Form 870 Irs

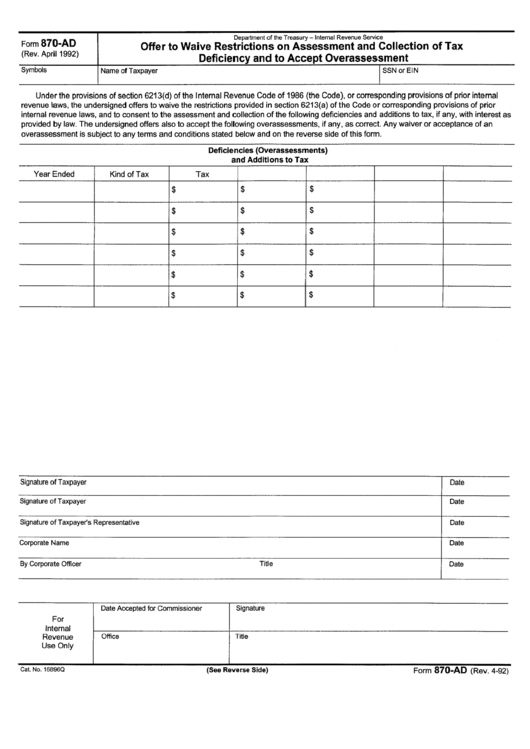

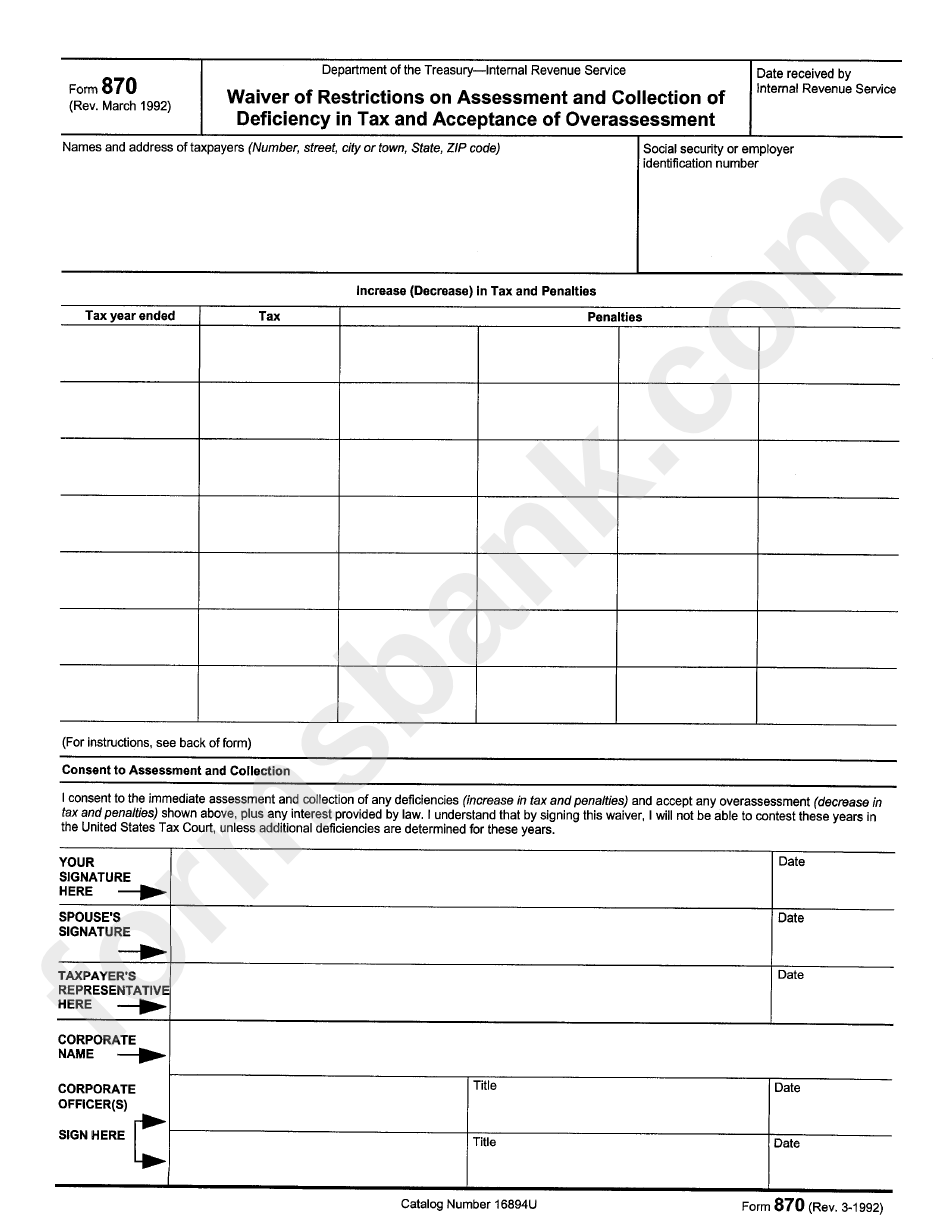

Form 870 Irs - Web select the get form button to begin editing. An offer in compromise agreement; 1998 tax decrease 1999 tax increase 2000 2001 tax. Web the form 870 should be signed and submitted to the address listed for irs by the debtor. Web after the irs enters into a closing agreement. If the irs agrees to enter into a closing agreement, it may still ask the taxpayer to sign a form 870. Web there are several ways to submit form 4868. March 1992) waiver of restrictions on assessment and collection of. Web form 870, waiver of restrictions on assessment & collection of deficiency in tax & acceptance of overassessment. Fill out each fillable field.

Web form 870 means internal revenue service form 870, waiver of restrictions on assessment and collection of deficiency in tax and acceptance of overassessment,. March 1992) waiver of restrictions on assessment and collection of. Fill out each fillable field. Open the downloaded pdf file using a pdf reader or editor. Web up to $40 cash back how to fill out irs form 3870 pdf: Web an irs form 870, “internal revenue service return for certification of status” (see pdf for the complete form text), includes the income tax withheld and payable, withholding on. Get ready for tax season deadlines by completing any required tax forms today. Web there are several ways to submit form 4868. Web select the get form button to begin editing. Web you previously agreed to pay the amount you owe by signing an agreement such as an irs form 906, closing agreement;

Web form 870 means internal revenue service form 870, waiver of restrictions on assessment and collection of deficiency in tax and acceptance of overassessment,. Web an irs form 870, “internal revenue service return for certification of status” (see pdf for the complete form text), includes the income tax withheld and payable, withholding on. If the irs agrees to enter into a closing agreement, it may still ask the taxpayer to sign a form 870. Download the irs form 3870 pdf from the official irs website. Web there are several ways to submit form 4868. Web under certain circumstances (when deemed appropriate by the appeals officer and agreed to by an appeals manager) proceed with a settlement of the affected year by. For more information about form 870, refer to the instructions in the notice of federal. 1998 tax decrease 1999 tax increase 2000 2001 tax. Make sure the info you fill in irs form 8870. An offer in compromise agreement;

Irs Form 8379 Pdf Form Resume Examples 3q9JkkdgYA

Web select the get form button to begin editing. Web the form 870 should be signed and submitted to the address listed for irs by the debtor. Web up to $40 cash back how to fill out irs form 3870 pdf: Web under certain circumstances (when deemed appropriate by the appeals officer and agreed to by an appeals manager) proceed.

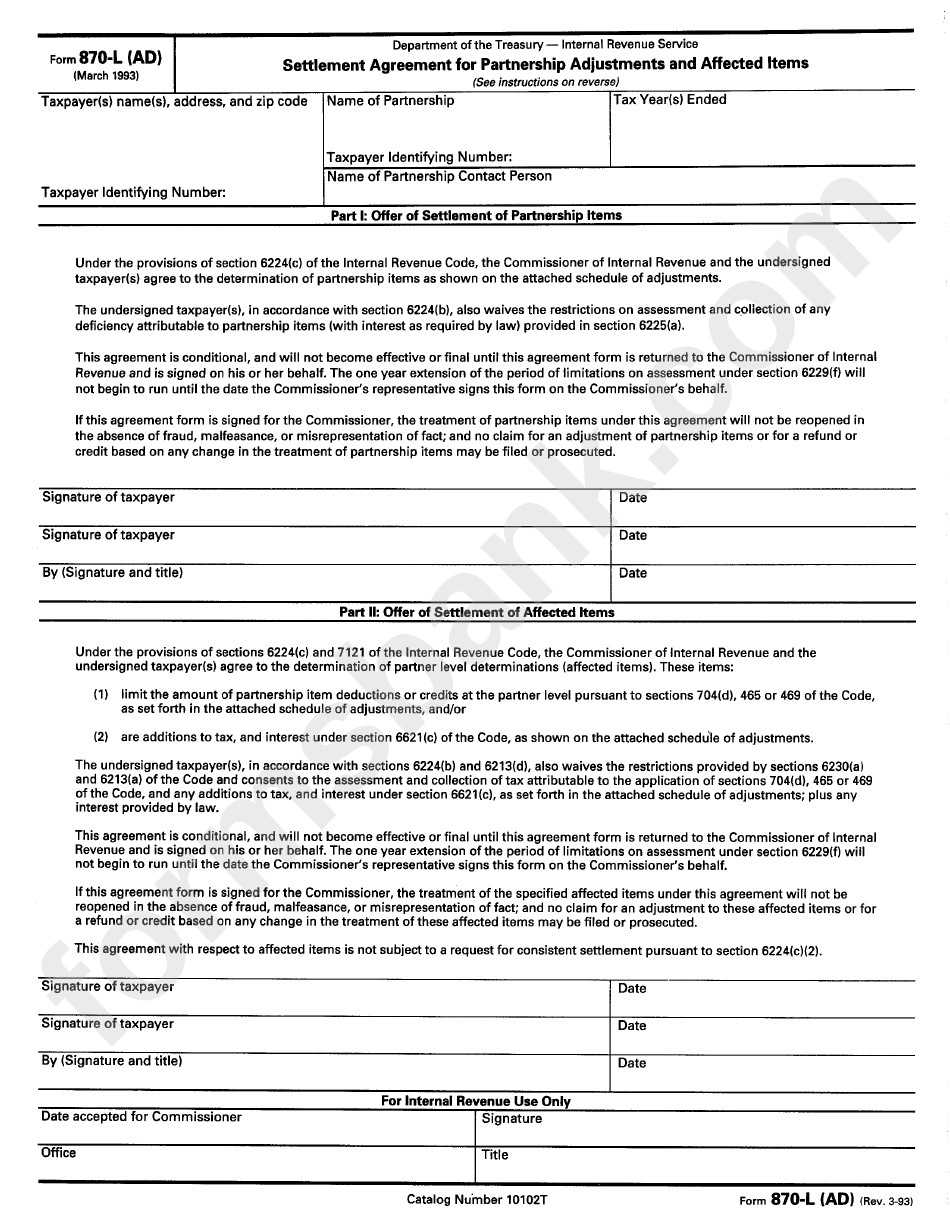

Form 870Ad Offer To Waive Restrictions On Assessment And Collection

1998 tax decrease 1999 tax increase 2000 2001 tax. Complete, edit or print tax forms instantly. Web after the irs enters into a closing agreement. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web an irs form 870, “internal revenue service return for certification of status” (see pdf for.

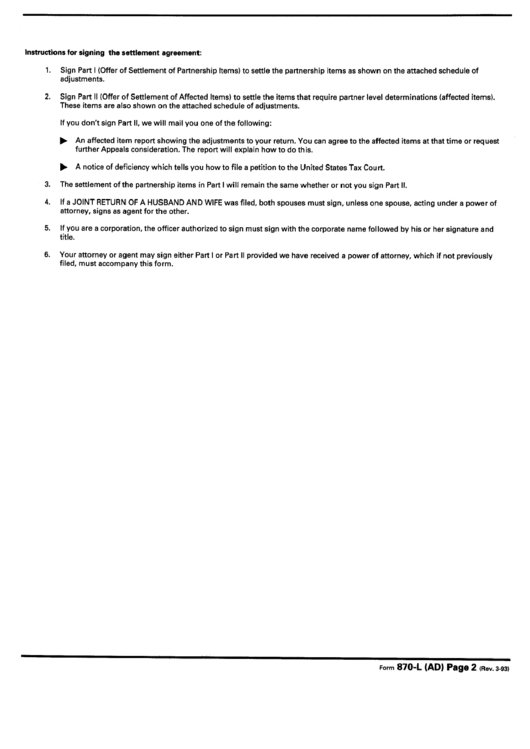

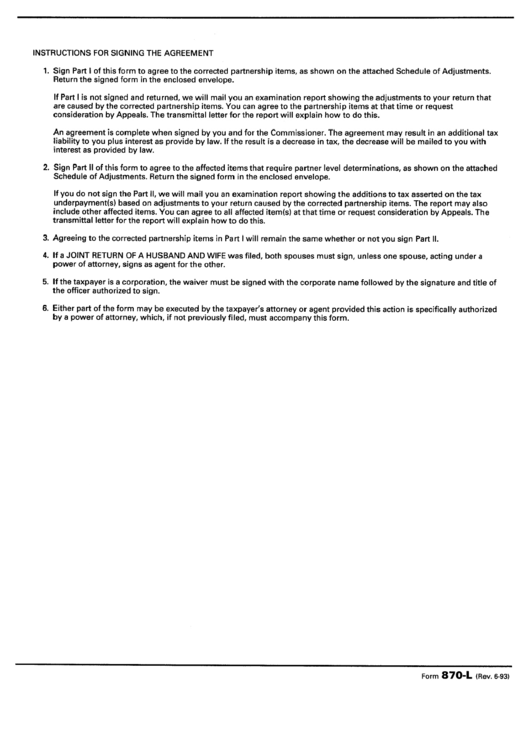

Instructions For Form 870L(Ad) 1993 printable pdf download

Web form 870 means internal revenue service form 870, waiver of restrictions on assessment and collection of deficiency in tax and acceptance of overassessment,. Web the form 870 should be signed and submitted to the address listed for irs by the debtor. Complete, edit or print tax forms instantly. If the irs agrees to enter into a closing agreement, it.

8.19.11 Agreed TEFRA Partnership Cases Internal Revenue Service

Web information about form 8870, information return for transfers associated with certain personal benefit contracts, including recent updates, related forms and. Get ready for tax season deadlines by completing any required tax forms today. Make sure the info you fill in irs form 8870. If the irs agrees to enter into a closing agreement, it may still ask the taxpayer.

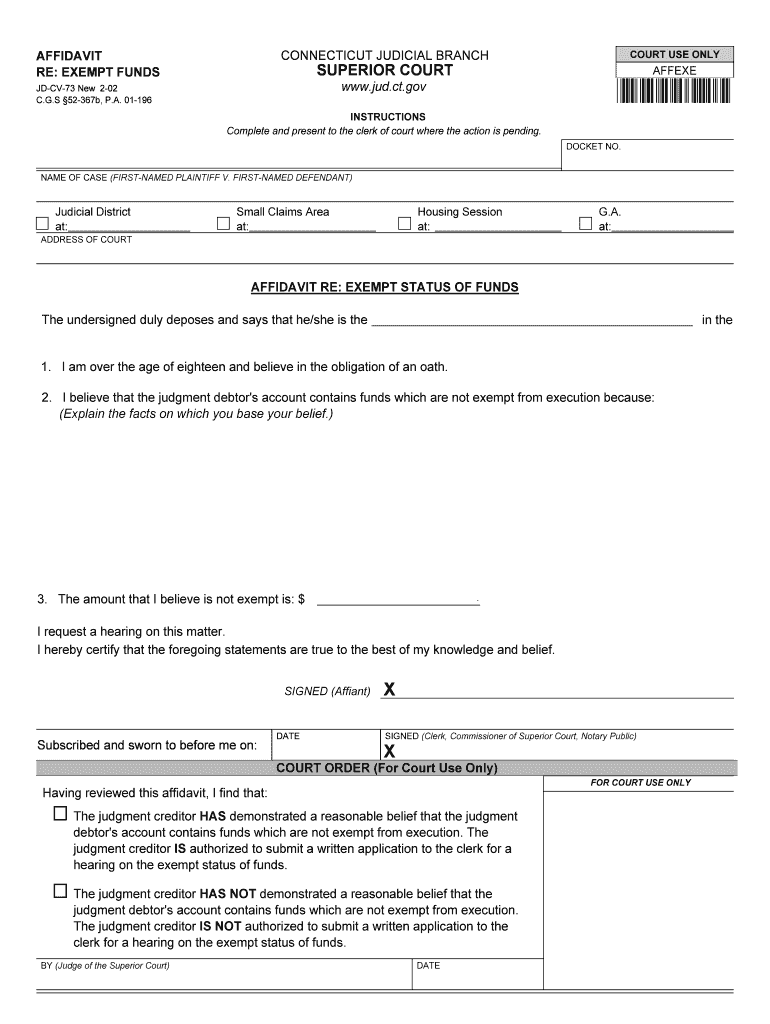

Chapter 870 Judicial Department Cga Ct Gov Form Fill Out and Sign

Web after the irs enters into a closing agreement. Web form 870 means internal revenue service form 870, waiver of restrictions on assessment and collection of deficiency in tax and acceptance of overassessment,. Fill out each fillable field. 1998 tax decrease 1999 tax increase 2000 2001 tax. Ad complete irs tax forms online or print government tax documents.

Form 870 Waiver Of Restrictions On Assessment And Collection Of

Web after the irs enters into a closing agreement. Web information about form 8870, information return for transfers associated with certain personal benefit contracts, including recent updates, related forms and. If the irs agrees to enter into a closing agreement, it may still ask the taxpayer to sign a form 870. Get ready for tax season deadlines by completing any.

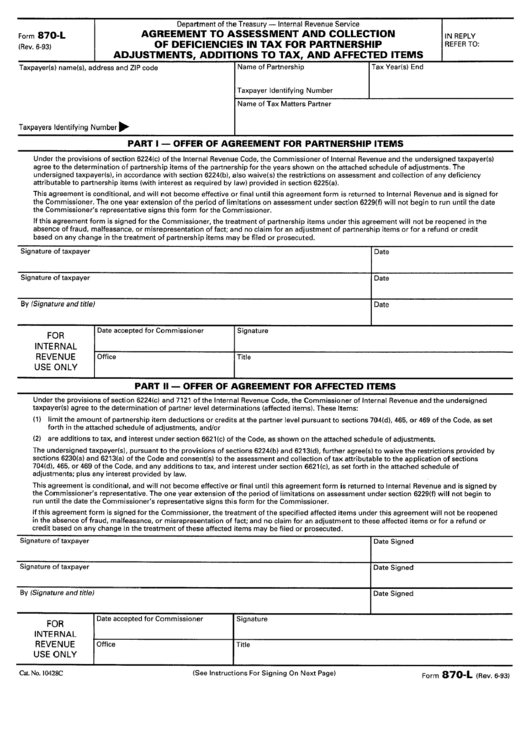

Form 870L Agreement To Assessment And Collection Of Deficiencies In

Web the form 870 should be signed and submitted to the address listed for irs by the debtor. Web you previously agreed to pay the amount you owe by signing an agreement such as an irs form 906, closing agreement; Web form 870 means internal revenue service form 870, waiver of restrictions on assessment and collection of deficiency in tax.

Form 870L(Ad) Settlement Agreement For Partnership Adjustment And

Download the irs form 3870 pdf from the official irs website. Web there are several ways to submit form 4868. Open the downloaded pdf file using a pdf reader or editor. Ad complete irs tax forms online or print government tax documents. Web under certain circumstances (when deemed appropriate by the appeals officer and agreed to by an appeals manager).

Top 15 Irs Form 870 Templates free to download in PDF format

Web after the irs enters into a closing agreement. Web up to $40 cash back how to fill out irs form 3870 pdf: (revised april, 1992) this offer must be. An offer in compromise agreement; Web the function of the appeals office is to resolve tax controversies, without litigation, on a basis which is fair and impartial to both the.

8.19.1 Procedures and Authorities Internal Revenue Service

An offer in compromise agreement; Make sure the info you fill in irs form 8870. 1998 tax decrease 1999 tax increase 2000 2001 tax. Web the function of the appeals office is to resolve tax controversies, without litigation, on a basis which is fair and impartial to both the government and the taxpayer and in a. Taxpayers can file form.

Web Under Certain Circumstances (When Deemed Appropriate By The Appeals Officer And Agreed To By An Appeals Manager) Proceed With A Settlement Of The Affected Year By.

Web an irs form 870, “internal revenue service return for certification of status” (see pdf for the complete form text), includes the income tax withheld and payable, withholding on. Download the irs form 3870 pdf from the official irs website. Open the downloaded pdf file using a pdf reader or editor. March 1992) waiver of restrictions on assessment and collection of.

An Offer In Compromise Agreement;

Web select the get form button to begin editing. Get ready for tax season deadlines by completing any required tax forms today. For more information about form 870, refer to the instructions in the notice of federal. Web form 870 means internal revenue service form 870, waiver of restrictions on assessment and collection of deficiency in tax and acceptance of overassessment,.

If The Irs Agrees To Enter Into A Closing Agreement, It May Still Ask The Taxpayer To Sign A Form 870.

Web you previously agreed to pay the amount you owe by signing an agreement such as an irs form 906, closing agreement; Make sure the info you fill in irs form 8870. Web after the irs enters into a closing agreement. Web there are several ways to submit form 4868.

Ad Complete Irs Tax Forms Online Or Print Government Tax Documents.

(revised april, 1992) this offer must be. Web information about form 8870, information return for transfers associated with certain personal benefit contracts, including recent updates, related forms and. Web the form 870 should be signed and submitted to the address listed for irs by the debtor. Complete, edit or print tax forms instantly.