Form 3911 Mailing Address California

Form 3911 Mailing Address California - Sign it in a few clicks. The form is typically used to track down missing tax refunds. Web you can write to the internal revenue service, attention: Web form 3911 needs to be signed and must be signed by your spouse if you filed a joint tax return. This is not a 1040 form. Be forewarned that you may experience long wait times because of limited staffing. Send form 3911 mailing address via email, link, or fax. Section ii refund information (please check all boxes that apply to you.) 8. How soon can i expect a response from the irs after filing form 3911? Individual business, form other tax period:

The form must be completed and mailed or faxed to the specified irs office. Web 7 rows find irs mailing addresses for taxpayers and tax professionals. Web you can write to the internal revenue service, attention: Web form 3911 can be used as written documentation to change a taxpayer's address. Web submit the completed fda form 3911 using the “submit by email” button on the form or email the completed form to drugnotifications@fda.hhs.gov and include “illegitimate product notification. Edit your where to send 3911 form online. Address (include zip code) 7. Your claim for a missing refund is processed one of two ways: Address (include zip code) 7. I need to send this form asap and want to send it to the correct place.

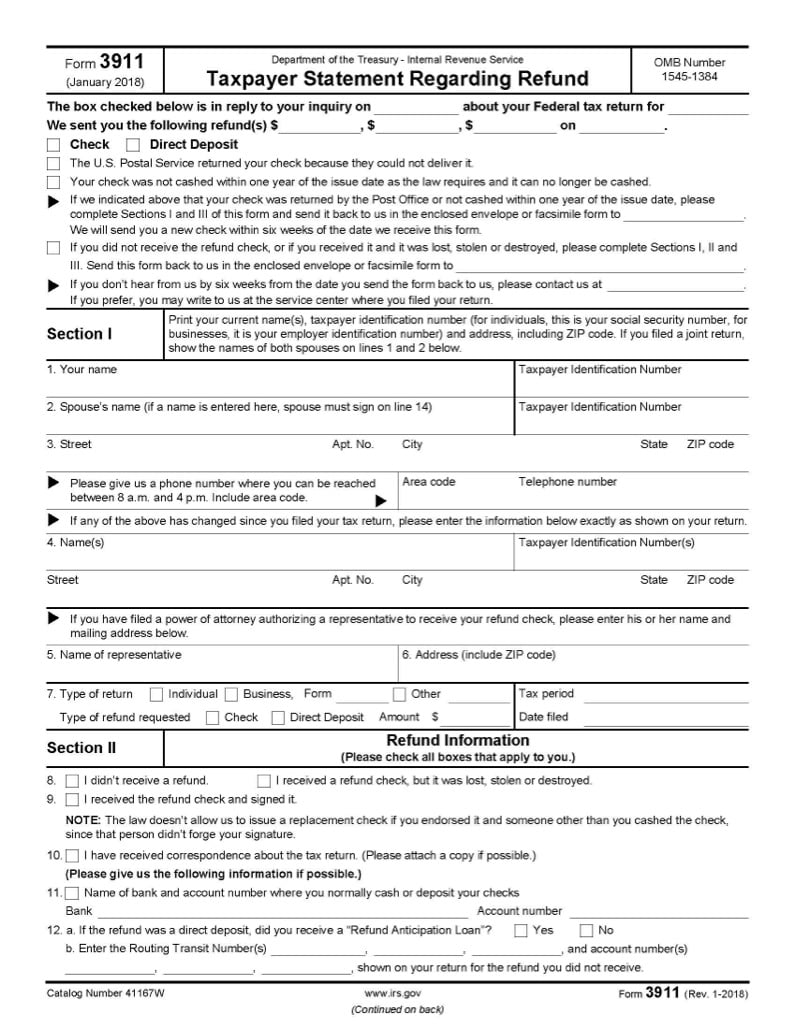

Web download and complete the form 3911, taxpayer statement regarding refund pdf or the irs can send you a form 3911 to get the replacement process started. Zip codeif you authorized a representative to receive your refund check, enter his or her name and mailing address below. Web 7 rows find irs mailing addresses for taxpayers and tax professionals. The form must be completed and mailed or faxed to the specified irs office. Get the where to mail form 3911 you require. Address (include zip code) 7. Be forewarned that you may experience long wait times because of limited staffing. Web form 3911 can be used as written documentation to change a taxpayer's address. Form 3911 is provided to individuals who do not qualify to request a replacement check through the internet, automated phone system or by contacting a customer service representative. Web level 15 @belinda5 wrote:

Tax Refund Scams and How to Avoid Them

This is not a 1040 form. Your claim for a missing refund is processed one of two ways: Section ii refund information (please check all boxes that apply to you.) 8. Web download and complete the form 3911, taxpayer statement regarding refund pdf or the irs can send you a form 3911 to get the replacement process started. I am.

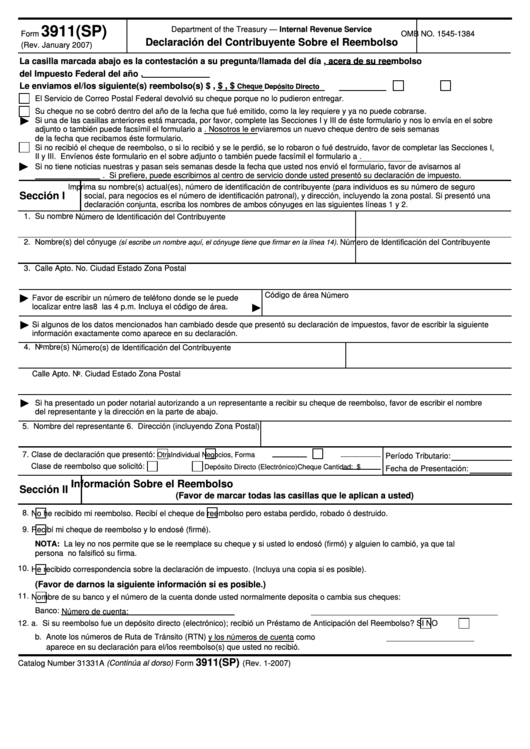

Fillable Form 3911(Sp) Declaracion Del Contribuyente Sobre El

Involved parties names, addresses and phone numbers etc. Web level 15 @belinda5 wrote: See irm 21.4.3.5.3, undeliverable refund checks. Alternatively, you could also send the irs a completed form 3911, taxpayer statement regarding refund. Web submit the completed fda form 3911 using the “submit by email” button on the form or email the completed form to drugnotifications@fda.hhs.gov and include “illegitimate.

Fill Free fillable Taxpayer Statement Regarding Refund Form 3911

Web level 15 @belinda5 wrote: You will be instructed to complete form 3911 to complete initiate a trace of the eip (economic impact payment) Web address on return if different from current address. Upon receipt of form 3911, update the address and input cc chkcl. Instead, please use the envelope provided or mail the form to the internal revenue service.

CT CT3911 2006 Fill out Tax Template Online US Legal Forms

Web you can write to the internal revenue service, attention: This is not a 1040 form. Form 3911 is provided to individuals who do not qualify to request a replacement check through the internet, automated phone system or by contacting a customer service representative. Be forewarned that you may experience long wait times because of limited staffing. Web form 3911.

Form 3911 Never received tax refund or Economic Impact Payment

Web 7 rows find irs mailing addresses for taxpayers and tax professionals. Instead, please use the envelope provided or mail the form to the internal revenue service center where you would normally file a paper tax return. The form is typically used to track down missing tax refunds. Web download and complete the form 3911, taxpayer statement regarding refund pdf.

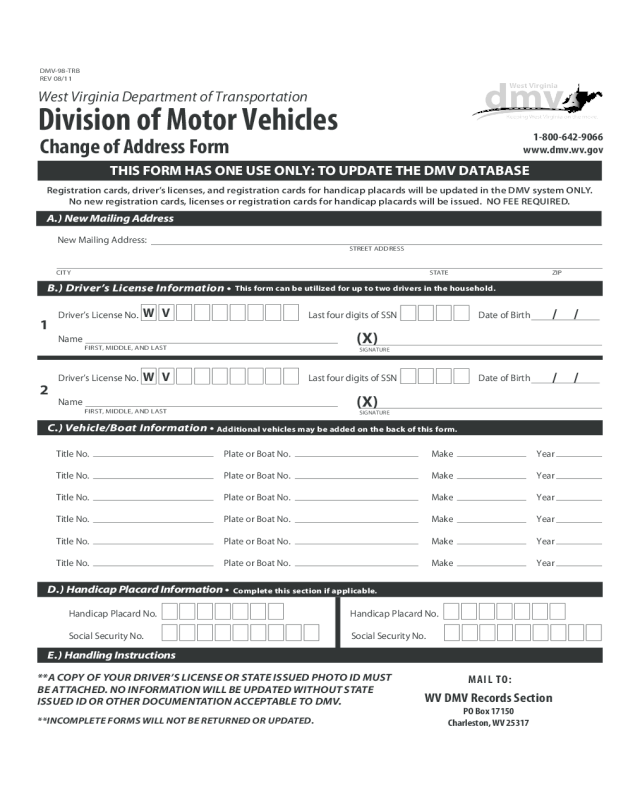

2022 DMV Change of Address Form Fillable, Printable PDF & Forms

Address (include zip code) 7. You will be instructed to complete form 3911 to complete initiate a trace of the eip (economic impact payment) Open it up with online editor and begin adjusting. Web submit the completed fda form 3911 using the “submit by email” button on the form or email the completed form to drugnotifications@fda.hhs.gov and include “illegitimate product.

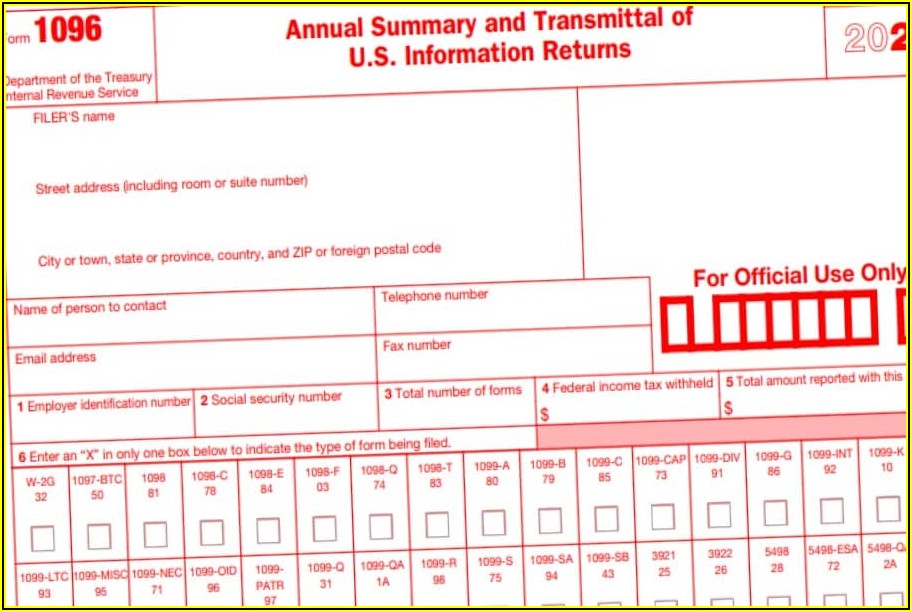

Irs Form 1096 Mailing Address Form Resume Examples MeVRBKooVD

You will be instructed to complete form 3911 to complete initiate a trace of the eip (economic impact payment) Certified mail you can send a letter or documentation to us by certified mail. I need to send this form asap and want to send it to the correct place. Web submit the completed fda form 3911 using the “submit by.

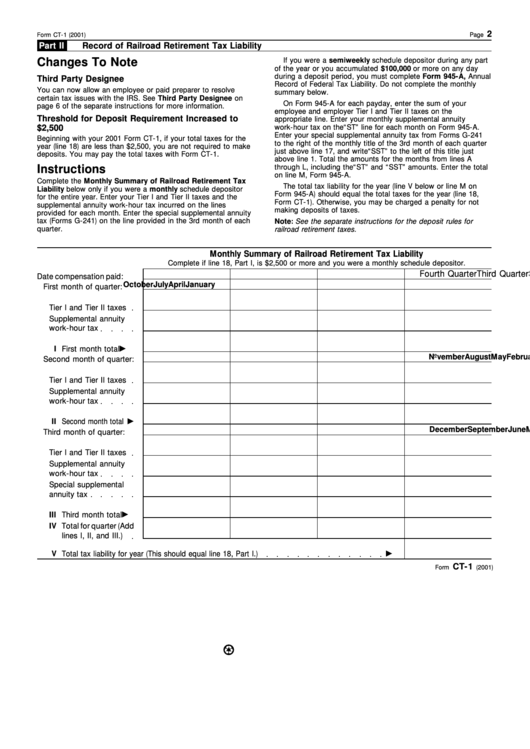

Instructions For Form Ct1 Employer'S Annual Railroad Retirement Tax

You will be instructed to complete form 3911 to complete initiate a trace of the eip (economic impact payment) Section ii refund information (please check all boxes that apply to you.) 8. You can also download it, export it or print it out. Individual business, form other tax period: I need to send this form asap and want to send.

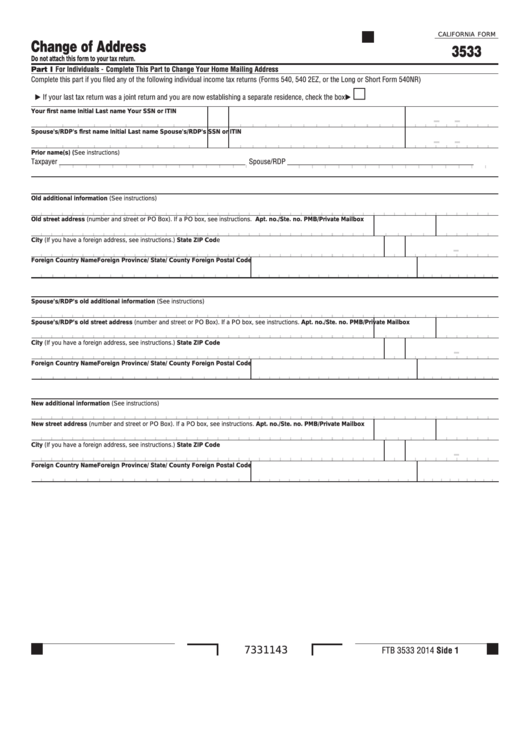

California Form 3533 Change Of Address printable pdf download

This is not a 1040 form. Web download and complete the form 3911, taxpayer statement regarding refund pdf or the irs can send you a form 3911 to get the replacement process started. Web form 3911 can be used as written documentation to change a taxpayer's address. Upon receipt of form 3911, update the address and input cc chkcl. Open.

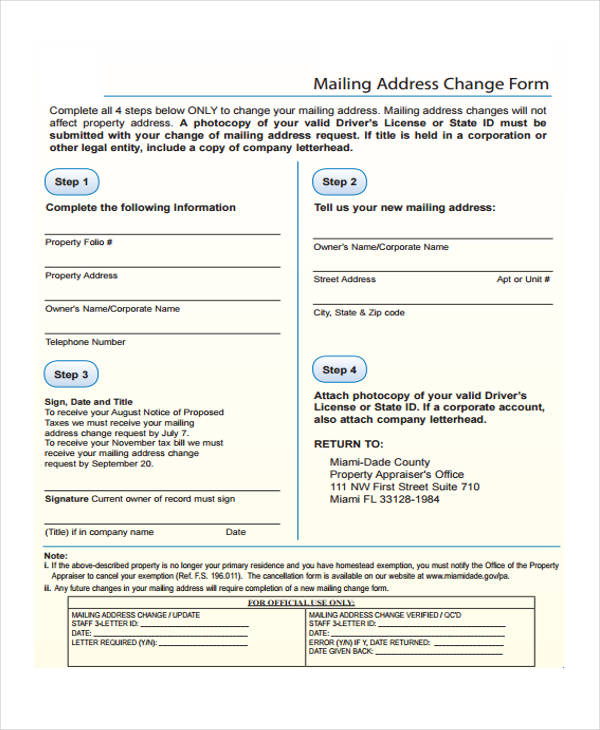

FREE 35+ Change Forms in PDF

Web submit the completed fda form 3911 using the “submit by email” button on the form or email the completed form to drugnotifications@fda.hhs.gov and include “illegitimate product notification. How soon can i expect a response from the irs after filing form 3911? Instead, please use the envelope provided or mail the form to the internal revenue service center where you.

Involved Parties Names, Addresses And Phone Numbers Etc.

Type text, add images, blackout confidential details, add comments, highlights and more. Change the template with exclusive fillable fields. I am very confused where to send my 3911 form. Open it up with online editor and begin adjusting.

Individual Business, Form Other Tax Period:

Address (include zip code) 7. Send form 3911 mailing address via email, link, or fax. Web where do i send form 3911 may 18, 2020 8:40 am 0 reply bookmark icon doninga level 15 @skyjockey48 wrote: Do not send this form to this office.

Be Forewarned That You May Experience Long Wait Times Because Of Limited Staffing.

Web 7 rows find irs mailing addresses for taxpayers and tax professionals. However, if the refund check was returned undelivered by the postal service, do not input cc chkcl. The form must be completed and mailed or faxed to the specified irs office. Web you can write to the internal revenue service, attention:

Instead, Please Use The Envelope Provided Or Mail The Form To The Internal Revenue Service Center Where You Would Normally File A Paper Tax Return.

I need to send this form asap and want to send it to the correct place. If the check wasn't cashed, you'll receive a replacement check once the original check is canceled. You will be instructed to complete form 3911 to complete initiate a trace of the eip (economic impact payment) Alternatively, you could also send the irs a completed form 3911, taxpayer statement regarding refund.