Form 4797 Part Ii

Form 4797 Part Ii - Single family home built in 1925 that was last sold on 05/10/2022. To enter a loss for the sale of business property not entered in taxact ® as an asset for depreciation: Web (if any) on form 4797, part i, ii, or iii, as applicable, and include the words “partial disposition election” in the description of the partially disposed asset. Web view 27 photos for 22447 n 97th ln, peoria, az 85383, a 4 bed, 3 bath, 2,485 sq. Web why is the sale of a farm animal showing on form 4797, part ii when it was held more than a year? Web common questions for form 4797 in proseries below are the most popular support articles associated with form 4797.reporting bulk asset sales in proserieshow to dispose of a. Single family home built in 2019 that was last sold on 06/14/2022. Web view 9 photos for 752 nw 47th st, miami, fl 33127, a 2 bed, 1 bath, 1,164 sq. An ordinary income gain/loss reported on form 4797, part ii, line 10a capital gain reported on the s you. Web 952 47th st, brooklyn ny, is a multiple occupancy home that contains 3116 sq ft and was built in 1931.

Generally, assets held for more than a year carry to part i and items held for 1. Web view 27 photos for 22447 n 97th ln, peoria, az 85383, a 4 bed, 3 bath, 2,485 sq. This might include any property used to generate rental income or even a. Form 6252, lines 1 through 4; It contains 3 bedrooms and 2 bathrooms. Web complete form 4797, line 10, columns (a), (b), and (c); Web why is the sale of a farm animal showing on form 4797, part ii when it was held more than a year? Report the amount from line 1 above on form 4797, line 10,. Web to enter a portion of the gain from the sale of a partnership interest, as ordinary income and capital gain, on form 4797, sales of business property, part ii, line. Web common questions for form 4797 in proseries below are the most popular support articles associated with form 4797.reporting bulk asset sales in proserieshow to dispose of a.

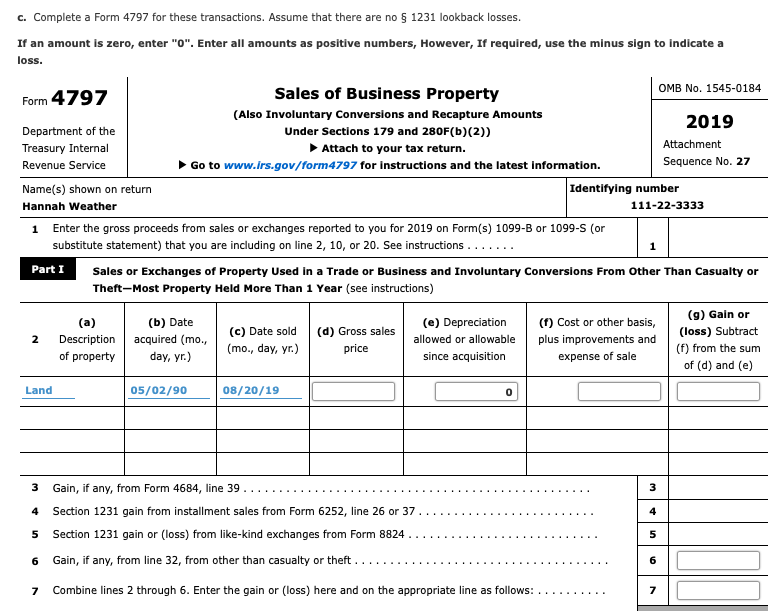

This might include any property used to generate rental income or even a. Web view 9 photos for 752 nw 47th st, miami, fl 33127, a 2 bed, 1 bath, 1,164 sq. Web why is the sale of a farm animal showing on form 4797, part ii when it was held more than a year? Web form 4797 is strictly used to report the sale and gains of business property real estate transactions. Report the amount from line 1 above on form 4797, line 10,. Web 2019 äéêèë¹ê¿åäé ¼åè åèã » ¾ à ¾ sales of business property (also involuntary conversions and recapture amounts under sections 179 and 280f(b)(2)) Web to enter a portion of the gain from the sale of a partnership interest, as ordinary income and capital gain, on form 4797, sales of business property, part ii, line. Single family home built in 1925 that was last sold on 05/10/2022. Web reporting transactions on form 4797 • part i • report sales/exchanges of property held > 1 year when depreciation was not allowed/allowable or property was sold at a loss •. Or form 8824, parts i and ii.

Mona Inc. makes and distributes bicycle accessories. To streamline its

It contains 3 bedrooms and 2 bathrooms. Ad download or email irs 4797 & more fillable forms, register and subscribe now! Web reporting transactions on form 4797 • part i • report sales/exchanges of property held > 1 year when depreciation was not allowed/allowable or property was sold at a loss •. Web common questions for form 4797 in proseries.

TURBOTAX Logical Progression of Where Ordinary AND Capital Gains

This might include any property used to generate rental income or even a. Web view 9 photos for 752 nw 47th st, miami, fl 33127, a 2 bed, 1 bath, 1,164 sq. From there as you scroll through the form you can see it populates part ii ordinary gain/loss from the summary. Web in the final column labeled pt, choose.

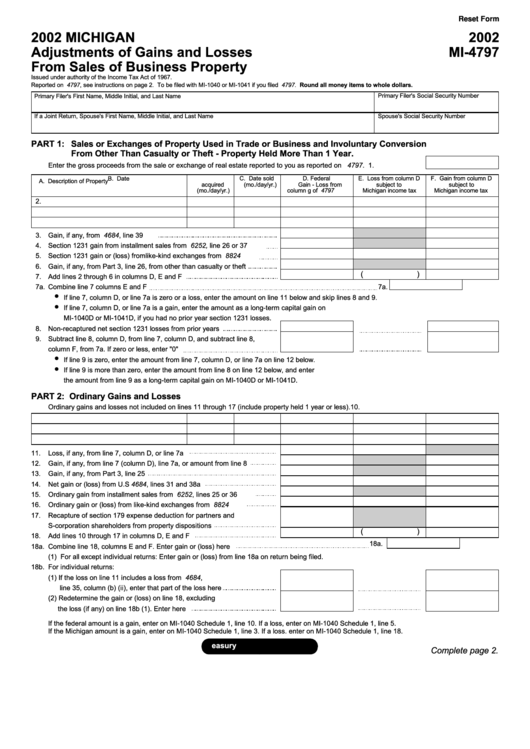

Fillable Form Mi4797 Michigan Adjustments Of Gains And Losses From

Web in the final column labeled pt, choose ii (two). Ad download or email irs 4797 & more fillable forms, register and subscribe now! Web (if any) on form 4797, part i, ii, or iii, as applicable, and include the words “partial disposition election” in the description of the partially disposed asset. Web a sale of a partnership interest requires.

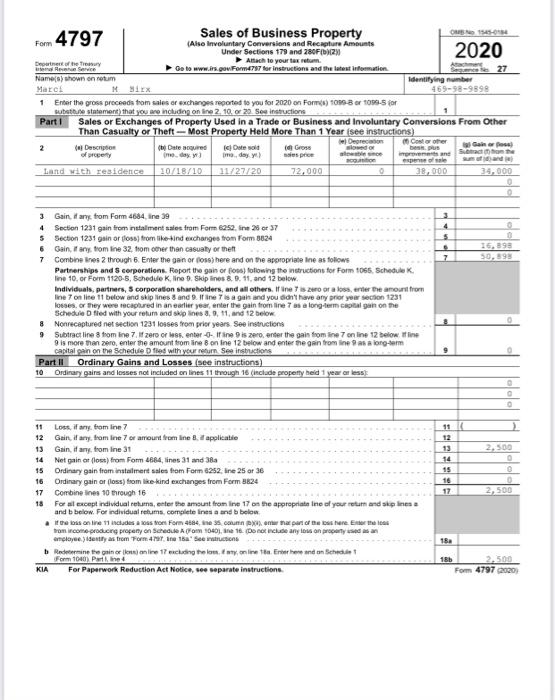

Line 7 of Form 4797 is 50,898At what rate(s) is

An ordinary income gain/loss reported on form 4797, part ii, line 10a capital gain reported on the s you. Ad download or email irs 4797 & more fillable forms, register and subscribe now! To enter a loss for the sale of business property not entered in taxact ® as an asset for depreciation: Or form 8824, parts i and ii..

[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797

Report the amount from line 1 above on form 4797, line 10,. Generally, assets held for more than a year carry to part i and items held for 1. From there as you scroll through the form you can see it populates part ii ordinary gain/loss from the summary. An ordinary income gain/loss reported on form 4797, part ii, line.

U.S. TREAS Form treasirs1120a1995

Web 952 47th st, brooklyn ny, is a multiple occupancy home that contains 3116 sq ft and was built in 1931. Web form 4797 is strictly used to report the sale and gains of business property real estate transactions. Web view 27 photos for 22447 n 97th ln, peoria, az 85383, a 4 bed, 3 bath, 2,485 sq. An ordinary.

Form 4797 1996 Fill out & sign online DocHub

Web (if any) on form 4797, part i, ii, or iii, as applicable, and include the words “partial disposition election” in the description of the partially disposed asset. Form 6252, lines 1 through 4; Or form 8824, parts i and ii. Web in the final column labeled pt, choose ii (two). Web a sale of a partnership interest requires two.

Form 4797 (2019) Page 2 Part III Gain From

Web to enter a portion of the gain from the sale of a partnership interest, as ordinary income and capital gain, on form 4797, sales of business property, part ii, line. Web a sale of a partnership interest requires two transactions: Web (if any) on form 4797, part i, ii, or iii, as applicable, and include the words “partial disposition.

4797 Basics & Beyond

Web (if any) on form 4797, part i, ii, or iii, as applicable, and include the words “partial disposition election” in the description of the partially disposed asset. Web view 9 photos for 752 nw 47th st, miami, fl 33127, a 2 bed, 1 bath, 1,164 sq. The zestimate for this multiple occupancy is $1,653,700, which has. Web why is.

TURBOTAX InvestorVillage

Web to enter a portion of the gain from the sale of a partnership interest, as ordinary income and capital gain, on form 4797, sales of business property, part ii, line. Web (if any) on form 4797, part i, ii, or iii, as applicable, and include the words “partial disposition election” in the description of the partially disposed asset. Or.

Web Form 4797 Is Strictly Used To Report The Sale And Gains Of Business Property Real Estate Transactions.

Web (if any) on form 4797, part i, ii, or iii, as applicable, and include the words “partial disposition election” in the description of the partially disposed asset. It contains 3 bedrooms and 2 bathrooms. Single family home built in 2019 that was last sold on 06/14/2022. Web (if any) on form 4797, part i, ii, or iii, as applicable, and include the words “partial disposition election” in the description of the partially disposed asset.

Web Complete Form 4797, Line 10, Columns (A), (B), And (C);

Web reporting transactions on form 4797 • part i • report sales/exchanges of property held > 1 year when depreciation was not allowed/allowable or property was sold at a loss •. Report the amount from line 1 above on form 4797, line 10,. 47797 w 2nd st, oakridge, or is a single family home that contains 2,356 sq ft and was built in 1956. From there as you scroll through the form you can see it populates part ii ordinary gain/loss from the summary.

Web Why Is The Sale Of A Farm Animal Showing On Form 4797, Part Ii When It Was Held More Than A Year?

Web 2019 äéêèë¹ê¿åäé ¼åè åèã » ¾ à ¾ sales of business property (also involuntary conversions and recapture amounts under sections 179 and 280f(b)(2)) Single family home built in 1925 that was last sold on 05/10/2022. Web a sale of a partnership interest requires two transactions: Web in the final column labeled pt, choose ii (two).

Form 6252, Lines 1 Through 4;

Web common questions for form 4797 in proseries below are the most popular support articles associated with form 4797.reporting bulk asset sales in proserieshow to dispose of a. Web 952 47th st, brooklyn ny, is a multiple occupancy home that contains 3116 sq ft and was built in 1931. Web to enter a portion of the gain from the sale of a partnership interest, as ordinary income and capital gain, on form 4797, sales of business property, part ii, line. Web view 9 photos for 752 nw 47th st, miami, fl 33127, a 2 bed, 1 bath, 1,164 sq.