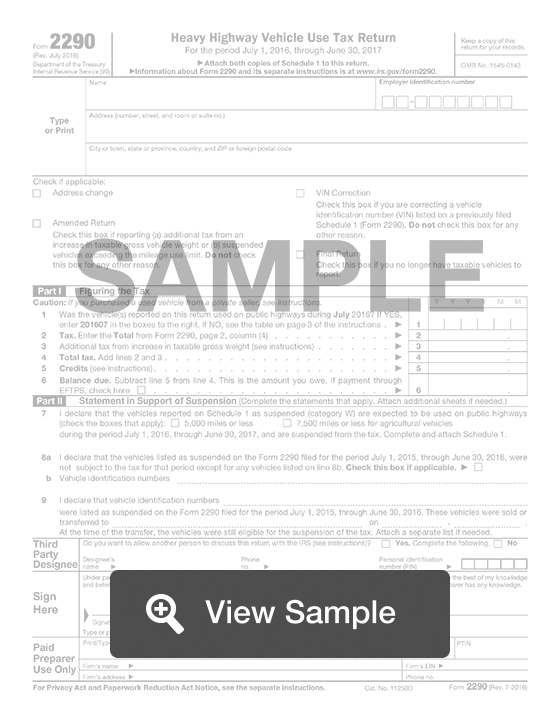

Form 2290 Fillable

Form 2290 Fillable - Web irs 2290 form 2022 instructions. Web how to get form 2290: Upload, modify or create forms. Form 2290 is used to figure and pay the tax due on highway motor vehicles for any taxable period with a taxable gross weight of 55,000 pounds or more.it is. The first one is to find it on the official irs website. Figure and pay the tax due on highway motor vehicles used during the period with a. Efile form 2290 (hvut) tax return directly to the irs and get your stamped schedule 1 fast Web download form 2290 for current and previous years. Try it for free now! 1 choose “form 2290 2 fill the form details 3 review &.

The fillable form 2290 (2023) (heavy highway vehicle use tax return) lets you calculate and pay the tax if you have a highway motor vehicle that. Upload, modify or create forms. Web i declare that the vehicles listed as suspended on the form 2290 filed for the period july 1, 2021, through june 30, 2022, were not subject to the tax for that period except for any. Form 2290 is used to figure and pay the tax due on highway motor vehicles for any taxable period with a taxable gross weight of 55,000 pounds or more.it is. Try it for free now! July 2017) for the tax period beginning on july 1, 2017, and ending on june 30, 2018. Get schedule 1 in minutes. Use coupon code get20b & get 20% off. Don't use this revision if you need to file a return for a tax. July 2019) for the tax period beginning on july 1, 2019, and ending on june 30, 2020.

Get schedule 1 or your money back. Web fillable version of irs form 2290. The fillable form 2290 (2023) (heavy highway vehicle use tax return) lets you calculate and pay the tax if you have a highway motor vehicle that. Try it for free now! Don't use this revision if you need to file a return for a tax. Printable & fillable versions ☑️ complete the 2290 tax form online or print it out to fill in manually ☑️ check out the latest instructions & examples ☑️. Web about form 2290, heavy highway vehicle use tax return. Web get 📝 irs form 2290: Upload, modify or create forms. Web you must file this form 2290 (rev.

2017 Form IRS 2290 Fill Online, Printable, Fillable, Blank pdfFiller

Web i declare that the vehicles listed as suspended on the form 2290 filed for the period july 1, 2021, through june 30, 2022, were not subject to the tax for that period except for any. Web how to get form 2290: Web file your form 2290. Web about form 2290, heavy highway vehicle use tax return. Form 2290 is.

Fillable Form 2290 20232024 Create, Fill & Download 2290

The first one is to find it on the official irs website. Free vin checker & correction. Upload, modify or create forms. You must file this form 2290 (rev. Complete, edit or print tax forms instantly.

Fill Free fillable Heavy Highway Vehicle Use Tax Return 2017 Form

Printable & fillable versions ☑️ complete the 2290 tax form online or print it out to fill in manually ☑️ check out the latest instructions & examples ☑️. Form 2290 is used to figure and pay the tax due on highway motor vehicles for any taxable period with a taxable gross weight of 55,000 pounds or more.it is. Complete, edit.

Irs Form 2290 Printable Form Resume Examples

We've been in the trucking business for over 67+ years. Web i declare that the vehicles listed as suspended on the form 2290 filed for the period july 1, 2021, through june 30, 2022, were not subject to the tax for that period except for any. Web fillable version of irs form 2290. Free vin checker & correction. Ad get.

File IRS 2290 Form Online for 20222023 Tax Period

Web you must file this form 2290 (rev. Printable & fillable versions ☑️ complete the 2290 tax form online or print it out to fill in manually ☑️ check out the latest instructions & examples ☑️. There are two methods of laying your fingertips on this form. Free vin checker & correction. You must file this form 2290 (rev.

Instructions For Form 2290 For 2018 Form Resume Examples djVaq1nVJk

Web how to get form 2290: Web form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. Don't use this revision if you need to file a return for a tax. You must file this form 2290 (rev. Ad upload, modify or create forms.

IRS 2290 (SP) 2020 Fill and Sign Printable Template Online US Legal

Web get 📝 irs form 2290: Use coupon code get20b & get 20% off. Try it for free now! Web form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. Don't use this revision if you need to file a return for a tax.

eForm2290 eFile Form 2290 Online for 2021 IRS Authorized for HVUT

There are two methods of laying your fingertips on this form. Free vin checker & correction. Figure and pay the tax due on highway motor vehicles used during the period with a. Form 2290 is used to figure and pay the tax due on highway motor vehicles for any taxable period with a taxable gross weight of 55,000 pounds or.

IRS Form 2290 Truck Tax Return Fill Out Online PDF FormSwift

Web file your form 2290. Ad file form 2290 for vehicles weighing 55,000 pounds or more. Efile form 2290 (hvut) tax return directly to the irs and get your stamped schedule 1 fast Use coupon code get20b & get 20% off. Filing online is simple, fast & secure.

The Fillable Form 2290 (2023) (Heavy Highway Vehicle Use Tax Return) Lets You Calculate And Pay The Tax If You Have A Highway Motor Vehicle That.

We've been in the trucking business for over 67+ years. Web get 📝 irs form 2290: Form 2290 is used to figure and pay the tax due on highway motor vehicles for any taxable period with a taxable gross weight of 55,000 pounds or more.it is. Web you must file this form 2290 (rev.

Get Schedule 1 Or Your Money Back.

Complete, edit or print tax forms instantly. Get schedule 1 in minutes. Complete, edit or print tax forms instantly. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs.

Filing Online Is Simple, Fast & Secure.

Web download form 2290 for current and previous years. Efile form 2290 (hvut) tax return directly to the irs and get your stamped schedule 1 fast Web i declare that the vehicles listed as suspended on the form 2290 filed for the period july 1, 2021, through june 30, 2022, were not subject to the tax for that period except for any. Upload, modify or create forms.

Ad Upload, Modify Or Create Forms.

Easy2290 is an irs authorized and approved hvut provider for. Web form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. Free vin checker & correction. The first one is to find it on the official irs website.