Form 8832 Llc

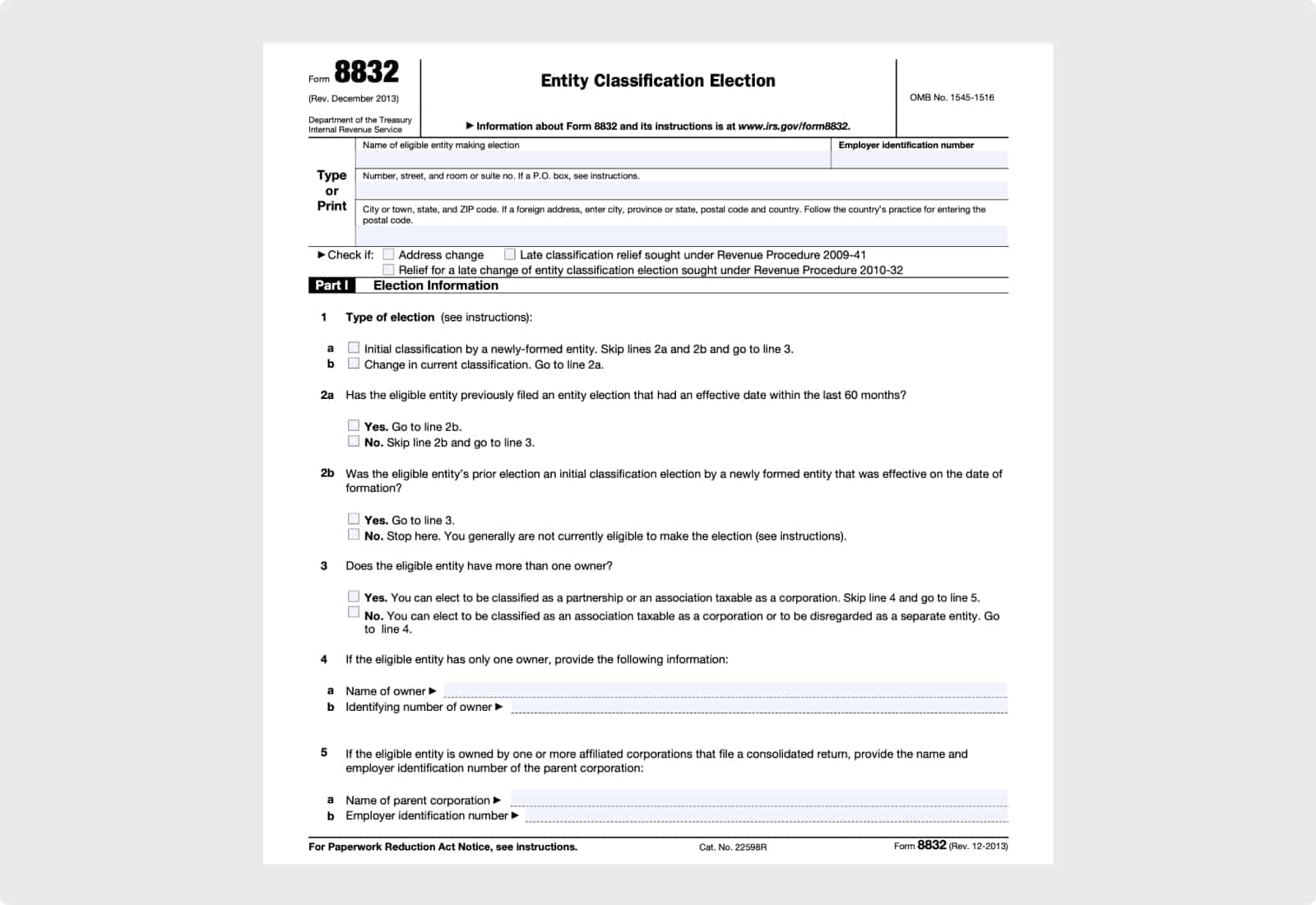

Form 8832 Llc - For example, an llc can elect to be taxed as a c corporation. Web information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file. Run payroll and benefits with gusto get started quick links why would i change my tax classification? Web form 8832 is the entity classification election form from the irs. Form 8832 is used by eligible entities to choose how they are classified for federal tax purposes. Web form 8832 is the document llcs submit to the irs to change their default tax classification. However, the following types of corporations are treated as eligible entities: It is filed to elect a tax status other than the default status for your entity. Web a limited liability company (llc) may face these issues. Web form 8832 is the irs form a new limited liability company (llc) uses to elect how it wants to be taxed or an established llc uses to change its current tax classification.

Form 8832 is used by eligible entities to choose how they are classified for federal tax purposes. For income tax purposes, an llc with only one member is treated as an entity disregarded as separate from its owner, unless it files form 8832 and affirmatively elects to be. Web information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file. An llc that is not automatically classified as a corporation and does not file form 8832 will be classified, for federal tax purposes under the default rules. What types of businesses need form 8832? However, the following types of corporations are treated as eligible entities: Web form 8832 is the irs form a new limited liability company (llc) uses to elect how it wants to be taxed or an established llc uses to change its current tax classification. Run payroll and benefits with gusto get started quick links why would i change my tax classification? Web form 8832 is the document llcs submit to the irs to change their default tax classification. Here’s a quick overview of form 8832:

For income tax purposes, an llc with only one member is treated as an entity disregarded as separate from its owner, unless it files form 8832 and affirmatively elects to be. Run payroll and benefits with gusto get started quick links why would i change my tax classification? Web form 8832 is the entity classification election form from the irs. Web eligible entities include limited liability companies (llcs) and partnerships. Web in our simple guide, we'll walk you through form 8832 instructions so you can change how your organization will be classified for federal taxation purposes. Web when choosing how they want their firms to be taxed, llc business owners utilize irs form 8832, the entity classification election form. Web a domestic llc with at least two members is classified as a partnership for federal income tax purposes unless it files form 8832 and elects to be treated as a corporation. It is filed to elect a tax status other than the default status for your entity. Web information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file. Web form 8832 is the irs form a new limited liability company (llc) uses to elect how it wants to be taxed or an established llc uses to change its current tax classification.

USING FORM 8832 TO CHANGE THE US TAX CLASSIFICATION OF YOUR COMPANY

Here’s a quick overview of form 8832: Web in our simple guide, we'll walk you through form 8832 instructions so you can change how your organization will be classified for federal taxation purposes. Web information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file. Web eligible entities include limited liability companies (llcs).

Using Form 8832 to Change Your LLC’s Tax Classification

For income tax purposes, an llc with only one member is treated as an entity disregarded as separate from its owner, unless it files form 8832 and affirmatively elects to be. For example, an llc can elect to be taxed as a c corporation. It is filed to elect a tax status other than the default status for your entity..

Form 8832 and Changing Your LLC Tax Status Bench Accounting

Web form 8832 is the irs form a new limited liability company (llc) uses to elect how it wants to be taxed or an established llc uses to change its current tax classification. For example, an llc can elect to be taxed as a c corporation. An llc can be classified as a corporation, partnership, or disregarded entity for federal.

What is Form 8832 and How Do I File it?

Run payroll and benefits with gusto get started quick links why would i change my tax classification? What types of businesses need form 8832? It is filed to elect a tax status other than the default status for your entity. However, the following types of corporations are treated as eligible entities: Here’s a quick overview of form 8832:

LLC vs. Corporation (Which One Should I Choose?) SimplifyLLC

Llcs are formed at the state level. Run payroll and benefits with gusto get started quick links why would i change my tax classification? Web form 8832 is the irs form a new limited liability company (llc) uses to elect how it wants to be taxed or an established llc uses to change its current tax classification. Web form 8832.

Form 8832 All About It and How to File It?

Web a limited liability company (llc) may face these issues. An eligible entity that previously electedto be an association taxable as a corporation by filing form 8832. What types of businesses need form 8832? It is filed to elect a tax status other than the default status for your entity. Run payroll and benefits with gusto get started quick links.

Irs Form 8832 Fillable Pdf Printable Forms Free Online

Run payroll and benefits with gusto get started quick links why would i change my tax classification? Web when choosing how they want their firms to be taxed, llc business owners utilize irs form 8832, the entity classification election form. Most commonly, it’s used if you want your llc to be taxed as a c corporation. Web eligible entities include.

Form 8832 Fillable Online and PDF eSign Genie

Form 8832 is used by eligible entities to choose how they are classified for federal tax purposes. Web form 8832 is the irs form a new limited liability company (llc) uses to elect how it wants to be taxed or an established llc uses to change its current tax classification. Llcs are formed at the state level. Web information about.

Using Form 8832 to Change Your LLC’s Tax Classification

Llcs are formed at the state level. Web a domestic llc with at least two members is classified as a partnership for federal income tax purposes unless it files form 8832 and elects to be treated as a corporation. For income tax purposes, an llc with only one member is treated as an entity disregarded as separate from its owner,.

LLC taxed as CCorp (Form 8832) [Pros and cons] LLCU® (2023)

Run payroll and benefits with gusto get started quick links why would i change my tax classification? Web a domestic llc with at least two members is classified as a partnership for federal income tax purposes unless it files form 8832 and elects to be treated as a corporation. Generally, corporations are not eligible entities. Most commonly, it’s used if.

Web Eligible Entities Include Limited Liability Companies (Llcs) And Partnerships.

Web form 8832 is the irs form a new limited liability company (llc) uses to elect how it wants to be taxed or an established llc uses to change its current tax classification. Here’s a quick overview of form 8832: An llc that is not automatically classified as a corporation and does not file form 8832 will be classified, for federal tax purposes under the default rules. Web form 8832 is the entity classification election form from the irs.

It Is Filed To Elect A Tax Status Other Than The Default Status For Your Entity.

Web when choosing how they want their firms to be taxed, llc business owners utilize irs form 8832, the entity classification election form. Llcs are formed at the state level. However, the following types of corporations are treated as eligible entities: Web in our simple guide, we'll walk you through form 8832 instructions so you can change how your organization will be classified for federal taxation purposes.

Run Payroll And Benefits With Gusto Get Started Quick Links Why Would I Change My Tax Classification?

Web form 8832 is the document llcs submit to the irs to change their default tax classification. Web a limited liability company (llc) may face these issues. An llc can be classified as a corporation, partnership, or disregarded entity for federal tax purposes, meaning that its revenue is reported on the owner’s personal federal income tax return. What types of businesses need form 8832?

Form 8832 Is Used By Eligible Entities To Choose How They Are Classified For Federal Tax Purposes.

An eligible entity that previously electedto be an association taxable as a corporation by filing form 8832. Most commonly, it’s used if you want your llc to be taxed as a c corporation. For income tax purposes, an llc with only one member is treated as an entity disregarded as separate from its owner, unless it files form 8832 and affirmatively elects to be. For example, an llc can elect to be taxed as a c corporation.

![LLC taxed as CCorp (Form 8832) [Pros and cons] LLCU® (2023)](https://www.llcuniversity.com/wp-content/uploads/IRS-CP277-Form-8832-Approval.jpg)