Form 8594 Instructions 2022

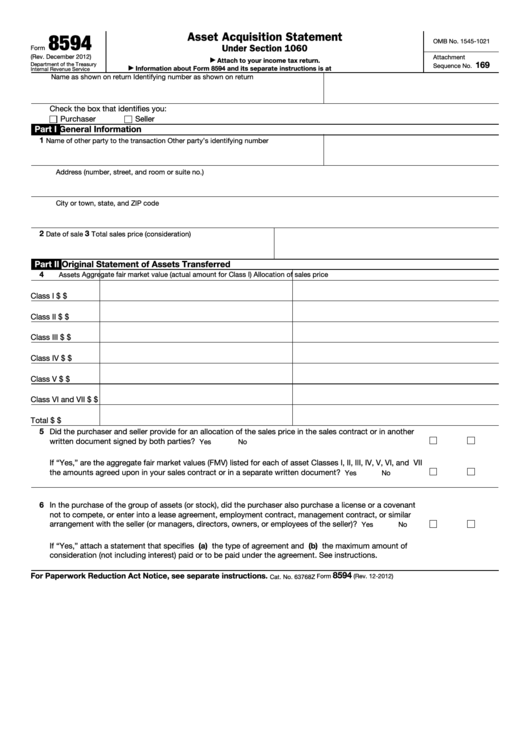

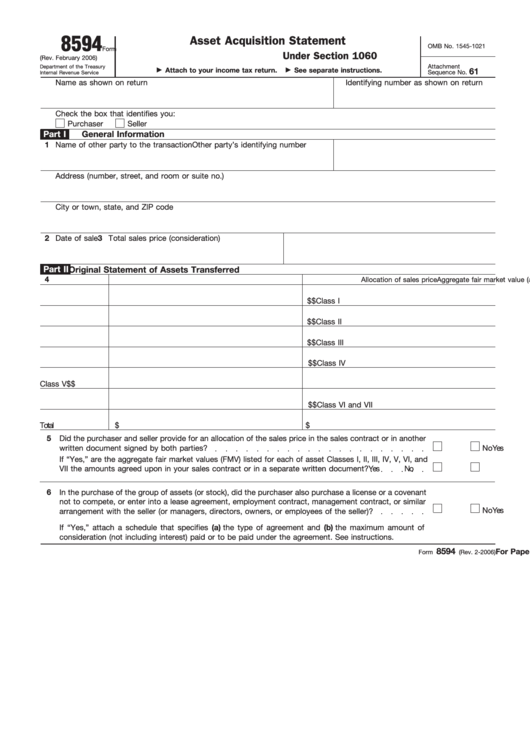

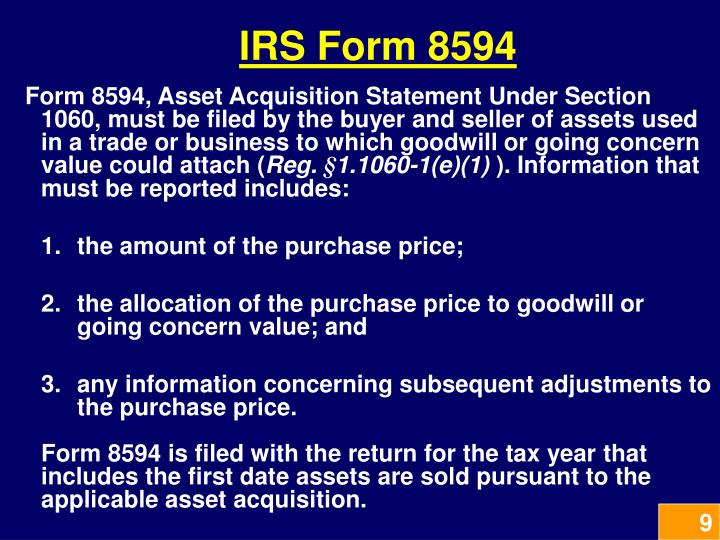

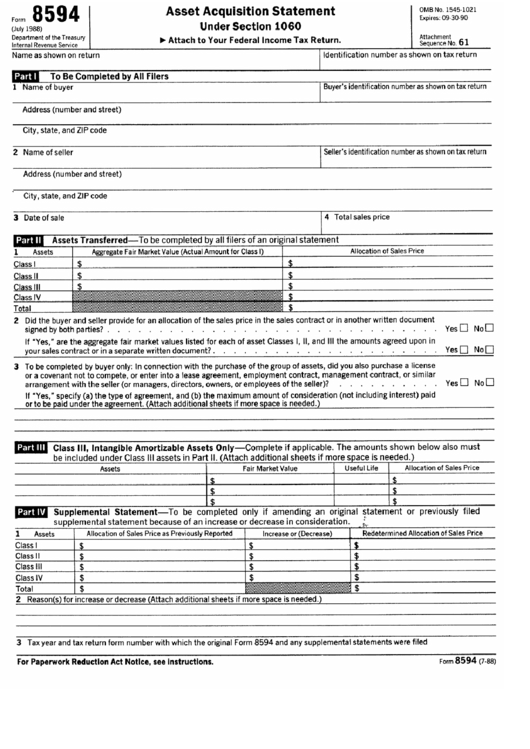

Form 8594 Instructions 2022 - Web instructions for form 8594 the irs instructs that both the buyer and seller must file the form and attach their income tax returns. The form must be filed when a group of assets were transferred (in a trade or business), and if the buyer’s basis in such assets is determined by the amount paid for the assets. You can print other federal tax forms here. November 2021) department of the treasury internal revenue service. Web form 8594 instructions list seven classes of assets. Enter the total consideration transferred for the assets. For asset acquisitions occurring after march 15, 2001, make the allocation among the following assets in proportion to (but not more than) their fair market value on the purchase date in the following order: The buyers and sellers of a group of assets that make up a business use form 8594 when goodwill or going concern value attaches. Web information about form 8594, asset acquisition statement under section 1060, including recent updates, related forms and instructions on how to file. Both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going concern value attaches, or could attach, to such assets and if the purchaser's basis in the assets is determined only by the amount paid for the assets.

The form must be filed when a group of assets were transferred (in a trade or business), and if the buyer’s basis in such assets is determined by the amount paid for the assets. Both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going concern value attaches, or could attach, to such assets and if the purchaser's basis in the assets is determined only by the amount paid for the assets. Web instructions instructions for form 4797 (2022) future developments instructions for form 4797 (2022) sales of business property (also involuntary conversions and recapture amounts under sections 179 and 280f (b) (2)) section references are to the internal revenue code unless otherwise noted. Web instructions for form 8594 the irs instructs that both the buyer and seller must file the form and attach their income tax returns. The buyers and sellers of a group of assets that make up a business use form 8594 when goodwill or going concern value attaches. Web both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going concern value attaches, or could attach, to such assets and if the purchaser's basis in the assets is determined only by the amount paid for the assets. For a particular class of assets, enter. Web we last updated the asset acquisition statement under section 1060 in february 2023, so this is the latest version of form 8594, fully updated for tax year 2022. Enter the name, address, and tin of the other party to the transaction. You can print other federal tax forms here.

The form must be filed when a group of assets were transferred (in a trade or business), and if the buyer’s basis in such assets is determined by the amount paid for the assets. Web information about form 8594, asset acquisition statement under section 1060, including recent updates, related forms and instructions on how to file. Web both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going concern value attaches, or could attach, to such assets and if the purchaser's basis in the assets is determined only by the amount paid for the assets. November 2021) department of the treasury internal revenue service. Enter the total consideration transferred for the assets. Enter the date on which the sale of the assets took place. Web we last updated the asset acquisition statement under section 1060 in february 2023, so this is the latest version of form 8594, fully updated for tax year 2022. Web instructions instructions for form 4797 (2022) future developments instructions for form 4797 (2022) sales of business property (also involuntary conversions and recapture amounts under sections 179 and 280f (b) (2)) section references are to the internal revenue code unless otherwise noted. Web form 8594 instructions list seven classes of assets. Web instructions for form 8594 the irs instructs that both the buyer and seller must file the form and attach their income tax returns.

Asset Statement Form 4 Free Templates in PDF, Word, Excel Download

November 2021) skip to main content Enter the name, address, and tin of the other party to the transaction. Web information about form 8594, asset acquisition statement under section 1060, including recent updates, related forms and instructions on how to file. Web form 8594 instructions list seven classes of assets. Enter the date on which the sale of the assets.

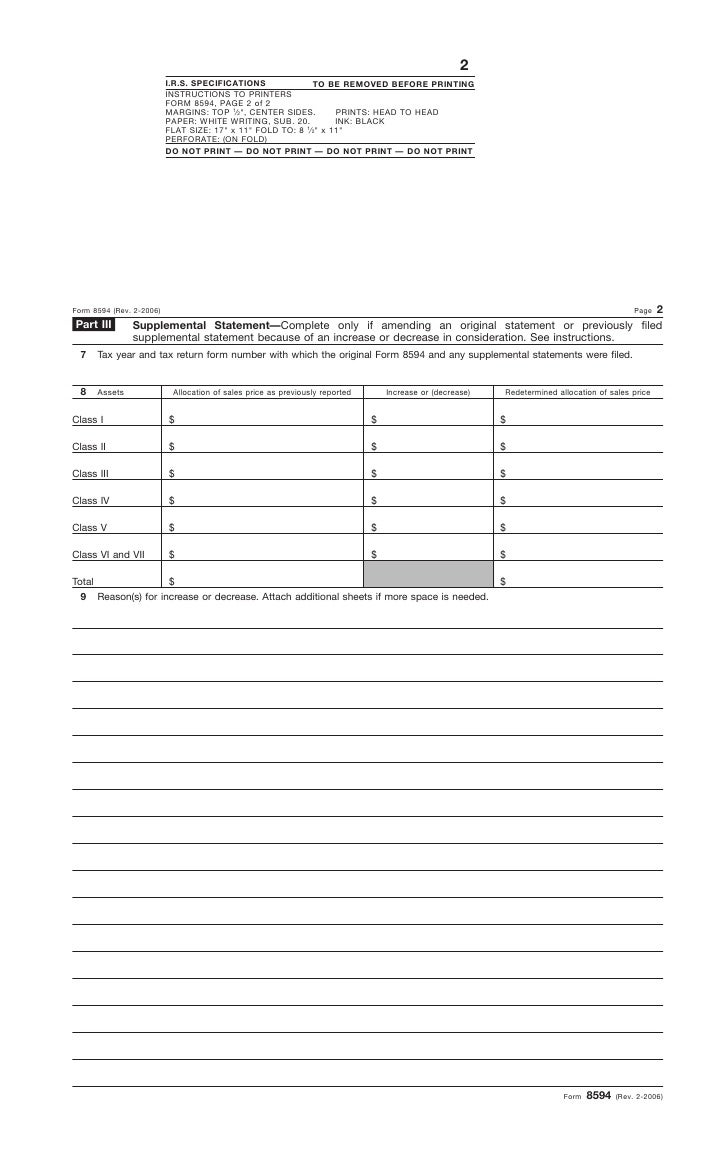

Fillable Form 8594 Asset Acquisition Statement printable pdf download

November 2021) department of the treasury internal revenue service. The buyers and sellers of a group of assets that make up a business use form 8594 when goodwill or going concern value attaches. For a particular class of assets, enter. Enter the name, address, and tin of the other party to the transaction. Web instructions for form 8594 the irs.

Printable 4730591 Rev A Bi Form 2014 00 005 Rev 0 Fill Online

For a particular class of assets, enter. The buyers and sellers of a group of assets that make up a business use form 8594 when goodwill or going concern value attaches. Enter the total consideration transferred for the assets. November 2021) skip to main content Both the seller and purchaser of a group of assets that makes up a trade.

Instructions for Form 8594

You can print other federal tax forms here. Web form 8594 instructions list seven classes of assets. The buyers and sellers of a group of assets that make up a business use form 8594 when goodwill or going concern value attaches. November 2021) skip to main content Enter the date on which the sale of the assets took place.

PPT Taxable Acquisitions PowerPoint Presentation ID3850409

Web instructions instructions for form 4797 (2022) future developments instructions for form 4797 (2022) sales of business property (also involuntary conversions and recapture amounts under sections 179 and 280f (b) (2)) section references are to the internal revenue code unless otherwise noted. Enter the name, address, and tin of the other party to the transaction. Web both the seller and.

Form 8594 Asset Acquisition Statement Under Section 1060 Internal

Enter the name, address, and tin of the other party to the transaction. Web instructions instructions for form 4797 (2022) future developments instructions for form 4797 (2022) sales of business property (also involuntary conversions and recapture amounts under sections 179 and 280f (b) (2)) section references are to the internal revenue code unless otherwise noted. For asset acquisitions occurring after.

Irs Form Purchase Of Business Leah Beachum's Template

Web information about form 8594, asset acquisition statement under section 1060, including recent updates, related forms and instructions on how to file. Both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going concern value attaches, or could attach, to such.

Form 8594Asset Acquisition Statement

The buyers and sellers of a group of assets that make up a business use form 8594 when goodwill or going concern value attaches. November 2021) department of the treasury internal revenue service. Web we last updated the asset acquisition statement under section 1060 in february 2023, so this is the latest version of form 8594, fully updated for tax.

Form 8594 Edit, Fill, Sign Online Handypdf

Enter the total consideration transferred for the assets. Web instructions for form 8594 the irs instructs that both the buyer and seller must file the form and attach their income tax returns. November 2021) skip to main content You can print other federal tax forms here. Both the seller and purchaser of a group of assets that makes up a.

SS4 Form 2021 IRS Forms Zrivo

The buyers and sellers of a group of assets that make up a business use form 8594 when goodwill or going concern value attaches. Enter the total consideration transferred for the assets. November 2021) department of the treasury internal revenue service. For a particular class of assets, enter. Web information about form 8594, asset acquisition statement under section 1060, including.

Enter The Date On Which The Sale Of The Assets Took Place.

Enter the total consideration transferred for the assets. The form must be filed when a group of assets were transferred (in a trade or business), and if the buyer’s basis in such assets is determined by the amount paid for the assets. Both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going concern value attaches, or could attach, to such assets and if the purchaser's basis in the assets is determined only by the amount paid for the assets. For a particular class of assets, enter.

The Buyers And Sellers Of A Group Of Assets That Make Up A Business Use Form 8594 When Goodwill Or Going Concern Value Attaches.

November 2021) skip to main content Enter the name, address, and tin of the other party to the transaction. You can print other federal tax forms here. Web we last updated the asset acquisition statement under section 1060 in february 2023, so this is the latest version of form 8594, fully updated for tax year 2022.

Web Instructions Instructions For Form 4797 (2022) Future Developments Instructions For Form 4797 (2022) Sales Of Business Property (Also Involuntary Conversions And Recapture Amounts Under Sections 179 And 280F (B) (2)) Section References Are To The Internal Revenue Code Unless Otherwise Noted.

For asset acquisitions occurring after march 15, 2001, make the allocation among the following assets in proportion to (but not more than) their fair market value on the purchase date in the following order: Web both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going concern value attaches, or could attach, to such assets and if the purchaser's basis in the assets is determined only by the amount paid for the assets. Web information about form 8594, asset acquisition statement under section 1060, including recent updates, related forms and instructions on how to file. Web form 8594 instructions list seven classes of assets.

November 2021) Department Of The Treasury Internal Revenue Service.

Web instructions for form 8594 the irs instructs that both the buyer and seller must file the form and attach their income tax returns.