Form 5405 Lookup

Form 5405 Lookup - Web if you made a qualifying home purchase in 2008 and owned and used the home as a principal residence in all of 2022, you must enter the additional federal income tax on. Notify the irs that the home you purchased in 2008 and for which you claimed the credit was disposed of or. The taxpayer who claimed the. Web to claim the homebuyer's tax credit for 2010, you will need to file irs form 5405. Part iii form 5405 gain or (loss) worksheet. Use form 5405 to do the following. Complete, edit or print tax forms instantly. November 2020) department of the treasury internal revenue service. See instructions if you filed a joint return for the year you claimed the credit or you checked the box on. Web locate the 5405 #1:

Web to claim the homebuyer's tax credit for 2010, you will need to file irs form 5405. Repayment of prior year credit subsection. November 2020) department of the treasury internal revenue service. Web locate the 5405 #1: The taxpayer who claimed the. Web 4 enter the amount of the credit you claimed on form 5405 for a prior year. Web click either form 5405 if you disposed of the home or ceased using the home as your main home in 2020 or worksheet if you need to make the annual repayment and the home is. Use form 5405 to do the following. Web purpose of form. In an effort to stimulate the economy, the federal government.

The taxpayer who claimed the. Web click here to look up the remaining credit. November 2020) department of the treasury internal revenue service. Easily track repayment of the home buyer’s tax credit by entering data into form 5405 on the. If mfj, and the spouse must also repay. Repayment of prior year credit section. Web locate the 5405 #1: Web purpose of form. Notify the irs that the home you purchased in 2008 and for which you claimed the credit was disposed of or. See instructions if you filed a joint return for the year you claimed the credit or you checked the box on line.

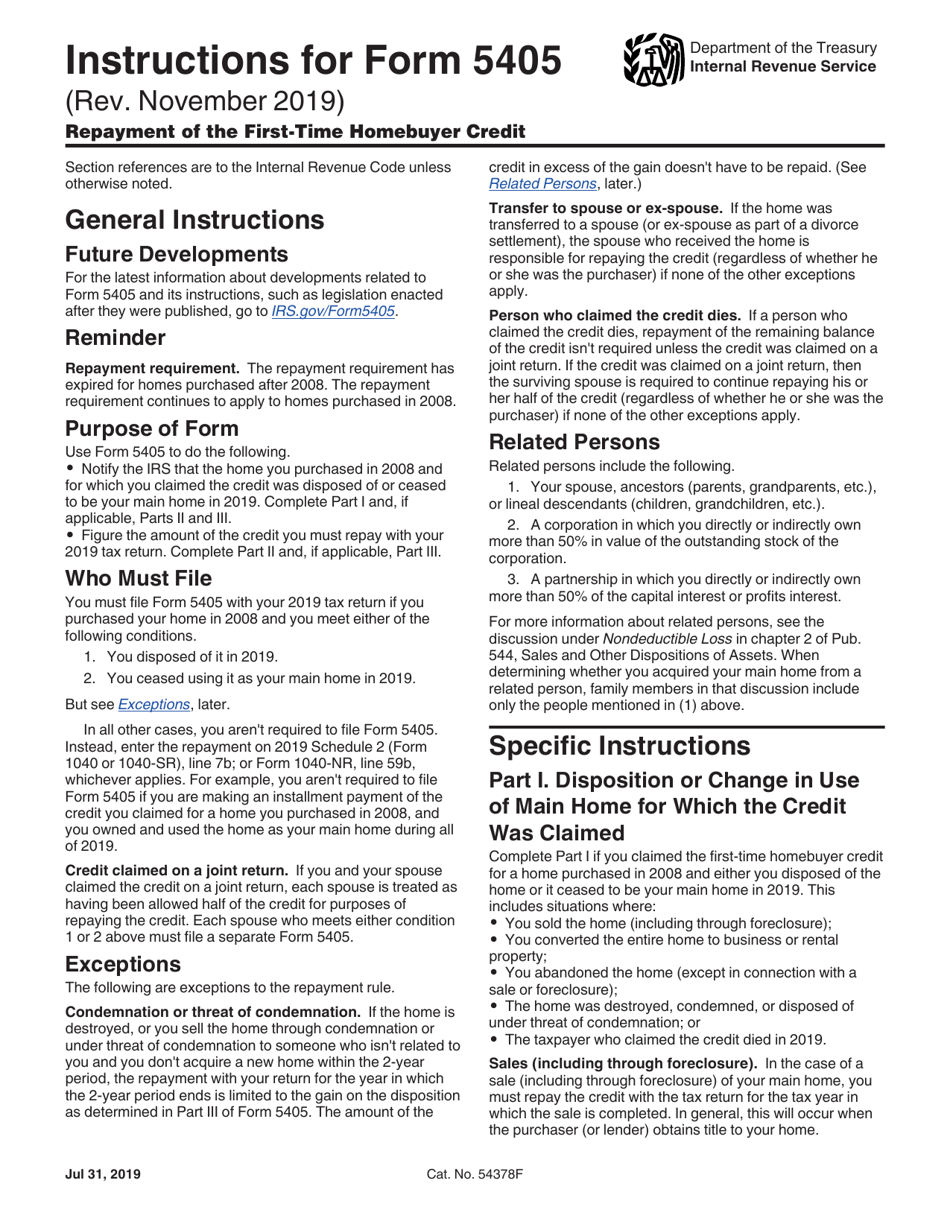

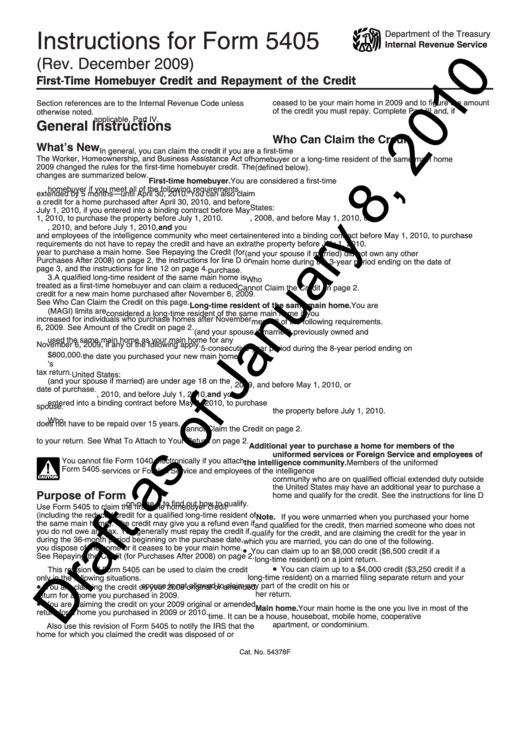

Instructions For Form 5405 2009 printable pdf download

Enter half of the amount in prior year installments. See instructions if you filed a joint return for the year you claimed the credit or you checked the box on. Complete, edit or print tax forms instantly. See instructions if you filed a joint return for the year you claimed the credit or you checked the box on line. To.

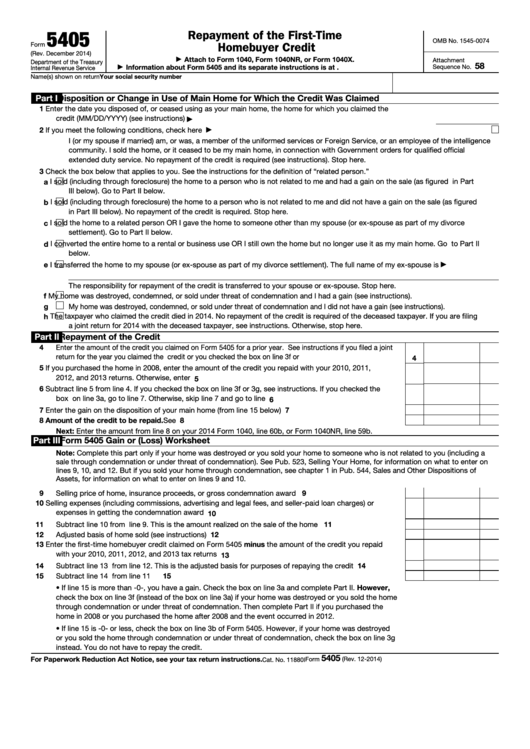

Fillable Form 5405 Repayment Of The FirstTime Homebuyer Credit

Repayment of prior year credit section. Use form 5405 to do the following. My home was destroyed, condemned, or sold under threat of condemnation and i didn’t have a gain. Web locate the 5405 #1: Web to claim the homebuyer's tax credit for 2010, you will need to file irs form 5405.

FIA Historic Database

Repayment of prior year credit subsection. In an effort to stimulate the economy, the federal government. Complete, edit or print tax forms instantly. The form is used for the credit received if you bought a. Easily track repayment of the home buyer’s tax credit by entering data into form 5405 on the.

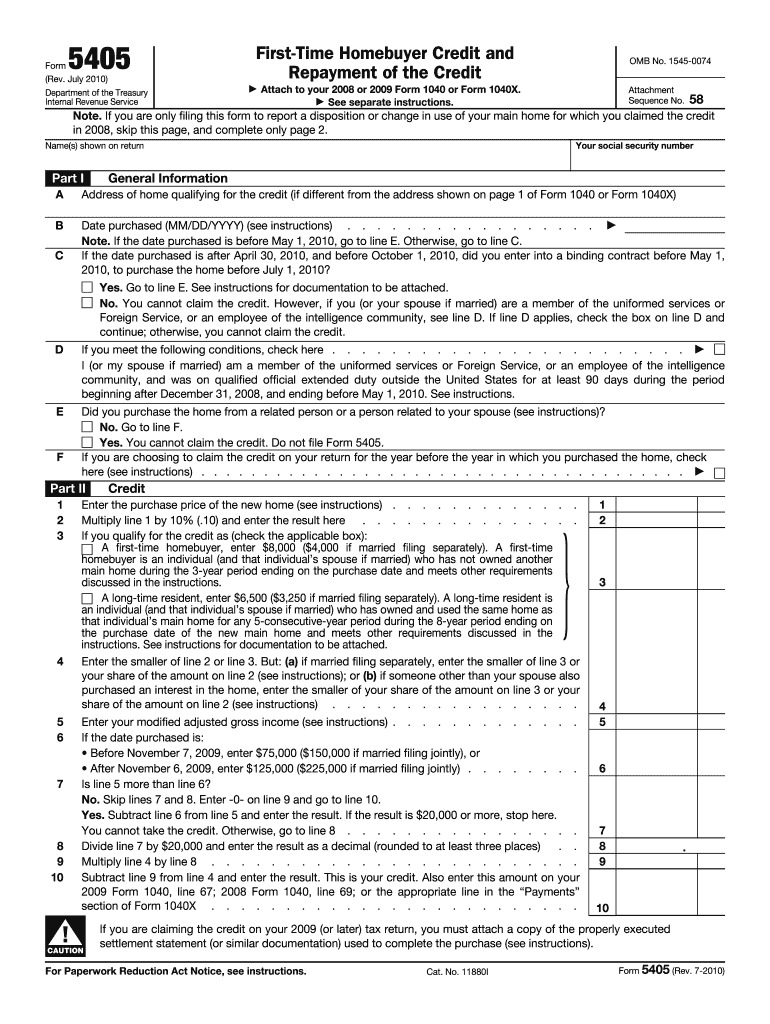

Form 5405 FirstTime Homebuyer Credit and Repayment of the Credit

November 2020) department of the treasury internal revenue service. Get ready for tax season deadlines by completing any required tax forms today. The taxpayer who claimed the. Web if you made a qualifying home purchase in 2008 and owned and used the home as a principal residence in all of 2022, you must enter the additional federal income tax on..

Download Instructions for IRS Form 5405 Repayment of the FirstTime

Repayment of prior year credit section. To complete form 5405 due to the disposition of the home or due to it no longer being the main home, from the main menu of the tax. Repayment of prior year credit subsection. See instructions if you filed a joint return for the year you claimed the credit or you checked the box.

Form 5405 YouTube

In an effort to stimulate the economy, the federal government. If mfj, and the spouse must also repay. Web 4 enter the amount of the credit you claimed on form 5405 for a prior year. The taxpayer who claimed the. Enter half of the amount in original credit.

O.C. Real Estate Notes On Tax Credit Extension

The form is used for the credit received if you bought a. Enter half of the amount in original credit. Web if you made a qualifying home purchase in 2008 and owned and used the home as a principal residence in all of 2022, you must enter the additional federal income tax on. Web click either form 5405 if you.

Instructions For Form 5405 Draft (Rev. December 2011) printable pdf

The taxpayer who claimed the. Part iii form 5405 gain or (loss) worksheet. Enter half of the amount in original credit. To complete form 5405 due to the disposition of the home or due to it no longer being the main home, from the main menu of the tax. See instructions if you filed a joint return for the year.

Form 5405 Fill Out and Sign Printable PDF Template signNow

Web click here to look up the remaining credit. If you are repaying the credit on. To complete form 5405 due to the disposition of the home or due to it no longer being the main home, from the main menu of the tax. Web locate the 5405 #1: Repayment of prior year credit subsection.

Instructions For Form 5405 (Rev. March 2011) printable pdf download

Web to claim the homebuyer's tax credit for 2010, you will need to file irs form 5405. Repayment of prior year credit subsection. Web click here to look up the remaining credit. The form is used for the credit received if you bought a. The taxpayer who claimed the.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

If you are repaying the credit on. Web locate the 5405 #1: Notify the irs that the home you purchased in 2008 and for which you claimed the credit was disposed of or. Use form 5405 to do the following.

Repayment Of Prior Year Credit Section.

Web to claim the homebuyer's tax credit for 2010, you will need to file irs form 5405. In an effort to stimulate the economy, the federal government. If mfj, and the spouse must also repay. Enter half of the amount in original credit.

Web If You Made A Qualifying Home Purchase In 2008 And Owned And Used The Home As A Principal Residence In All Of 2022, You Must Enter The Additional Federal Income Tax On.

See instructions if you filed a joint return for the year you claimed the credit or you checked the box on. November 2020) department of the treasury internal revenue service. Enter half of the amount in prior year installments. Easily track repayment of the home buyer’s tax credit by entering data into form 5405 on the.

Web 4 Enter The Amount Of The Credit You Claimed On Form 5405 For A Prior Year.

The taxpayer who claimed the. Web click either form 5405 if you disposed of the home or ceased using the home as your main home in 2020 or worksheet if you need to make the annual repayment and the home is. Complete, edit or print tax forms instantly. My home was destroyed, condemned, or sold under threat of condemnation and i didn’t have a gain.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-23at12.21.54PM-9f1fd40798a54df0b41b2473e3541290.png)