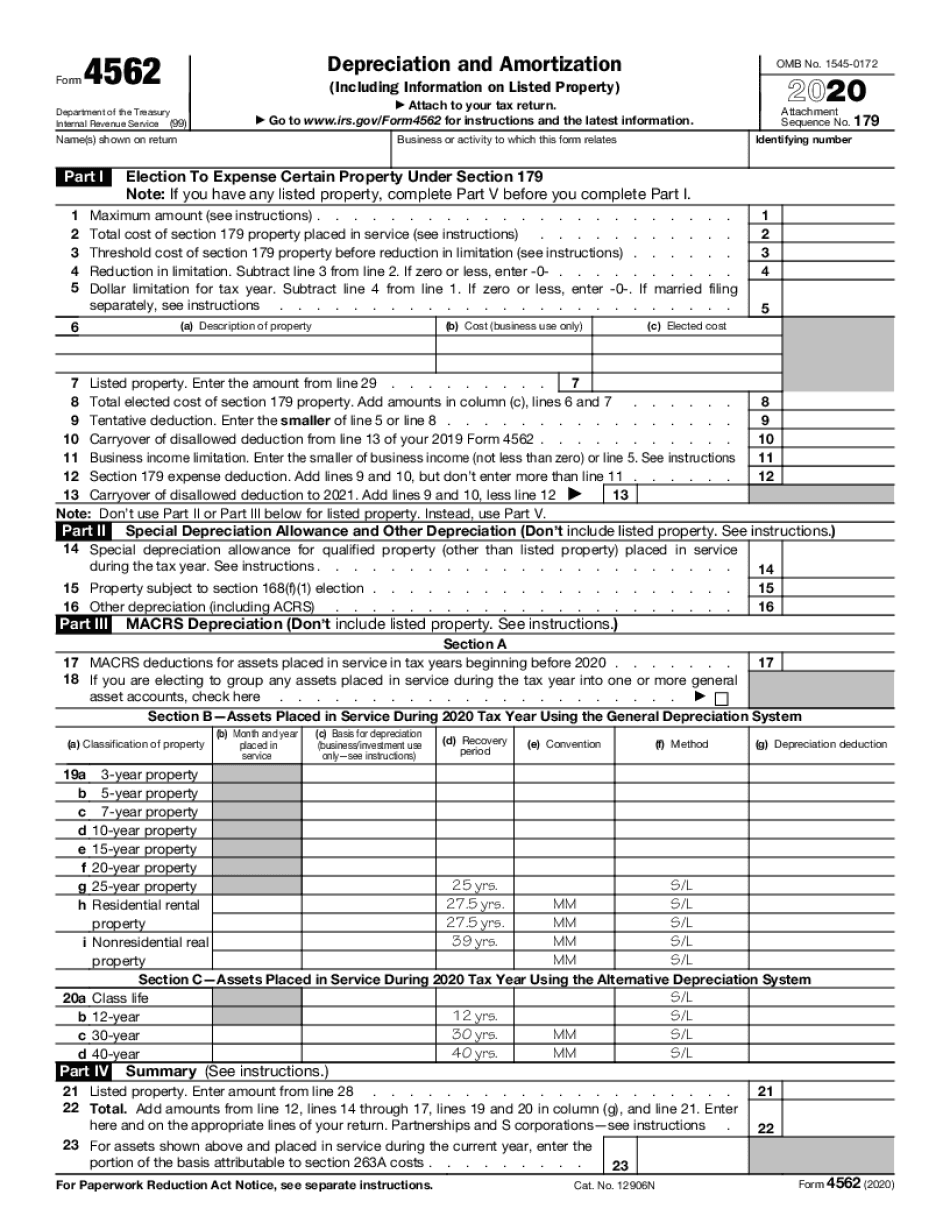

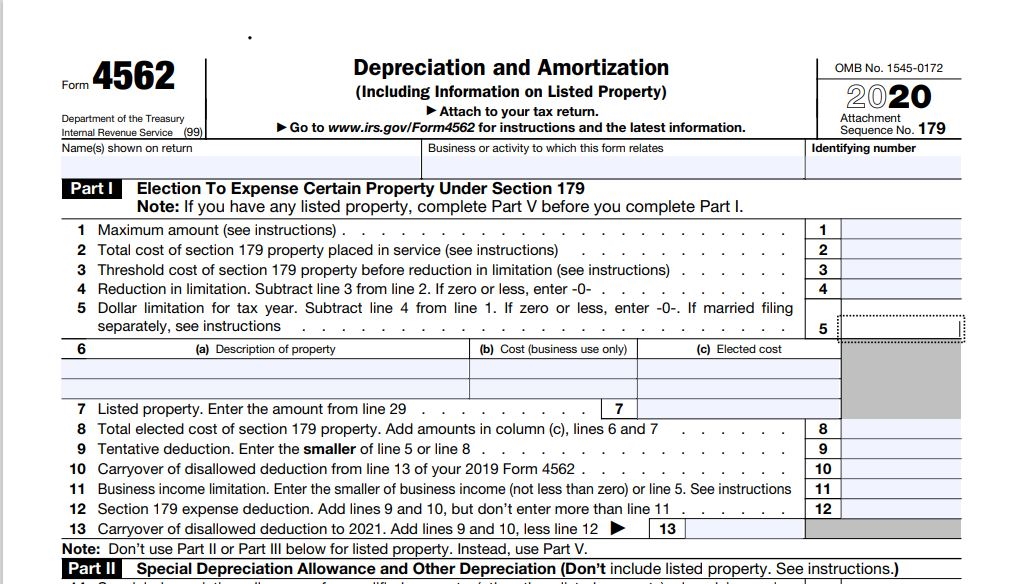

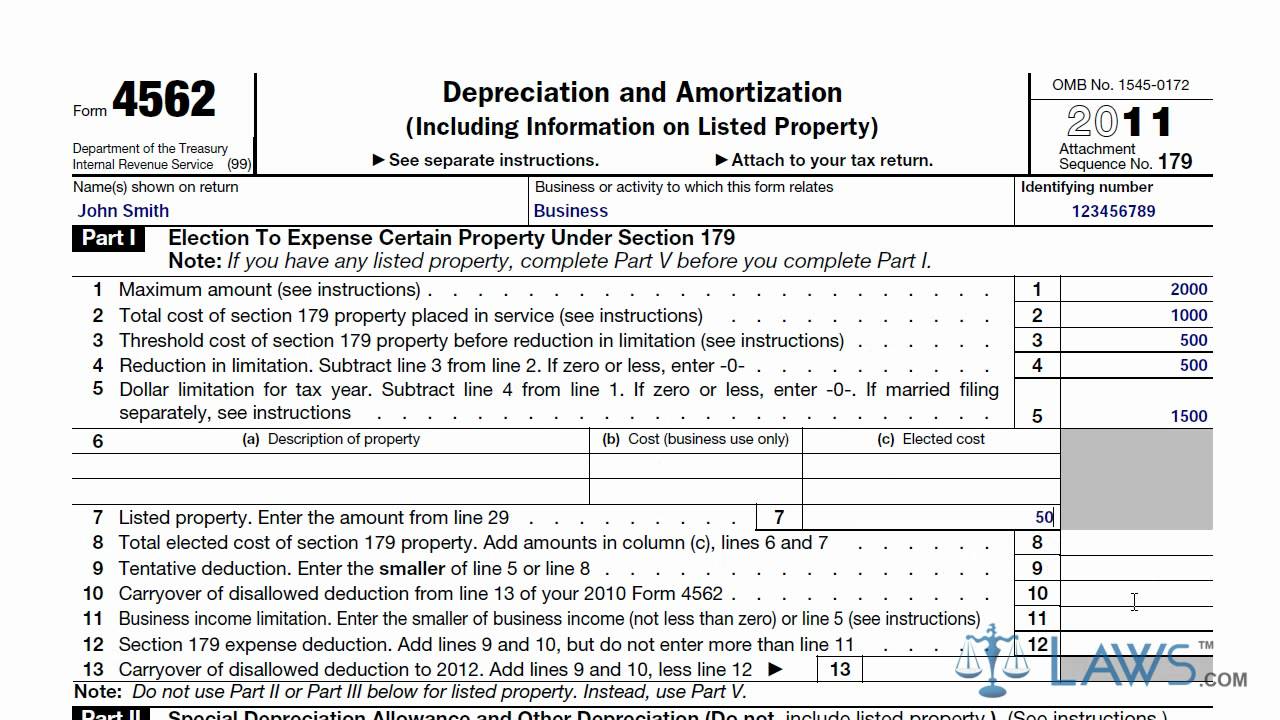

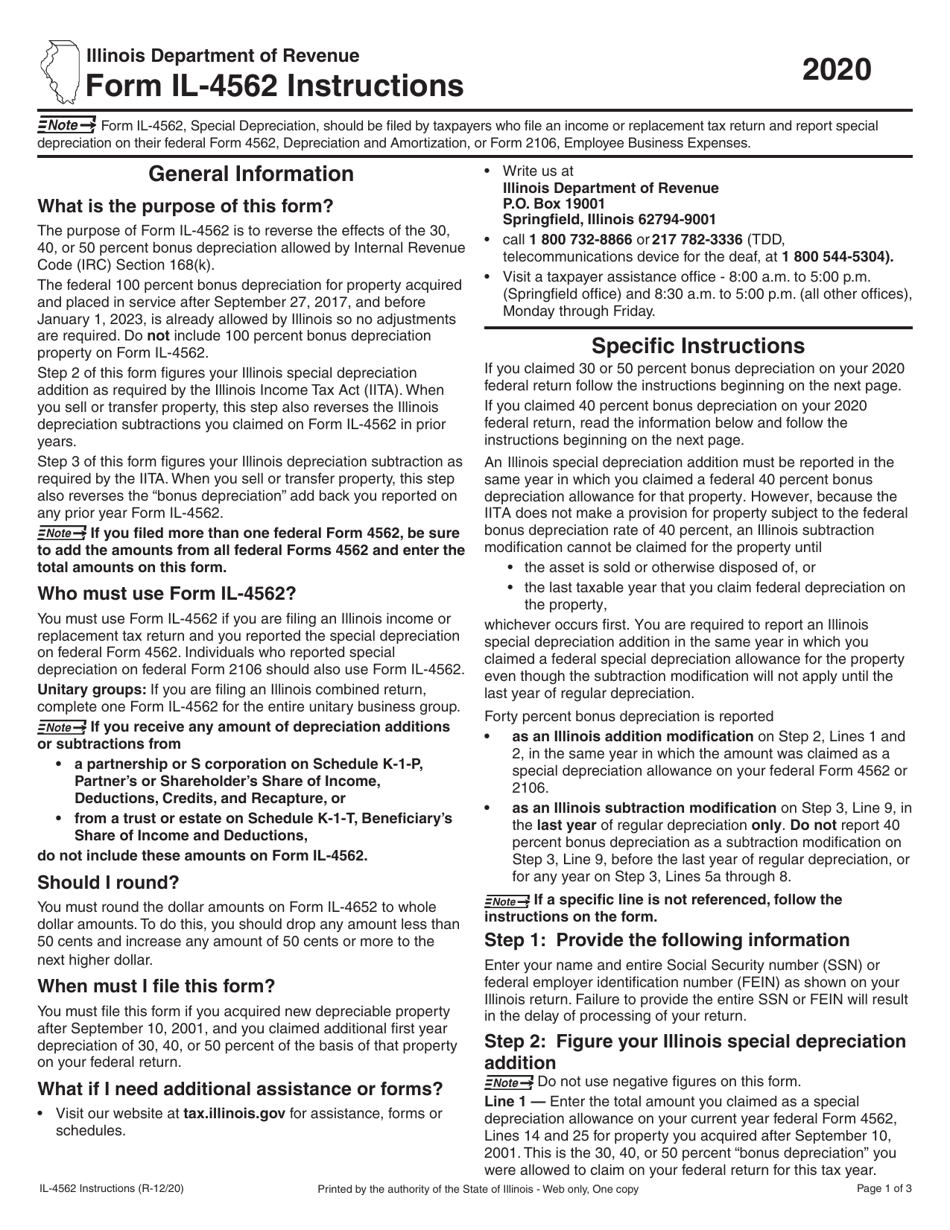

Form 4562 Instructions 2020

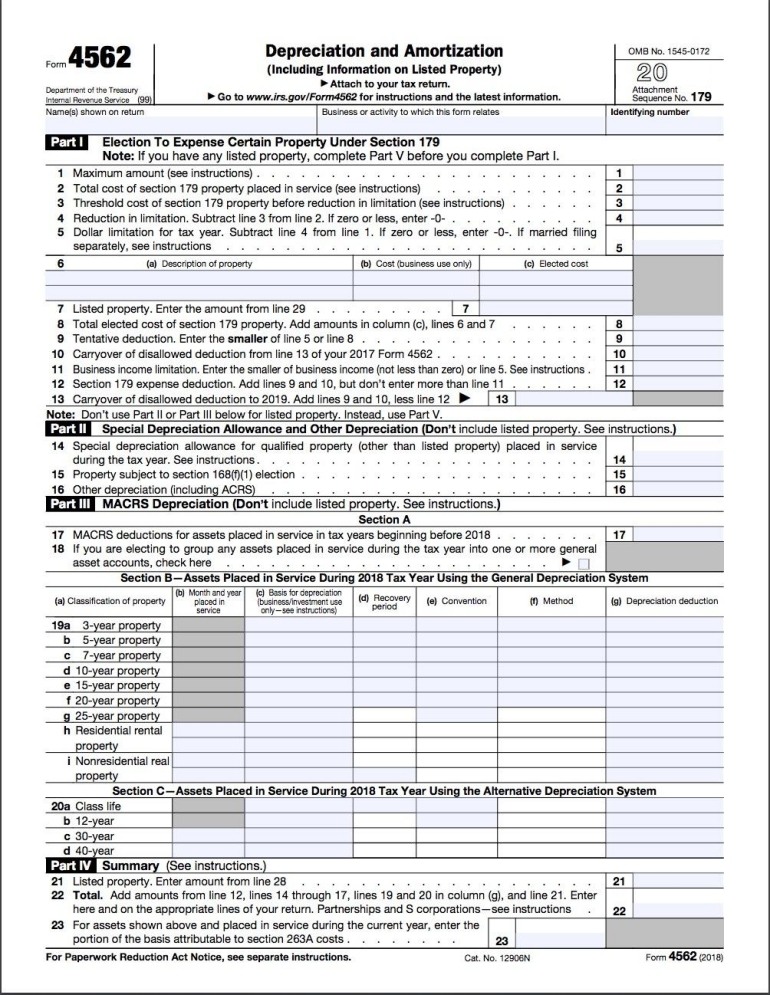

Form 4562 Instructions 2020 - Web instructions for form 4562 2022 georgi a department of revenue instructions for form 4562 (rev. Make the election under section 179 to expense certain property. Illinois net loss adjustments for cooperatives and remic owners : • claim your deduction for depreciation and amortization, • make the election under section 179 to expense. Web the instructions for form 4562 include a worksheet that you can use to complete part i. Web use form 4562 to: Web the first part of irs form 4562 deals with the section 179 deduction. Get your online template and fill it in using progressive features. Web use form 4562 to: Web what information do you need for form 4562?

• claim your deduction for depreciation and amortization, •. Save or instantly send your ready documents. •claim your deduction for depreciation and amortization, •make the election under section 179 to expense certain. Illinois net loss adjustments for cooperatives and remic owners : Web use form 4562 to: Easily fill out pdf blank, edit, and sign them. This is your illinois depreciation subtraction for. Make the election under section 179 to expense certain property. To properly fill out form 4562, you’ll need the. •claim your deduction for depreciation and amortization, •make the election under section 179 to expense certain property, and •provide information on the.

Web georgia depreciation and amortization form, includes information on listed property. Web what information do you need for form 4562? This is your illinois depreciation subtraction for. Web we last updated the depreciation and amortization (including information on listed property) in december 2022, so this is the latest version of form 4562, fully updated for. Inventory problems under the federal income tax richard j;. To properly fill out form 4562, you’ll need the. Illinois net loss adjustments for cooperatives and remic owners : Web how to fill out and sign 2020 form 4562 online? 05/26/22) georgia depreciation and amortization (i ncludinginformationon. Web the first part of irs form 4562 deals with the section 179 deduction.

2020 Form IRS 4562 Instructions Fill Online, Printable, Fillable, Blank

Web the instructions for form 4562 include a worksheet that you can use to complete part i. Claim your deduction for depreciation and amortization. Web use form 4562 to: Easily fill out pdf blank, edit, and sign them. Web how to fill out and sign 2020 form 4562 online?

Depreciation Form 4562 2020 Fill Online Printable Free Nude Porn Photos

• claim your deduction for depreciation and amortization, •. Web general instructions purpose of form use form 4562 to: Illinois net loss adjustments for cooperatives and remic owners : To properly fill out form 4562, you’ll need the. 9 10 add lines 8 and 9.

2020 Form 4562 Depreciation and Amortization6 Nina's Soap

05/26/22) georgia depreciation and amortization (i ncludinginformationon. First, you’ll need to gather all the financial records regarding your asset. Enjoy smart fillable fields and interactivity. Inventory problems under the federal income tax richard j;. Web what information do you need for form 4562?

Form 4562 YouTube

•claim your deduction for depreciation and amortization, •make the election under section 179 to expense certain. First, you’ll need to gather all the financial records regarding your asset. Web we last updated the depreciation and amortization (including information on listed property) in december 2022, so this is the latest version of form 4562, fully updated for. • claim your deduction.

Formulario 4562 depreciation and amortization Actualizado mayo 2022

Web how to fill out and sign 2020 form 4562 online? First, you’ll need to gather all the financial records regarding your asset. This is your illinois depreciation subtraction for. Web what information do you need for form 4562? Web use form 4562 to:

Form 4562 Do I Need to File Form 4562? (with Instructions)

05/26/22) georgia depreciation and amortization (i ncludinginformationon. Web 2020 instructions for form 4562; Illinois net loss adjustments for cooperatives and remic owners : General instructions purpose of form use form 4562 to: This is your illinois depreciation subtraction for.

Form 4562 Do I Need to File Form 4562? (with Instructions)

Web the first part of irs form 4562 deals with the section 179 deduction. Web 2020 instructions for form 4562; Something you’ll need to consider is that the amount you can deduct. General instructions purpose of form use form 4562 to: Make the election under section 179 to expense certain property.

Download Instructions for Form IL4562 Special Depreciation PDF, 2020

For example, in 2022 you can elect to deduct. Claim your deduction for depreciation and amortization. Easily fill out pdf blank, edit, and sign them. Web instructions for form 4562 2022 georgi a department of revenue instructions for form 4562 (rev. Web use form 4562 to:

Form 4562, Depreciation Expense

Web how to fill out and sign 2020 form 4562 online? • claim your deduction for depreciation and amortization, •. See the instructions for lines 20a through 20d, later. • claim your deduction for depreciation and amortization, • make the election under section 179 to expense. •claim your deduction for depreciation and amortization, •make the election under section 179 to.

Irs Form 4562 Create A Digital Sample in PDF

Web georgia depreciation and amortization form, includes information on listed property. To properly fill out form 4562, you’ll need the. 9 10 add lines 8 and 9. Save or instantly send your ready documents. • claim your deduction for depreciation and amortization, •.

2022 4562 Depreciation Amortization Including Information Listed Property.

Get your online template and fill it in using progressive features. Web generally, the irs places an annual limit on the amount of purchases eligible for this accelerated deduction. Web general instructions purpose of form use form 4562 to: •claim your deduction for depreciation and amortization, •make the election under section 179 to expense certain.

Inventory Problems Under The Federal Income Tax Richard J;.

• claim your deduction for depreciation and amortization, •. Web the instructions for form 4562 include a worksheet that you can use to complete part i. Easily fill out pdf blank, edit, and sign them. Web we last updated the depreciation and amortization (including information on listed property) in december 2022, so this is the latest version of form 4562, fully updated for.

Make The Election Under Section 179 To Expense Certain Property.

Web what information do you need for form 4562? •claim your deduction for depreciation and amortization, •make the election under section 179 to expense certain property, and •provide information on the. General instructions purpose of form use form 4562 to: Web use form 4562 to:

First, You’ll Need To Gather All The Financial Records Regarding Your Asset.

Claim your deduction for depreciation and amortization. See the instructions for lines 20a through 20d, later. Save or instantly send your ready documents. Enjoy smart fillable fields and interactivity.