Form 5471 Schedule M Instructions

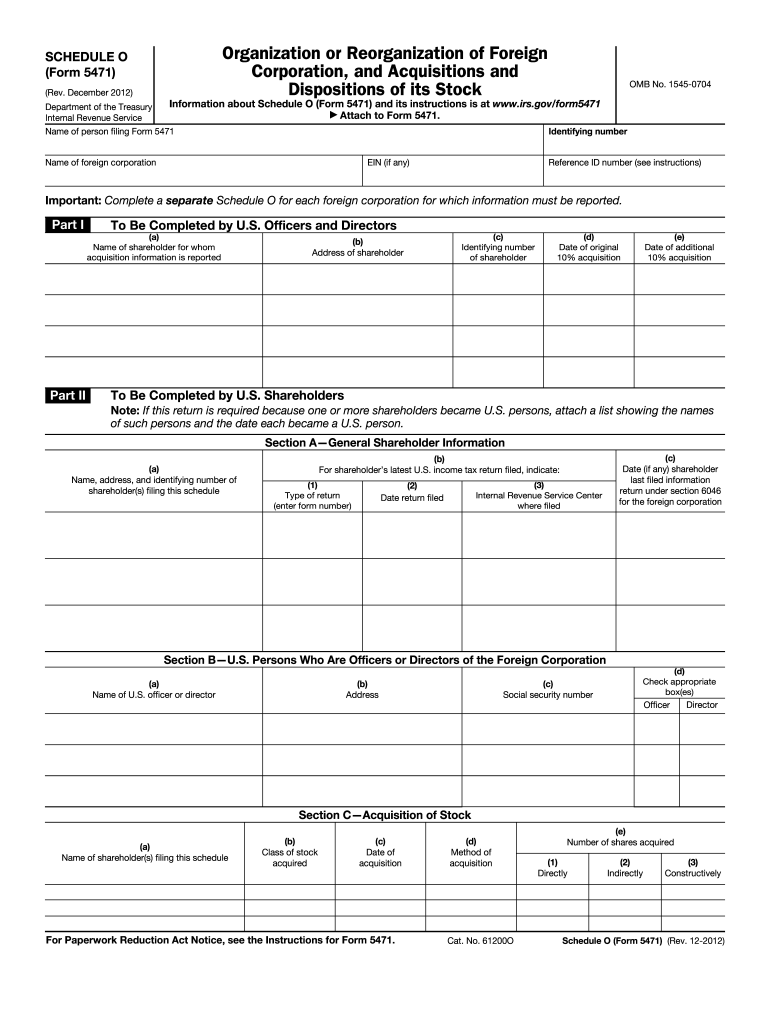

Form 5471 Schedule M Instructions - Individual tax return form 1040 instructions; Persons with respect to certain foreign corporations, including recent updates, related forms, and instructions on how to file. Web information about form 5471, information return of u.s. Web schedule m (form 5471) (rev. Persons with respect to certain foreign corporations And the december 2012 revision of separate schedule o.) information return of u.s. Changes to separate schedule o (form 5471). Persons that are direct owners, indirect owners. File form 5471 to satisfy the reporting requirements of sections 6038 and 6046, and the related regulations. No changes have been made to schedule o (form 5471).

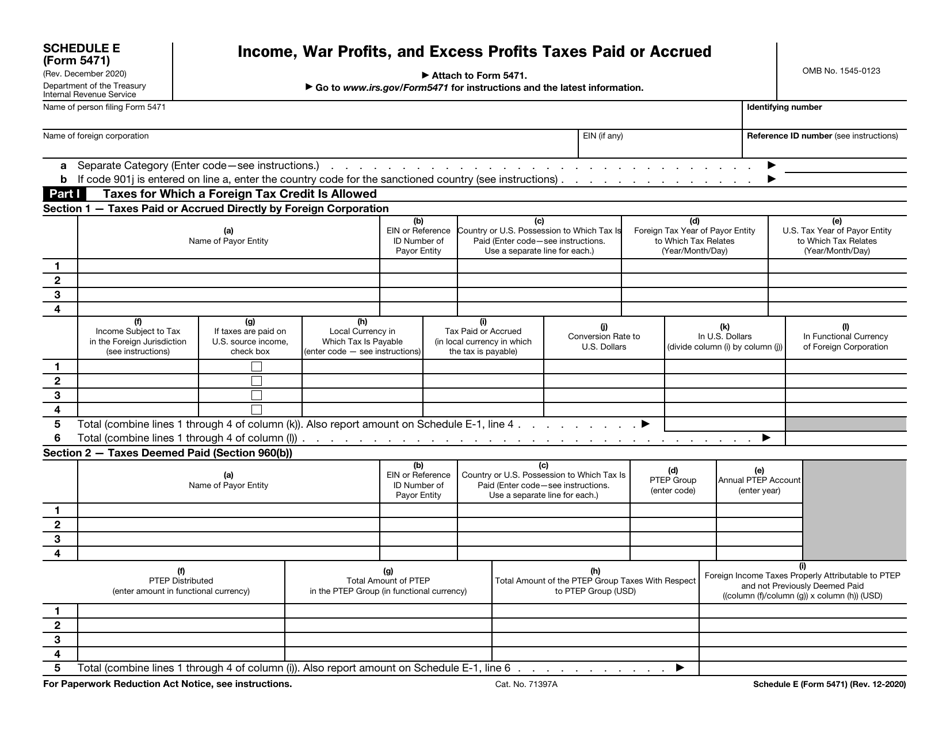

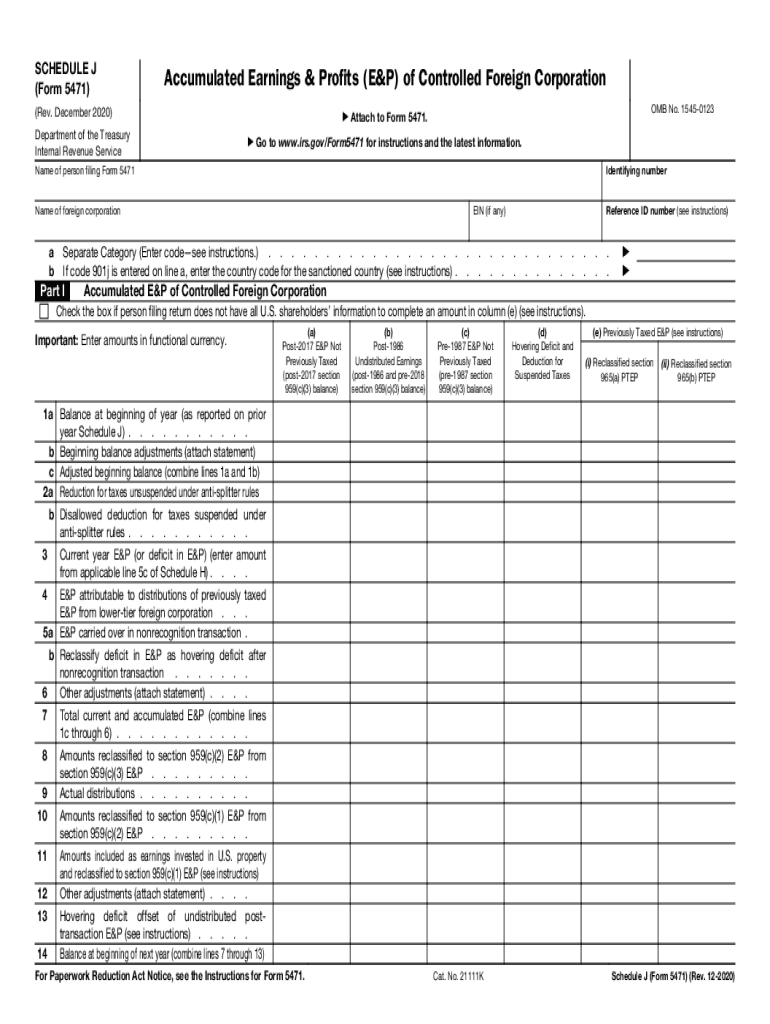

Use the december 2018 revision. No changes have been made to schedule o (form 5471). December 2005) department of the treasury internal revenue service attach to form 5471. Web this article is designed to provide a basic overview of the internal revenue service (“irs”) form 5471, schedule m. No changes have been made to schedule m (form 5471). Persons that are direct owners, indirect owners. The december 2020 revision of separate schedules j, p, q, and r; Form 5471 (schedule e) income, war profits, and excess profits taxes paid or accrued : Individual tax return form 1040 instructions; File form 5471 to satisfy the reporting requirements of sections 6038 and 6046, and the related regulations.

Form 5471 (schedule e) income, war profits, and excess profits taxes paid or accrued : Name of person filing form 5471 identifying number name of foreign corporation important: Web changes to separate schedule m (form 5471). The december 2020 revision of separate schedules j, p, q, and r; Request for taxpayer identification number (tin) and certification. Who must complete schedule m. Persons that are direct owners, indirect owners. Persons with respect to certain foreign corporations, including recent updates, related forms, and instructions on how to file. Changes to separate schedule o (form 5471). Changes to separate schedule p (form 5471).

Download Instructions for IRS Form 5471 Information Return of U.S

See instructions for form 5471. Who must complete schedule m. Use the december 2018 revision. No changes have been made to schedule m (form 5471). Web changes to separate schedule m (form 5471).

IRS Form 5471 Schedule E Download Fillable PDF or Fill Online

Web information about form 5471, information return of u.s. December 2021) department of the treasury internal revenue. Persons with respect to certain foreign corporations Web popular forms & instructions; Persons that are direct owners, indirect owners.

form 5471 schedule e1 Fill Online, Printable, Fillable Blank form

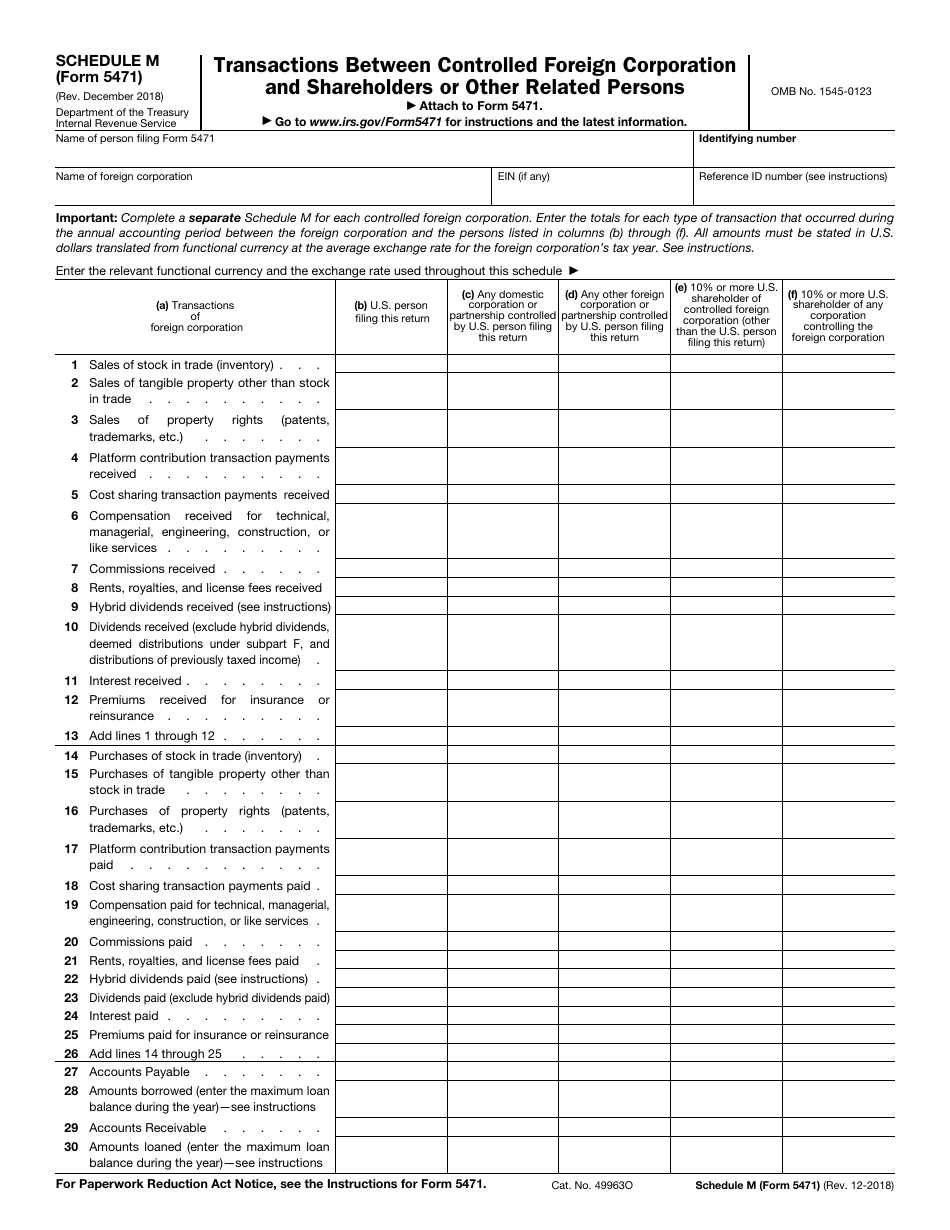

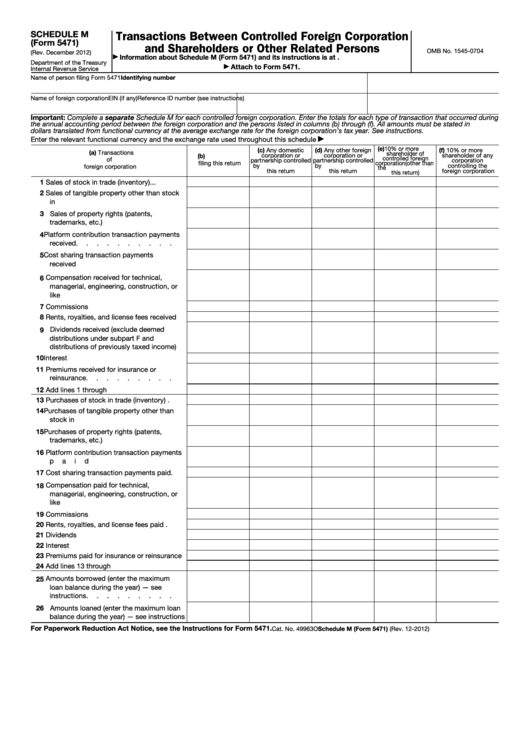

Complete a separate schedule m for each controlled foreign corporation. Web schedule m (form 5471) transactions between controlled foreign corporation and shareholders or other related persons (rev. Web information about form 5471, information return of u.s. December 2005) department of the treasury internal revenue service attach to form 5471. Form 5471 and its accompanying schedules must be completed and filed.

20122021 Form IRS 5471 Schedule O Fill Online, Printable, Fillable

No changes have been made to schedule m (form 5471). December 2021) department of the treasury internal revenue service name of person filing form 5471 omb no. Go to www.irs.gov/form5471 for instructions and the latest information. Web instructions for form 5471(rev. Who must complete schedule m.

IRS Form 5471 Schedule M Download Fillable PDF or Fill Online

Who must complete schedule m. December 2021) department of the treasury internal revenue. Enter the totals for each type of transaction that Schedule m contains information about related party transactions between the cfc and u.s. New lines 13 and 28 were added for reporting loan guarantee fees received (line 13) and loan guarantee fees paid (line 28).

Fillable Form 5471 Schedule M Transactions Between Controlled

File form 5471 to satisfy the reporting requirements of sections 6038 and 6046, and the related regulations. New lines 13 and 28 were added for reporting loan guarantee fees received (line 13) and loan guarantee fees paid (line 28). Changes to separate schedule p (form 5471). Use the december 2018 revision. Use the december 2012 revision.

Editable IRS Form 5471 2018 2019 Create A Digital Sample in PDF

Persons that are direct owners, indirect owners. December 2005) department of the treasury internal revenue service attach to form 5471. No changes have been made to schedule o (form 5471). No changes have been made to schedule m (form 5471). And the december 2012 revision of separate schedule o.) information return of u.s.

A LinebyLine Review of the IRS Form 5471 Schedule M SF Tax Counsel

Web this article is designed to provide a basic overview of the internal revenue service (“irs”) form 5471, schedule m. Name of person filing form 5471 identifying number name of foreign corporation important: December 2005) department of the treasury internal revenue service attach to form 5471. December 2021) department of the treasury internal revenue service name of person filing form.

Form 5471 Fill Out and Sign Printable PDF Template signNow

Form 5471 (schedule e) income, war profits, and excess profits taxes paid or accrued : Web instructions for form 5471(rev. Web schedule m (form 5471) (rev. Web popular forms & instructions; New lines 13 and 28 were added for reporting loan guarantee fees received (line 13) and loan guarantee fees paid (line 28).

The Tax Times IRS Issues Updated New Form 5471 What's New?

Go to www.irs.gov/form5471 for instructions and the latest information. File form 5471 to satisfy the reporting requirements of sections 6038 and 6046, and the related regulations. Persons with respect to certain foreign corporations, including recent updates, related forms, and instructions on how to file. The december 2020 revision of separate schedules j, p, q, and r; Web changes to separate.

New Lines 13 And 28 Were Added For Reporting Loan Guarantee Fees Received (Line 13) And Loan Guarantee Fees Paid (Line 28).

Persons that are direct owners, indirect owners. Use the december 2018 revision. Go to www.irs.gov/form5471 for instructions and the latest information. Persons with respect to certain foreign corporations, including recent updates, related forms, and instructions on how to file.

Schedule M Contains Information About Related Party Transactions Between The Cfc And U.s.

See instructions for form 5471. Web changes to separate schedule m (form 5471). Enter the totals for each type of transaction that No changes have been made to schedule o (form 5471).

The December 2020 Revision Of Separate Schedules J, P, Q, And R;

Who must complete schedule m. Web this article is designed to provide a basic overview of the internal revenue service (“irs”) form 5471, schedule m. Complete a separate schedule m for each controlled foreign corporation. Name of person filing form 5471 identifying number name of foreign corporation important:

Use The December 2012 Revision.

And the december 2012 revision of separate schedule o.) information return of u.s. Request for taxpayer identification number (tin) and certification. December 2021) department of the treasury internal revenue. Web changes to separate schedule m (form 5471).