Form 8283 Pdf

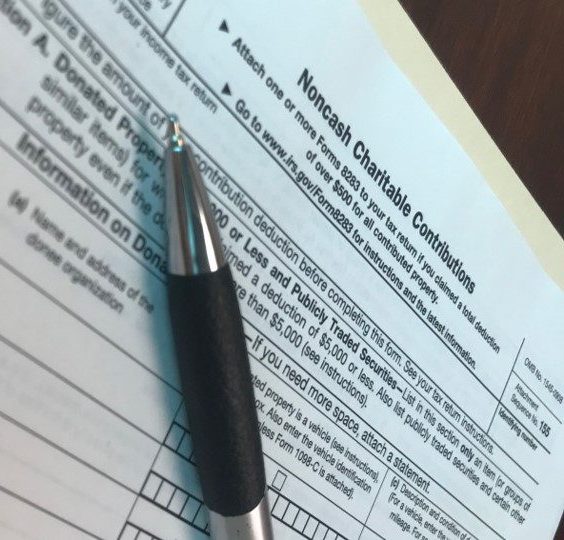

Form 8283 Pdf - Web fraudulent overstatement of the property value as described in the qualified appraisal or this form 8283 may subject me to the penalty under section 6701(a) (aiding and abetting the. Web file form 8283 only if the amount claimed as a deduction is more than $5,000 per item or group of similar items. December 2020) noncash charitable contributions. Figure the amount of your contribution deduction before completing this form. 8283, claim for death benefits (sgli/vgli) the form is in pdf format, readable with the adobe reader. Web recommended by irs form 8283, noncash charitable contributions 2014 form 8283 form 8283 for 2014. Get ready for tax season deadlines by completing any required tax forms today. Department of the treasury internal revenue service. 2013 form 8283 form 8283 for 2013. Form 8283 is used to claim a deduction for.

2013 form 8283 form 8283 for 2013. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Choose the correct version of the editable pdf form. Attach one or more forms 8283 to your tax return if. Use this form to request an advance insurance payment for a servicemember or. Aattach one or more forms 8283 to your tax return if. Web fraudulent overstatement of the property value as described in the qualified appraisal or this form 8283 may subject me to the penalty under section 6701(a) (aiding and abetting the. Form 8283 is used to claim a deduction for. Web if a casualty officer is helping you file your claim, download this version:

Web recommended by irs form 8283, noncash charitable contributions 2014 form 8283 form 8283 for 2014. November 2019) department of the treasury internal revenue service. Figure the amount of your contribution deduction before completing this form. Form 8283 is required as an xml document, unless one of the following apply. Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today. Form 8283 is used to claim a deduction for. See your tax return instructions. Web if a casualty officer is helping you file your claim, download this version: Complete, edit or print tax forms instantly.

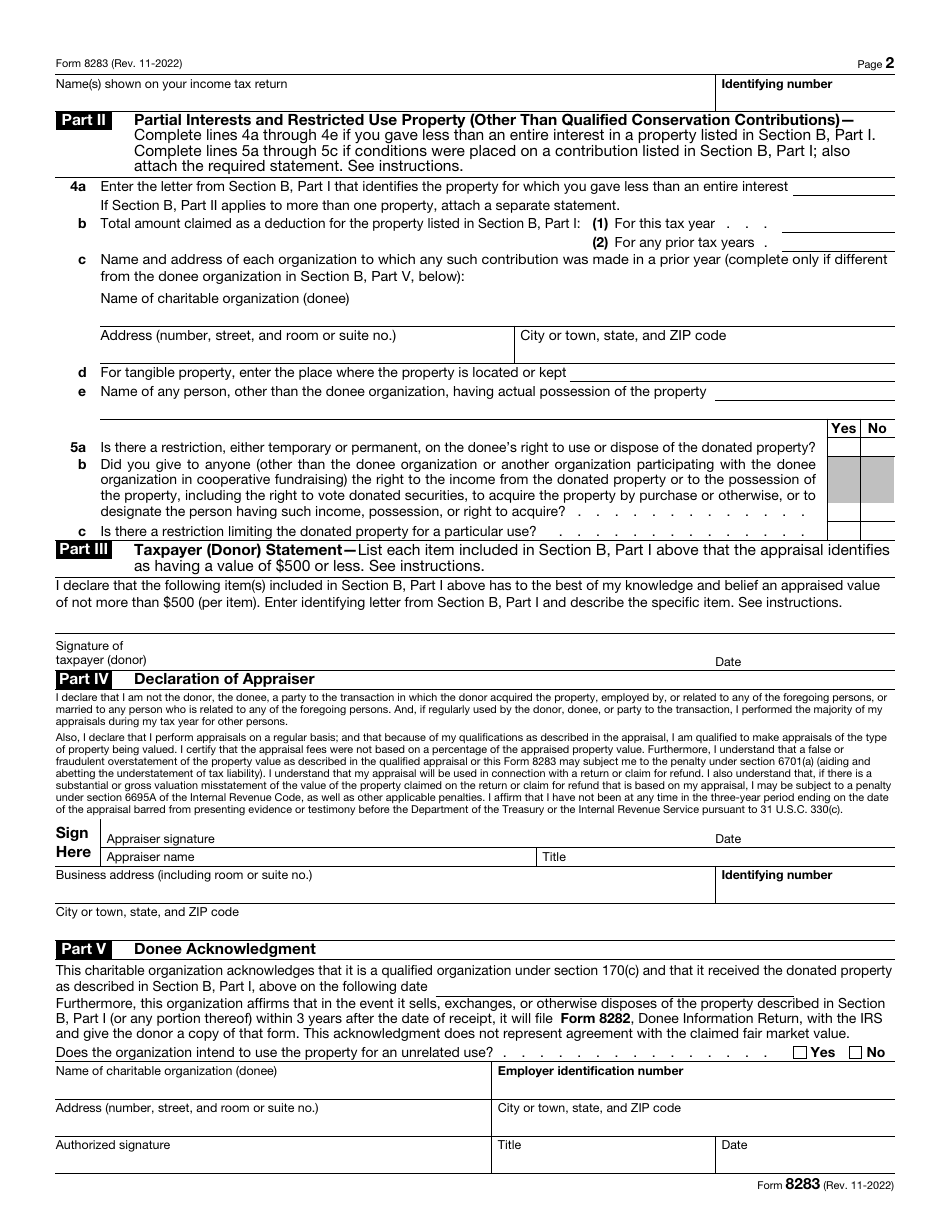

2022 form 8283 Fill Online, Printable, Fillable Blank

8283, claim for death benefits (sgli/vgli) the form is in pdf format, readable with the adobe reader. 2013 form 8283 form 8283 for 2013. Ad access irs tax forms. See your tax return instructions. Get ready for tax season deadlines by completing any required tax forms today.

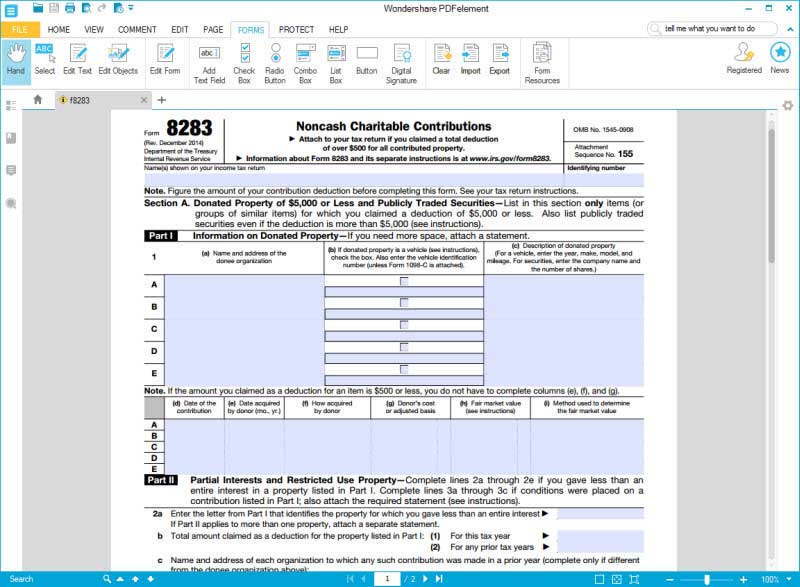

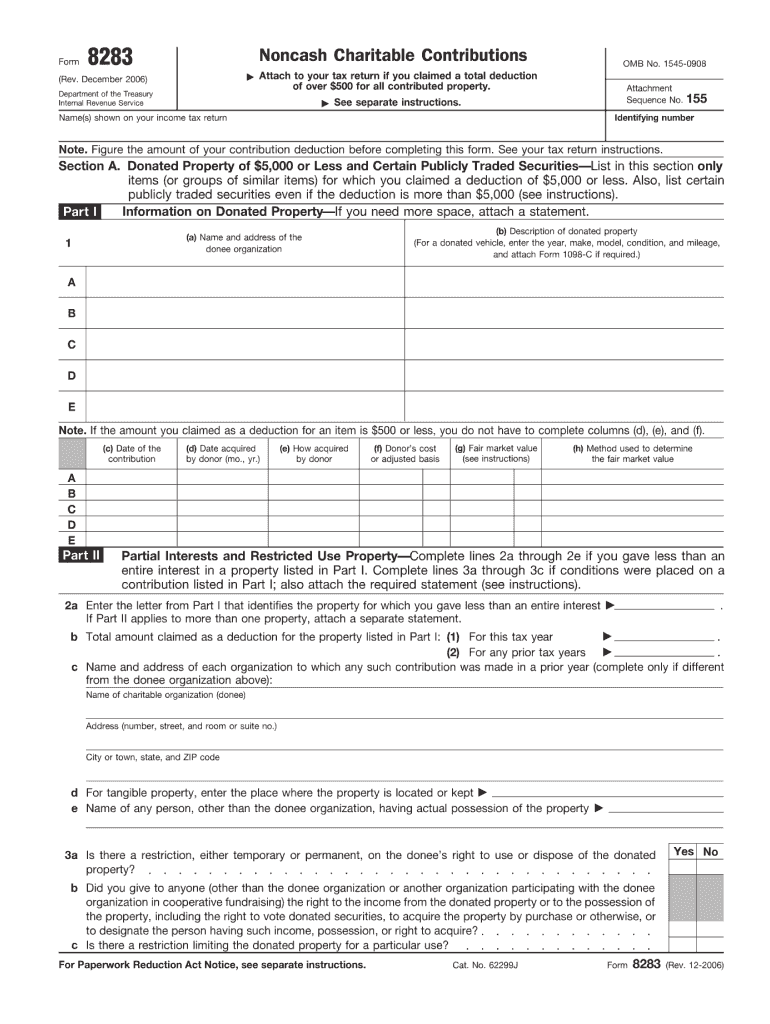

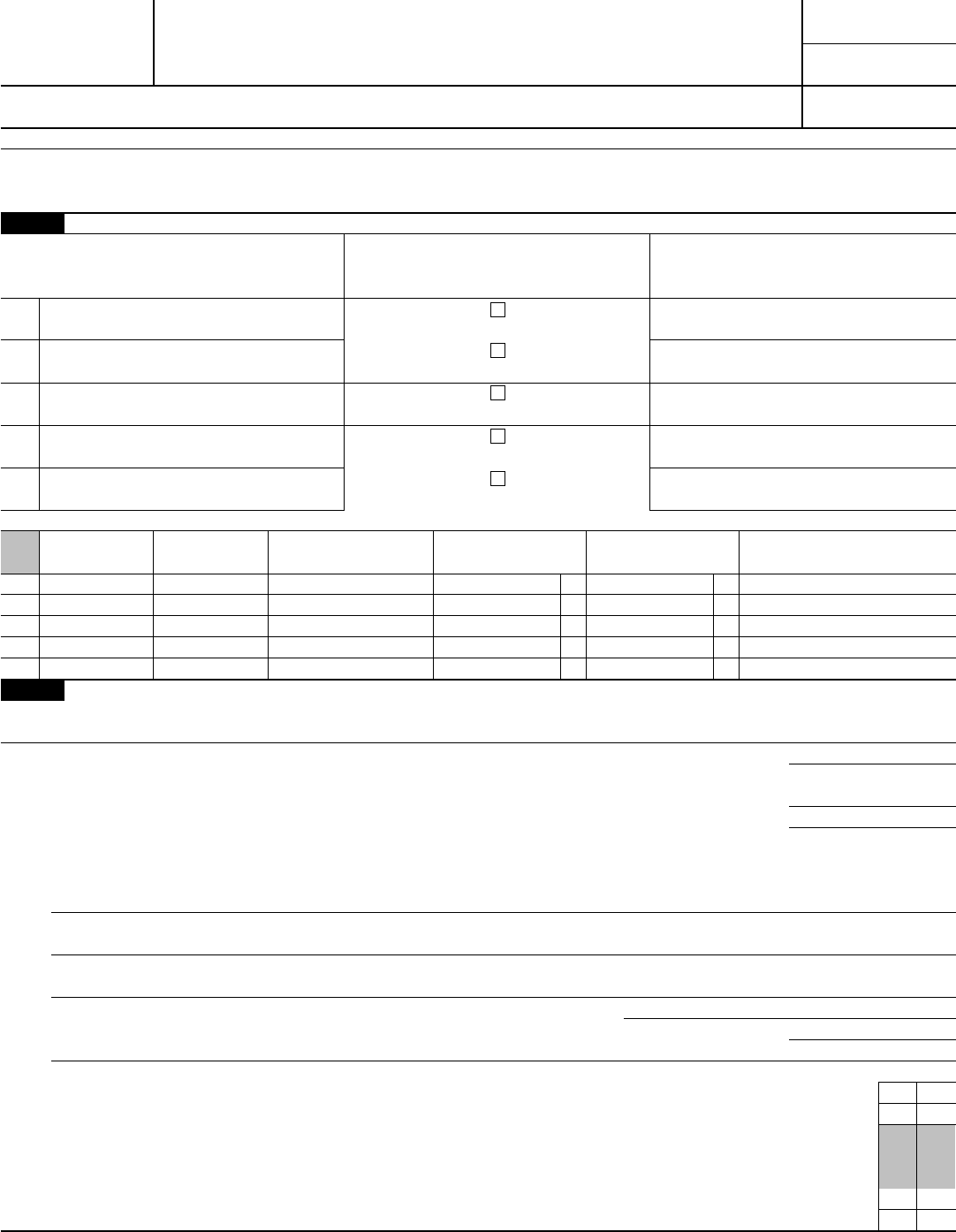

Download IRS Form 8283 Noncash Charitable Contributions Printable

Aattach one or more forms 8283 to your tax return if. Web servicemember/veteran accelerated benefits option form. Instructions for form 8283 (rev. Attach one or more forms 8283 to your tax return if. A partnership or s corporation.

IRS Form 8283 Download Fillable PDF or Fill Online Noncash Charitable

8283, claim for death benefits (sgli/vgli) the form is in pdf format, readable with the adobe reader. December 2020) noncash charitable contributions. Complete, edit or print tax forms instantly. Web recommended by irs form 8283, noncash charitable contributions 2014 form 8283 form 8283 for 2014. Aattach one or more forms 8283 to your tax return if.

Instructions for How to Fill in IRS Form 8283

2013 form 8283 form 8283 for 2013. Web recommended by irs form 8283, noncash charitable contributions 2014 form 8283 form 8283 for 2014. Complete, edit or print tax forms instantly. Department of the treasury internal revenue service. 8283a, claim for family coverage death benefits (sgli) if you are filing directly as.

Example of form 8283 filled out Fill out & sign online DocHub

See your tax return instructions. Figure the amount of your contribution deduction before completing this form. Web recommended by irs form 8283, noncash charitable contributions 2014 form 8283 form 8283 for 2014. Web file form 8283 only if the amount claimed as a deduction is more than $5,000 per item or group of similar items. Instructions for form 8283 (rev.

Form 8283 Edit, Fill, Sign Online Handypdf

Aattach one or more forms 8283 to your tax return if. Ad access irs tax forms. November 2019) department of the treasury internal revenue service. Department of the treasury internal revenue service. Web file form 8283 only if the amount claimed as a deduction is more than $5,000 per item or group of similar items.

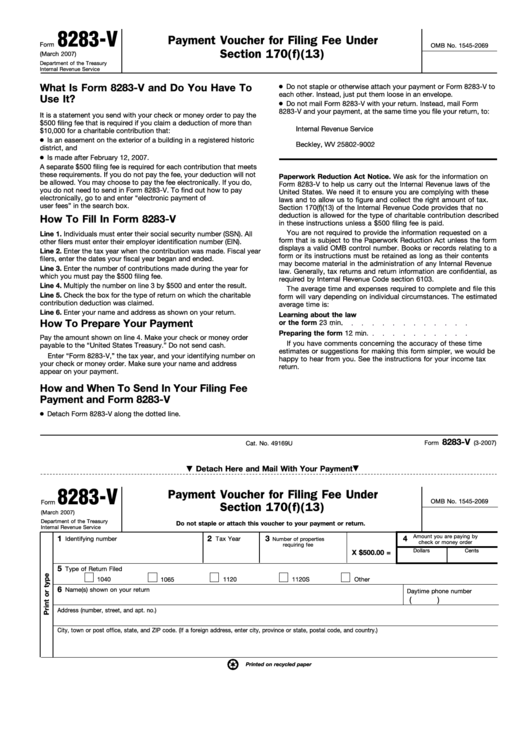

Fillable Form 8283V Payment Voucher For Filing Fee Under Section 170

Get ready for tax season deadlines by completing any required tax forms today. Figure the amount of your contribution deduction before completing this form. Web find and fill out the correct form 8283 tax form. Complete, edit or print tax forms instantly. Web fraudulent overstatement of the property value as described in the qualified appraisal or this form 8283 may.

IRS Form 8283 Sharpe Group blog

Form 8283 is used to claim a deduction for. Web use form 8283 to report information about noncash charitable contributions. Web if a casualty officer is helping you file your claim, download this version: Web find and fill out the correct form 8283 tax form. Get ready for tax season deadlines by completing any required tax forms today.

Irs form 8283 instructions

Get ready for tax season deadlines by completing any required tax forms today. 8283, claim for death benefits (sgli/vgli) the form is in pdf format, readable with the adobe reader. Form 8283 is used to claim a deduction for. Choose the correct version of the editable pdf form. Get ready for tax season deadlines by completing any required tax forms.

Fill Free fillable Form 8283V Payment Voucher for Filing Fee PDF form

Web recommended by irs form 8283, noncash charitable contributions 2014 form 8283 form 8283 for 2014. Form 8283 is used to claim a deduction for. Get ready for tax season deadlines by completing any required tax forms today. Web use form 8283 to report information about noncash charitable contributions. Attach one or more forms 8283 to your tax return if.

December 2020) Noncash Charitable Contributions.

Use this form to request an advance insurance payment for a servicemember or. Complete, edit or print tax forms instantly. Aattach one or more forms 8283 to your tax return if. December 2014) department of the treasury internal revenue service noncash charitable contributions a attach to your tax return if you claimed a total.

Web Information About Form 8283, Noncash Charitable Contributions, Including Recent Updates, Related Forms And Instructions On How To File.

Form 8283 is used to claim a deduction for. Attach one or more forms 8283 to your tax return if. Figure the amount of your contribution deduction before completing this form. November 2019) department of the treasury internal revenue service.

Web Servicemember/Veteran Accelerated Benefits Option Form.

Web updated for tax year 2022 • december 1, 2022 09:21 am overview if the combined value of all property you donate is more than $500, you must prepare irs. Web instructions for form 8283 (rev. 2013 form 8283 form 8283 for 2013. Choose the correct version of the editable pdf form.

Ad Access Irs Tax Forms.

Get ready for tax season deadlines by completing any required tax forms today. Department of the treasury internal revenue service. Web recommended by irs form 8283, noncash charitable contributions 2014 form 8283 form 8283 for 2014. Get ready for tax season deadlines by completing any required tax forms today.