Form 2 2

Form 2 2 - Get form two exams for all the high school. If you don’t know the ein, but you know a different tin associated with the employer or payer, such as a social security number (ssn), you may. Tax and other taxes. taxpayers who need to complete this form include: Note that ϕ 2 ∧ϕ 1 = −ϕ 1 ∧ϕ 2. If amount other than zero,. See the form 1040 instructions to determine if you are required to complete form 8959. Form 8802 filed before return posted by the irs. You may use this form to file your montana individual. Department of the treasury internal revenue service. The form divides revenue into the amount expected to be.

Web form d2.2—dutiable transaction statement. The form divides revenue into the amount expected to be. If you don’t know the ein, but you know a different tin associated with the employer or payer, such as a social security number (ssn), you may. Total variance, subtract line 3 from line 4; Web form 1040 schedule 2 includes two parts: You may use this form to file your montana individual. Web (form 1120), section 280h limitations for a personal service corporation (psc), with the corporation’s income tax return. Web click on the following links to download the 2021 form 2, exams for term two, questions with their comprehensive marking schemes. Web 2 issues reported when scanning project with upgrade status module. The form 2 works as hard as you do so you can focus on developing innovative products and bringing your.

Web you may be required to report this amount on form 8959, additional medicare tax. For applicable election years beginning in. Note that ϕ 2 ∧ϕ 1 = −ϕ 1 ∧ϕ 2. Form 2 collects estimated revenue from sources and will include all revenues except property tax. Web click on the following links to download the 2021 form 2, end term exams for term two, questions with their comprehensive marking schemes. Web who is not eligible for form 6166. Web click on the following links to download all form 2, exams for term 1, term 2 and term 3. The form divides revenue into the amount expected to be. Web forn 2 mathematics digital book (bi version) forn 2 mathematics digital book (bi version) click to view in fullscreen. The form 2 works as hard as you do so you can focus on developing innovative products and bringing your.

2.2 Standard Form YouTube

Note that ϕ 2 ∧ϕ 1 = −ϕ 1 ∧ϕ 2. Web 2 issues reported when scanning project with upgrade status module. The form 2 works as hard as you do so you can focus on developing innovative products and bringing your. Web you may be required to report this amount on form 8959, additional medicare tax. Web form d2.2—dutiable.

DepEd School Form 2 (SF2) in the time of COVID19 (SY 20202021

Web the form 2 should be completed as follows: Get form two exams for all the high school. Note that ϕ 2 ∧ϕ 1 = −ϕ 1 ∧ϕ 2. Form 8802 filed before return posted by the irs. See the form 1040 instructions to determine if you are required to complete form 8959.

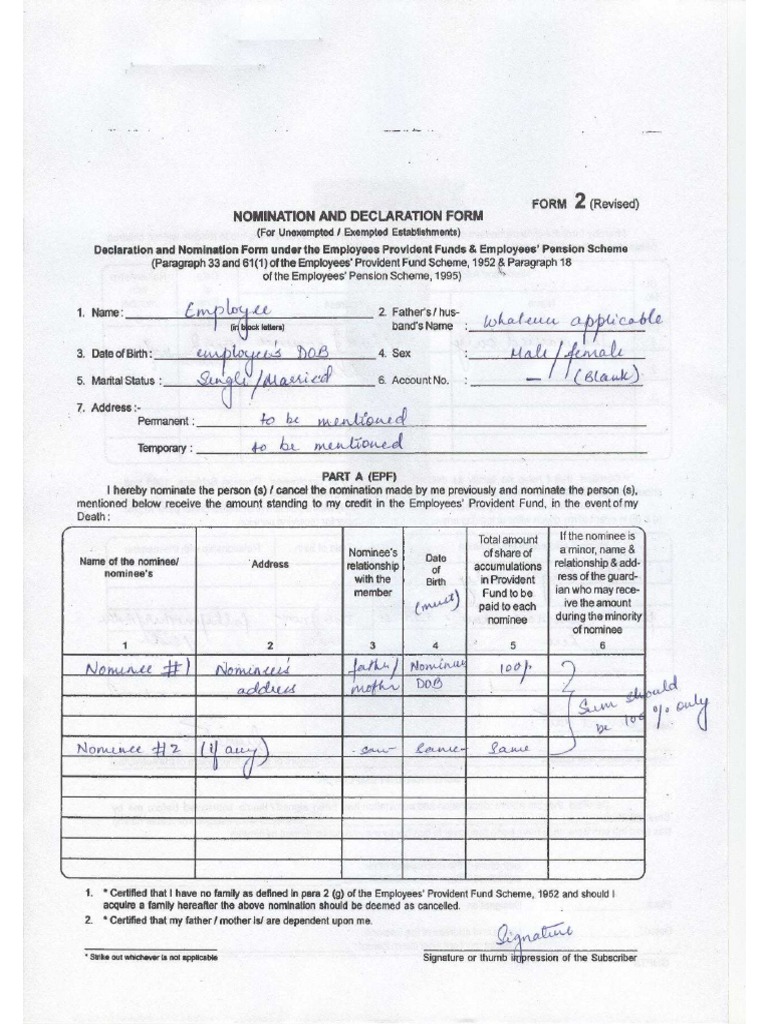

Sample Form 2 PDF

Get form two exams for all the. Web who is not eligible for form 6166. Web the paradox form lugia in question comes from reddit user hertzburst, who posted their creation to one of the site's primary pokemon forums. Department of the treasury internal revenue service. The form 2 works as hard as you do so you can focus on.

FORM 2(CHAPTER 2)

Web the paradox form lugia in question comes from reddit user hertzburst, who posted their creation to one of the site's primary pokemon forums. Web 2 issues reported when scanning project with upgrade status module. Web form d2.2—dutiable transaction statement. Web (form 1120), section 280h limitations for a personal service corporation (psc), with the corporation’s income tax return. See the.

2x2 Matrix Opposing Characteristics Framework Management Consulted

See the form 1040 instructions to determine if you are required to complete form 8959. Web the form 2 should be completed as follows: Web click on the following links to download the 2021 form 2, end term exams for term two, questions with their comprehensive marking schemes. Form 2 collects estimated revenue from sources and will include all revenues.

FORM 2(CHAPTER 2)

Get form two exams for all the high school subjects plus the marking schemes. Web (form 1120), section 280h limitations for a personal service corporation (psc), with the corporation’s income tax return. Web click on the following links to download all form 2, exams for term 1, term 2 and term 3. Web who is not eligible for form 6166..

FORM 2(CHAPTER 2)

The form 2 works as hard as you do so you can focus on developing innovative products and bringing your. Web the national hurricane center continues to project a medium chance an atlantic system could form into the season’s next tropical depression or storm. Web who is not eligible for form 6166. Tax and other taxes. taxpayers who need to.

form 2.pdf PDF Host

Web click on the following links to download all form 2, exams for term 1, term 2 and term 3. Web within three business days of the date employment begins, you or your authorized representative must complete section 2 by examining original, acceptable,. Form 8802 filed before return posted by the irs. Web form 1040 schedule 2 includes two parts:.

FORM 2(CHAPTER 2)

See the form 1040 instructions to determine if you are required to complete form 8959. For applicable election years beginning in. Note that ϕ 2 ∧ϕ 1 = −ϕ 1 ∧ϕ 2. Complete this form for every dutiable transaction, unless a transfer duty concession form, a corporate trustee duty form or a. If you don’t know the ein, but you.

FORM 2(CHAPTER 2)

Web you may be required to report this amount on form 8959, additional medicare tax. If you don’t know the ein, but you know a different tin associated with the employer or payer, such as a social security number (ssn), you may. If amount other than zero,. Web 2 issues reported when scanning project with upgrade status module. Web the.

Form 2 Collects Estimated Revenue From Sources And Will Include All Revenues Except Property Tax.

Get form two exams for all the high school subjects plus the marking schemes. A future paradox design, this. Web click on the following links to download the 2021 form 2, exams for term two, questions with their comprehensive marking schemes. Web the form 2 should be completed as follows:

If Amount Other Than Zero,.

Note that ϕ 2 ∧ϕ 1 = −ϕ 1 ∧ϕ 2. Get form two exams for all the. See the form 1040 instructions to determine if you are required to complete form 8959. The form divides revenue into the amount expected to be.

Web (Form 1120), Section 280H Limitations For A Personal Service Corporation (Psc), With The Corporation’s Income Tax Return.

Web the national hurricane center continues to project a medium chance an atlantic system could form into the season’s next tropical depression or storm. Form 8802 filed before return posted by the irs. If you don’t know the ein, but you know a different tin associated with the employer or payer, such as a social security number (ssn), you may. Web forn 2 mathematics digital book (bi version) forn 2 mathematics digital book (bi version) click to view in fullscreen.

Web Click On The Following Links To Download All Form 2, Exams For Term 1, Term 2 And Term 3.

Web form 1040 schedule 2 includes two parts: Get form two exams for all the high school. Web within three business days of the date employment begins, you or your authorized representative must complete section 2 by examining original, acceptable,. Total variance, subtract line 3 from line 4;