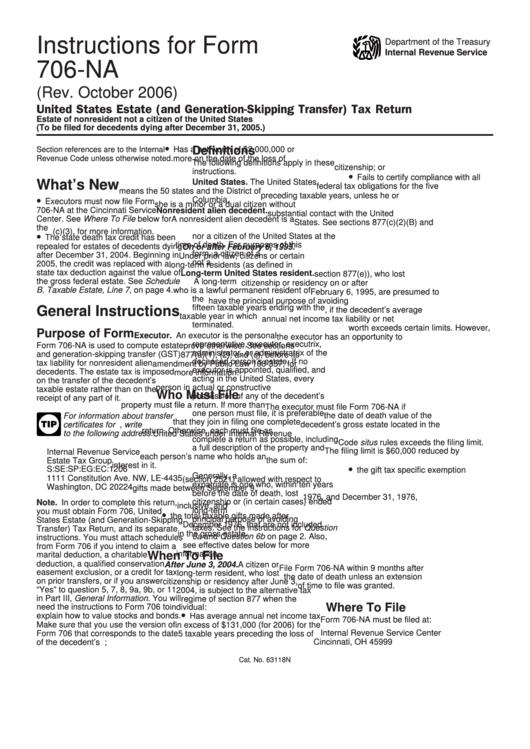

Form 706 Na Instructions

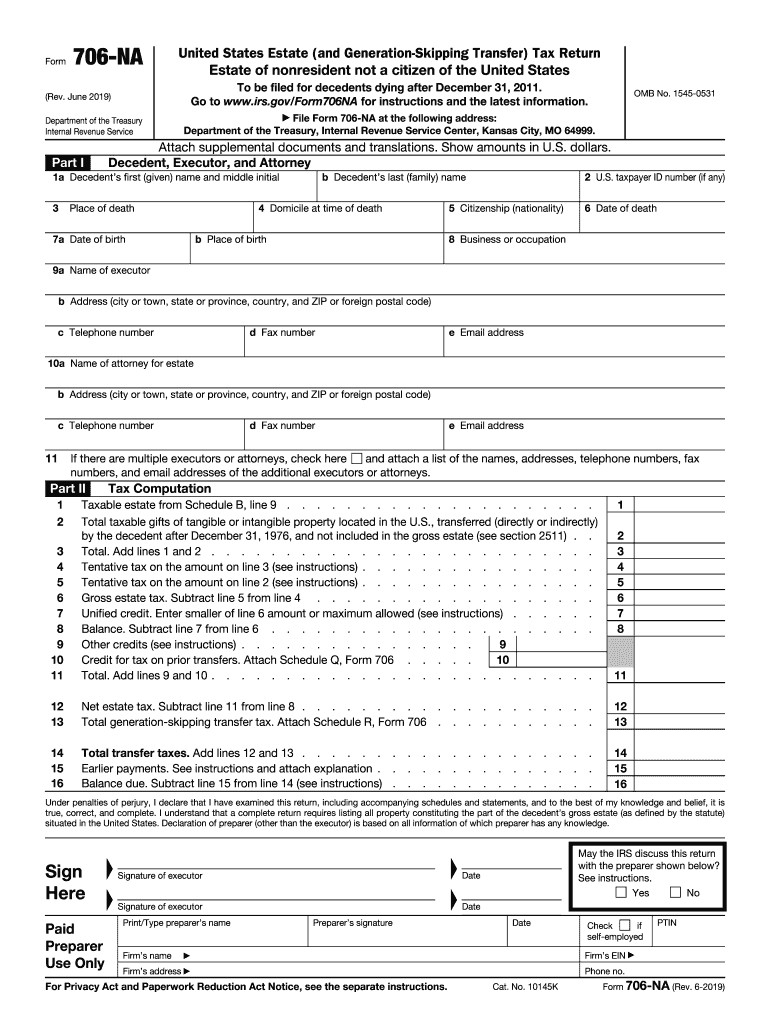

Form 706 Na Instructions - It is important to check that you are using the correct revision of the document for the year that the deceased passed away. Web irs form 706 is a tax return used to compute estate and gst tax liability for u.s. Form 706 is available as a pdf online and must be filed with the. Attach supplemental documents and translations. The form consists of six parts and 19 supporting schedules spanning 29 pages. For information about transfer certificates for u.s. Web for instructions and the latest information. Part i decedent, executor, and attorney. You must also include any schedules if you will claim any of the following deductions: Exceeds the filing limit of $60,000.

Web irs form 706 is a tax return used to compute estate and gst tax liability for u.s. Form 706 is available as a pdf online and must be filed with the. Part i decedent, executor, and attorney. The form consists of six parts and 19 supporting schedules spanning 29 pages. How long does it take to obtain a. Attach supplemental documents and translations. Department of the treasury, internal revenue service center, kansas city, mo 64999. Tax credit for prior transfers Web for instructions and the latest information. For information about transfer certificates for u.s.

It is important to check that you are using the correct revision of the document for the year that the deceased passed away. Web irs form 706 is a tax return used to compute estate and gst tax liability for u.s. The form consists of six parts and 19 supporting schedules spanning 29 pages. The estate tax is imposed on the transfer of the decedent's taxable estate rather than on the receipt of any part of it. Attach supplemental documents and translations. Form 706 is available as a pdf online and must be filed with the. Exceeds the filing limit of $60,000. Tax credit for prior transfers How long does it take to obtain a. You must also include any schedules if you will claim any of the following deductions:

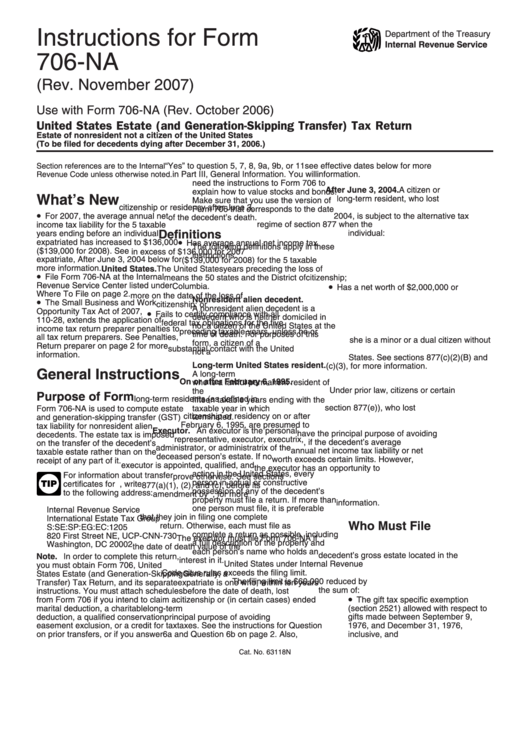

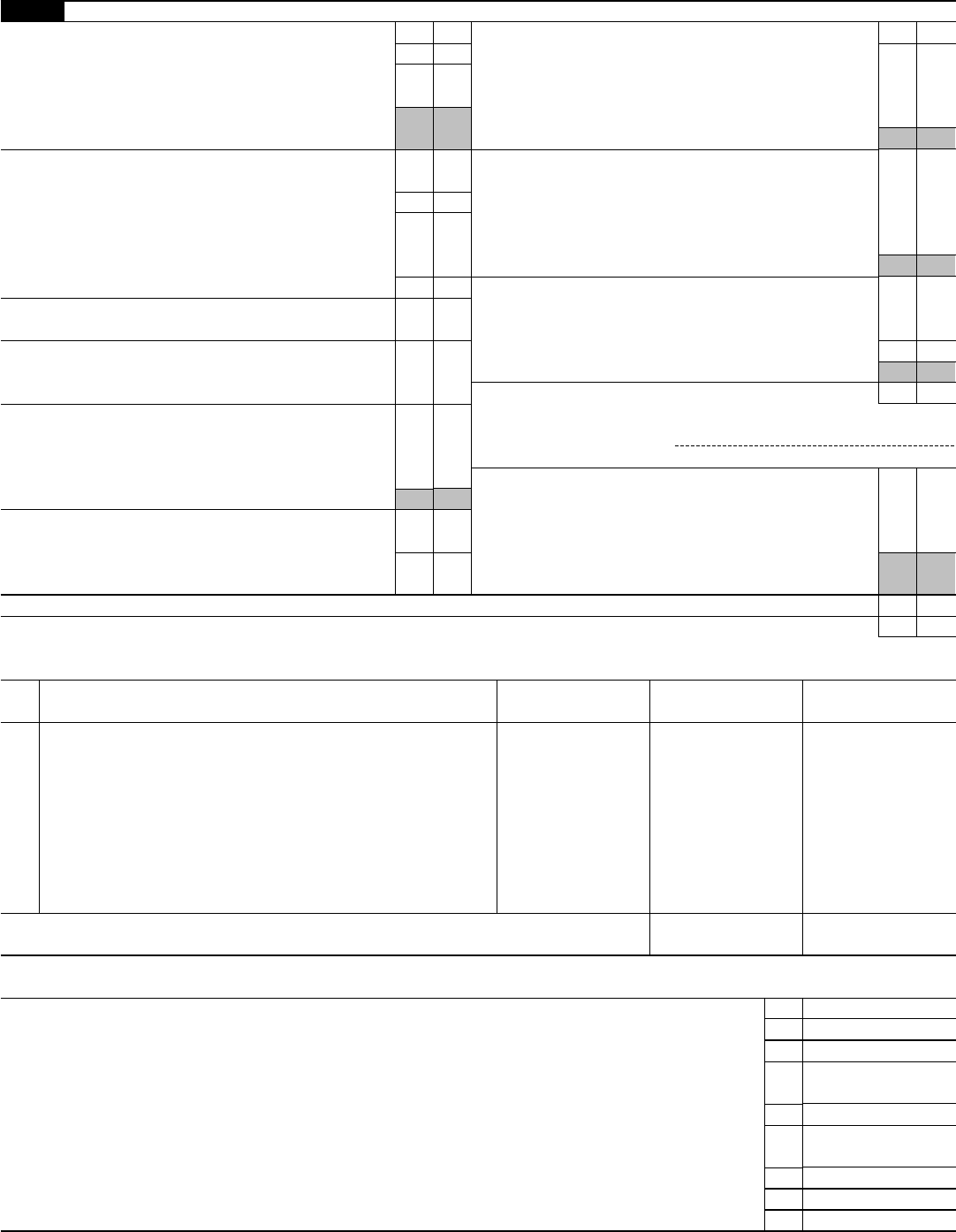

Instructions Draft For Form 706Na United States Estate (And

How long does it take to obtain a. You must also include any schedules if you will claim any of the following deductions: Web for instructions and the latest information. Form 706 is available as a pdf online and must be filed with the. Exceeds the filing limit of $60,000.

Irs form 706 na Fill out & sign online DocHub

Attach supplemental documents and translations. You must also include any schedules if you will claim any of the following deductions: Part i decedent, executor, and attorney. The estate tax is imposed on the transfer of the decedent's taxable estate rather than on the receipt of any part of it. It is important to check that you are using the correct.

Instructions For Form 706Na United States Estate (And Generation

Exceeds the filing limit of $60,000. Web for instructions and the latest information. It is important to check that you are using the correct revision of the document for the year that the deceased passed away. The estate tax is imposed on the transfer of the decedent's taxable estate rather than on the receipt of any part of it. Tax.

79 706 Forms And Schedules And Templates free to download in PDF

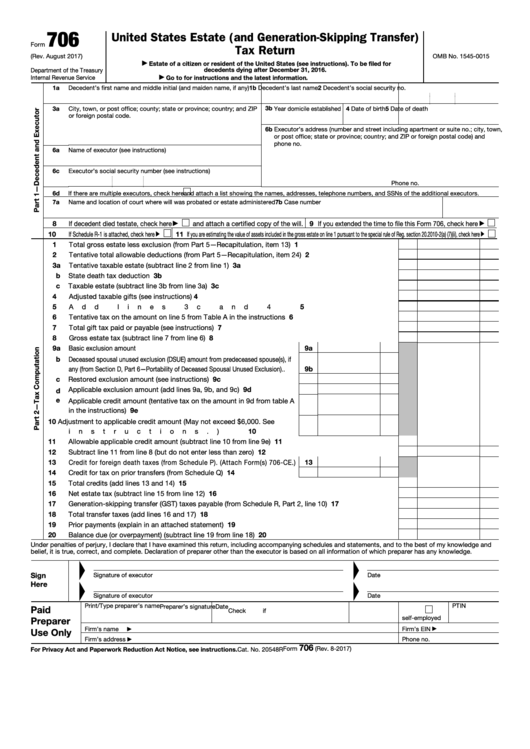

Tax credit for prior transfers How long does it take to obtain a. Web irs form 706 is a tax return used to compute estate and gst tax liability for u.s. Form 706 is used to figure the estate tax imposed by chapter 11, and compute the gst tax imposed by chapter 13 on direct skips. You must also include.

Instructions For Form 706 United States Estate (And Generation

Part i decedent, executor, and attorney. Tax credit for prior transfers It is important to check that you are using the correct revision of the document for the year that the deceased passed away. Form 706 is used to figure the estate tax imposed by chapter 11, and compute the gst tax imposed by chapter 13 on direct skips. The.

Instructions For Form 706Na United States Estate (And Generation

Form 706 is available as a pdf online and must be filed with the. How long does it take to obtain a. Department of the treasury, internal revenue service center, kansas city, mo 64999. Part i decedent, executor, and attorney. For information about transfer certificates for u.s.

Instructions For Form 706Na United States Estate (And Generation

Web for instructions and the latest information. Tax credit for prior transfers Department of the treasury, internal revenue service center, kansas city, mo 64999. Form 706 is used to figure the estate tax imposed by chapter 11, and compute the gst tax imposed by chapter 13 on direct skips. Part i decedent, executor, and attorney.

Form 706NA Edit, Fill, Sign Online Handypdf

Exceeds the filing limit of $60,000. Attach supplemental documents and translations. Department of the treasury, internal revenue service center, kansas city, mo 64999. It is important to check that you are using the correct revision of the document for the year that the deceased passed away. Part i decedent, executor, and attorney.

Form 706NA United States Estate Tax Return (2013) Free Download

Exceeds the filing limit of $60,000. You must also include any schedules if you will claim any of the following deductions: Attach supplemental documents and translations. Tax credit for prior transfers For information about transfer certificates for u.s.

Instructions For Form 706Na United States Estate (And Generation

Part i decedent, executor, and attorney. Web irs form 706 is a tax return used to compute estate and gst tax liability for u.s. The form consists of six parts and 19 supporting schedules spanning 29 pages. Form 706 is used to figure the estate tax imposed by chapter 11, and compute the gst tax imposed by chapter 13 on.

For Information About Transfer Certificates For U.s.

The estate tax is imposed on the transfer of the decedent's taxable estate rather than on the receipt of any part of it. How long does it take to obtain a. Tax credit for prior transfers Form 706 is used to figure the estate tax imposed by chapter 11, and compute the gst tax imposed by chapter 13 on direct skips.

Part I Decedent, Executor, And Attorney.

Web irs form 706 is a tax return used to compute estate and gst tax liability for u.s. Department of the treasury, internal revenue service center, kansas city, mo 64999. It is important to check that you are using the correct revision of the document for the year that the deceased passed away. Web for instructions and the latest information.

You Must Also Include Any Schedules If You Will Claim Any Of The Following Deductions:

Exceeds the filing limit of $60,000. Form 706 is available as a pdf online and must be filed with the. Attach supplemental documents and translations. The form consists of six parts and 19 supporting schedules spanning 29 pages.