Form 6765 Instructions

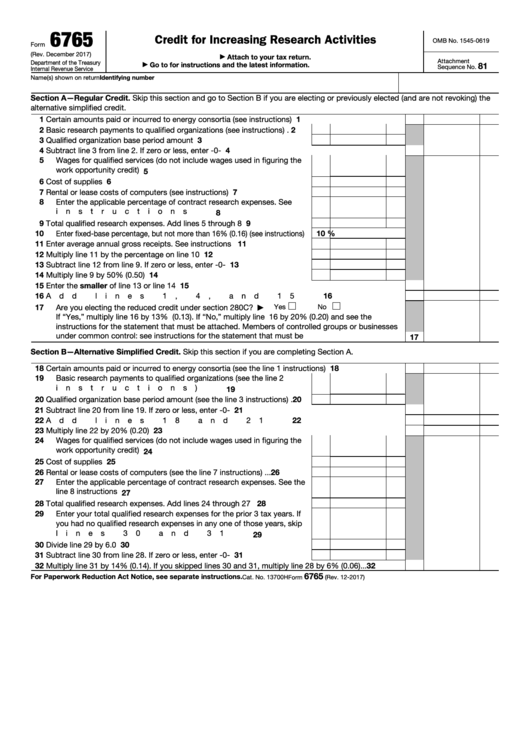

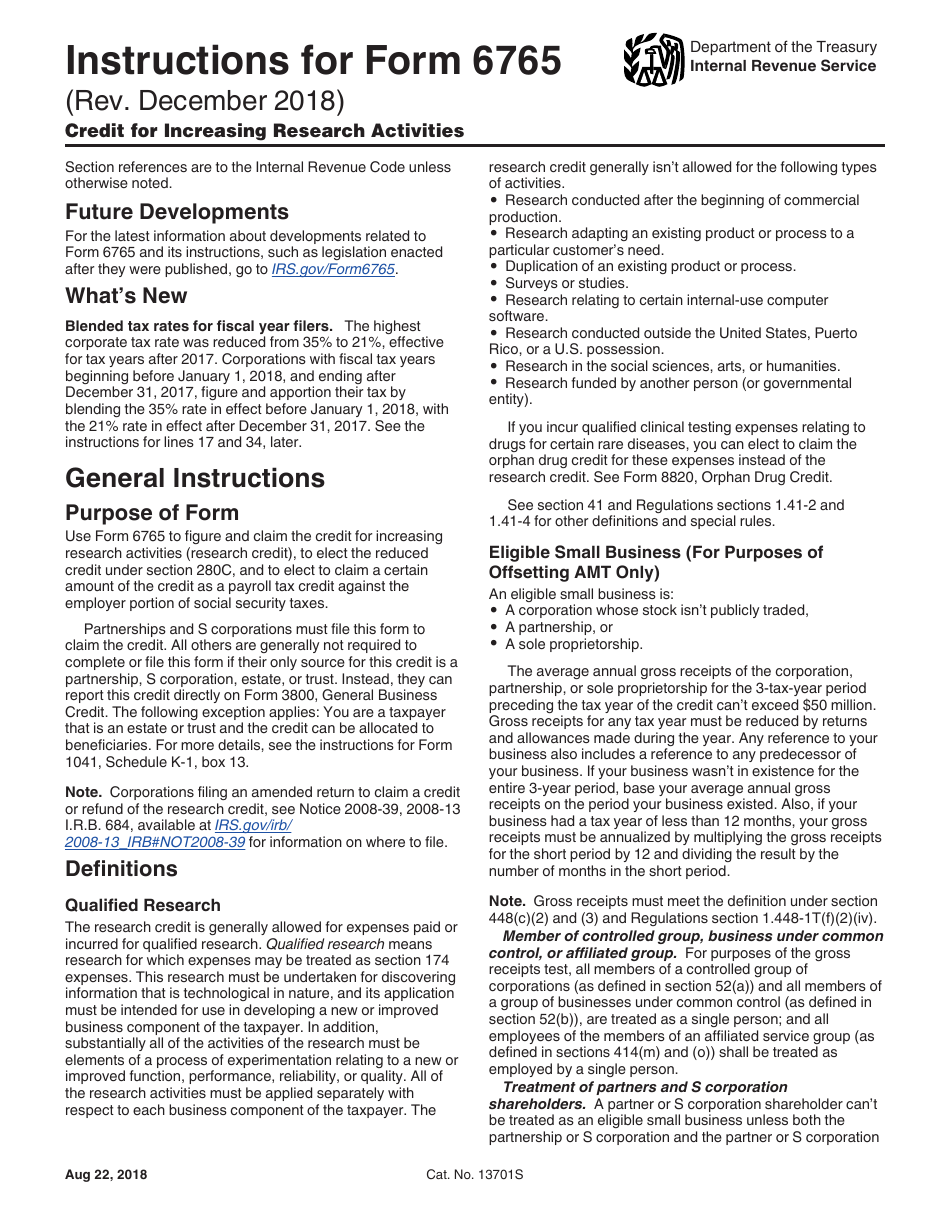

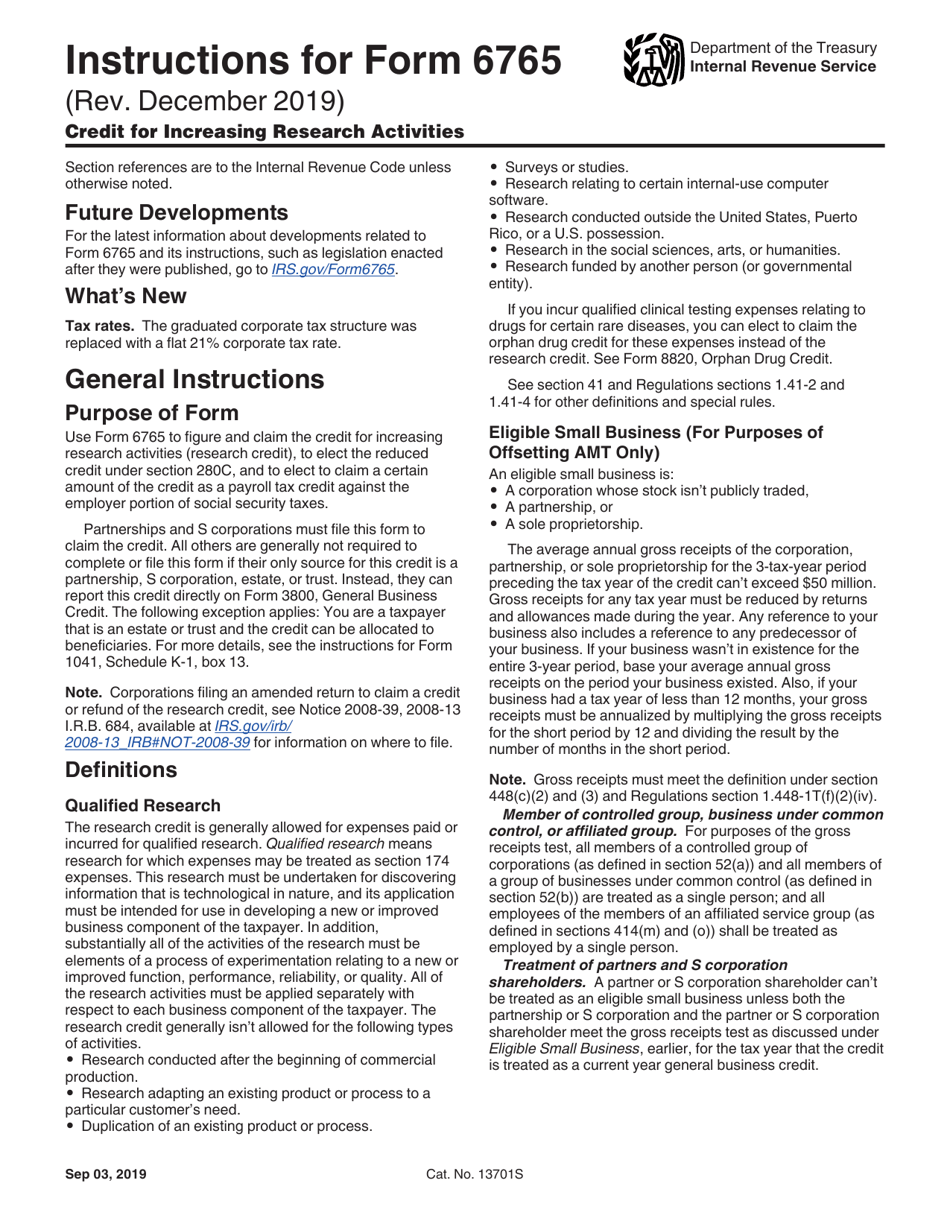

Form 6765 Instructions - Web what is form 6765? Taxpayers use form 6765 to: Figure and claim the credit for increasing research activities. Elect to take a reduced credit (see below for more information on this election) elect and calculate the payroll tax credit (see below). Web to document their qualified r&d expenses, businesses must complete the four basic sections of form 6765: Web who should fill form 6765? Members of controlled groups or businesses under common control, see instructions for the statement that must be attached. Elect the reduced credit under section 280c. The form includes four sections: Section b applies to the alternative simplified credit (asc).

Figure and claim the credit for increasing research activities. Determine if your startup is eligible ; Attach to your tax return The faa “clarified” how taxpayers can make a valid claim under section 41 (research credit) on an amended return or administrative adjustment request (aar). Web use form 6765 to: To calculate the regular credit amount Section b applies to the alternative simplified credit (asc). Taxpayers use form 6765 to: Instructions on filling out form 6765: Web who should fill form 6765?

Figure and claim the credit for increasing research activities. As expected, the irs formalized the rules they outlined in faa20214101f. Attach to your tax return Web who should fill form 6765? Taxpayers use form 6765 to: Web use form 6765 to: Determine if your startup is eligible ; Web to document their qualified r&d expenses, businesses must complete the four basic sections of form 6765: Web use form 6765 to figure and claim the credit for increasing research activities, to elect the reduced credit under section 280c, and to elect to claim a certain amount of the credit as a payroll tax credit against the employer portion of social security taxes. Web instructions for the statement that must be attached.

LEGO instructions Wild West 6765 Gold City Junction YouTube

Attach to your tax return Web the draft form 6765 instructions remind taxpayers of the process to follow for bba partnerships. Partnerships and s corporations must file this form to claim the credit. Form 6765 is used to calculate and claim the r&d tax credits you are entitled to for increasing research and experimentation activities. Members of controlled groups or.

Fillable Form 6765 Credit For Increasing Research Activities 2016

For paperwork reduction act notice, see separate instructions. Partnerships and s corporations must file this form to claim the credit. Figure and claim the credit for increasing research activities. Calculate and claim the r&d tax credit; Web use form 6765 to:

Form 6765 Credit for Increasing Research Activities (2014) Free Download

Web what is form 6765? Web use form 6765 to: Web what is form 6765, and why would i need it? Form 6765 is used to calculate and claim the r&d tax credits you are entitled to for increasing research and experimentation activities. To calculate the regular credit amount

How to Fill Out Form 6765 (R&D Tax Credit) RD Tax Credit Software

For paperwork reduction act notice, see separate instructions. Calculate and claim the r&d tax credit; Members of controlled groups or businesses under common control, see instructions for the statement that must be attached. Elect and figure the payroll tax credit. Elect to take a reduced credit (see below for more information on this election) elect and calculate the payroll tax.

Form 6765, Credit for Increasing Research Activities A Beginner’s

Members of controlled groups or businesses under common control, see instructions for the statement that must be attached. Calculate and claim the r&d tax credit; It also allows you to communicate how you would like to. Web what is form 6765, and why would i need it? Web use form 6765 to figure and claim the credit for increasing research.

Form 6765 Credit for Increasing Research Activities (2014) Free Download

Elect the reduced credit under section 280c. Bba partnerships cannot file amended returns but instead, must file under the aar. Web the irs released a draft of the instructions for form 6765, credit for increasing research activities. Web to document their qualified r&d expenses, businesses must complete the four basic sections of form 6765: Web what is form 6765?

Download Instructions for IRS Form 6765 Credit for Increasing Research

Partnerships and s corporations must file this form to claim the credit. To calculate the regular credit amount Members of controlled groups or businesses under common control, see instructions for the statement that must be attached. As expected, the irs formalized the rules they outlined in faa20214101f. Form 6765 is used to calculate and claim the r&d tax credits you.

Explore Our Sample of Condominium Association Budget Template for Free

Web to document their qualified r&d expenses, businesses must complete the four basic sections of form 6765: Attach to your tax return Section a is used to claim the regular credit and has eight lines of required information (lines 1,2,3,7,8,10,11 and17). It also allows you to communicate how you would like to. Instructions for form 6765(print versionpdf).

IRS Form 6765

To calculate the regular credit amount Web the irs released a draft of the instructions for form 6765, credit for increasing research activities. For paperwork reduction act notice, see separate instructions. Form 6765 is used to calculate and claim the r&d tax credits you are entitled to for increasing research and experimentation activities. Attach to your tax return

Download Instructions for IRS Form 6765 Credit for Increasing Research

Determine if your startup is eligible ; Web use form 6765 to: Web the draft form 6765 instructions remind taxpayers of the process to follow for bba partnerships. Figure and claim the credit for increasing research activities. Instructions for form 6765(print versionpdf).

Bba Partnerships Cannot File Amended Returns But Instead, Must File Under The Aar.

To calculate the regular credit amount Elect and figure the payroll tax credit. Web who should fill form 6765? Web the draft form 6765 instructions remind taxpayers of the process to follow for bba partnerships.

Elect The Reduced Credit Under Section 280C.

It also allows you to communicate how you would like to. Web use form 6765 to: Form 6765 is used to calculate and claim the r&d tax credits you are entitled to for increasing research and experimentation activities. The faa “clarified” how taxpayers can make a valid claim under section 41 (research credit) on an amended return or administrative adjustment request (aar).

Web Instructions For The Statement That Must Be Attached.

As expected, the irs formalized the rules they outlined in faa20214101f. The form includes four sections: Elect to take a reduced credit (see below for more information on this election) elect and calculate the payroll tax credit (see below). Web what is form 6765, and why would i need it?

Members Of Controlled Groups Or Businesses Under Common Control, See Instructions For The Statement That Must Be Attached.

Figure and claim the credit for increasing research activities. Web use form 6765 to figure and claim the credit for increasing research activities, to elect the reduced credit under section 280c, and to elect to claim a certain amount of the credit as a payroll tax credit against the employer portion of social security taxes. Calculate and claim the r&d tax credit; Instructions on filling out form 6765: