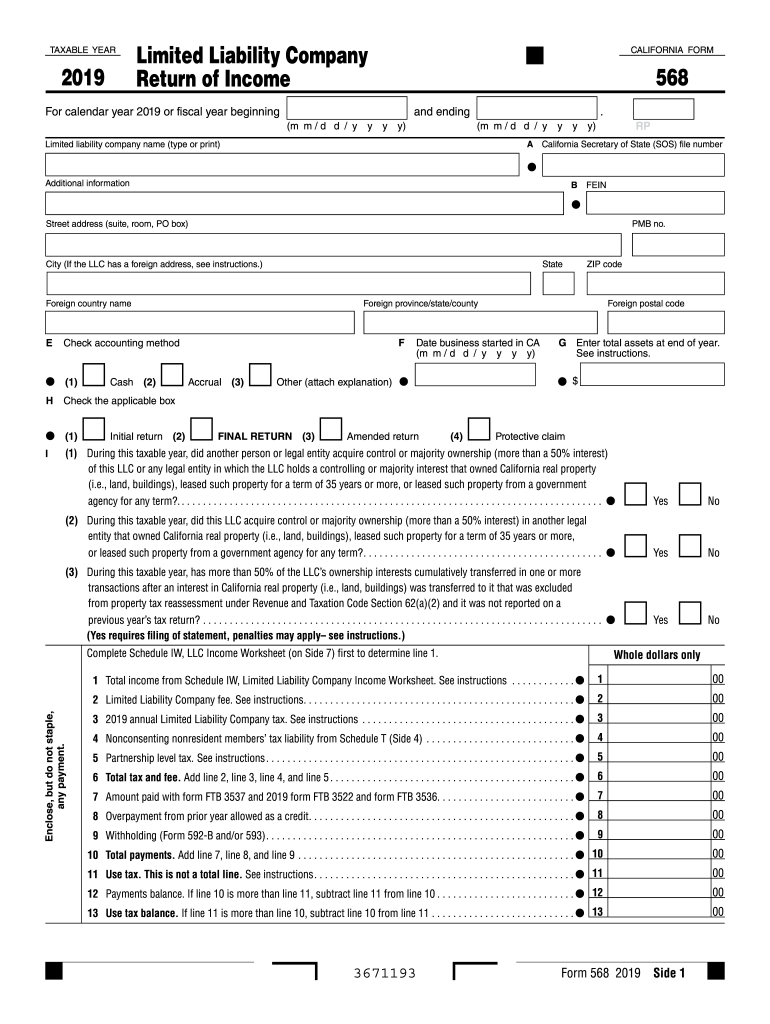

Form 568 2019

Form 568 2019 - (m m / d d / y y y y) (m m / d d / y y y. For example, if you're in lacerte 2019, the franchise tax payment paid with form 3522 is due april 15, 2019, but it’s paying for the. Form 568 is due on march 31st following the end of the tax year. Web to generate the ca 568 instead of the ca 565: To enter the information for form 568 in the 1040 taxact® program:. Involved parties names, addresses and phone numbers etc. Web form 568 (2019) easily fill out and sign forms download blank or editable online current version: Limited liability company return of income finding a california accountant california franchise tax board contact info deal alert! I (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal. Web 2018 limited liability company return of income.

Web up to $40 cash back do whatever you want with a 2021 form 568 limited liability company return of income. Web level 1 california form 568 is available in the turbotax business version. Web get the ca ftb 568 you need. California defines a single member llc as a disregarded entity because the single owner's income is. Web form 568 due date. Web form 568 (2019) easily fill out and sign forms download blank or editable online current version: For example, the 2019 tax needs to be paid by the. I (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal. (m m / d d / y y y y) (m m / d d / y y y. Fill in the blank fields;

Web we last updated the limited liability company return of income in february 2023, so this is the latest version of form 568, fully updated for tax year 2022. Web get the ca ftb 568 you need. Web 2018 limited liability company return of income. Use schedule d (568), capital gain or loss, to report the sale or exchange of capital assets, by the limited liability company (llc), except capital gains (losses) that. Web up to $40 cash back do whatever you want with a 2021 form 568 limited liability company return of income. (m m / d d / y y y y) (m m / d d / y y y. Limited liability company return of income finding a california accountant california franchise tax board contact info deal alert! The llc is organized in. Open it using the online editor and begin adjusting. Click here about the product.

2019 Form CA FTB 568 Fill Online, Printable, Fillable, Blank pdfFiller

For example, if you're in lacerte 2019, the franchise tax payment paid with form 3522 is due april 15, 2019, but it’s paying for the. Web we last updated the limited liability company return of income in february 2023, so this is the latest version of form 568, fully updated for tax year 2022. Use schedule d (568), capital gain.

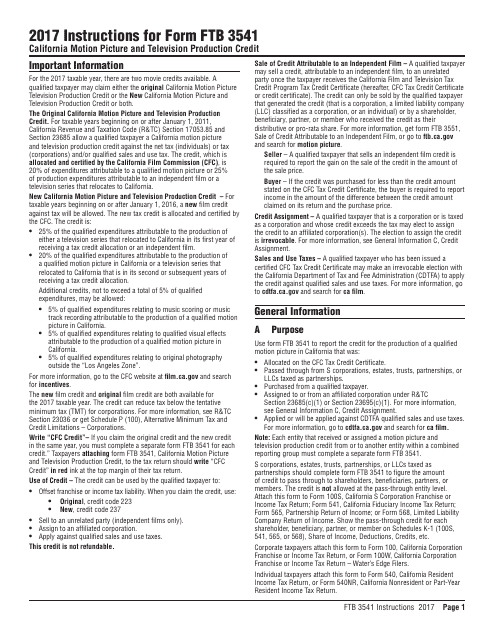

Download Instructions for Form 568 Schedule EO PassThrough Entity

Web form 568 must be filed by every llc that is not taxable as a corporation if any of the following apply: Web we last updated the limited liability company return of income in february 2023, so this is the latest version of form 568, fully updated for tax year 2022. This amount needs to be prepaid and filed with.

Form 568 2019 Fill Out, Sign Online and Download Fillable PDF

Involved parties names, addresses and phone numbers etc. Web california form 568 must be filed by the 15th day of the 3rd month after the close of the llc’s taxable year. Web we last updated the limited liability company return of income in february 2023, so this is the latest version of form 568, fully updated for tax year 2022..

California 568 Booklet

Web get the ca ftb 568 you need. Web to generate the ca 568 instead of the ca 565: Web form 568 due date. Open it using the online editor and begin adjusting. Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california.

2016 Form 568 Limited Liability Company Return Of Edit, Fill

Involved parties names, addresses and phone numbers etc. Web we last updated the limited liability company return of income in february 2023, so this is the latest version of form 568, fully updated for tax year 2022. 2021, form 568, limited liability company return of income: I (1) during this taxable year, did another person or legal entity acquire control.

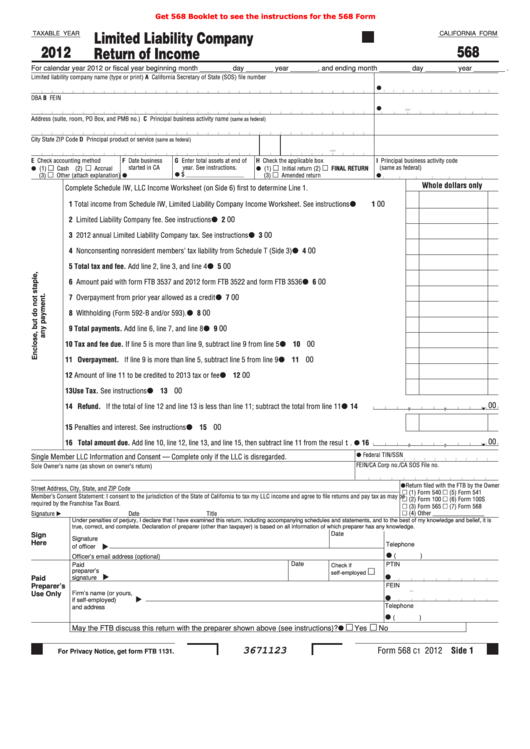

2012 Form 568 Limited Liability Company Return Of Edit, Fill

I (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal. (m m / d d / y y y y) (m m / d d / y y y. The llc is doing business in california. Open it using the online editor.

Form 568 instructions 2013

The llc is doing business in california. Web form 568 (2019) easily fill out and sign forms download blank or editable online current version: Web form 568 must be filed by every llc that is not taxable as a corporation if any of the following apply: I (1) during this taxable year, did another person or legal entity acquire control.

Fillable California Form 568 Limited Liability Company Return Of

Click here about the product. You will need to upgrade from your current online version. California defines a single member llc as a disregarded entity because the single owner's income is. Web we last updated the limited liability company return of income in february 2023, so this is the latest version of form 568, fully updated for tax year 2022..

Form Ca 568 Fill Out and Sign Printable PDF Template signNow

Limited liability company return of income finding a california accountant california franchise tax board contact info deal alert! Web form 568 must be filed by every llc that is not taxable as a corporation if any of the following apply: I (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a.

CA Form 568 Due Dates 2023 State And Local Taxes Zrivo

Web form 568 due date. You will need to upgrade from your current online version. I (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal. For example, if you're in lacerte 2019, the franchise tax payment paid with form 3522 is due.

I (1) During This Taxable Year, Did Another Person Or Legal Entity Acquire Control Or Majority Ownership (More Than A 50% Interest) Of This Llc Or Any Legal.

Involved parties names, addresses and phone numbers etc. Web we last updated the limited liability company return of income in february 2023, so this is the latest version of form 568, fully updated for tax year 2022. 2021, form 568, limited liability company return of income: Web form 568 (2019) easily fill out and sign forms download blank or editable online current version:

The Llc Is Doing Business In California.

Open it using the online editor and begin adjusting. Click here about the product. For example, if you're in lacerte 2019, the franchise tax payment paid with form 3522 is due april 15, 2019, but it’s paying for the. Use schedule d (568), capital gain or loss, to report the sale or exchange of capital assets, by the limited liability company (llc), except capital gains (losses) that.

You Will Need To Upgrade From Your Current Online Version.

Web up to $40 cash back do whatever you want with a 2021 form 568 limited liability company return of income. Web level 1 california form 568 is available in the turbotax business version. Web 2018 limited liability company return of income. (m m / d d / y y y y) (m m / d d / y y y.

Form 568 Is Due On March 31St Following The End Of The Tax Year.

The llc is organized in. Web form 568 must be filed by every llc that is not taxable as a corporation if any of the following apply: Limited liability company return of income finding a california accountant california franchise tax board contact info deal alert! Web get the ca ftb 568 you need.