Form 712 For Life Insurance

Form 712 For Life Insurance - Web the irs federal form 712 reports the value of a life insurance policy's proceeds after the insured dies for estate tax purposes. Web irs form 712 is an informational tax form that is used to report the value of life insurance policies as part of an estate tax return. The value of all policies on the decedent’s life must be reported on the estate tax return on schedule d, regardless of whether they were owned inside the estate or not. Web i received form 712 for a $5000 life insurance payout following my husband's death. Do i need to report that as income? If a policy doesn’t meet the. This form is not filed by itself, but as an accompaniment to other estate tax forms, most notably irs form 706: Web information about gestalt 712, life insurance statement, including recent actualizations, related forms, and instructions on how to file. Web form 712 reports the value of a policy in order to prepare the estate tax forms. Turbotax home & biz windows posted june 4, 2019 7:13 pm last updated june 04, 2019 7:13 pm 0 2 6,799 reply bookmark icon 1 best answer sweetiejean level 15 not on your personal tax return.

Web information about gestalt 712, life insurance statement, including recent actualizations, related forms, and instructions on how to file. Web the irs federal form 712 reports the value of a life insurance policy's proceeds after the insured dies for estate tax purposes. Web form 712 reports the value of a policy in order to prepare the estate tax forms. Do i need to report that as income? Web i received form 712 for a $5000 life insurance payout following my husband's death. If there were multiple policies in effect, the. This form is not filed by itself, but as an accompaniment to other estate tax forms, most notably irs form 706: Web irs form 712 is an informational tax form that is used to report the value of life insurance policies as part of an estate tax return. Web information about form 712, life insurance statement, including recent updates, related forms, and instructions on how to file. Turbotax home & biz windows posted june 4, 2019 7:13 pm last updated june 04, 2019 7:13 pm 0 2 6,799 reply bookmark icon 1 best answer sweetiejean level 15 not on your personal tax return.

This form is not filed by itself, but as an accompaniment to other estate tax forms, most notably irs form 706: Turbotax home & biz windows posted june 4, 2019 7:13 pm last updated june 04, 2019 7:13 pm 0 2 6,799 reply bookmark icon 1 best answer sweetiejean level 15 not on your personal tax return. Web irs form 712 is an informational tax form that is used to report the value of life insurance policies as part of an estate tax return. Web the irs federal form 712 reports the value of a life insurance policy's proceeds after the insured dies for estate tax purposes. Web form 712 reports the value of a policy in order to prepare the estate tax forms. Web information about gestalt 712, life insurance statement, including recent actualizations, related forms, and instructions on how to file. If a policy doesn’t meet the. Web i received form 712 for a $5000 life insurance payout following my husband's death. The value of all policies on the decedent’s life must be reported on the estate tax return on schedule d, regardless of whether they were owned inside the estate or not. Web internal revenue service (irs) tax code 7702 sets the guidelines for determining the tax status of whole, universal life and other types of permanent life insurance.

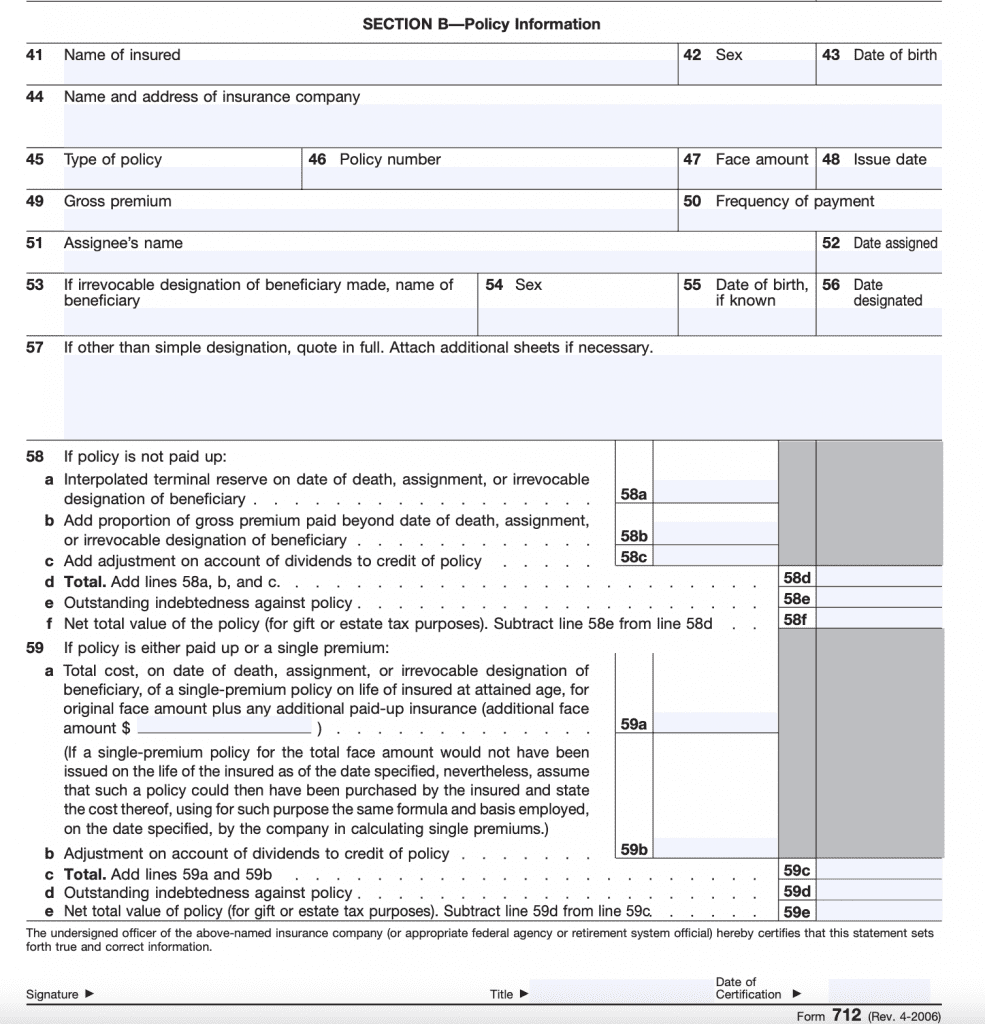

Form 712 Life Insurance Statement (2006) Free Download

Web information about form 712, life insurance statement, including recent updates, related forms, and instructions on how to file. If there were multiple policies in effect, the. Do i need to report that as income? The value of all policies on the decedent’s life must be reported on the estate tax return on schedule d, regardless of whether they were.

IRS Form 945 Instructions

Web information about gestalt 712, life insurance statement, including recent actualizations, related forms, and instructions on how to file. The value of all policies on the decedent’s life must be reported on the estate tax return on schedule d, regardless of whether they were owned inside the estate or not. Web irs form 712 is an informational tax form that.

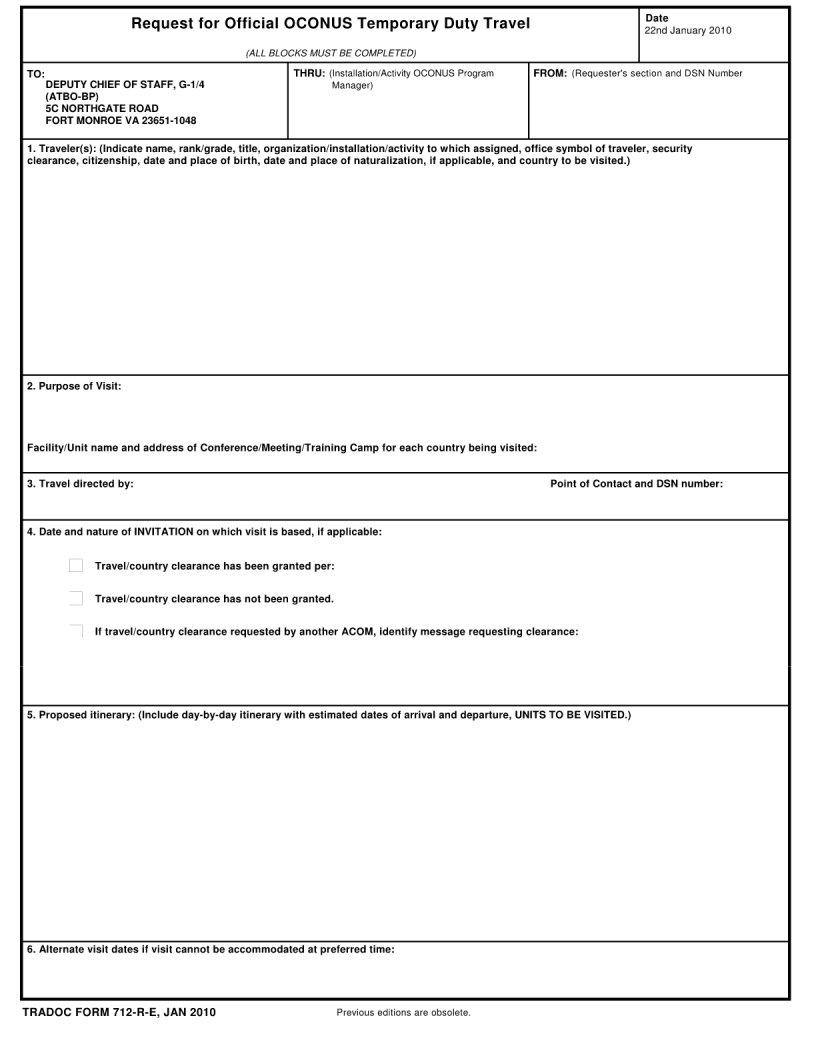

Tradoc Form 712 R E ≡ Fill Out Printable PDF Forms Online

Web internal revenue service (irs) tax code 7702 sets the guidelines for determining the tax status of whole, universal life and other types of permanent life insurance. Web irs form 712 is an informational tax form that is used to report the value of life insurance policies as part of an estate tax return. The value of all policies on.

Form 712 Life Insurance Statement (2006) Free Download

Web internal revenue service (irs) tax code 7702 sets the guidelines for determining the tax status of whole, universal life and other types of permanent life insurance. If there were multiple policies in effect, the. Web irs form 712 is an informational tax form that is used to report the value of life insurance policies as part of an estate.

IRS Form 712 A Guide to the Life Insurance Statement

If there were multiple policies in effect, the. Turbotax home & biz windows posted june 4, 2019 7:13 pm last updated june 04, 2019 7:13 pm 0 2 6,799 reply bookmark icon 1 best answer sweetiejean level 15 not on your personal tax return. If a policy doesn’t meet the. Do i need to report that as income? Web internal.

Life Insurance Form 712 Realtors Can Save Up to 58 on Life Insurance

Web the irs federal form 712 reports the value of a life insurance policy's proceeds after the insured dies for estate tax purposes. The value of all policies on the decedent’s life must be reported on the estate tax return on schedule d, regardless of whether they were owned inside the estate or not. Web form 712 reports the value.

United Insurance Claim Form Pdf

If there were multiple policies in effect, the. Web irs form 712 is an informational tax form that is used to report the value of life insurance policies as part of an estate tax return. Web internal revenue service (irs) tax code 7702 sets the guidelines for determining the tax status of whole, universal life and other types of permanent.

Life Insurance Form 712 Realtors Can Save Up to 58 on Life Insurance

Web irs form 712 is an informational tax form that is used to report the value of life insurance policies as part of an estate tax return. Web i received form 712 for a $5000 life insurance payout following my husband's death. Web information about gestalt 712, life insurance statement, including recent actualizations, related forms, and instructions on how to.

Insurance Policy Form 712

This form is not filed by itself, but as an accompaniment to other estate tax forms, most notably irs form 706: Web internal revenue service (irs) tax code 7702 sets the guidelines for determining the tax status of whole, universal life and other types of permanent life insurance. The value of all policies on the decedent’s life must be reported.

Form 712 Life Insurance Statement (2006) Free Download

This form is not filed by itself, but as an accompaniment to other estate tax forms, most notably irs form 706: The value of all policies on the decedent’s life must be reported on the estate tax return on schedule d, regardless of whether they were owned inside the estate or not. Do i need to report that as income?.

The Value Of All Policies On The Decedent’s Life Must Be Reported On The Estate Tax Return On Schedule D, Regardless Of Whether They Were Owned Inside The Estate Or Not.

Web irs form 712 is an informational tax form that is used to report the value of life insurance policies as part of an estate tax return. Turbotax home & biz windows posted june 4, 2019 7:13 pm last updated june 04, 2019 7:13 pm 0 2 6,799 reply bookmark icon 1 best answer sweetiejean level 15 not on your personal tax return. If there were multiple policies in effect, the. Web i received form 712 for a $5000 life insurance payout following my husband's death.

Web The Irs Federal Form 712 Reports The Value Of A Life Insurance Policy's Proceeds After The Insured Dies For Estate Tax Purposes.

Web information about gestalt 712, life insurance statement, including recent actualizations, related forms, and instructions on how to file. Web form 712 reports the value of a policy in order to prepare the estate tax forms. Do i need to report that as income? Web information about form 712, life insurance statement, including recent updates, related forms, and instructions on how to file.

Web Internal Revenue Service (Irs) Tax Code 7702 Sets The Guidelines For Determining The Tax Status Of Whole, Universal Life And Other Types Of Permanent Life Insurance.

This form is not filed by itself, but as an accompaniment to other estate tax forms, most notably irs form 706: If a policy doesn’t meet the.