Form 5471 Schedule G Instructions

Form 5471 Schedule G Instructions - Enter separate category code with respect to which this schedule q is. 9901, 85 fr 43042, july 15, 2020, as. Complete, edit or print tax forms instantly. Schedule g contains numerous yes/no questions for additional irs disclosures. So, a 5a filer is an unrelated section. Taxpayer who is a shareholder in any section 965 specified foreign corporation. Web for paperwork reduction act notice, see instructions. Complete any applicable fields with. Shareholder who doesn't qualify as either a category 5b or 5c filer. The category of filer checkboxes control which.

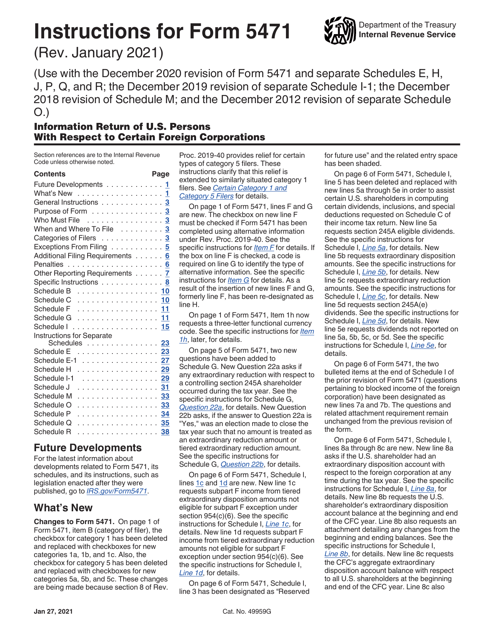

Web for paperwork reduction act notice, see instructions. Web follow the instructions below for an individual (1040) return, or click on a different tax type to get started. Web more on part iii, schedule e, part iii, column (g) is for taxes attributable to residual income group as determined and reported on form 5471, schedule q, and you guys know. Taxpayer who is a shareholder in any section 965 specified foreign corporation. On page 5 of form 5471, two new. Persons from the top left 5471 box. Enter separate category code with respect to which this schedule q is. See the specific instructions for item 1h, later, for details. An sfc includes any foreign corporation with one or more. Shareholder who doesn't qualify as either a category 5b or 5c filer.

On page 5 of form 5471, two new. Web category 1 filer any u.s. An sfc includes any foreign corporation with one or more. Shareholder who doesn't qualify as either a category 5b or 5c filer. Web select information of u.s. The category of filer checkboxes control which. See the specific instructions for item 1h, later, for details. Web more on part iii, schedule e, part iii, column (g) is for taxes attributable to residual income group as determined and reported on form 5471, schedule q, and you guys know. So, a 5a filer is an unrelated section. Web form 5471 & instructions internal revenue service (irs) form 5471 is required by us person shareholders, directors, and officers of international/foreign corporations who.

IRS Issues Updated New Form 5471 What's New?

An sfc includes any foreign corporation with one or more. 9901, 85 fr 43042, july 15, 2020, as. Enter separate category code with respect to which this schedule q is. Taxpayer who is a shareholder in any section 965 specified foreign corporation. Web form 5471 & instructions internal revenue service (irs) form 5471 is required by us person shareholders, directors,.

2012 form 5471 instructions Fill out & sign online DocHub

The category of filer checkboxes control which. Enter separate category code with respect to which this schedule q is. Web form 5471 & instructions internal revenue service (irs) form 5471 is required by us person shareholders, directors, and officers of international/foreign corporations who. Web for paperwork reduction act notice, see instructions. Taxpayer who is a shareholder in any section 965.

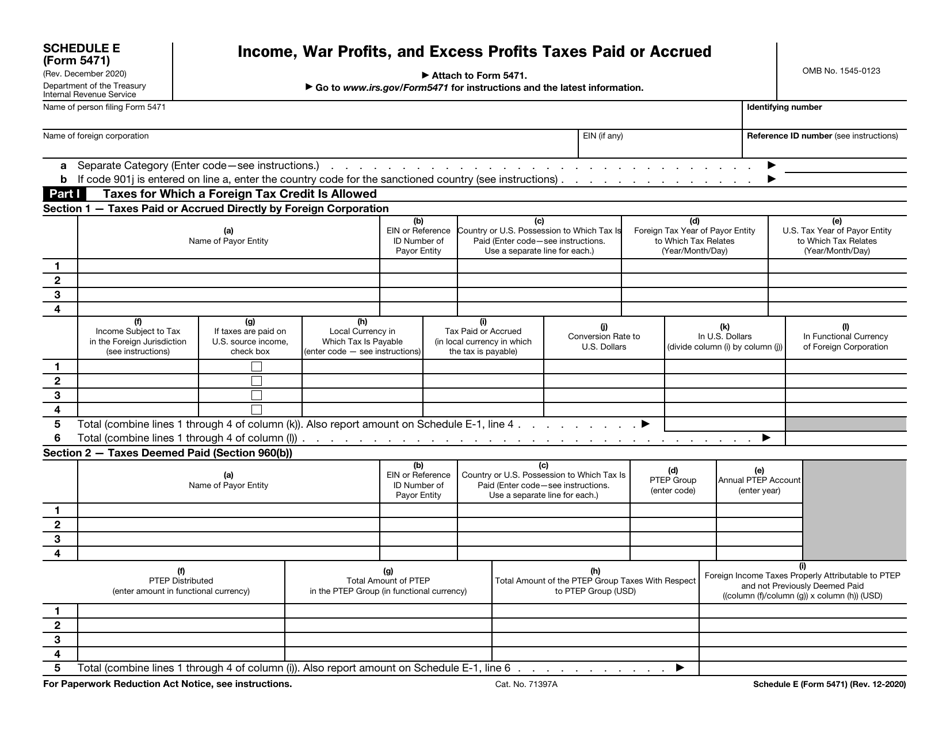

form 5471 schedule e1 Fill Online, Printable, Fillable Blank form

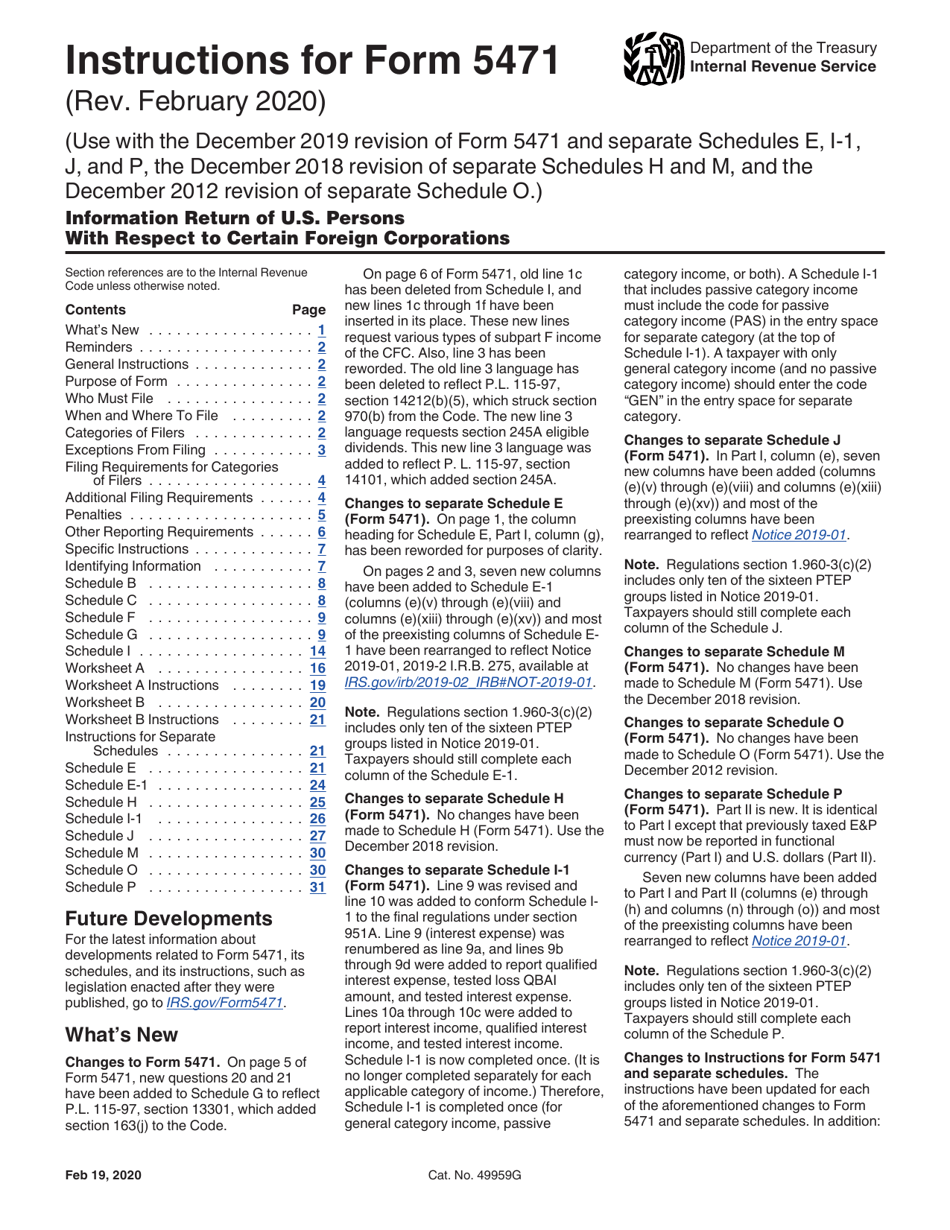

Web for instructions and the latest information. Persons with respect to certain foreign corporations, is designed to report the activities of the foreign corporation and to function. Web form 5471 & instructions internal revenue service (irs) form 5471 is required by us person shareholders, directors, and officers of international/foreign corporations who. Web follow the instructions below for an individual (1040).

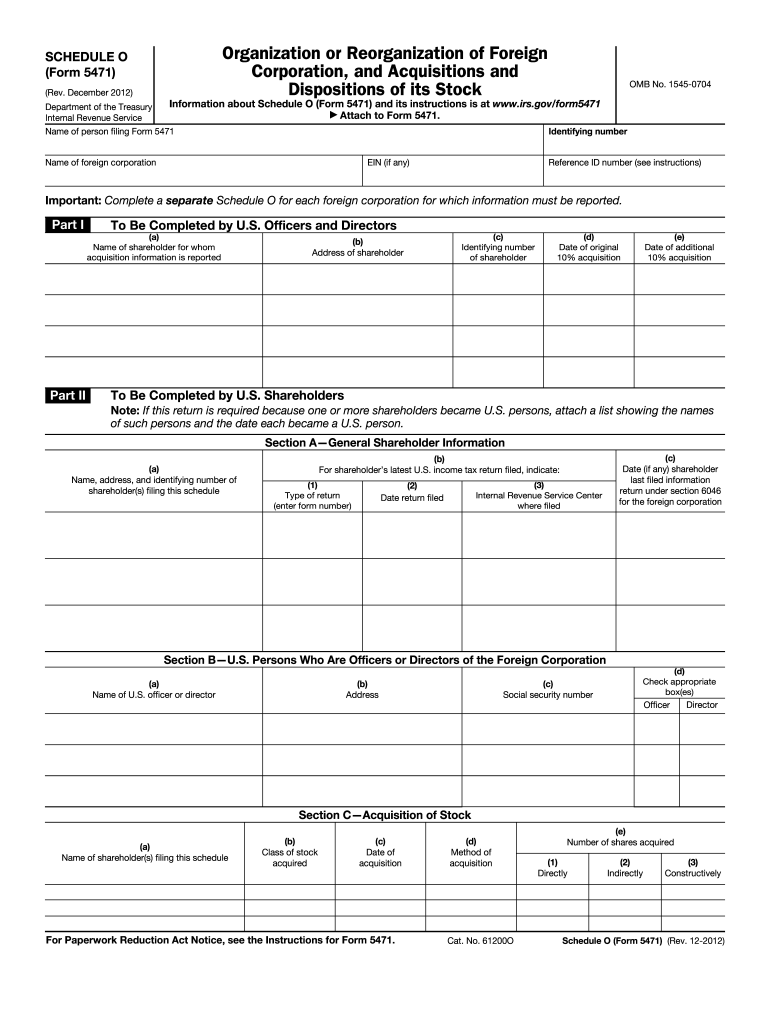

20122021 Form IRS 5471 Schedule O Fill Online, Printable, Fillable

Web follow the instructions below for an individual (1040) return, or click on a different tax type to get started. Persons with respect to certain foreign corporations, is designed to report the activities of the foreign corporation and to function. Shareholder who doesn't qualify as either a category 5b or 5c filer. Web the instructions to form 5471 describes a.

IRS Form 5471 Schedule E Download Fillable PDF or Fill Online

See the specific instructions for item 1h, later, for details. Web form 5471, information return of u.s. Web for instructions and the latest information. Schedule g contains numerous yes/no questions for additional irs disclosures. Web category 1 filer any u.s.

Download Instructions for IRS Form 5471 Information Return of U.S

Schedule g contains numerous yes/no questions for additional irs disclosures. Complete any applicable fields with. Web form 5471 & instructions internal revenue service (irs) form 5471 is required by us person shareholders, directors, and officers of international/foreign corporations who. Complete, edit or print tax forms instantly. 9901, 85 fr 43042, july 15, 2020, as.

Download Instructions for IRS Form 5471 Information Return of U.S

Taxpayer who is a shareholder in any section 965 specified foreign corporation. Web the instructions to form 5471 describes a category 5a filer as a u.s. Web on page 5 of form 5471, the wording of schedule g, lines 6a through 6d was amended to reflect the final regulations under section 250 (t.d. Web form 5471, information return of u.s..

form 5471 schedule j instructions 2022 Fill Online, Printable

On page 5 of form 5471, two new. Web more on part iii, schedule e, part iii, column (g) is for taxes attributable to residual income group as determined and reported on form 5471, schedule q, and you guys know. Ein (if any) reference id number. Web complete a separate schedule q with respect to each applicable category of income.

Form 5471 Schedule J Instructions 2019 cloudshareinfo

Web for paperwork reduction act notice, see instructions. On page 5 of form 5471, two new. Web follow the instructions below for an individual (1040) return, or click on a different tax type to get started. 9901, 85 fr 43042, july 15, 2020, as. Shareholder who doesn't qualify as either a category 5b or 5c filer.

Demystifying the Form 5471 Part 9. Schedule G SF Tax Counsel

An sfc includes any foreign corporation with one or more. Enter separate category code with respect to which this schedule q is. Persons with respect to certain foreign corporations, is designed to report the activities of the foreign corporation and to function. Ein (if any) reference id number. Schedule g contains numerous yes/no questions for additional irs disclosures.

Persons With Respect To Certain Foreign Corporations, Is Designed To Report The Activities Of The Foreign Corporation And To Function.

Shareholder who doesn't qualify as either a category 5b or 5c filer. Complete any applicable fields with. Web complete a separate schedule q with respect to each applicable category of income (see instructions). Schedule g contains numerous yes/no questions for additional irs disclosures.

Ad Access Irs Tax Forms.

An sfc includes any foreign corporation with one or more. So, a 5a filer is an unrelated section. Web select information of u.s. Web form 5471 & instructions internal revenue service (irs) form 5471 is required by us person shareholders, directors, and officers of international/foreign corporations who.

Web Category 1 Filer Any U.s.

9901, 85 fr 43042, july 15, 2020, as. Web form 5471, information return of u.s. Persons from the top left 5471 box. Web for instructions and the latest information.

Enter Separate Category Code With Respect To Which This Schedule Q Is.

Get ready for tax season deadlines by completing any required tax forms today. Ein (if any) reference id number. Web more on part iii, schedule e, part iii, column (g) is for taxes attributable to residual income group as determined and reported on form 5471, schedule q, and you guys know. See the specific instructions for item 1h, later, for details.