Form 5500 Schedule C Instructions

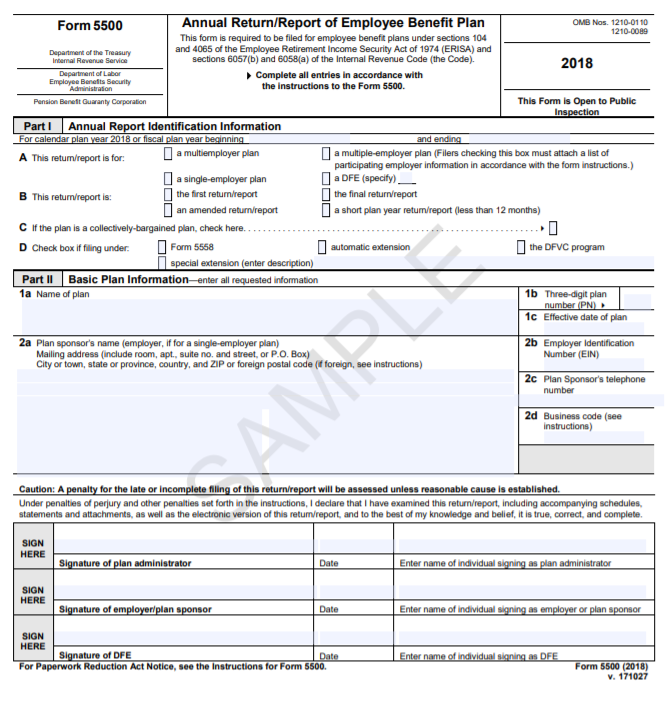

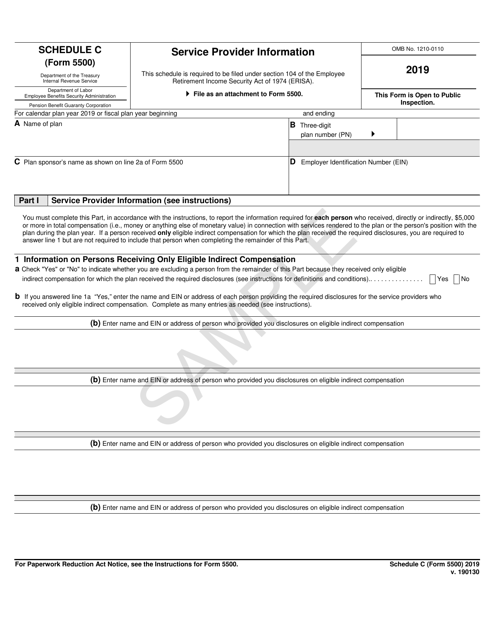

Form 5500 Schedule C Instructions - We anticipate that similar rules will apply to the retroactive adoption of a plan pursuant to section 201 of the secure act after an employer’s 2021 taxable year. Web form 5500 schedule c: An annuity or custodial account arrangement under code sections 403(b)(1) or (7) not established or maintained by an Eligible indirect compensation disclosure guide. Web (form 5500) department of the treasury internal revenue service department of labor employee benefits security administration pension benefit guaranty corporation this schedule is required to be filed under section 104 of the employee retirement income security act of 1974 (erisa). Remember to check the schedule c box on the form 5500 (part ii, line 10b(4)) if a schedule c is attached to the form 5500. Web the form 5500 series is documentation designed to satisfy the annual reporting requirements under title i and title iv of the employee retirement income security act (erisa) and the internal revenue code. An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity. Web the instructions for the 2021 form 5500 will further explain the filing requirements for plans adopted retroactively. Web form 5500 is the form used to file the annual report of employee benefit plan information with the dol (department of labor).

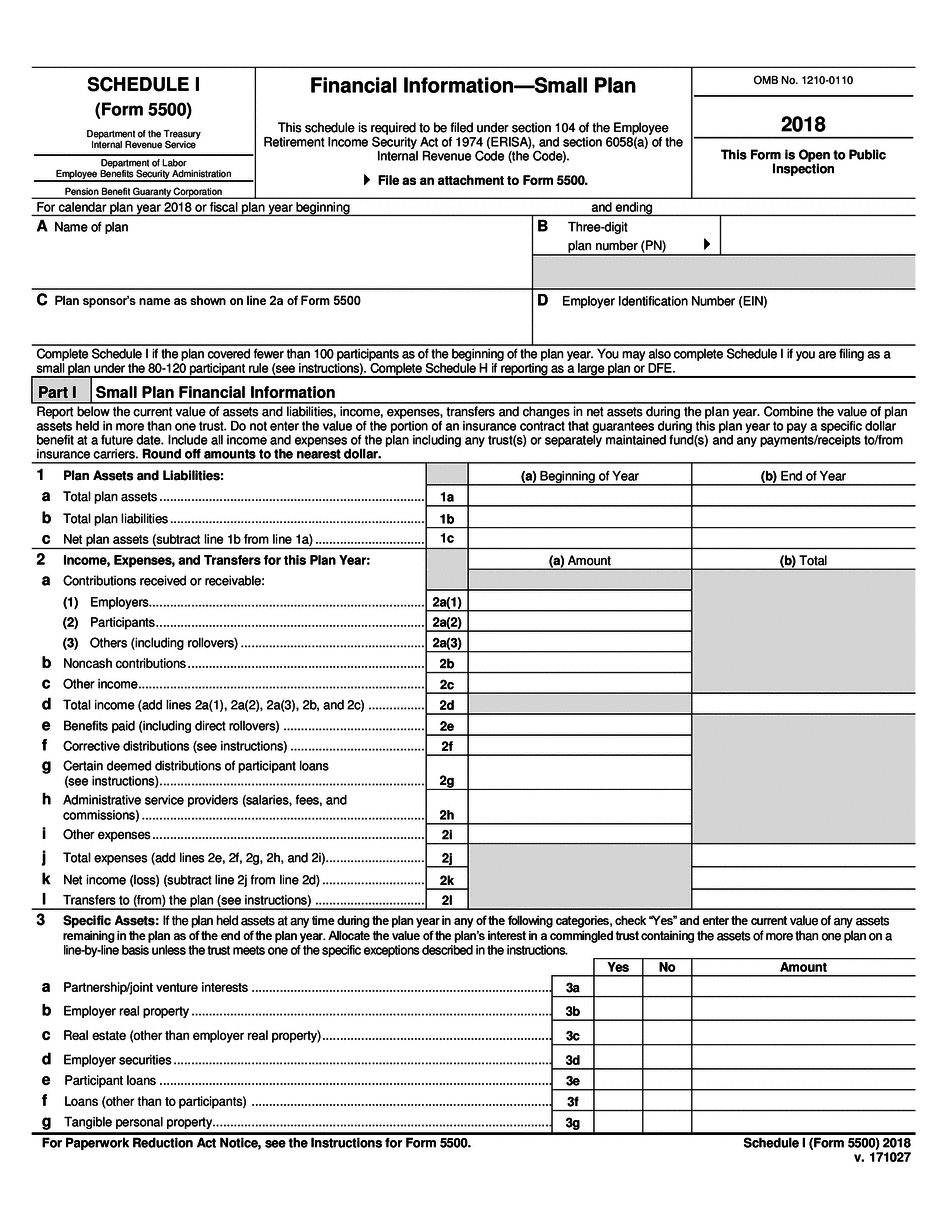

Web the instructions for the 2021 form 5500 will further explain the filing requirements for plans adopted retroactively. This guide is designed to help plan sponsors complete form 5500 schedule c (service provider information). Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Web plans required to file form 5500 schedule c if your plan had 100 or more eligible participants (this includes active employees who are eligible to participate and terminated employees with account balances) on the first day of the plan year, your plan is considered a large plan filer and will generally be required to file an irs schedule h, Web form 5500 schedule c: An annuity or custodial account arrangement under code sections 403(b)(1) or (7) not established or maintained by an Web the form 5500 series is part of erisa's overall reporting and disclosure framework, which is intended to assure that employee benefit plans are operated and managed in accordance with certain prescribed standards and that participants and beneficiaries, as well as regulators, are provided or have access to sufficient information to protect the r. Web the form 5500 series is documentation designed to satisfy the annual reporting requirements under title i and title iv of the employee retirement income security act (erisa) and the internal revenue code. Web (form 5500) department of the treasury internal revenue service department of labor employee benefits security administration pension benefit guaranty corporation this schedule is required to be filed under section 104 of the employee retirement income security act of 1974 (erisa). File as an attachment to form 5500.

Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Eligible indirect compensation disclosure guide. Web form 5500 schedule c: If the employee benefit plan is subject to erisa (the employee benefit income security act of. Web the form 5500 series is part of erisa's overall reporting and disclosure framework, which is intended to assure that employee benefit plans are operated and managed in accordance with certain prescribed standards and that participants and beneficiaries, as well as regulators, are provided or have access to sufficient information to protect the r. File as an attachment to form 5500. Web the form 5500 series is documentation designed to satisfy the annual reporting requirements under title i and title iv of the employee retirement income security act (erisa) and the internal revenue code. An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity. An unfunded excess benefit plan. This guide is designed to help plan sponsors complete form 5500 schedule c (service provider information).

Schedule C (Form 5500) service provider

Eligible indirect compensation disclosure guide. File as an attachment to form 5500. Web the instructions for the 2021 form 5500 will further explain the filing requirements for plans adopted retroactively. Web the form 5500 series is part of erisa's overall reporting and disclosure framework, which is intended to assure that employee benefit plans are operated and managed in accordance with.

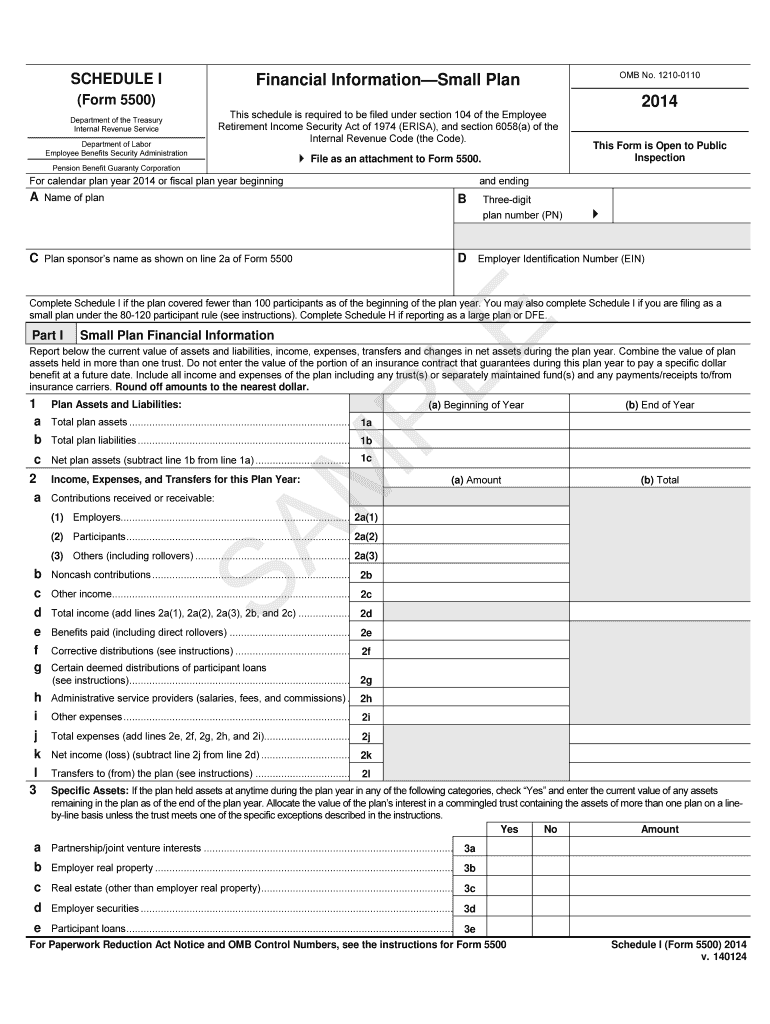

Form 5500 Instructions 5 Steps to Filing Correctly

Web the form 5500 series is documentation designed to satisfy the annual reporting requirements under title i and title iv of the employee retirement income security act (erisa) and the internal revenue code. Web the form 5500 series is part of erisa's overall reporting and disclosure framework, which is intended to assure that employee benefit plans are operated and managed.

Sample Schedule C The Document Template

Eligible indirect compensation disclosure guide. If the employee benefit plan is subject to erisa (the employee benefit income security act of. Web plans required to file form 5500 schedule c if your plan had 100 or more eligible participants (this includes active employees who are eligible to participate and terminated employees with account balances) on the first day of the.

Form 5500 Is Due by July 31 for Calendar Year Plans

Web plans required to file form 5500 schedule c if your plan had 100 or more eligible participants (this includes active employees who are eligible to participate and terminated employees with account balances) on the first day of the plan year, your plan is considered a large plan filer and will generally be required to file an irs schedule h,.

Form 5500 Fill Out and Sign Printable PDF Template signNow

Web plans required to file form 5500 schedule c if your plan had 100 or more eligible participants (this includes active employees who are eligible to participate and terminated employees with account balances) on the first day of the plan year, your plan is considered a large plan filer and will generally be required to file an irs schedule h,.

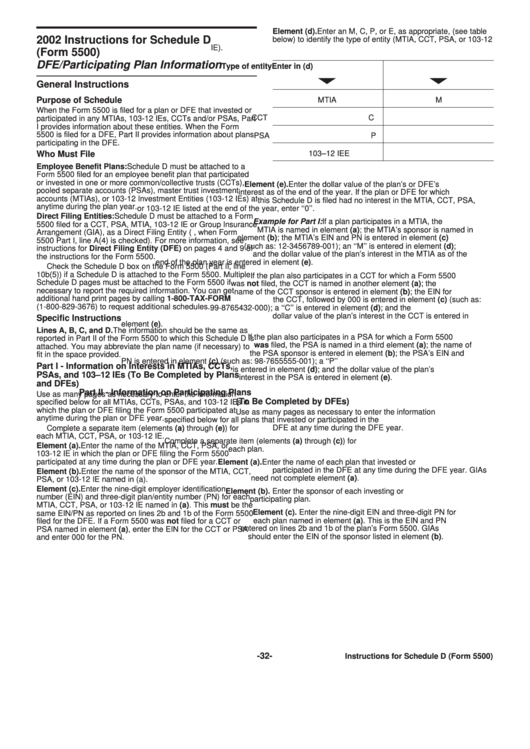

Instructions For Schedule D (Form 5500) Dfe/participating Plan

An unfunded excess benefit plan. Remember to check the schedule c box on the form 5500 (part ii, line 10b(4)) if a schedule c is attached to the form 5500. Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Web the instructions for the.

Form 5500 Fill Out and Sign Printable PDF Template signNow

Web (form 5500) department of the treasury internal revenue service department of labor employee benefits security administration pension benefit guaranty corporation this schedule is required to be filed under section 104 of the employee retirement income security act of 1974 (erisa). Web form 5500 is the form used to file the annual report of employee benefit plan information with the.

Form 5500 Instructions 5 Steps to Filing Correctly (2023)

Web (form 5500) department of the treasury internal revenue service department of labor employee benefits security administration pension benefit guaranty corporation this schedule is required to be filed under section 104 of the employee retirement income security act of 1974 (erisa). Web form 5500 is the form used to file the annual report of employee benefit plan information with the.

Form 5500 Instructions 5 Steps to Filing Correctly

An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity. Eligible indirect compensation disclosure guide. An annuity or custodial account arrangement under code sections 403(b)(1) or (7) not established or maintained by an Remember to check the schedule c.

IRS Form 5500 Schedule C Download Fillable PDF or Fill Online Service

Web the form 5500 series is documentation designed to satisfy the annual reporting requirements under title i and title iv of the employee retirement income security act (erisa) and the internal revenue code. Web the form 5500 series is part of erisa's overall reporting and disclosure framework, which is intended to assure that employee benefit plans are operated and managed.

We Anticipate That Similar Rules Will Apply To The Retroactive Adoption Of A Plan Pursuant To Section 201 Of The Secure Act After An Employer’s 2021 Taxable Year.

Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Remember to check the schedule c box on the form 5500 (part ii, line 10b(4)) if a schedule c is attached to the form 5500. Web form 5500 is the form used to file the annual report of employee benefit plan information with the dol (department of labor). If the employee benefit plan is subject to erisa (the employee benefit income security act of.

An Activity Qualifies As A Business If Your Primary Purpose For Engaging In The Activity Is For Income Or Profit And You Are Involved In The Activity With Continuity And Regularity.

An unfunded excess benefit plan. An annuity or custodial account arrangement under code sections 403(b)(1) or (7) not established or maintained by an Web (form 5500) department of the treasury internal revenue service department of labor employee benefits security administration pension benefit guaranty corporation this schedule is required to be filed under section 104 of the employee retirement income security act of 1974 (erisa). File as an attachment to form 5500.

Web Form 5500 Schedule C:

Web the form 5500 series is documentation designed to satisfy the annual reporting requirements under title i and title iv of the employee retirement income security act (erisa) and the internal revenue code. Web plans required to file form 5500 schedule c if your plan had 100 or more eligible participants (this includes active employees who are eligible to participate and terminated employees with account balances) on the first day of the plan year, your plan is considered a large plan filer and will generally be required to file an irs schedule h, This guide is designed to help plan sponsors complete form 5500 schedule c (service provider information). Web the form 5500 series is part of erisa's overall reporting and disclosure framework, which is intended to assure that employee benefit plans are operated and managed in accordance with certain prescribed standards and that participants and beneficiaries, as well as regulators, are provided or have access to sufficient information to protect the r.

Eligible Indirect Compensation Disclosure Guide.

Web the instructions for the 2021 form 5500 will further explain the filing requirements for plans adopted retroactively.