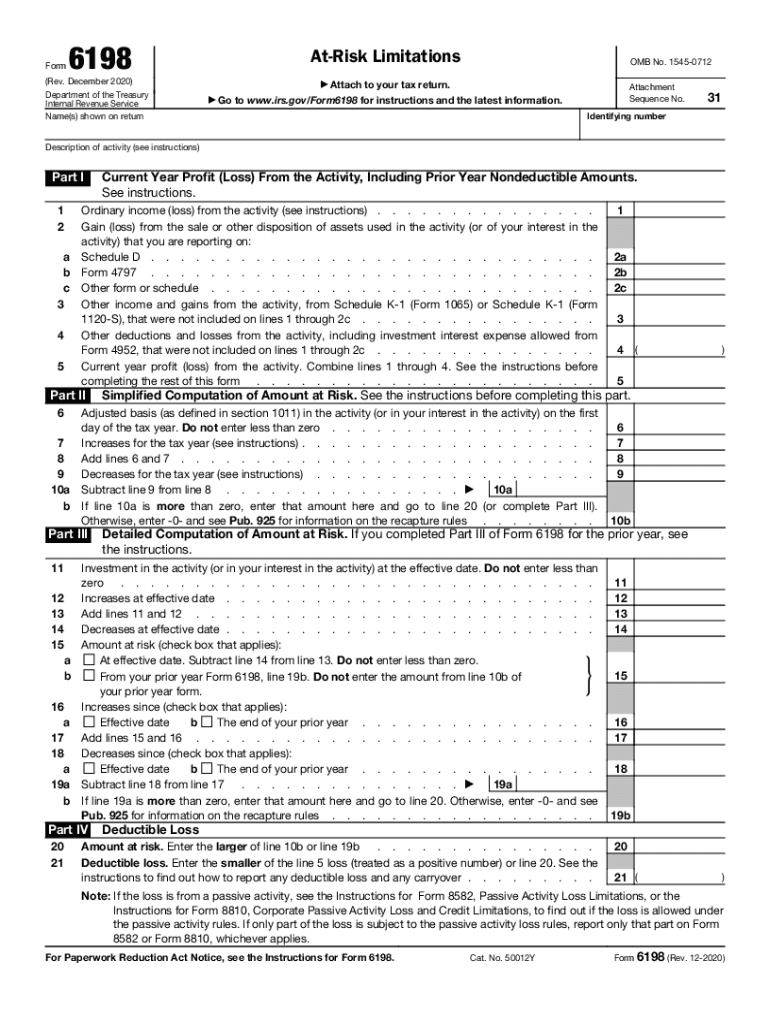

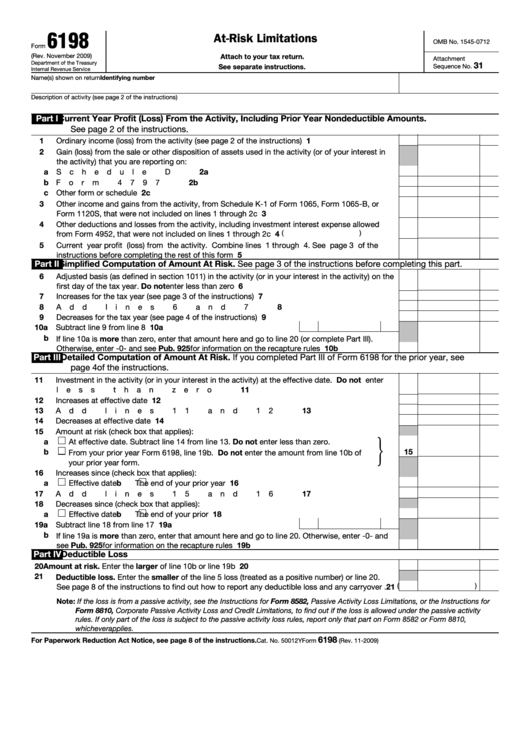

Form 6198 Explained

Form 6198 Explained - Web the basics starting with the basis limitation under sec. Form 6198 must be completed if there is an entry on line 19 above. Web the internal revenue service (irs) lets taxpayers deduct cash spent on company expenses up to a specified amount. To learn more, see publication 925: Ad edit, sign and print tax forms on any device with signnow. This form gathers information on your total income or. Solved•by intuit•3•updated july 12, 2022. Web purpose of form use form 6198 to figure: Web use irs form 461 to calculate limitations on business losses and report them on your personal tax return. Web if some of the money you invested isn’t at risk, use form 6198 to figure your allowable loss.

You do not have to file form 6198 if file form 6198 if during the tax year 1. Web the internal revenue service (irs) lets taxpayers deduct cash spent on company expenses up to a specified amount. Solved•by intuit•3•updated july 12, 2022. To learn more, see publication 925: This form gathers information on your total income or. Form 6198 is used to determine the profit (or loss) from an. Web use irs form 461 to calculate limitations on business losses and report them on your personal tax return. Web if some of the money you invested isn’t at risk, use form 6198 to figure your allowable loss. Web drafting irs form 6198 is a good skill to have so you can determine the maximum deductible amount after a loss in your invested business throughout the tax year. Ad edit, sign and print tax forms on any device with signnow.

Form 6198 must be completed if there is an entry on line 19 above. Get ready for tax season deadlines by completing any required tax forms today. You can download or print current or past. Web this new form and its separate instructions are used to claim the irc 179d deduction for qualifying energy efficient commercial building expenses. Web as modified by section 465(a)(3). Web purpose of form use form 6198 to figure: Web if some of the money you invested isn’t at risk, use form 6198 to figure your allowable loss. Ad edit, sign and print tax forms on any device with signnow. Solved•by intuit•3•updated july 12, 2022. Form 6198 is used to determine the profit (or loss) from an.

Guide to Understanding the AtRisk Basis Rules and Form 6198 (UARB

Web the basics starting with the basis limitation under sec. Get ready for tax season deadlines by completing any required tax forms today. Web purpose of form use form 6198 to figure: Web if some of the money you invested isn’t at risk, use form 6198 to figure your allowable loss. Form 6198 must be completed if there is an.

6198 At Risk Limitations Fill Out and Sign Printable PDF Template

You can download or print current or past. Ad edit, sign and print tax forms on any device with signnow. Form 6198 should be filed when a taxpayer has a loss in a. To learn more, see publication 925: Nonrecourse loans used to you are engaged in an.

Form 6198 atRisk Limitations Inscription on the Piece of Paper Stock

Web drafting irs form 6198 is a good skill to have so you can determine the maximum deductible amount after a loss in your invested business throughout the tax year. This form gathers information on your total income or. Form 6198 should be filed when a taxpayer has a loss in a. Web the internal revenue service (irs) lets taxpayers.

_MG_6198 corrected copy Unsung

Ad edit, sign and print tax forms on any device with signnow. Nonrecourse loans used to you are engaged in an. Get ready for tax season deadlines by completing any required tax forms today. 704 (d), a partner's basis in its partnership interest can never be negative. Form 6198 is used to determine the profit (or loss) from an.

Form 6198 Fill Out and Sign Printable PDF Template signNow

You can download or print current or past. Web this new form and its separate instructions are used to claim the irc 179d deduction for qualifying energy efficient commercial building expenses. Web the basics starting with the basis limitation under sec. Form 6198 is used to determine the profit (or loss) from an. Web if some of the money you.

3M PerfectIt RUBBING COMPOUND PASTE Paint Supplies Bayswater

Web purpose of form use form 6198 to figure: To learn more, see publication 925: Nonrecourse loans used to you are engaged in an. You can download or print current or past. This form gathers information on your total income or.

Top 6 Form 6198 Templates free to download in PDF format

You do not have to file form 6198 if file form 6198 if during the tax year 1. Web the internal revenue service (irs) lets taxpayers deduct cash spent on company expenses up to a specified amount. Get ready for tax season deadlines by completing any required tax forms today. Web this new form and its separate instructions are used.

Elegant terns (Sterna elegans) nesting Stock Photo

Solved•by intuit•3•updated july 12, 2022. This form gathers information on your total income or. Form 6198 must be completed if there is an entry on line 19 above. Web the internal revenue service (irs) lets taxpayers deduct cash spent on company expenses up to a specified amount. Web drafting irs form 6198 is a good skill to have so you.

Fill Free fillable AtRisk Limitations Form 6198 (Rev. November 2009

Web drafting irs form 6198 is a good skill to have so you can determine the maximum deductible amount after a loss in your invested business throughout the tax year. Web use irs form 461 to calculate limitations on business losses and report them on your personal tax return. This form gathers information on your total income or. Web as.

Download Instructions for IRS Form 6198 AtRisk Limitations PDF

Web if some of the money you invested isn’t at risk, use form 6198 to figure your allowable loss. Web as modified by section 465(a)(3). Form 6198 should be filed when a taxpayer has a loss in a. Web this new form and its separate instructions are used to claim the irc 179d deduction for qualifying energy efficient commercial building.

Web Use Irs Form 461 To Calculate Limitations On Business Losses And Report Them On Your Personal Tax Return.

Web as modified by section 465(a)(3). You can download or print current or past. Form 6198 must be completed if there is an entry on line 19 above. Web drafting irs form 6198 is a good skill to have so you can determine the maximum deductible amount after a loss in your invested business throughout the tax year.

Solved•By Intuit•3•Updated July 12, 2022.

This form gathers information on your total income or. To learn more, see publication 925: Form 6198 is used to determine the profit (or loss) from an. You do not have to file form 6198 if file form 6198 if during the tax year 1.

Nonrecourse Loans Used To You Are Engaged In An.

Get ready for tax season deadlines by completing any required tax forms today. 704 (d), a partner's basis in its partnership interest can never be negative. Web the internal revenue service (irs) lets taxpayers deduct cash spent on company expenses up to a specified amount. Web this new form and its separate instructions are used to claim the irc 179d deduction for qualifying energy efficient commercial building expenses.

Web Purpose Of Form Use Form 6198 To Figure:

Form 6198 should be filed when a taxpayer has a loss in a. If a loss exceeds basis, basis. Web if some of the money you invested isn’t at risk, use form 6198 to figure your allowable loss. Ad edit, sign and print tax forms on any device with signnow.