Form 8332 Head Of Household

Form 8332 Head Of Household - Web the custodial parent signs a form 8332, release/revocation of release of claim to exemption for child by custodial parent or a substantially similar statement,. Web form 8332 doesn't apply to other tax benefits, such as the earned income credit, dependent care credit, or head of household filing status. Web beginning with the 2015 tax year, all taxpayers who file using the head of household (hoh) filing status must submit a completed ftb 3532, head of household filing status. Townhomes home built in 2007 that was last sold on 03/04/2022. Complete, edit or print tax forms instantly. Web a noncustodial parent who claims the child as a dependent must file form 8332 or a substantially similar statement with the return or, with form 8453 for an electronic return. Web 11332 sw 238th st is a 1,857 square foot townhouse on a 2,571 square foot lot with 3 bedrooms and 2 bathrooms. Dependency exemption child tax credit the. Web taxpayers who file as head of household typically pay a lower tax rate than what they would if they filed as single or married filing separately. Ad access irs tax forms.

Web form 8332 doesn't apply to other tax benefits, such as the earned income credit, dependent care credit, or head of household filing status. Child and dependent care credit, earned income credit, head of household tax status. Filing as a head of. Townhomes home built in 2007 that was last sold on 03/04/2022. The earned income tax credit, child and dependent. Web form 8332 and head of household i have a court order where the ex and i are to alternate who can claim the dependent on their respective tax returns. Get ready for tax season deadlines by completing any required tax forms today. Web 11332 sw 238th st is a 1,857 square foot townhouse on a 2,571 square foot lot with 3 bedrooms and 2 bathrooms. If i am the custodial parent, and file form 8332 this year (2017) to release claim of child exemption, do i still file as head of household? Dependency exemption child tax credit the.

Ad download or email irs 8332 & more fillable forms, register and subscribe now! The noncustodial parent claims both of these: Web the custodial parent completes form 8332 to give the exemption to the other parent. 65 or older (one spouse) $27,300: Townhomes home built in 2007 that was last sold on 03/04/2022. Complete, edit or print tax forms instantly. Web if you need to complete form 8332 release/revocation of release of claim to exemption for child by custodial parent (usually only done by the custodial parent), you can do that. Web the full name of form 8332 is release/revocation of release of claim to exemption for child by custodial parent. If i am the custodial parent, and file form 8332 this year (2017) to release claim of child exemption, do i still file as head of household? Web the custodial parent signs a form 8332, release/revocation of release of claim to exemption for child by custodial parent or a substantially similar statement,.

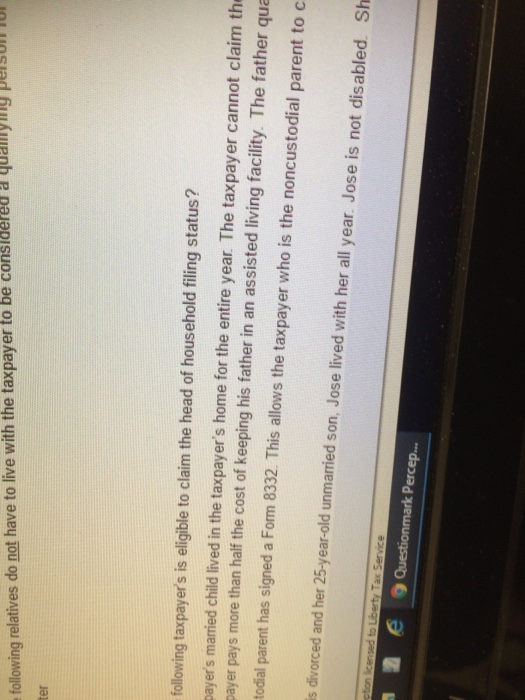

Solved Following taxpayer's is eligible to claim the head of

Ad access irs tax forms. While the tax benefit of exemptions is $0 until 2025 under tax. Web view 26 photos for 11332 sw 238th st unit 11332, homestead, fl 33032, a 3 bed, 3 bath, 1,857 sq. Web the custodial parent completes form 8332 to give the exemption to the other parent. Married filing jointly *** under 65 (both.

Form 8332 Release/Revocation of Release of Claim to Exemption for

The noncustodial parent claims both of these: Web view 26 photos for 11332 sw 238th st unit 11332, homestead, fl 33032, a 3 bed, 3 bath, 1,857 sq. Ad download or email irs 8332 & more fillable forms, register and subscribe now! Web taxpayers who file as head of household typically pay a lower tax rate than what they would.

Ask RJ Will the judge force my ex to sign IRS Form 8332? RJ Peters

Married filing jointly *** under 65 (both spouses) $25,900: Web the full name of form 8332 is release/revocation of release of claim to exemption for child by custodial parent. Filing as a head of. Web form 8332 doesn't apply to other tax benefits, such as the earned income credit, dependent care credit, or head of household filing status. Web beginning.

IRS Form 8332 Fill it with the Best PDF Form Filler

Complete, edit or print tax forms instantly. The noncustodial parent claims both of these: Web the following tax benefits cannot be transferred by form 8332: Child and dependent care credit, earned income credit, head of household tax status. Townhomes home built in 2007 that was last sold on 03/04/2022.

IRS Form 8332 How Can I Claim a Child? The Handy Tax Guy

Web taxpayers who file as head of household typically pay a lower tax rate than what they would if they filed as single or married filing separately. Web beginning with the 2015 tax year, all taxpayers who file using the head of household (hoh) filing status must submit a completed ftb 3532, head of household filing status. Child and dependent.

What is Form 8332 Release/Revocation of Release of Claim to Exemption

Dependency exemption child tax credit the. Web if you need to complete form 8332 release/revocation of release of claim to exemption for child by custodial parent (usually only done by the custodial parent), you can do that. Web taxpayers who file as head of household typically pay a lower tax rate than what they would if they filed as single.

Form 8332 Don't Claim the Same! November 13, 2019 Western CPE

Filing as a head of. Ad access irs tax forms. Web form 8332 doesn't apply to other tax benefits, such as the earned income credit, dependent care credit, or head of household filing status. Complete, edit or print tax forms instantly. Web the custodial parent completes form 8332 to give the exemption to the other parent.

Form 8332 Release/Revocation of Release of Claim to Exemption for Ch…

The noncustodial parent claims both of these: Web 11332 sw 238th st is a 1,857 square foot townhouse on a 2,571 square foot lot with 3 bedrooms and 2 bathrooms. The earned income tax credit, child and dependent. Web form 8332 and head of household i have a court order where the ex and i are to alternate who can.

Fillable Form 8332 (Rev. January 2006) Release Of Claim To Exemption

Web if you need to complete form 8332 release/revocation of release of claim to exemption for child by custodial parent (usually only done by the custodial parent), you can do that. Web taxpayers who file as head of household typically pay a lower tax rate than what they would if they filed as single or married filing separately. Web the.

20182020 Form IRS 8332 Fill Online, Printable, Fillable, Blank PDFfiller

Web taxpayers who file as head of household typically pay a lower tax rate than what they would if they filed as single or married filing separately. If i am the custodial parent, and file form 8332 this year (2017) to release claim of child exemption, do i still file as head of household? Web the custodial parent signs a.

Web The Custodial Parent Completes Form 8332 To Give The Exemption To The Other Parent.

If i am the custodial parent, and file form 8332 this year (2017) to release claim of child exemption, do i still file as head of household? The noncustodial parent claims both of these: 65 or older (one spouse) $27,300: Web beginning with the 2015 tax year, all taxpayers who file using the head of household (hoh) filing status must submit a completed ftb 3532, head of household filing status.

While The Tax Benefit Of Exemptions Is $0 Until 2025 Under Tax.

Get ready for tax season deadlines by completing any required tax forms today. Townhomes home built in 2007 that was last sold on 03/04/2022. Complete, edit or print tax forms instantly. Filing as a head of.

Web The Full Name Of Form 8332 Is Release/Revocation Of Release Of Claim To Exemption For Child By Custodial Parent.

Ad access irs tax forms. Web form 8332 and head of household i have a court order where the ex and i are to alternate who can claim the dependent on their respective tax returns. Web taxpayers who file as head of household typically pay a lower tax rate than what they would if they filed as single or married filing separately. Dependency exemption child tax credit the.

Ad Download Or Email Irs 8332 & More Fillable Forms, Register And Subscribe Now!

Child and dependent care credit, earned income credit, head of household tax status. Web if you need to complete form 8332 release/revocation of release of claim to exemption for child by custodial parent (usually only done by the custodial parent), you can do that. Web form 8332 doesn't apply to other tax benefits, such as the earned income credit, dependent care credit, or head of household filing status. Web 11332 sw 238th st is a 1,857 square foot townhouse on a 2,571 square foot lot with 3 bedrooms and 2 bathrooms.