Form 712 Irs

Form 712 Irs - Web irs form 712 is an informational tax form that is used to report the value of life insurance policies as part of an estate tax return. Web application for irs individual taxpayer identification number. It's the executor's job to wrap up the financial affairs of the. Current revision form 712 pdf recent developments none at this time. Web form 712 should be included with any form 709 gift tax return related to certain policy transfers during the insured’s lifetime to establish the value of the gift as well as with the form 706 estate tax return after death. If your spouse is your beneficiary, the life insurance payout is not taxed and will be passed on to them fully, along with the rest of your estate that was left to them. Spouses typically have an unlimited exemption with regards to estate taxes. Web the irs federal form 712 reports the value of a life insurance policy's proceeds after the insured dies for estate tax purposes. Web form 712 states the value of your life insurance policies based upon when you died. This form is not filed by itself, but as an accompaniment to other estate tax forms, most notably irs form 706:

Get or renew an individual taxpayer identification number (itin) for federal tax purposes if you are not eligible for a social security number. Web form 712 states the value of your life insurance policies based upon when you died. Current revision form 712 pdf recent developments none at this time. Web application for irs individual taxpayer identification number. If your spouse is your beneficiary, the life insurance payout is not taxed and will be passed on to them fully, along with the rest of your estate that was left to them. Web irs form 712 is an informational tax form that is used to report the value of life insurance policies as part of an estate tax return. Web form 712 should be included with any form 709 gift tax return related to certain policy transfers during the insured’s lifetime to establish the value of the gift as well as with the form 706 estate tax return after death. It's the executor's job to wrap up the financial affairs of the. American mayflower life insurance company federal home life insurance company first colony life insurance company genworth life and annuity insurance. This form is not filed by itself, but as an accompaniment to other estate tax forms, most notably irs form 706:

It's the executor's job to wrap up the financial affairs of the. This form is not filed by itself, but as an accompaniment to other estate tax forms, most notably irs form 706: Web irs form 712 is an informational tax form that is used to report the value of life insurance policies as part of an estate tax return. Web the irs federal form 712 reports the value of a life insurance policy's proceeds after the insured dies for estate tax purposes. American mayflower life insurance company federal home life insurance company first colony life insurance company genworth life and annuity insurance. Get or renew an individual taxpayer identification number (itin) for federal tax purposes if you are not eligible for a social security number. Web application for irs individual taxpayer identification number. Web form 712 states the value of your life insurance policies based upon when you died. Current revision form 712 pdf recent developments none at this time. Web internal revenue service form 712 is primarily of interest to people serving as the executor of a deceased person's estate.

How to Get a Copy of Last Years Tax Return Tax forms, Employee tax

Web internal revenue service form 712 is primarily of interest to people serving as the executor of a deceased person's estate. Web the irs federal form 712 reports the value of a life insurance policy's proceeds after the insured dies for estate tax purposes. Web form 712 states the value of your life insurance policies based upon when you died..

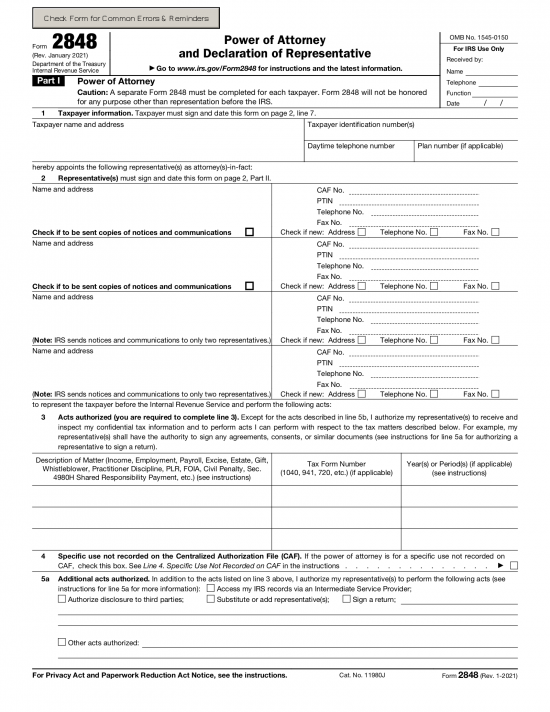

Free IRS Power of Attorney Form 2848 Revised Jan. 2021 PDF eForms

Web the irs federal form 712 reports the value of a life insurance policy's proceeds after the insured dies for estate tax purposes. Get or renew an individual taxpayer identification number (itin) for federal tax purposes if you are not eligible for a social security number. Current revision form 712 pdf recent developments none at this time. Web form 712.

Form 712 Life Insurance Statement (2006) Free Download

Web internal revenue service form 712 is primarily of interest to people serving as the executor of a deceased person's estate. Get or renew an individual taxpayer identification number (itin) for federal tax purposes if you are not eligible for a social security number. It's the executor's job to wrap up the financial affairs of the. Web the irs federal.

Как да попълните формуляр 720 на IRS Тримесечна Федерална данъчна

Web form 712 states the value of your life insurance policies based upon when you died. Current revision form 712 pdf recent developments none at this time. This form is not filed by itself, but as an accompaniment to other estate tax forms, most notably irs form 706: Spouses typically have an unlimited exemption with regards to estate taxes. American.

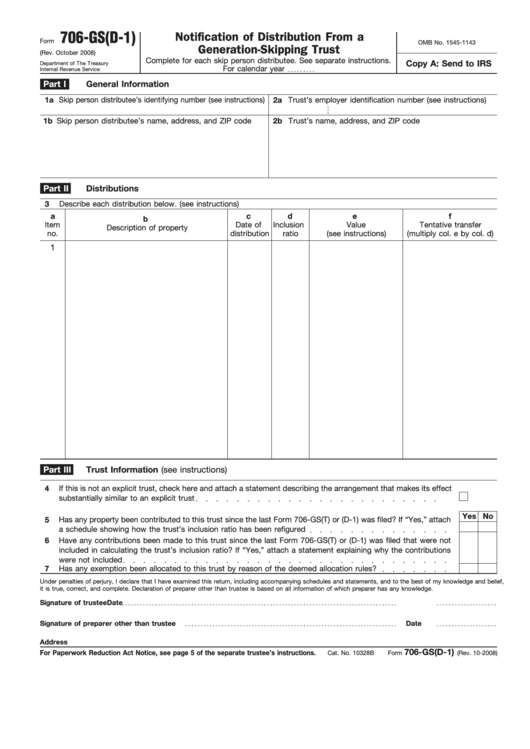

Fillable Form 706Gs(D1) Notification Of Distribution From A

It's the executor's job to wrap up the financial affairs of the. If your spouse is your beneficiary, the life insurance payout is not taxed and will be passed on to them fully, along with the rest of your estate that was left to them. Web form 712 states the value of your life insurance policies based upon when you.

Discussion Manafort Trump Still Not Going To Release His Tax Returns

Web form 712 states the value of your life insurance policies based upon when you died. Web application for irs individual taxpayer identification number. This form is not filed by itself, but as an accompaniment to other estate tax forms, most notably irs form 706: American mayflower life insurance company federal home life insurance company first colony life insurance company.

IRS Form 712 A Guide to the Life Insurance Statement

Spouses typically have an unlimited exemption with regards to estate taxes. Web irs form 712 is an informational tax form that is used to report the value of life insurance policies as part of an estate tax return. Web the irs federal form 712 reports the value of a life insurance policy's proceeds after the insured dies for estate tax.

Life Insurance Form 712 Realtors Can Save Up to 58 on Life Insurance

Web form 712 states the value of your life insurance policies based upon when you died. It's the executor's job to wrap up the financial affairs of the. Current revision form 712 pdf recent developments none at this time. This form is not filed by itself, but as an accompaniment to other estate tax forms, most notably irs form 706:.

Form 712 Life Insurance Statement (2006) Free Download

Spouses typically have an unlimited exemption with regards to estate taxes. It's the executor's job to wrap up the financial affairs of the. Web the irs federal form 712 reports the value of a life insurance policy's proceeds after the insured dies for estate tax purposes. Web internal revenue service form 712 is primarily of interest to people serving as.

Life Insurance Form 712 Realtors Can Save Up to 58 on Life Insurance

American mayflower life insurance company federal home life insurance company first colony life insurance company genworth life and annuity insurance. Web application for irs individual taxpayer identification number. Web form 712 states the value of your life insurance policies based upon when you died. Get or renew an individual taxpayer identification number (itin) for federal tax purposes if you are.

Web The Irs Federal Form 712 Reports The Value Of A Life Insurance Policy's Proceeds After The Insured Dies For Estate Tax Purposes.

If your spouse is your beneficiary, the life insurance payout is not taxed and will be passed on to them fully, along with the rest of your estate that was left to them. It's the executor's job to wrap up the financial affairs of the. Spouses typically have an unlimited exemption with regards to estate taxes. American mayflower life insurance company federal home life insurance company first colony life insurance company genworth life and annuity insurance.

Web Application For Irs Individual Taxpayer Identification Number.

Web irs form 712 is an informational tax form that is used to report the value of life insurance policies as part of an estate tax return. Get or renew an individual taxpayer identification number (itin) for federal tax purposes if you are not eligible for a social security number. This form is not filed by itself, but as an accompaniment to other estate tax forms, most notably irs form 706: Web form 712 should be included with any form 709 gift tax return related to certain policy transfers during the insured’s lifetime to establish the value of the gift as well as with the form 706 estate tax return after death.

Web Internal Revenue Service Form 712 Is Primarily Of Interest To People Serving As The Executor Of A Deceased Person's Estate.

Current revision form 712 pdf recent developments none at this time. Web form 712 states the value of your life insurance policies based upon when you died.