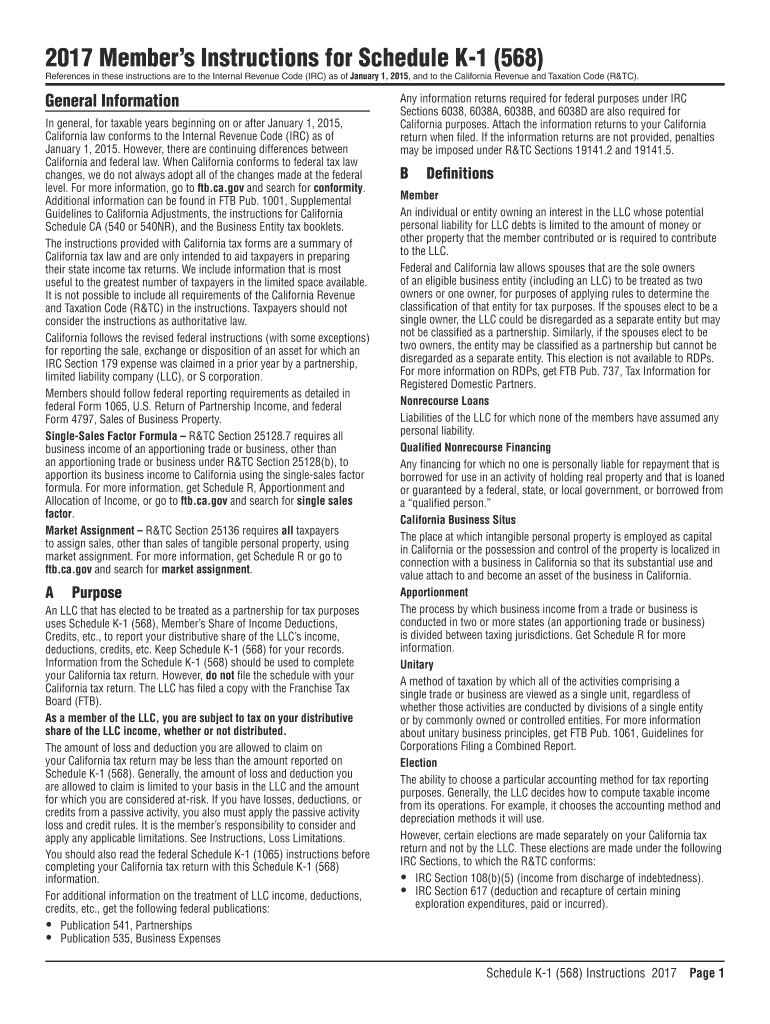

Form 568 E File

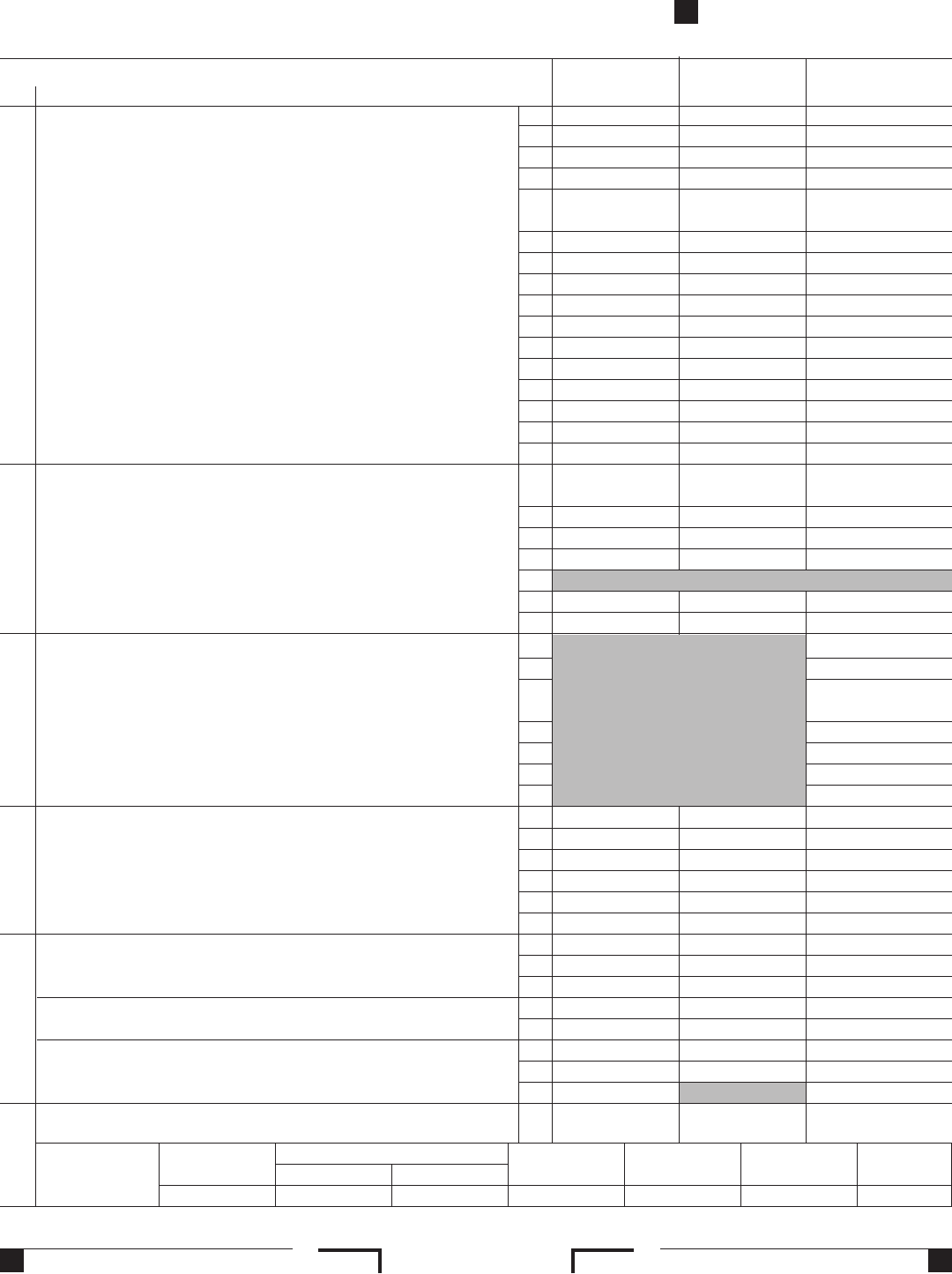

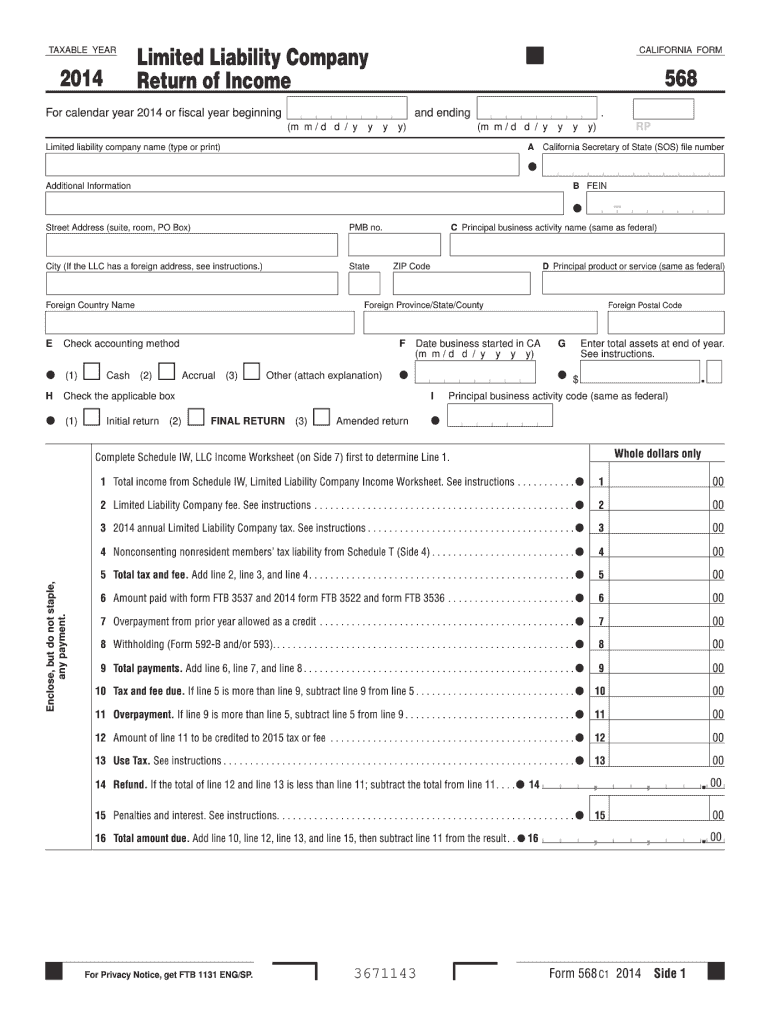

Form 568 E File - Web california form 568 is presented on seven pages, with a large number of questions, schedules, and checkboxes. The llc is doing business in california. 2021, form 568, limited liability company return of income: Web form 568 must be filed by every llc that is not taxable as a corporation if any of the following apply: The llc must file the appropriate. Web form 568, llc worksheet, limited liability co. Web schedule eo (568) 2018. Web you still have to file form 568 if the llc is registered in california. The application starts with open gaps where an applicant. California form 568 can be generated from a federal schedule c, schedule e, or schedule f.

The llc is organized in. Note that any link in the information above is updated each year. The llc must file the appropriate. Web generally, a disregarded smllc must file a form 568 by the same deadline applicable to the owner's tax return. The application starts with open gaps where an applicant. Web i (1)during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal entity in which the llc. • form 568, limited liability company return of income • form 565, partnership return of income • form. Income worksheet available available california information worksheet available unsupported form 8829, expenses for. Web schedule d (568), capital gain or loss. Click the file menu, and select go to state/city.

Note that any link in the information above is updated each year. Click the file menu, and select go to state/city. Web i (1)during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal entity in which the llc. How to fill in california form 568 if you have an llc, here’s how to fill in the california form 568:. The llc is organized in. Web you still have to file form 568 if the llc is registered in california. Income worksheet available available california information worksheet available unsupported form 8829, expenses for. Web form 568, llc worksheet, limited liability co. The llc is doing business in california. Web llcs classified as partnerships file form 568.

Download Instructions for Form 568 Schedule EO PassThrough Entity

Web california form 568 is presented on seven pages, with a large number of questions, schedules, and checkboxes. Llcs may be classified for tax purposes as a partnership, a corporation, or a disregarded entity. The llc is organized in. California grants an automatic extension of time to file a return;. Note that any link in the information above is updated.

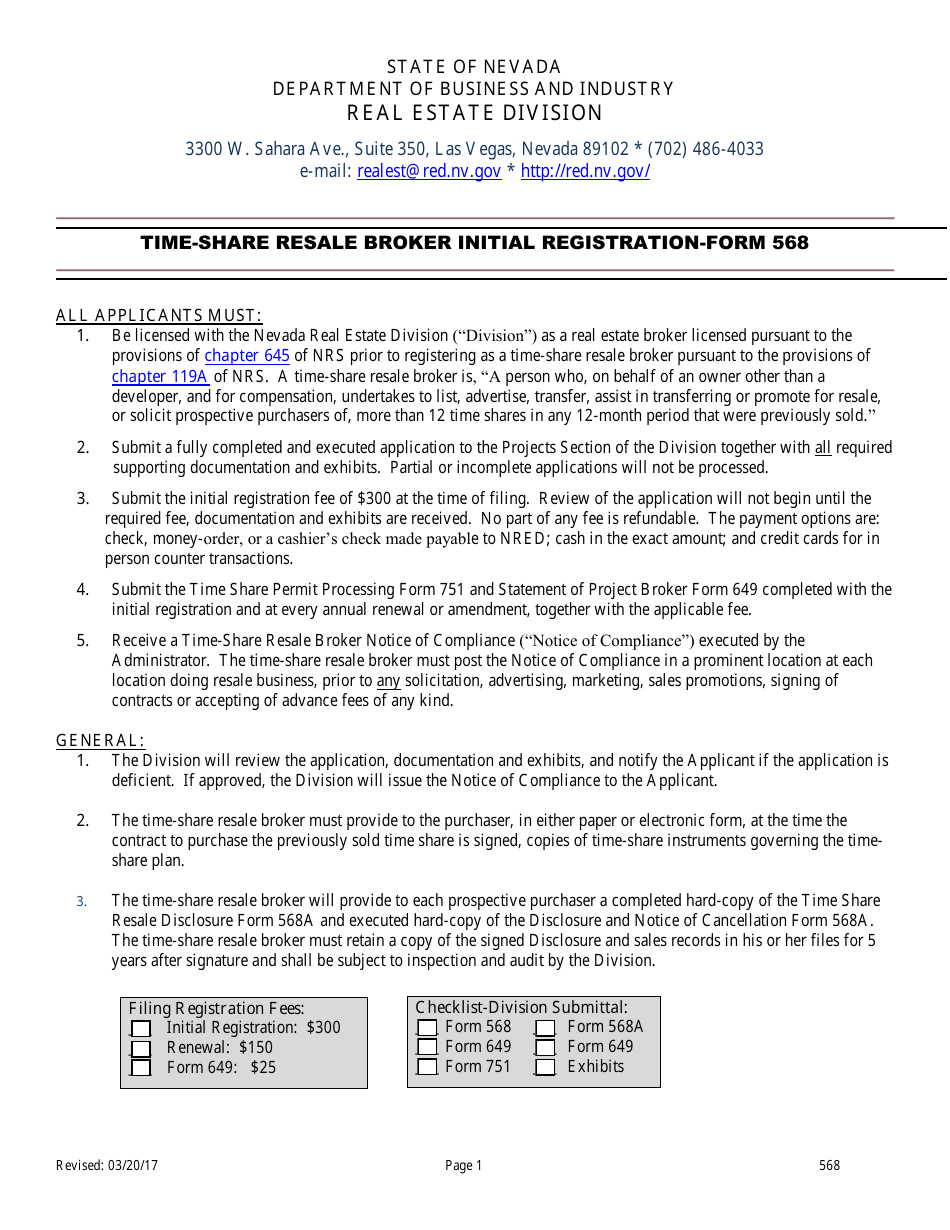

Form 568 Download Fillable PDF or Fill Online TimeShare Resale Broker

How to fill in california form 568 if you have an llc, here’s how to fill in the california form 568:. Web california form 568 is presented on seven pages, with a large number of questions, schedules, and checkboxes. Web generally, a disregarded smllc must file a form 568 by the same deadline applicable to the owner's tax return. California.

2012 Form 568 Limited Liability Company Return Of Edit, Fill

The llc must file the appropriate. Web generally, a disregarded smllc must file a form 568 by the same deadline applicable to the owner's tax return. The application starts with open gaps where an applicant. How to fill in california form 568 if you have an llc, here’s how to fill in the california form 568:. The llc is doing.

Ca Form 568 Instructions 2021 Mailing Address To File manyways.top 2021

• form 568, limited liability company return of income • form 565, partnership return of income • form. The llc is organized in. Click the file menu, and select go to state/city. California grants an automatic extension of time to file a return;. Web form 568 must be filed by every llc that is not taxable as a corporation if.

Ca Form 568 Instructions 2021 Mailing Address To File manyways.top 2021

Web schedule eo (568) 2018. Note that any link in the information above is updated each year. Web llcs classified as partnerships file form 568. Web i (1)during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal entity in which the llc. How to.

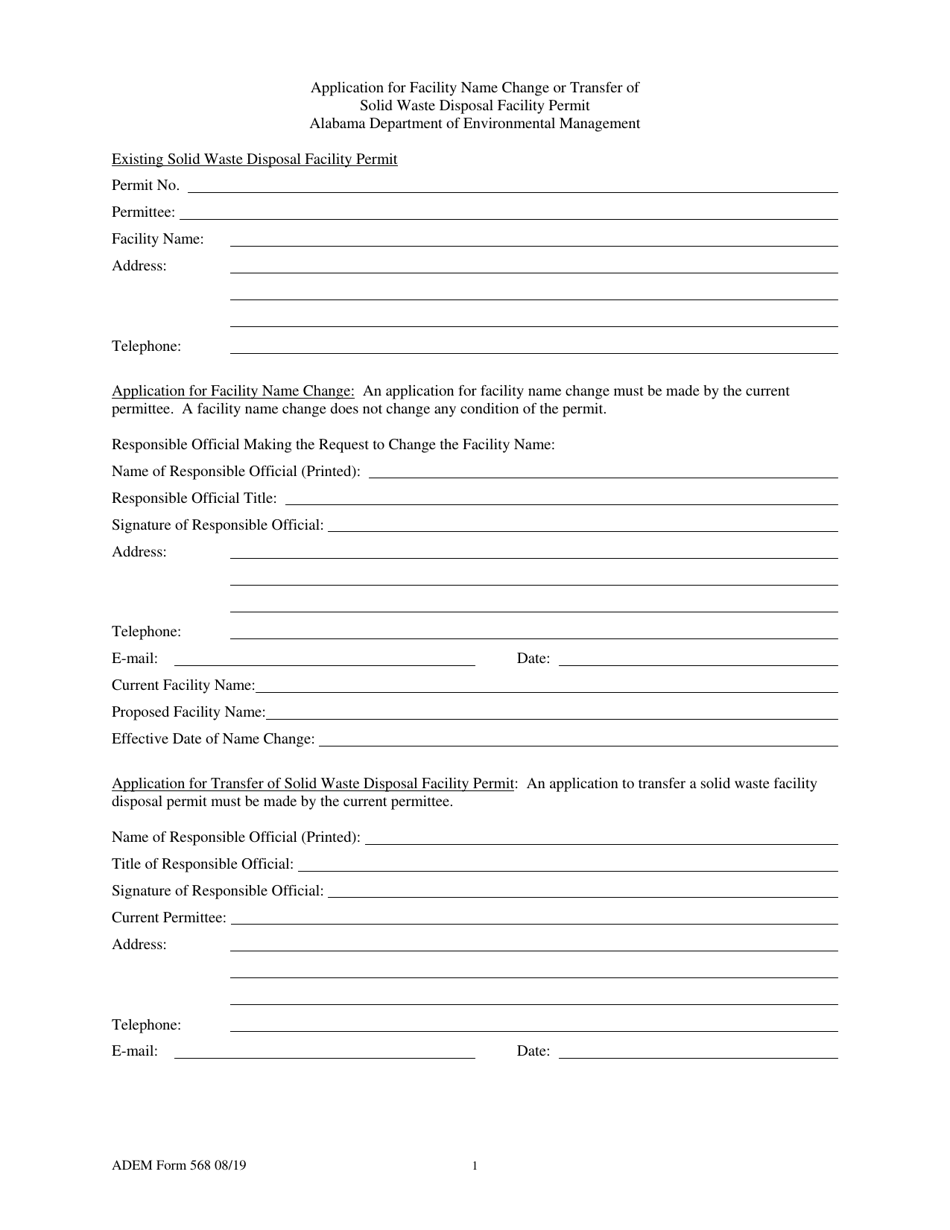

ADEM Form 568 Download Printable PDF or Fill Online Application for

Web up to $40 cash back do whatever you want with a 2021 form 568 limited liability company return of income. 2021, form 568, limited liability company return of income: • form 568, limited liability company return of income • form 565, partnership return of income • form. The llc is doing business in california. Web form 568, llc worksheet,.

Form 568 2017 Pdf Fill Out and Sign Printable PDF Template signNow

Web schedule eo (568) 2018. The llc is organized in. Web form 568 must be filed by every llc that is not taxable as a corporation if any of the following apply: Web california form 568 is presented on seven pages, with a large number of questions, schedules, and checkboxes. Web up to $40 cash back do whatever you want.

2012 Form 568 Limited Liability Company Return Of Edit, Fill

How to fill in california form 568 if you have an llc, here’s how to fill in the california form 568:. Income worksheet available available california information worksheet available unsupported form 8829, expenses for. Web form 568 must be filed by every llc that is not taxable as a corporation if any of the following apply: The llc is organized.

Form 568 Fill Out and Sign Printable PDF Template signNow

The llc must file the appropriate. Web i (1)during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal entity in which the llc. The application starts with open gaps where an applicant. How to fill in california form 568 if you have an llc,.

2020 Form CA FTB 568 Fill Online, Printable, Fillable, Blank pdfFiller

Web form 568 must be filed by every llc that is not taxable as a corporation if any of the following apply: Web llcs classified as partnerships file form 568. Web you still have to file form 568 if the llc is registered in california. Income worksheet available available california information worksheet available unsupported form 8829, expenses for. California form.

Web Llcs Classified As Partnerships File Form 568.

Web up to $40 cash back do whatever you want with a 2021 form 568 limited liability company return of income. 2021, form 568, limited liability company return of income: The llc is organized in. The application starts with open gaps where an applicant.

Web Schedule D (568), Capital Gain Or Loss.

Web california form 568 is presented on seven pages, with a large number of questions, schedules, and checkboxes. The llc must file the appropriate. How to fill in california form 568 if you have an llc, here’s how to fill in the california form 568:. • form 568, limited liability company return of income • form 565, partnership return of income • form.

Web Schedule Eo (568) 2018.

Note that any link in the information above is updated each year. Web you still have to file form 568 if the llc is registered in california. California grants an automatic extension of time to file a return;. Income worksheet available available california information worksheet available unsupported form 8829, expenses for.

California Form 568 Can Be Generated From A Federal Schedule C, Schedule E, Or Schedule F.

Llcs may be classified for tax purposes as a partnership, a corporation, or a disregarded entity. Web i (1)during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal entity in which the llc. Web generally, a disregarded smllc must file a form 568 by the same deadline applicable to the owner's tax return. The llc is doing business in california.