Form 760C Line 3

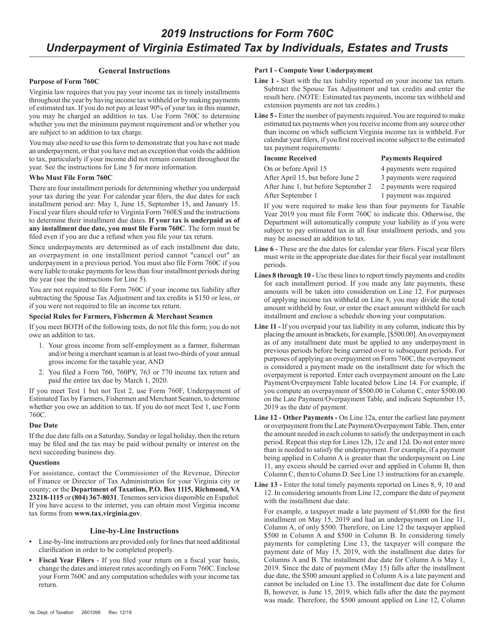

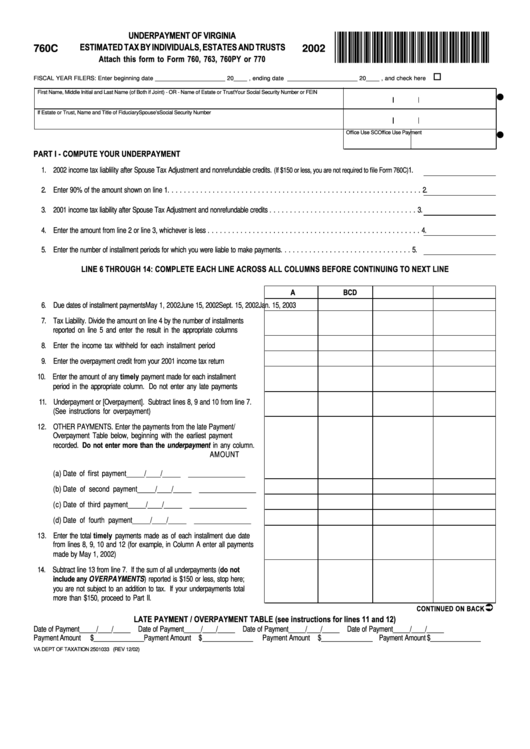

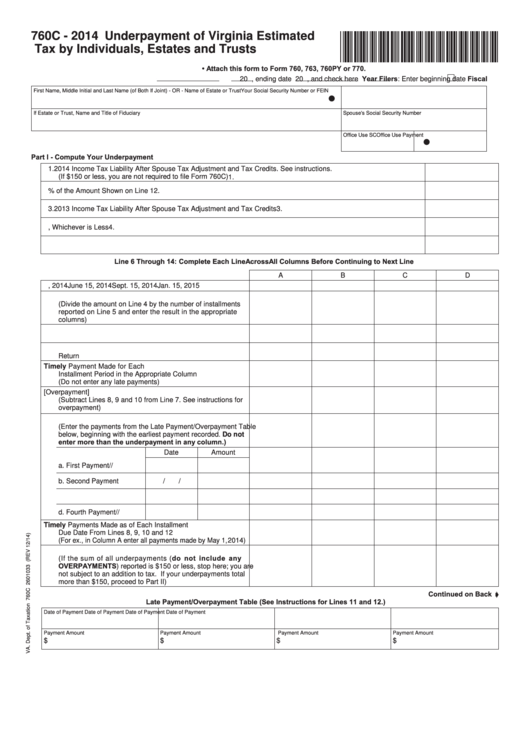

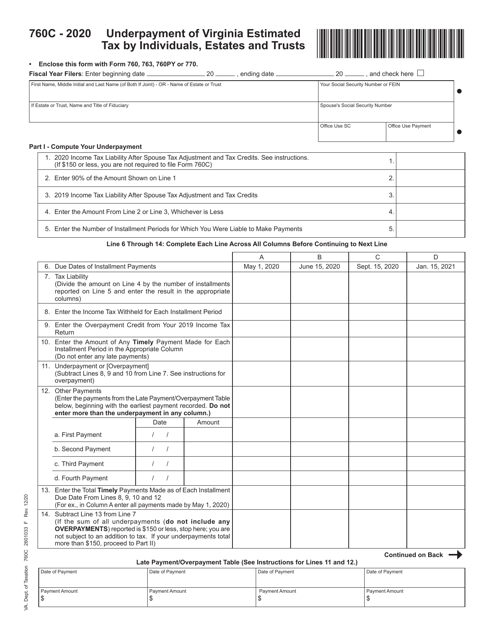

Form 760C Line 3 - Amount of underpayment from line. For all other periods, complete each line as instructed below. (if $150 or less, you are not required to file form 760c) enter 90% of the amount shown on line 1 2018 income tax liability after spouse tax adjustment and. Edit your virginia 760c tax online type text, add images, blackout confidential details, add comments, highlights and more. Use form 760f if at least 66 2/3% of your income is. Web purpose of form 760c. Virginia law requires that you pay your income tax in timely installments. 2021 income tax liability after spouse tax adjustment and tax credits 3. And enter 0 on line 24. Enter 90% of the amount shown on line 1 2.

Irrespective of whether the form or format is used, no entries are to be. Web form 760c line 3 jerichao returning member posted april 3, 2022 8:35 am last updated april 03, 2022 8:35 am form 760c line 3 form 760c: Web virginia — underpayment of estimated tax by individuals, estates, and trusts download this form print this form it appears you don't have a pdf plugin for this browser. Web purpose of form 760c. Sign it in a few clicks draw your signature, type. Amount of underpayment from line. Enter 90% of the amount shown on line 1 2. Web (if $150 or less, you are not required to file form 760c) 1. Web general instructions purpose of form 760c virginia law requires that you pay your income tax in timely installments throughout the year by having income tax withheld or making. Web line 18 addition to tax.

2020 income tax liability after spouse tax adjustment and tax. Web form 760c line 3 jerichao returning member posted april 3, 2022 8:35 am last updated april 03, 2022 8:35 am form 760c line 3 form 760c: Sign it in a few clicks draw your signature, type. Web purpose of form 760c. Web virginia — underpayment of estimated tax by individuals, estates, and trusts download this form print this form it appears you don't have a pdf plugin for this browser. Amount of underpayment from line. Web general instructions purpose of form 760c virginia law requires that you pay your income tax in timely installments throughout the year by having income tax withheld or making. Web (1, 2, 3, or 4) on line 20; Use form 760c to compute any addition to tax you may owe for underpayment of estimated taxes. Enter 90% of the amount shown on line 1 2.

Download Instructions for Form 760C Underpayment of Virginia Estimated

Enter the number of installment. And enter 0 on line 24. Sign it in a few clicks draw your signature, type. Web purpose of form 760c. For all other periods, complete each line as instructed below.

Where do i find my 2021 tax liability after spouse tax

Irrespective of whether the form or format is used, no entries are to be. Sign it in a few clicks draw your signature, type. 2021 income tax liability after spouse tax adjustment and tax credits 3. Web purpose of form 760c. Web mod form 760c (revised jan 23) sheet 1 of 4 compilation instructions mod form and format 760.

Form 760c Underpayment Of Virginia Estimated Tax By Individuals

Enter the amount from line 2 or line 3, whichever is less 4. Web (1, 2, 3, or 4) on line 20; (if $150 or less, you are not required to file form 760c) enter 90% of the amount shown on line 1 2018 income tax liability after spouse tax adjustment and. And enter 0 on line 24. Web form.

MIMO UM760COF 7 inch open frame with touch ESupplyLine

Amount of underpayment from line. 2020 income tax liability after spouse tax adjustment and tax. Enter the amount from line 2 or line 3, whichever is less 4. Web (1, 2, 3, or 4) on line 20; Web you are not required to file form 760c if your income tax liability (after subtracting the spouse tax adjustment and tax credits).

Fillable Form 760c Underpayment Of Virginia Estimated Tax By

Web purpose of form 760c. Enter 90% of the amount shown on line 1 2. Web you are not required to file form 760c if your income tax liability (after subtracting the spouse tax adjustment and tax credits) is $150 or less, or if you were not required to file. Enter the number of installment. And enter 0 on line.

760cg Fill Online, Printable, Fillable, Blank pdfFiller

2020 income tax liability after spouse tax adjustment and tax. Use form 760c to compute any addition to tax you may owe for underpayment of estimated taxes. Enter the amount from line 2 or line 3, whichever is less 4. Web form 760c line 3 jerichao returning member posted april 3, 2022 8:35 am last updated april 03, 2022 8:35.

2021 Form VA 760C Fill Online, Printable, Fillable, Blank pdfFiller

Web form 760c line 3 jerichao returning member posted april 3, 2022 8:35 am last updated april 03, 2022 8:35 am form 760c line 3 form 760c: Enter 90% of the amount shown on line 1 2. I have a simple return dependents 1 w2 and turbo tax is saying i need to put info in for form 760c line.

Spouse Tax Adjustment Worksheet

And enter 0 on line 24. Use form 760f if at least 66 2/3% of your income is. Web form 760c line 3 jerichao returning member posted april 3, 2022 8:35 am last updated april 03, 2022 8:35 am form 760c line 3 form 760c: Web (1, 2, 3, or 4) on line 20; Web general instructions purpose of form.

Apparently Unprecedented Tax Question (Form 760C Line 3) personalfinance

Web virginia — underpayment of estimated tax by individuals, estates, and trusts download this form print this form it appears you don't have a pdf plugin for this browser. Sign it in a few clicks draw your signature, type. Edit your virginia 760c tax online type text, add images, blackout confidential details, add comments, highlights and more. Web line 18.

SHURLINE 7in Stain Pad in the Specialty Paint Applicators department

Edit your virginia 760c tax online type text, add images, blackout confidential details, add comments, highlights and more. Enter 90% of the amount shown on line 1 2. Web mod form 760c (revised jan 23) sheet 1 of 4 compilation instructions mod form and format 760. Web general instructions purpose of form 760c virginia law requires that you pay your.

Use Form 760F If At Least 66 2/3% Of Your Income Is.

2020 income tax liability after spouse tax adjustment and tax. Web line 18 addition to tax. Enter the amount from line 2 or line 3, whichever is less 4. Web purpose of form 760c.

Web General Instructions Purpose Of Form 760C Virginia Law Requires That You Pay Your Income Tax In Timely Installments Throughout The Year By Having Income Tax Withheld Or Making.

Use form 760c to compute any addition to tax you may owe for underpayment of estimated taxes. Irrespective of whether the form or format is used, no entries are to be. Amount of underpayment from line. Skip lines 21 through 23;

(If $150 Or Less, You Are Not Required To File Form 760C) Enter 90% Of The Amount Shown On Line 1 2018 Income Tax Liability After Spouse Tax Adjustment And.

I have a simple return dependents 1 w2 and turbo tax is saying i need to put info in for form 760c line 3! Web you are not required to file form 760c if your income tax liability (after subtracting the spouse tax adjustment and tax credits) is $150 or less, or if you were not required to file. 2021 income tax liability after spouse tax adjustment and tax credits 3. Enter 90% of the amount shown on line 1 2.

For All Other Periods, Complete Each Line As Instructed Below.

Web mod form 760c (revised jan 23) sheet 1 of 4 compilation instructions mod form and format 760. Throughout the year by having income tax withheld or by making payments. Web (1, 2, 3, or 4) on line 20; Enter the number of installment.