Form 433D Irs Pdf

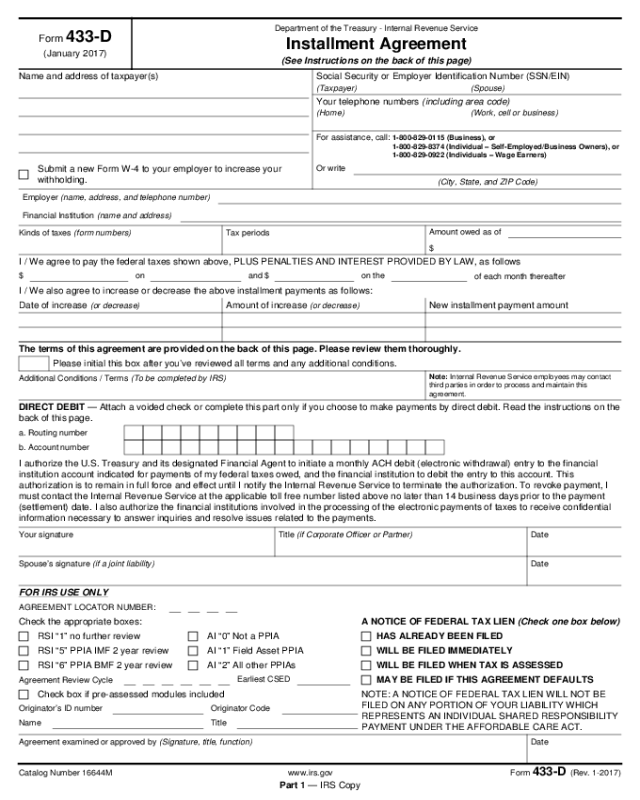

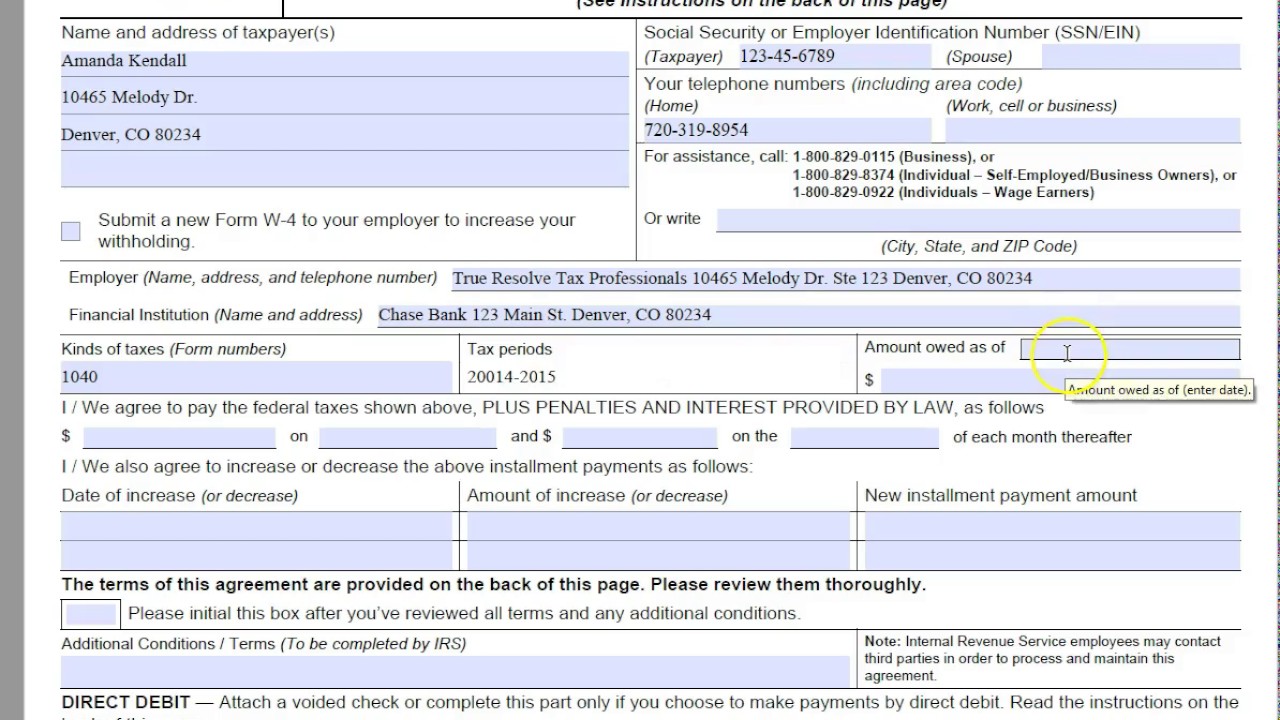

Form 433D Irs Pdf - Web department of the treasury — internal revenue service installment agreement (see instructions on the back of this page) name and address of taxpayer(s) submit a new. Ad access irs tax forms. Difference between tax forms basic conditions instructions for. Web make these quick steps to modify the pdf irs form 433 d online free of charge: Easily add and highlight text, insert pictures, checkmarks, and symbols, drop new fillable areas, and rearrange or remove pages from your paperwork. Complete, edit or print tax forms instantly. Sign in to the editor using your credentials or click create free. Installment agreement request and collection. Save or instantly send your ready documents. Easily fill out pdf blank, edit, and sign them.

You can download or print current or past. Ad access irs tax forms. Sign in to the editor using your credentials or click create free. Get ready for tax season deadlines by completing any required tax forms today. Easily add and highlight text, insert pictures, checkmarks, and symbols, drop new fillable areas, and rearrange or remove pages from your paperwork. The first step is to download the form from the official website of the treasury department and open it in pdfelement platform to start filling the form. Web make these quick steps to modify the pdf irs form 433 d online free of charge: Web department of the treasury — internal revenue service installment agreement (see instructions on the back of this page) name and address of taxpayer(s) submit a new. Installment agreement request and collection. Easily fill out pdf blank, edit, and sign them.

Web edit irs form 433 d. The first step is to download the form from the official website of the treasury department and open it in pdfelement platform to start filling the form. Web department of the treasury — internal revenue service installment agreement (see instructions on the back of this page) name and address of taxpayer(s) submit a new. Edit, download & esign pdf online. Web make these quick steps to modify the pdf irs form 433 d online free of charge: Complete, edit or print tax forms instantly. Sign in to the editor using your credentials or click create free. Easily fill out pdf blank, edit, and sign them. Get ready for tax season deadlines by completing any required tax forms today. Save or instantly send your ready documents.

How to Complete an IRS Form 433D Installment Agreement

Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Collection information statement for businesses. Edit, download & esign pdf online. Ad access irs tax forms.

Form 433d Edit, Fill, Sign Online Handypdf

Easily add and highlight text, insert pictures, checkmarks, and symbols, drop new fillable areas, and rearrange or remove pages from your paperwork. Get ready for tax season deadlines by completing any required tax forms today. Register and log in to your account. Easily fill out pdf blank, edit, and sign them. Web department of the treasury — internal revenue service.

Form 433d Edit, Fill, Sign Online Handypdf

Ad access irs tax forms. Web make these quick steps to modify the pdf irs form 433 d online free of charge: Web edit irs form 433 d. Easily fill out pdf blank, edit, and sign them. Edit, download & esign pdf online.

Form 433 D Pdf Fillable Form Resume Examples a6YngoxVBg

You can download or print current or past. Web make these quick steps to modify the pdf irs form 433 d online free of charge: Register and log in to your account. Edit, download & esign pdf online. The first step is to download the form from the official website of the treasury department and open it in pdfelement platform.

Form 433F Collection Information Statement for Individuals (ACS

Easily add and highlight text, insert pictures, checkmarks, and symbols, drop new fillable areas, and rearrange or remove pages from your paperwork. Collection information statement for businesses. Save or instantly send your ready documents. Complete, edit or print tax forms instantly. Sign in to the editor using your credentials or click create free.

IRS Form 433A (OIC) Offer in Compromise Example numbers used that

Difference between tax forms basic conditions instructions for. Web make these quick steps to modify the pdf irs form 433 d online free of charge: Complete, edit or print tax forms instantly. Easily fill out pdf blank, edit, and sign them. Collection information statement for businesses.

Fill Free fillable IRS Form 433A Collection Information Statement

Get ready for tax season deadlines by completing any required tax forms today. Easily add and highlight text, insert pictures, checkmarks, and symbols, drop new fillable areas, and rearrange or remove pages from your paperwork. Save or instantly send your ready documents. Collection information statement for businesses. Easily fill out pdf blank, edit, and sign them.

Irs Form 433 D Printable Master of Documents

Installment agreement request and collection. Web make these quick steps to modify the pdf irs form 433 d online free of charge: Complete, edit or print tax forms instantly. Register and log in to your account. Web edit irs form 433 d.

How to Fill Out IRS Form 433D

Ad access irs tax forms. You can download or print current or past. Complete, edit or print tax forms instantly. Save or instantly send your ready documents. The first step is to download the form from the official website of the treasury department and open it in pdfelement platform to start filling the form.

Download Form 433A for Free Page 5 FormTemplate

Collection information statement for businesses. Complete, edit or print tax forms instantly. Web department of the treasury — internal revenue service installment agreement (see instructions on the back of this page) name and address of taxpayer(s) submit a new. Sign in to the editor using your credentials or click create free. Register and log in to your account.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Collection information statement for businesses. Save or instantly send your ready documents. Easily fill out pdf blank, edit, and sign them. Sign in to the editor using your credentials or click create free.

Register And Log In To Your Account.

Installment agreement request and collection. Easily add and highlight text, insert pictures, checkmarks, and symbols, drop new fillable areas, and rearrange or remove pages from your paperwork. You can download or print current or past. Web department of the treasury — internal revenue service installment agreement (see instructions on the back of this page) name and address of taxpayer(s) submit a new.

Web Make These Quick Steps To Modify The Pdf Irs Form 433 D Online Free Of Charge:

Difference between tax forms basic conditions instructions for. Edit, download & esign pdf online. Ad access irs tax forms. The first step is to download the form from the official website of the treasury department and open it in pdfelement platform to start filling the form.

Complete, Edit Or Print Tax Forms Instantly.

Web edit irs form 433 d.