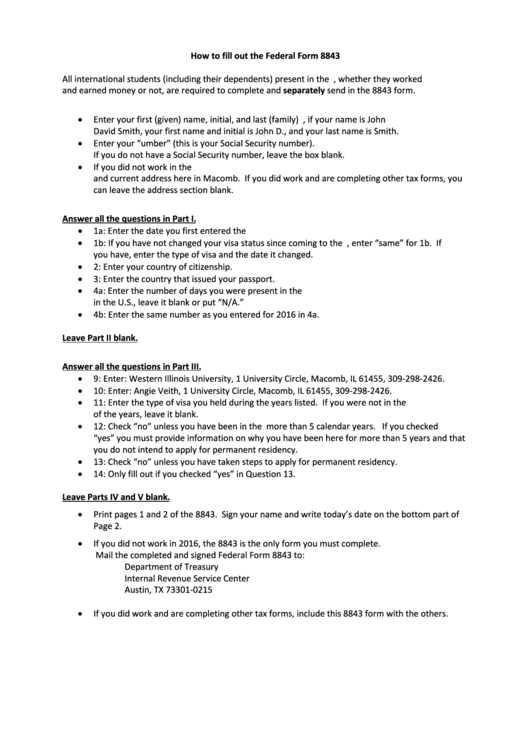

Tax how to file form 8843 (1)

For more information, please refer to irs instructions for form 8843 For the substantial presence test. If you have dependent family Web form 8843 is not a u.s. Web information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent updates, related forms, and instructions on how to file.

Form 8843 YouTube

The irs also has additional guidance on completing form 8843. For the substantial presence test. For any day during 2021. 2 of what country or countries were you a citizen during the tax year? If you have dependent family

Fillable Form 8843 Statement For Exempt Individuals And Individuals

How do i complete form 8843? It is a simplified version of the irs instructions found on pp. For any day during 2021. Alien individuals use form 8843 to explain excluded days of presence in the u.s. Deadlines, filing instructions, penalty for not filing form 8843.

How To Fill Out The Federal Form 8843 printable pdf download

Web form 8843 filing instructions. 3a what country or countries issued you a passport? Government that you are eligible for nonresident alien status for tax purposes and therefore exempt from being taxed on income you may have from outside the u.s. The purpose of form 8843 is to demonstrate to the u.s. Below are instructions to fill out and submit.

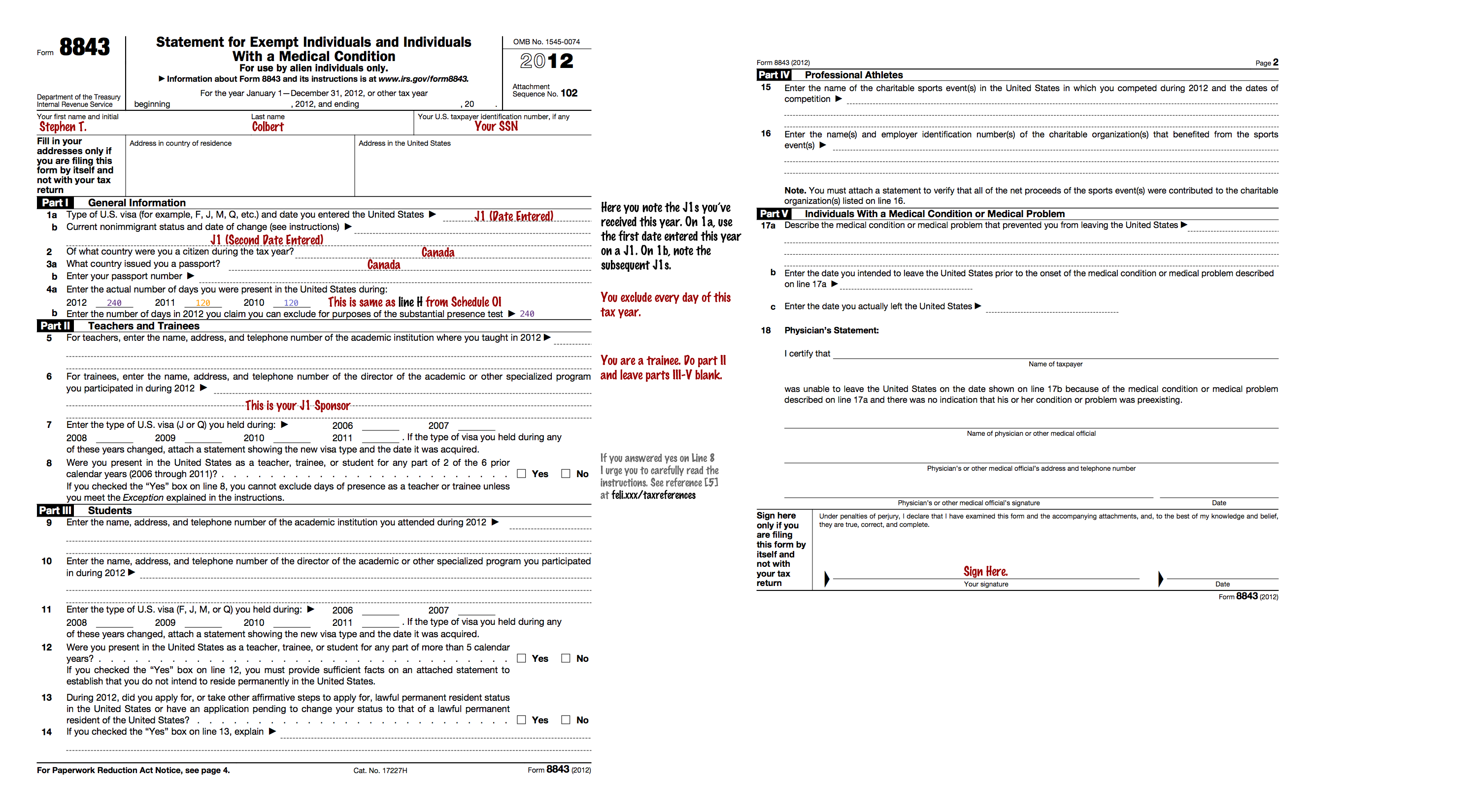

Unofficial UWaterloo Intern USA Tax Guide

Web you must file form 8843 by june 15, 2022. Web information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent updates, related forms, and instructions on how to file. Web form 8843 is not a u.s. It is an informational statement required by the irs for nonresidents for tax purposes. 3a what country.

Form 8843 Draft Statement For Exempt Individuals And Individuals With

Source income in the prior calendar year, year, this is the only form needed. Web form 8843 filing instructions. 3a what country or countries issued you a passport? How to fill out form 8843 easily online with sprintax. It should be filled out for every nonresident present in the u.s.

Form 8843 Statement for Exempt Individuals and Individuals with a

Web if you did not receive any taxable income last year, you can file the 8843 form by hand. • a nonresident alien (an individual who has not passed the green card test or the substantial presence test.) • present in the u.s. For foreign nationals who had no u.s. Below are instructions to fill out and submit form 8843.

IRS Form 8843 Editable and Printable Statement to Fill out

Government that you are eligible for nonresident alien status for tax purposes and therefore exempt from being taxed on income you may have from outside the u.s. It is a straightforward form with simple instructions outlined below. It is a simplified version of the irs instructions found on pp. Web you must file form 8843 by june 15, 2022. For.

• Present In The U.s.

For any day during 2021. Source income in the prior calendar year, year, this is the only form needed. The purpose of form 8843 is to demonstrate to the u.s. Below are instructions to fill out and submit form 8843 and supporting documents to the u.s.

4A Enter The Actual Number Of Days You Were Present In The United States During:

It is a simplified version of the irs instructions found on pp. Web if you did not receive any taxable income last year, you can file the 8843 form by hand. Deadlines, filing instructions, penalty for not filing form 8843. If you have dependent family

The Irs Also Has Additional Guidance On Completing Form 8843.

It should be filled out for every nonresident present in the u.s. Government that you are eligible for nonresident alien status for tax purposes and therefore exempt from being taxed on income you may have from outside the u.s. Web you must file form 8843 by june 15, 2022. 2 of what country or countries were you a citizen during the tax year?

Web Form 8843 Filing Instructions.

Web information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent updates, related forms, and instructions on how to file. How to fill out form 8843 easily online with sprintax. How do i complete form 8843? For more information, please refer to irs instructions for form 8843