Form 5471 Sch E-1

Form 5471 Sch E-1 - Income, war profits, and excess profits taxes paid or accrued. With respect to line a at the top of page 1 of schedule e, there is a new code “total” that is required for schedule e and. Web schedule e of form 5471 is used to report taxes paid or accrued by a foreign corporation for which a foreign tax credit is allowed and taxes for which a credit may not be taken. December 2020) department of the treasury internal revenue service. Persons with respect to certain foreign corporations. Web schedule e of form 5471 is used to report taxes paid or accrued by a foreign corporation for which a foreign tax credit is allowed and taxes for which a credit may not be taken. Web schedule q (form 5471) (rev. Web the primary purpose of schedule e is to claim foreign tax credits paid by a foreign corporation involving subpart f inclusions. Complete a separate form 5471 and all applicable schedules for each applicable foreign corporation. Report all amounts in u.s.

Persons with respect to certain foreign corporations. Persons with respect to certain foreign corporations. With respect to line a at the top of page 1 of schedule e, there is a new code “total” that is required for schedule e and. Web this is the 9th video in a series which covers the preparation of irs form 5471 for the 2021 tax year. December 2022) cfc income by cfc income groups department of the treasury internal revenue service attach to form 5471. Again, brian and riaz will talk. Web changes to separate schedule e (form 5471). The form 5471 schedules are: Web within form 5471 are 12 schedules you may or may not need to fill out. December 2020) department of the treasury internal revenue service.

Again, brian and riaz will talk. There are different parts to the form,. Web schedule e of form 5471 is used to report taxes paid or accrued by a foreign corporation for which a foreign tax credit is allowed and taxes for which a credit may not be taken. Web this is the 9th video in a series which covers the preparation of irs form 5471 for the 2021 tax year. December 2020) department of the treasury internal revenue service. December 2021) department of the treasury internal revenue service. Web within form 5471 are 12 schedules you may or may not need to fill out. The form 5471 schedules are: Web schedule q (form 5471) (rev. Complete a separate form 5471 and all applicable schedules for each applicable foreign corporation.

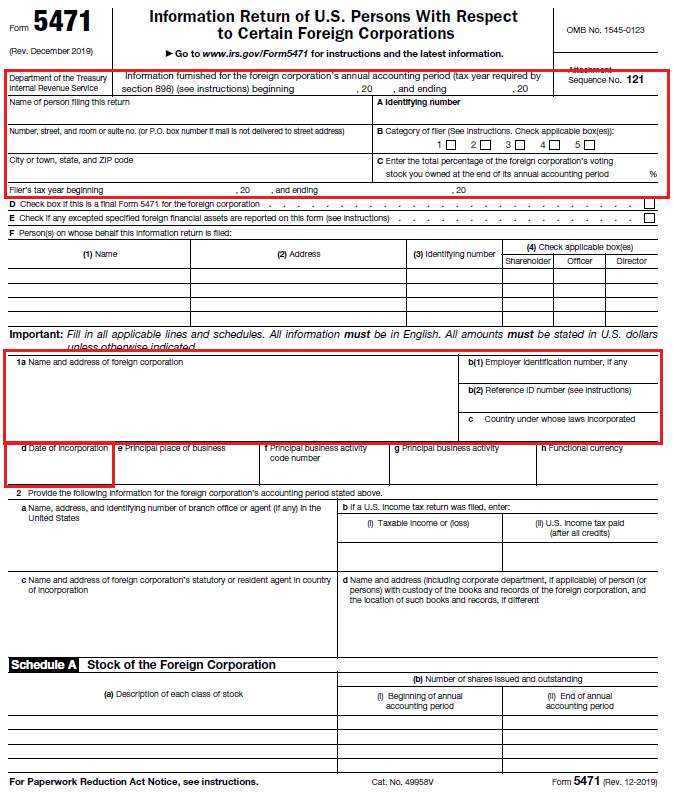

Form 5471, Page 1 YouTube

December 2020) department of the treasury internal revenue service. Web within form 5471 are 12 schedules you may or may not need to fill out. Web schedule e (form 5471) (rev. Web this is the 9th video in a series which covers the preparation of irs form 5471 for the 2021 tax year. Report all amounts in u.s.

IRS Form 5471 Carries Heavy Penalties and Consequences

December 2021) department of the treasury internal revenue service. Income, war profits, and excess profits taxes paid or accrued. Again, brian and riaz will talk. Report all amounts in u.s. Web this is the 9th video in a series which covers the preparation of irs form 5471 for the 2021 tax year.

A Dive into the New Form 5471 Categories of Filers and the Schedule R

Web schedule e of form 5471 is used to report taxes paid or accrued by a foreign corporation for which a foreign tax credit is allowed and taxes for which a credit may not be taken. December 2020) department of the treasury internal revenue service. With respect to line a at the top of page 1 of schedule e, there.

The Tax Times New Form 5471, Sch Q You Really Need to Understand

Complete a separate form 5471 and all applicable schedules for each applicable foreign corporation. Web the primary purpose of schedule e is to claim foreign tax credits paid by a foreign corporation involving subpart f inclusions. The form 5471 schedules are: Web within form 5471 are 12 schedules you may or may not need to fill out. Income, war profits,.

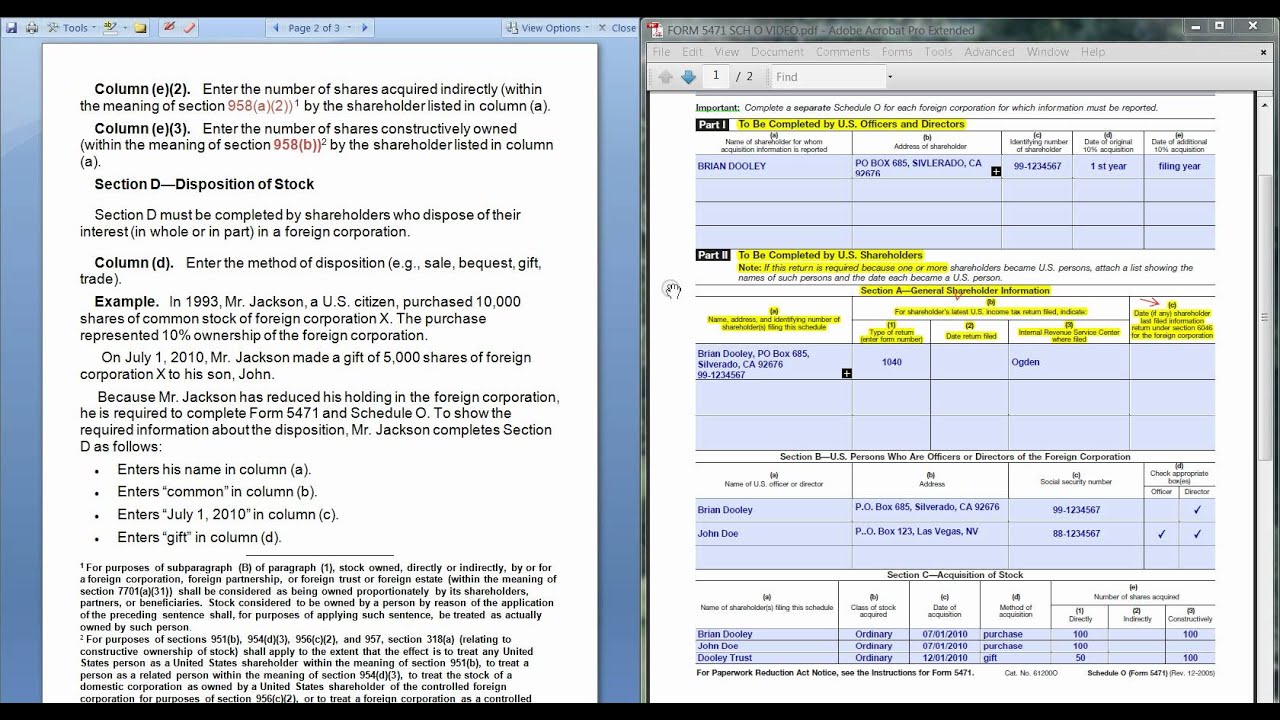

FORM 5471 SCHEDULE O CONTROLLED FOREIGN CORPORATION.avi YouTube

December 2022) department of the treasury internal revenue service. Persons with respect to certain foreign corporations. Web the primary purpose of schedule e is to claim foreign tax credits paid by a foreign corporation involving subpart f inclusions. Complete a separate form 5471 and all applicable schedules for each applicable foreign corporation. December 2021) department of the treasury internal revenue.

form 5471 schedule e1 Fill Online, Printable, Fillable Blank form

Income, war profits, and excess profits taxes paid or accrued. December 2021) department of the treasury internal revenue service. Web schedule e of form 5471 is used to report taxes paid or accrued by a foreign corporation for which a foreign tax credit is allowed and taxes for which a credit may not be taken. Again, brian and riaz will.

IRS Form 5471 Schedule E Download Fillable PDF or Fill Online

Web within form 5471 are 12 schedules you may or may not need to fill out. Report all amounts in u.s. Web this is the 9th video in a series which covers the preparation of irs form 5471 for the 2021 tax year. Web schedule e (form 5471) (rev. The form 5471 schedules are:

The Tax Times IRS Issues Updated New Form 5471 What's New?

December 2020) department of the treasury internal revenue service. Web the primary purpose of schedule e is to claim foreign tax credits paid by a foreign corporation involving subpart f inclusions. Web within form 5471 are 12 schedules you may or may not need to fill out. Web schedule e of form 5471 is used to report taxes paid or.

What is a Dormant Foreign Corporation?

Web the primary purpose of schedule e is to claim foreign tax credits paid by a foreign corporation involving subpart f inclusions. Complete a separate form 5471 and all applicable schedules for each applicable foreign corporation. December 2021) department of the treasury internal revenue service. Income, war profits, and excess profits taxes paid or accrued. Report all amounts in u.s.

Editable IRS Form 5471 2018 2019 Create A Digital Sample in PDF

December 2022) cfc income by cfc income groups department of the treasury internal revenue service attach to form 5471. December 2021) department of the treasury internal revenue service. December 2022) department of the treasury internal revenue service. Web the primary purpose of schedule e is to claim foreign tax credits paid by a foreign corporation involving subpart f inclusions. The.

Web This Is The 9Th Video In A Series Which Covers The Preparation Of Irs Form 5471 For The 2021 Tax Year.

Web schedule q (form 5471) (rev. December 2022) cfc income by cfc income groups department of the treasury internal revenue service attach to form 5471. Web within form 5471 are 12 schedules you may or may not need to fill out. Persons with respect to certain foreign corporations.

December 2020) Department Of The Treasury Internal Revenue Service.

Complete a separate form 5471 and all applicable schedules for each applicable foreign corporation. Persons with respect to certain foreign corporations. Income, war profits, and excess profits taxes paid or accrued. December 2022) department of the treasury internal revenue service.

Web Schedule E Of Form 5471 Is Used To Report Taxes Paid Or Accrued By A Foreign Corporation For Which A Foreign Tax Credit Is Allowed And Taxes For Which A Credit May Not Be Taken.

Web the primary purpose of schedule e is to claim foreign tax credits paid by a foreign corporation involving subpart f inclusions. December 2021) department of the treasury internal revenue service. Web schedule e of form 5471 is used to report taxes paid or accrued by a foreign corporation for which a foreign tax credit is allowed and taxes for which a credit may not be taken. There are different parts to the form,.

December 2021) Department Of The Treasury Internal Revenue Service.

Web changes to separate schedule e (form 5471). Report all amounts in u.s. With respect to line a at the top of page 1 of schedule e, there is a new code “total” that is required for schedule e and. The form 5471 schedules are: