Form 2439 Instructions

Form 2439 Instructions - Web to report a gain from form 2439 or 6252 or part i of form 4797; Web click + add form 2439 to create a new copy of the form or click edit to edit a form already created (desktop program: Web instructions to printers form 2439, page 1 of 6 margins: If you received a form 2439 with a gain in box 1c, part or all of that gain (which is also included in box 1a) may be eligible for. From the dispositions section select form 2439. Web the instructions provided with california tax forms are a summary of california tax law and are only intended to aid taxpayers in preparing their state income tax returns. To report a gain or loss from a partnership, s. Real property used in your trade or business; Claim a credit for the tax paid by the mutual fund. Web instructions for the shareholder section references are to the internal revenue code.

From the dispositions section select form 2439. Web per the instruction for form 2439: Attach copy b of form 2439 to your completed tax return. Claim a credit for the tax paid by the mutual fund. Go to screen 22.1 dispositions (schedule d, 4797, etc.). If you received a form 2439 with a gain in box 1c, part or all of that gain (which is also included in box 1a) may be eligible for. Click review instead of edit). Web report the capital gain on your income tax return for the year. Real property used in your trade or business; The sale or exchange of:

Web the instructions provided with california tax forms are a summary of california tax law and are only intended to aid taxpayers in preparing their state income tax returns. Click review instead of edit). Web to report a gain from form 2439 or 6252 or part i of form 4797; Go to screen 22.1 dispositions (schedule d, 4797, etc.). Web instructions to printers form 2439, page 1 of 6 margins: The amounts entered in boxes 1b, 1c, and 1d. To report a gain or loss from form 4684, 6781, or 8824; Web to enter the 2439 in the fiduciary module: To report a gain or loss from a partnership, s. The sale or exchange of:

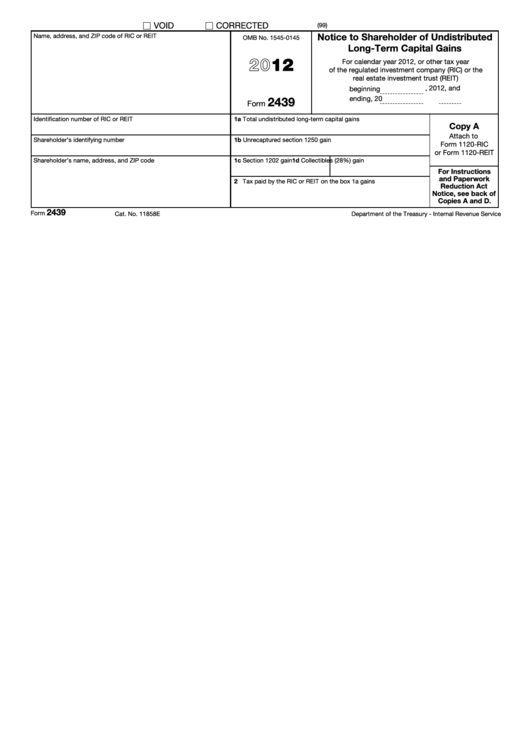

Form 2439 Notice to Shareholder of Undistributed LongTerm Capital

Web instructions for the shareholder section references are to the internal revenue code. The amounts entered in boxes 1b, 1c, and 1d. Web what is form 2439? Web per the instruction for form 2439: From the dispositions section select form 2439.

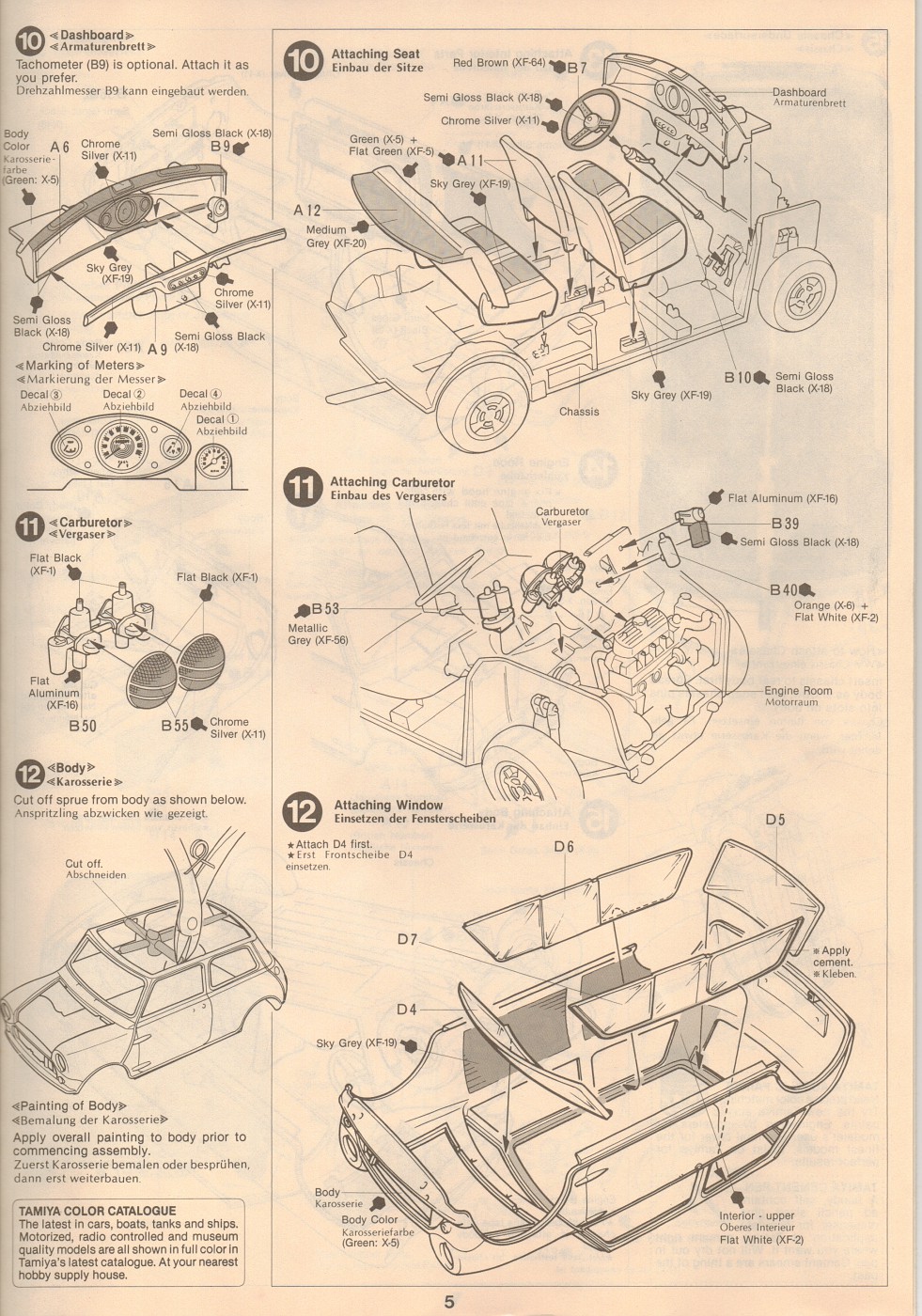

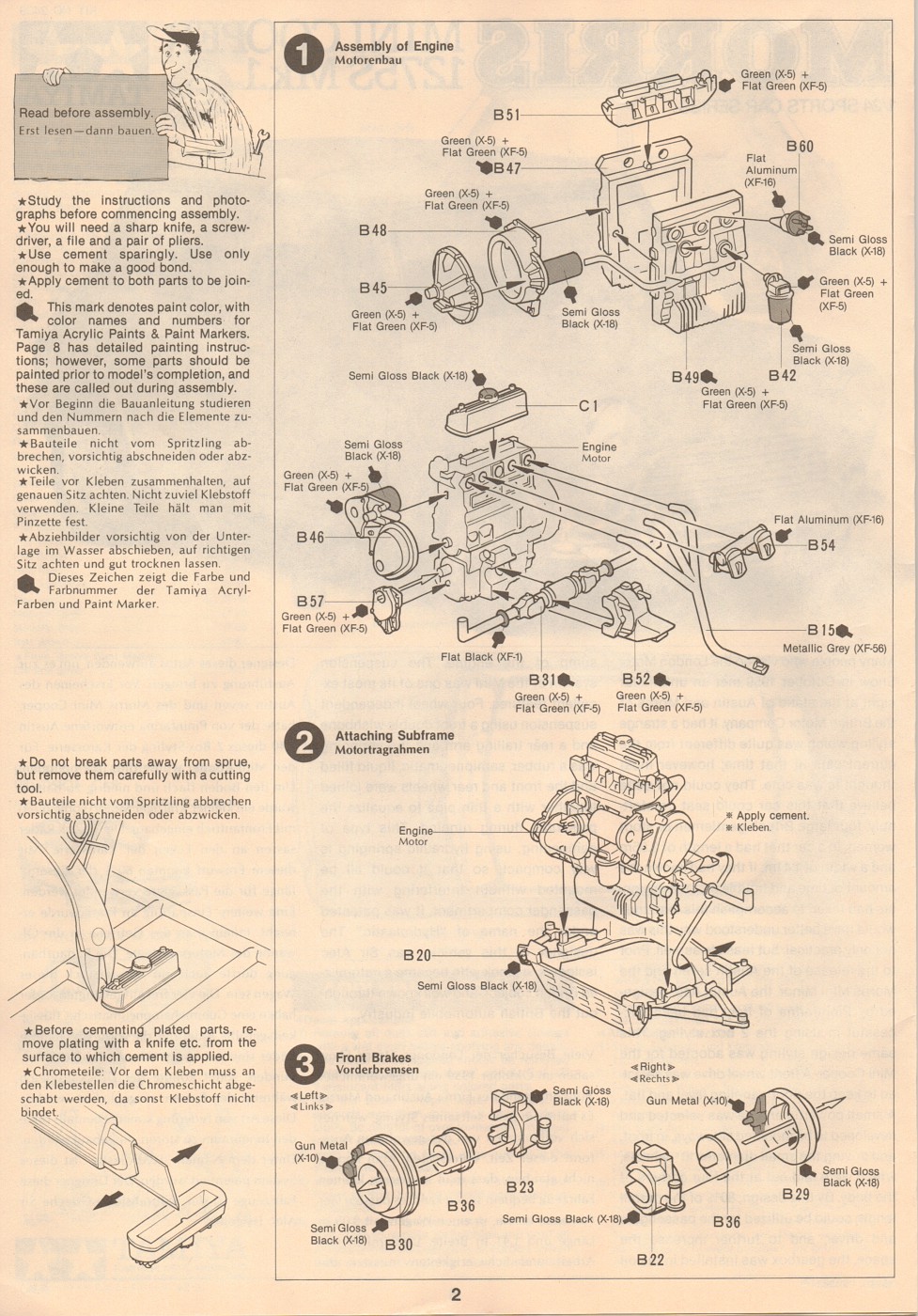

Photo File4 TAMIYA Morris Mini Cooper 1275S Mk.1 2439 album

Web the instructions provided with california tax forms are a summary of california tax law and are only intended to aid taxpayers in preparing their state income tax returns. Web report the capital gain on your income tax return for the year. Web per the instruction for form 2439: Click review instead of edit). The sale or exchange of:

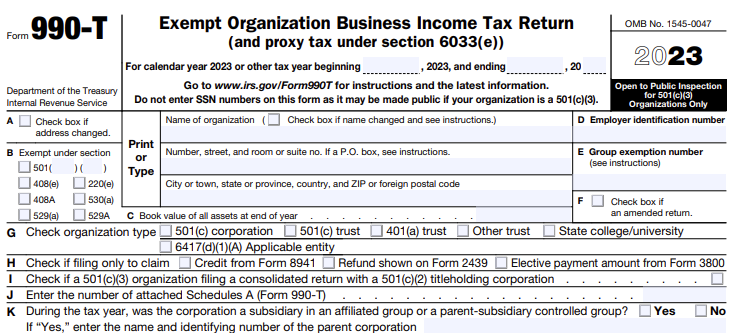

2022 IRS Form 990T Instructions ┃ How to fill out 990T?

The sale or exchange of: Click + add form 2439 to create a. From the dispositions section select form 2439. Complete copies a, b, c, and d of form 2439 for each owner. Go to screen 22.1 dispositions (schedule d, 4797, etc.).

1040 Schedule 3 (Drake18 and Drake19) (Schedule3)

Attach copy b of form 2439 to your completed tax return. Web form 2439 (pdf) form 2439 instructions (pdf) instructions for reporting. Web instructions to printers form 2439, page 1 of 6 margins: Click + add form 2439 to create a. Complete copies a, b, c, and d of form 2439 for each owner.

Form 990T Exempt Organization Business Tax Return (and proxy…

Web instructions to printers form 2439, page 1 of 6 margins: Web report the capital gain on your income tax return for the year. Web per the instruction for form 2439: Complete copies a, b, c, and d of form 2439 for each owner. From the dispositions section select form 2439.

Breanna Tax Form 2439

Click review instead of edit). Real property used in your trade or business; The sale or exchange of: To report a gain or loss from a partnership, s. Web form 2439 (pdf) form 2439 instructions (pdf) instructions for reporting.

Photo File1 TAMIYA Morris Mini Cooper 1275S Mk.1 2439 album

Web instructions to printers form 2439, page 1 of 6 margins: Click review instead of edit). Complete copies a, b, c, and d of form 2439 for each owner. If you received a form 2439 with a gain in box 1c, part or all of that gain (which is also included in box 1a) may be eligible for. The sale.

Form 1099S, Proceeds From Real Estate Transactions

Attach copy b of form 2439 to your completed tax return. Web to enter the 2439 in the fiduciary module: Web what is form 2439? To report a gain or loss from a partnership, s. The sale or exchange of:

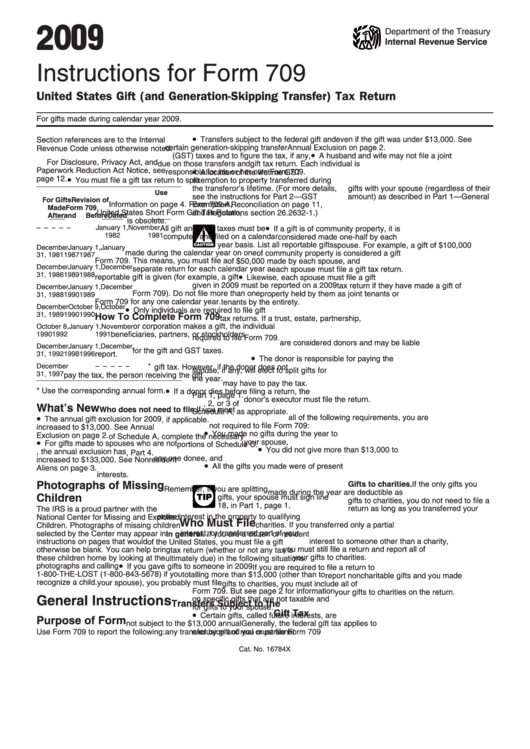

Instructions For Form 709 2009 printable pdf download

Claim a credit for the tax paid by the mutual fund. Attach copy b of form 2439 to your completed tax return. To report a gain or loss from form 4684, 6781, or 8824; Web form 2439 (pdf) form 2439 instructions (pdf) instructions for reporting. Web to enter the 2439 in the fiduciary module:

Fillable Form 2439 Notice To Shareholder Of Undistributed LongTerm

Web form 2439 (pdf) form 2439 instructions (pdf) instructions for reporting. Web to report a gain from form 2439 or 6252 or part i of form 4797; Web to enter the 2439 in the fiduciary module: To report a gain or loss from a partnership, s. Web instructions to printers form 2439, page 1 of 6 margins:

Claim A Credit For The Tax Paid By The Mutual Fund.

Web form 2439 (pdf) form 2439 instructions (pdf) instructions for reporting. Attach copy b of form 2439 to your completed tax return. To report a gain or loss from a partnership, s. Complete copies a, b, c, and d of form 2439 for each owner.

The Amounts Entered In Boxes 1B, 1C, And 1D.

To report a gain or loss from form 4684, 6781, or 8824; From the dispositions section select form 2439. Web per the instruction for form 2439: Click review instead of edit).

Web Instructions For The Shareholder Section References Are To The Internal Revenue Code.

Web the instructions provided with california tax forms are a summary of california tax law and are only intended to aid taxpayers in preparing their state income tax returns. Click + add form 2439 to create a. Web click + add form 2439 to create a new copy of the form or click edit to edit a form already created (desktop program: If you received a form 2439 with a gain in box 1c, part or all of that gain (which is also included in box 1a) may be eligible for.

The Sale Or Exchange Of:

Web to report a gain from form 2439 or 6252 or part i of form 4797; Web to enter the 2439 in the fiduciary module: Web instructions to printers form 2439, page 1 of 6 margins: Real property used in your trade or business;