Form 8582 Unallowed Loss

Form 8582 Unallowed Loss - Ad access irs tax forms. Joined dec 9, 2014 messages 9 reaction score 0. Web from 8582, passive activity loss limitations, is filed by individuals, estates, and trusts who have passive activity deductions (including prior year unallowed losses). Start date dec 9, 2014; Web form 8582 must generally be filed by taxpayers who have an overall gain (including any prior year unallowed losses) from business or rental passive activities. Main forum / tax discussion. Get ready for tax season deadlines by completing any required tax forms today. Web department of the treasury internal revenue service (99) passive activity loss limitations see separate instructions. Web up to 10% cash back the passive activity loss rules generally prevent taxpayers with adjusted gross income (agi) above $100,000 from deducting some or all losses from real estate. Web form 8582 (2006) worksheet 1—for form 8582, lines 1a, 1b, and 1c (see pages 7 and 8 of the instructions.) current year prior years overall gain or loss (c) unallowed loss (line 1c).

Web up to 10% cash back the passive activity loss rules generally prevent taxpayers with adjusted gross income (agi) above $100,000 from deducting some or all losses from real estate. If this is your first visit, be sure to check out the faq by clicking the link. Web form 8582 must generally be filed by taxpayers who have an overall gain (including any prior year unallowed losses) from business or rental passive activities. Web when creating the current year return, taxslayer pro will inform you if unallowed losses are found in the prior year return: A passive activity loss occurs when total losses. Web department of the treasury internal revenue service (99) passive activity loss limitations see separate instructions. Ad access irs tax forms. Web form 8582 (2006) worksheet 1—for form 8582, lines 1a, 1b, and 1c (see pages 7 and 8 of the instructions.) current year prior years overall gain or loss (c) unallowed loss (line 1c). Complete, edit or print tax forms instantly. Ad register and subscribe now to work on your irs 8582 & more fillable forms.

Web form 8582 must generally be filed by taxpayers who have an overall gain (including any prior year unallowed losses) from business or rental passive activities. Start date dec 9, 2014; A passive activity loss occurs when total losses. Web up to 10% cash back the passive activity loss rules generally prevent taxpayers with adjusted gross income (agi) above $100,000 from deducting some or all losses from real estate. If a rental real estate activity isn’t a passive activity for the current year, any prior year unallowed loss is treated as a loss from a former passive. Get ready for tax season deadlines by completing any required tax forms today. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Ad access irs tax forms. Web from 8582, passive activity loss limitations, is filed by individuals, estates, and trusts who have passive activity deductions (including prior year unallowed losses).

Fill Free fillable form 8582 passive activity loss limitations pdf

Ad register and subscribe now to work on your irs 8582 & more fillable forms. Web form 8582 must generally be filed by taxpayers who have an overall gain (including any prior year unallowed losses) from business or rental passive activities. Joined dec 9, 2014 messages 9 reaction score 0. Start date dec 9, 2014; Web per the form 8582.

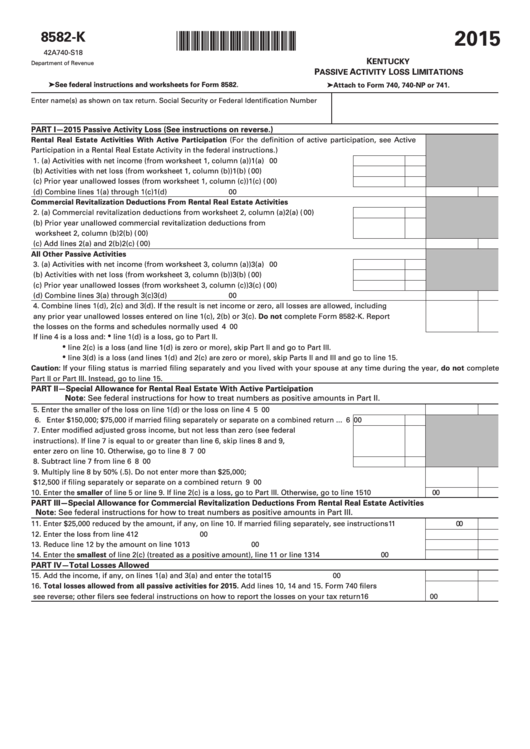

Fillable Form 8582K Kentucky Passive Activity Loss Limitations

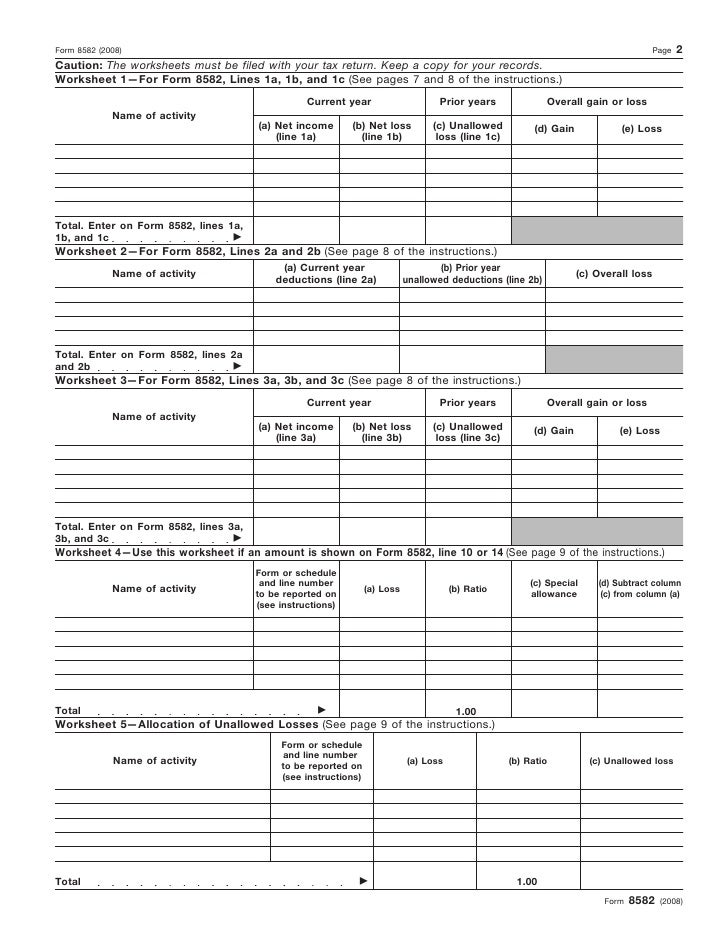

Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current year. Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current tax year and to report the application of prior year unallowed. Web form 8582 (2006) worksheet 1—for.

Instructions for Form 8582CR (12/2019) Internal Revenue Service

Complete, edit or print tax forms instantly. Web form 8582 must generally be filed by taxpayers who have an overall gain (including any prior year unallowed losses) from business or rental passive activities. Web per the form 8582 instructions: Ad register and subscribe now to work on your irs 8582 & more fillable forms. If this is your first visit,.

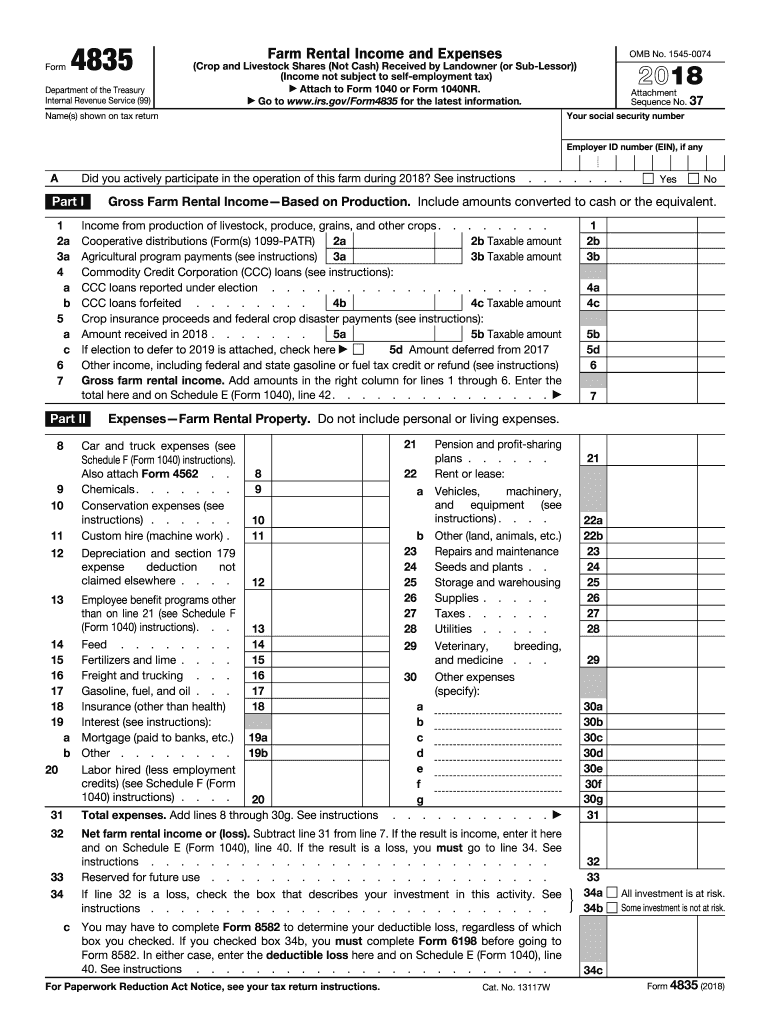

Us Government Tax Form 4835 Fill Out and Sign Printable PDF Template

Web form 8582 figures the amount of any passive activity loss for the current tax year for all activities and the amount of the passive activity loss allowed on your. Web department of the treasury internal revenue service (99) passive activity loss limitations see separate instructions. Start date dec 9, 2014; Web form 8582 is used by noncorporate taxpayers to.

Form 8582 Passive Activity Loss Limitations (2014) Free Download

Web department of the treasury internal revenue service (99) passive activity loss limitations see separate instructions. Web form 8582 must generally be filed by taxpayers who have an overall gain (including any prior year unallowed losses) from business or rental passive activities. If a rental real estate activity isn’t a passive activity for the current year, any prior year unallowed.

Form 8582Passive Activity Loss Limitations

A passive activity loss occurs when total losses. Web form 8582 must generally be filed by taxpayers who have an overall gain (including any prior year unallowed losses) from business or rental passive activities. Web form 8582 (2006) worksheet 1—for form 8582, lines 1a, 1b, and 1c (see pages 7 and 8 of the instructions.) current year prior years overall.

Form 8582 Passive Activity Loss Limitations (2014) Free Download

If this is your first visit, be sure to check out the faq by clicking the link. Web up to 10% cash back the passive activity loss rules generally prevent taxpayers with adjusted gross income (agi) above $100,000 from deducting some or all losses from real estate. Start date dec 9, 2014; Complete, edit or print tax forms instantly. Web.

Form 8582 Passive Activity Loss Limitations (2014) Free Download

Get ready for tax season deadlines by completing any required tax forms today. Web up to 10% cash back the passive activity loss rules generally prevent taxpayers with adjusted gross income (agi) above $100,000 from deducting some or all losses from real estate. Web department of the treasury internal revenue service (99) passive activity loss limitations see separate instructions. Start.

Form 8582 Passive Activity Loss Miller Financial Services

Get ready for tax season deadlines by completing any required tax forms today. Web form 8582 must generally be filed by taxpayers who have an overall gain (including any prior year unallowed losses) from business or rental passive activities. Web from 8582, passive activity loss limitations, is filed by individuals, estates, and trusts who have passive activity deductions (including prior.

Form 8582CR Passive Activity Credit Limitations (2012) Free Download

Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current year. Web per the form 8582 instructions: Web form 8582 figures the amount of any passive activity loss for the current tax year for all activities and the amount of the passive activity loss allowed on your. Start date.

Ad Register And Subscribe Now To Work On Your Irs 8582 & More Fillable Forms.

Start date dec 9, 2014; Web up to 10% cash back the passive activity loss rules generally prevent taxpayers with adjusted gross income (agi) above $100,000 from deducting some or all losses from real estate. Web form 8582 (2006) worksheet 1—for form 8582, lines 1a, 1b, and 1c (see pages 7 and 8 of the instructions.) current year prior years overall gain or loss (c) unallowed loss (line 1c). Web when creating the current year return, taxslayer pro will inform you if unallowed losses are found in the prior year return:

If This Is Your First Visit, Be Sure To Check Out The Faq By Clicking The Link.

Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current year. Ad access irs tax forms. Web per the form 8582 instructions: Web form 8582 must generally be filed by taxpayers who have an overall gain (including any prior year unallowed losses) from business or rental passive activities.

A Passive Activity Loss Occurs When Total Losses.

If a rental real estate activity isn’t a passive activity for the current year, any prior year unallowed loss is treated as a loss from a former passive. Complete, edit or print tax forms instantly. Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current tax year and to report the application of prior year unallowed. Web form 8582 figures the amount of any passive activity loss for the current tax year for all activities and the amount of the passive activity loss allowed on your.

Web From 8582, Passive Activity Loss Limitations, Is Filed By Individuals, Estates, And Trusts Who Have Passive Activity Deductions (Including Prior Year Unallowed Losses).

Get ready for tax season deadlines by completing any required tax forms today. Web department of the treasury internal revenue service (99) passive activity loss limitations see separate instructions. Main forum / tax discussion. Joined dec 9, 2014 messages 9 reaction score 0.