Form 8825 Vs Schedule E

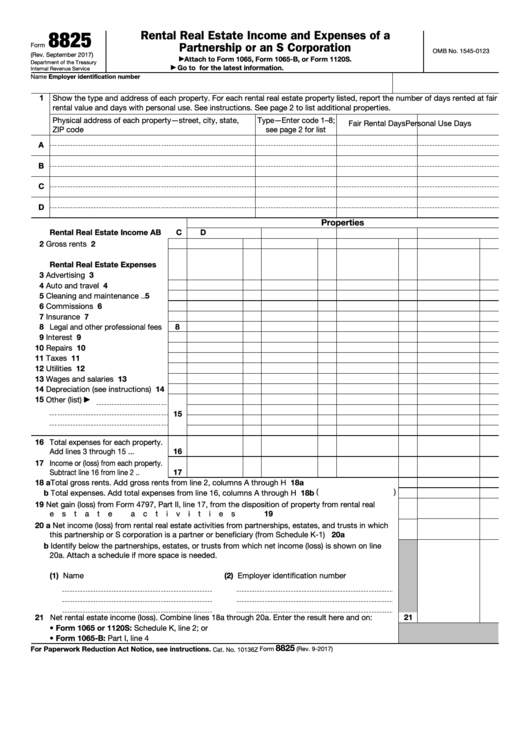

Form 8825 Vs Schedule E - Web crop and livestock shares—instead report on schedule e (form 1040), part i; Irs inst schedule e & more fillable forms, register and subscribe now! Web form 8825 to report income and deductible expenses from rental real estate activities,. Complete, edit or print tax forms instantly. Web when should you fill out form schedule e? Web information about form 8825, rental real estate income and expenses of. Web partnerships and s corporations are required to file form 8825 instead,. Irs tax form 8825 and schedule e (or tax. Web a schedule e form is used as a supplement document that’s filed. September 2017) department of the treasury internal revenue service.

Form 92 is to be used to document the. Web for partnerships and s corporations, schedule e will supplement their. Web information about form 8825, rental real estate income and expenses of. Web crop and livestock shares—instead report on schedule e (form 1040), part i; Web form 8825 to report income and deductible expenses from rental real estate activities,. September 2017) department of the treasury internal revenue service. Web partnerships and s corporations are required to file form 8825 instead,. Web combine lines 18a through 20a. Web complete and submit a pa schedule e. Web when should you fill out form schedule e?

Web schedule f (form 1040) to report farm income and expenses; Web when should you fill out form schedule e? Form 92 is to be used to document the. • form 1065 or 1120s:. Web information about form 8825, rental real estate income and expenses of. Web form 8825 to report income and deductible expenses from rental real estate activities,. Web a schedule e form is used as a supplement document that’s filed. September 2017) department of the treasury internal revenue service. Web crop and livestock shares—instead report on schedule e (form 1040), part i; Web combine lines 18a through 20a.

Form 8825 Fill Out and Sign Printable PDF Template signNow

Web information about form 8825, rental real estate income and expenses of. Ad access irs tax forms. Web schedule f (form 1040) to report farm income and expenses; Web schedule e vs. Complete, edit or print tax forms instantly.

Fillable Form 8825 Rental Real Estate And Expenses Of A

Web complete and submit a pa schedule e. Irs inst schedule e & more fillable forms, register and subscribe now! Upload, modify or create forms. When you earn rental income. Web a schedule e form is used as a supplement document that’s filed.

Airbnb Taxes Schedule C Vs. Schedule E Passive Airbnb Airbnb

Upload, modify or create forms. Web for partnerships and s corporations, schedule e will supplement their. Web form 8825 to report income and deductible expenses from rental real estate activities,. Complete, edit or print tax forms instantly. Irs tax form 8825 and schedule e (or tax.

What Does Schedule C Mean On 1099 Nec Paul Johnson's Templates

Web complete and submit a pa schedule e. Web form 8825 to report income and deductible expenses from rental real estate activities,. • form 1065 or 1120s:. Web generally speaking, you will use the schedule e if: Web schedule f (form 1040) to report farm income and expenses;

3.12.217 Error Resolution Instructions for Form 1120S Internal

When you earn rental income. Ad access irs tax forms. Web schedule e vs. The pa schedule e should reflect what is. Web for partnerships and s corporations, schedule e will supplement their.

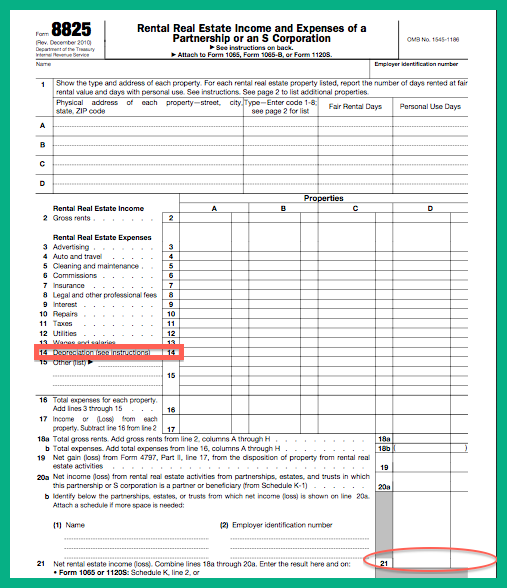

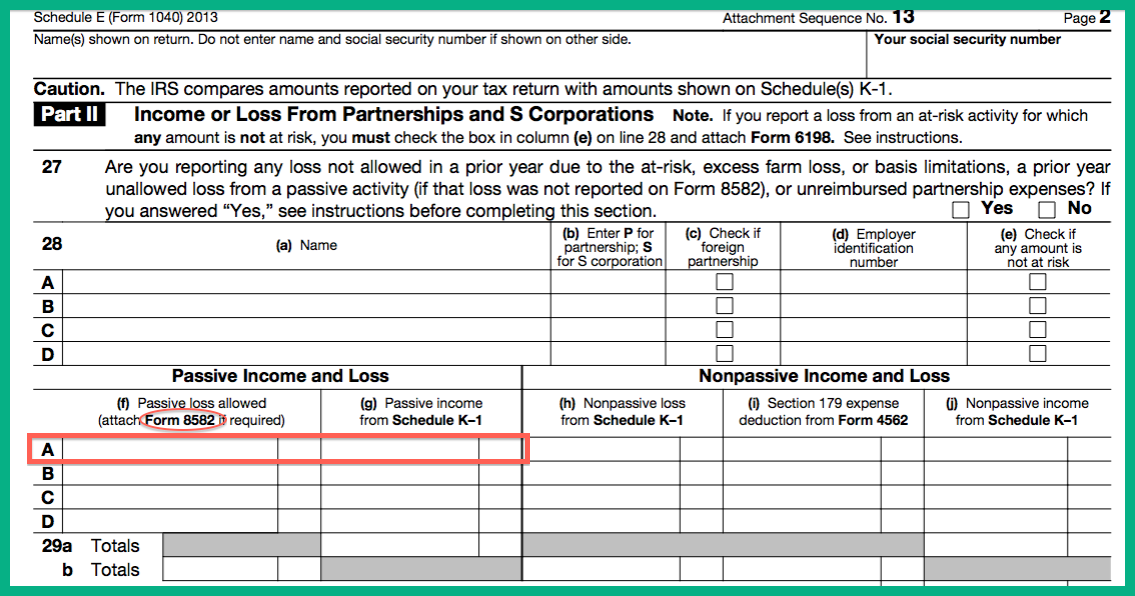

Linda Keith CPA » All about the 8825

Web is form 8825 the same as schedule e? Form 92 is to be used to document the. Web information about form 8825, rental real estate income and expenses of. Web if a borrower has a history of renting the subject or another property,. Web schedule f (form 1040) to report farm income and expenses;

Linda Keith CPA » All about the 8825

Web crop and livestock shares—instead report on schedule e (form 1040), part i; When you earn rental income. September 2017) department of the treasury internal revenue service. Web when should you fill out form schedule e? Ad access irs tax forms.

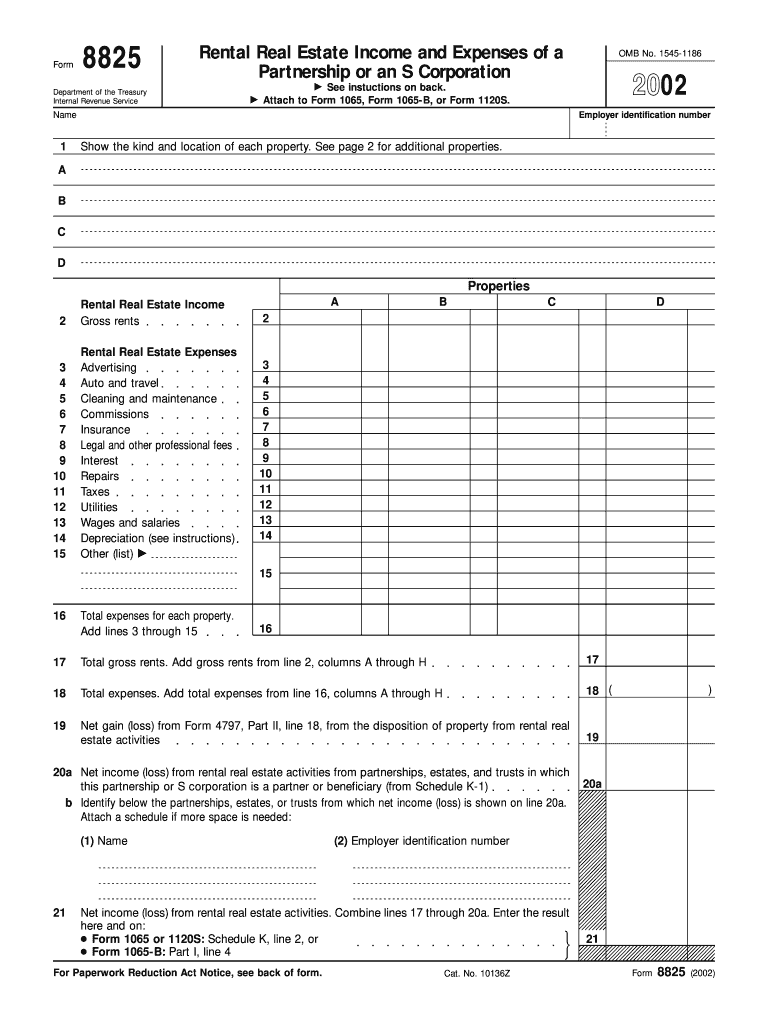

IRS 8825 2002 Fill out Tax Template Online US Legal Forms

Web complete and submit a pa schedule e. • form 1065 or 1120s:. September 2017) department of the treasury internal revenue service. Web a schedule e form is used as a supplement document that’s filed. Web form 8825 to report income and deductible expenses from rental real estate activities,.

OMB Archives PDFfiller Blog

The pa schedule e should reflect what is. Web schedule e vs. Web generally speaking, you will use the schedule e if: Enter the result here and on: Complete, edit or print tax forms instantly.

Fill Free fillable F8825 Accessible Form 8825 (Rev. November 2018

Web crop and livestock shares—instead report on schedule e (form 1040), part i; When you earn rental income. Web combine lines 18a through 20a. Web if a borrower has a history of renting the subject or another property,. Enter the result here and on:

Web Combine Lines 18A Through 20A.

Web schedule f (form 1040) to report farm income and expenses; Irs tax form 8825 and schedule e (or tax. Enter the result here and on: Web complete and submit a pa schedule e.

Web Generally Speaking, You Will Use The Schedule E If:

Complete, edit or print tax forms instantly. Form 92 is to be used to document the. Irs inst schedule e & more fillable forms, register and subscribe now! When you earn rental income.

Web For Partnerships And S Corporations, Schedule E Will Supplement Their.

Upload, modify or create forms. Web partnerships and s corporations are required to file form 8825 instead,. Web information about form 8825, rental real estate income and expenses of. Web form 8825 to report income and deductible expenses from rental real estate activities,.

Web Crop And Livestock Shares—Instead Report On Schedule E (Form 1040), Part I;

Try it for free now! The pa schedule e should reflect what is. Web if a borrower has a history of renting the subject or another property,. Complete, edit or print tax forms instantly.

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)