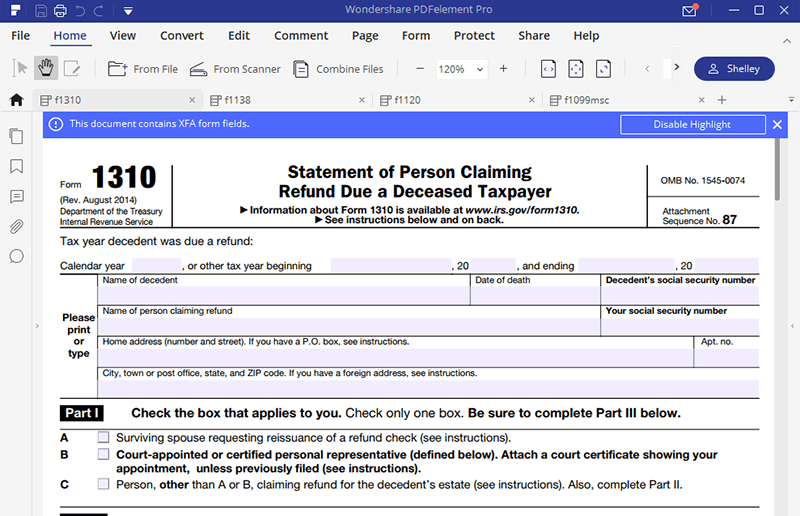

Form 1310 Instructions

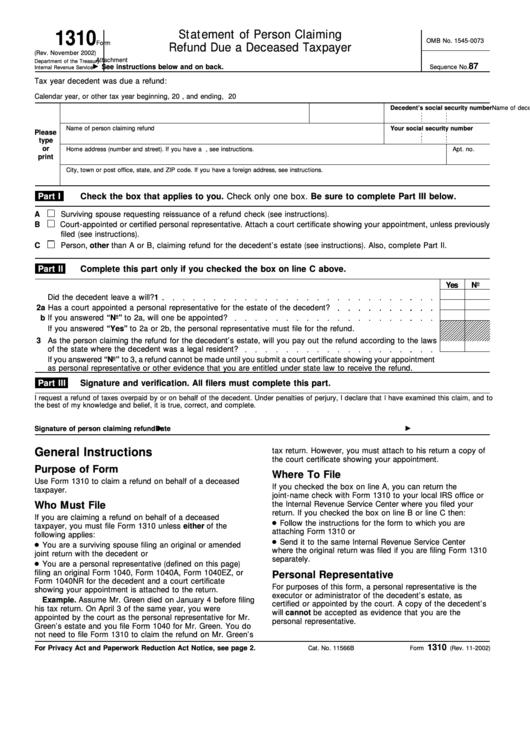

Form 1310 Instructions - If you are claiming a refund on behalf of a deceased taxpayer, you must. On april 3 of the same year, you were appointed Web information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates, related forms, and instructions on how to file. Use form 1310 to claim a refund on behalf of a deceased taxpayer. Green died on january 4 before filing his tax return. It is suggested, however, that the clerk keep a This could be an original or amended joint return. Web form 1310 is an irs form used to claim a federal tax refund for the beneficiary of a recently deceased taxpayer. Web if a tax refund is due, the person claiming the refund must fill out form 1310 (statement of person claiming refund due to deceased taxpayer) unless the individual is a surviving spouse filing a joint return or a court appointed personal representative. Web developments related to form 1310 and its instructions, such as legislation enacted after they were published, go to.

You are a surviving spouse filing an original or amended joint return with the decedent, or If you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the following applies: This could be an original or amended joint return. Web how do i file form 1310? Web instructions form b1310 ( 12/20) exemplification certificate. Use form 1310 to claim a refund on behalf of a deceased taxpayer. It is only necessary for the clerk to execute the form when a person requests that the form be completed. Employee on the date of injury and on the date of death and died as the result of a military or terrorist action. Web developments related to form 1310 and its instructions, such as legislation enacted after they were published, go to. You are not a surviving spouse who is filing a joint return with the decedent.

You are not a surviving spouse who is filing a joint return with the decedent. On april 3 of the same year, you were appointed Green died on january 4 before filing his tax return. This could be an original or amended joint return. If you are claiming a refund on behalf of a deceased taxpayer, you must. Web developments related to form 1310 and its instructions, such as legislation enacted after they were published, go to. You are a surviving spouse filing an original or amended joint return with the decedent, or It is only necessary for the clerk to execute the form when a person requests that the form be completed. Employee on the date of injury and on the date of death and died as the result of a military or terrorist action. Web how do i file form 1310?

Form 1310 2014 2019 Blank Sample to Fill out Online in PDF

If you are claiming a refund on behalf of a deceased taxpayer, you must. Web however, for exceptions to filing form 1310, see form 1310, statement of person claiming refund due a deceased taxpayer, under refund, earlier. Employee on the date of injury and on the date of death and died as the result of a military or terrorist action..

Irs Form 1310 Printable Master of Documents

Web form 1310 is an irs form used to claim a federal tax refund for the beneficiary of a recently deceased taxpayer. Use form 1310 to claim a refund on behalf of a deceased taxpayer. You must also attach proof of death that includes a statement that the individual was a u.s. Web however, for exceptions to filing form 1310,.

Mi 1310 Instructions Pdf Fill Out and Sign Printable PDF Template

Web developments related to form 1310 and its instructions, such as legislation enacted after they were published, go to. Web use form 1310 to claim a refund on behalf of a deceased taxpayer. Web if a tax refund is due, the person claiming the refund must fill out form 1310 (statement of person claiming refund due to deceased taxpayer) unless.

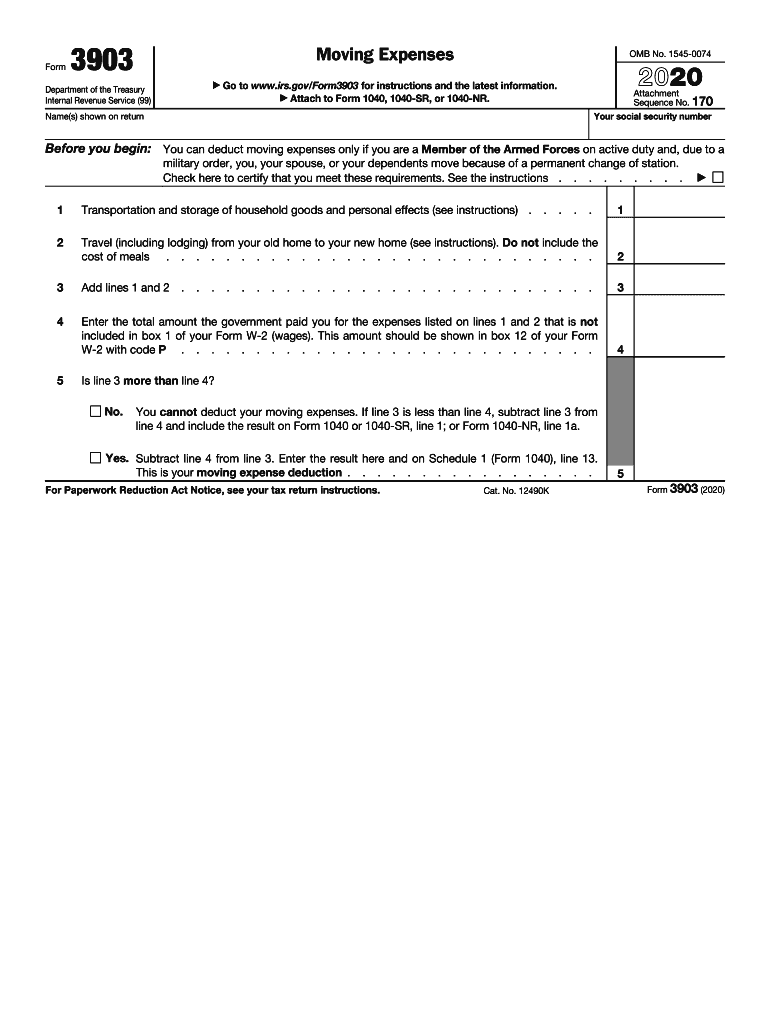

3903 Fill Out and Sign Printable PDF Template signNow

Where do i mail form 1310? Use form 1310 to claim a refund on behalf of a deceased taxpayer. Web if a tax refund is due, the person claiming the refund must fill out form 1310 (statement of person claiming refund due to deceased taxpayer) unless the individual is a surviving spouse filing a joint return or a court appointed.

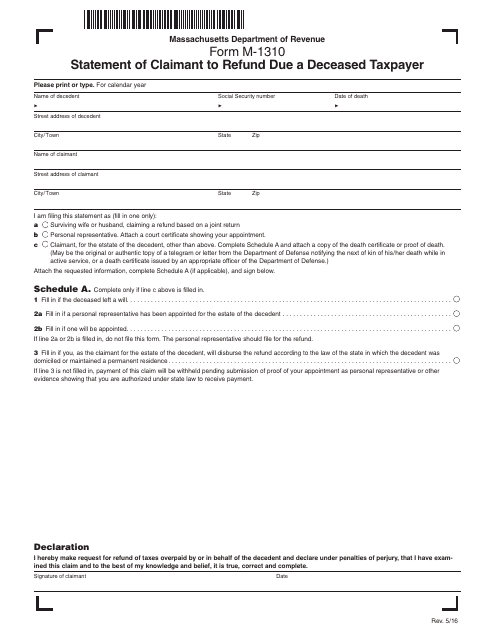

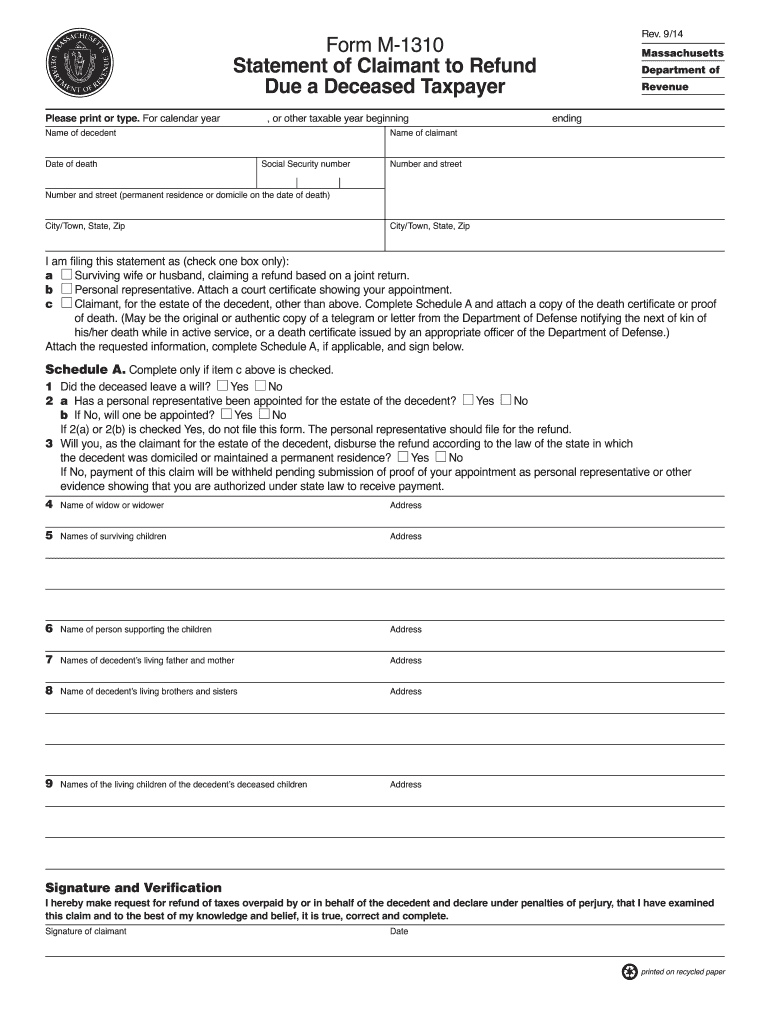

Form m 1310 instructions Fill Out and Sign Printable PDF Template

Web how do i file form 1310? If you are claiming a refund on behalf of a deceased taxpayer, you must. Web use form 1310 to claim a refund on behalf of a deceased taxpayer. Web information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates, related forms, and instructions on how to file..

IRS Form 1310 How to Fill it Right

If you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the following applies: Web if a tax refund is due, the person claiming the refund must fill out form 1310 (statement of person claiming refund due to deceased taxpayer) unless the individual is a surviving spouse filing a joint return.

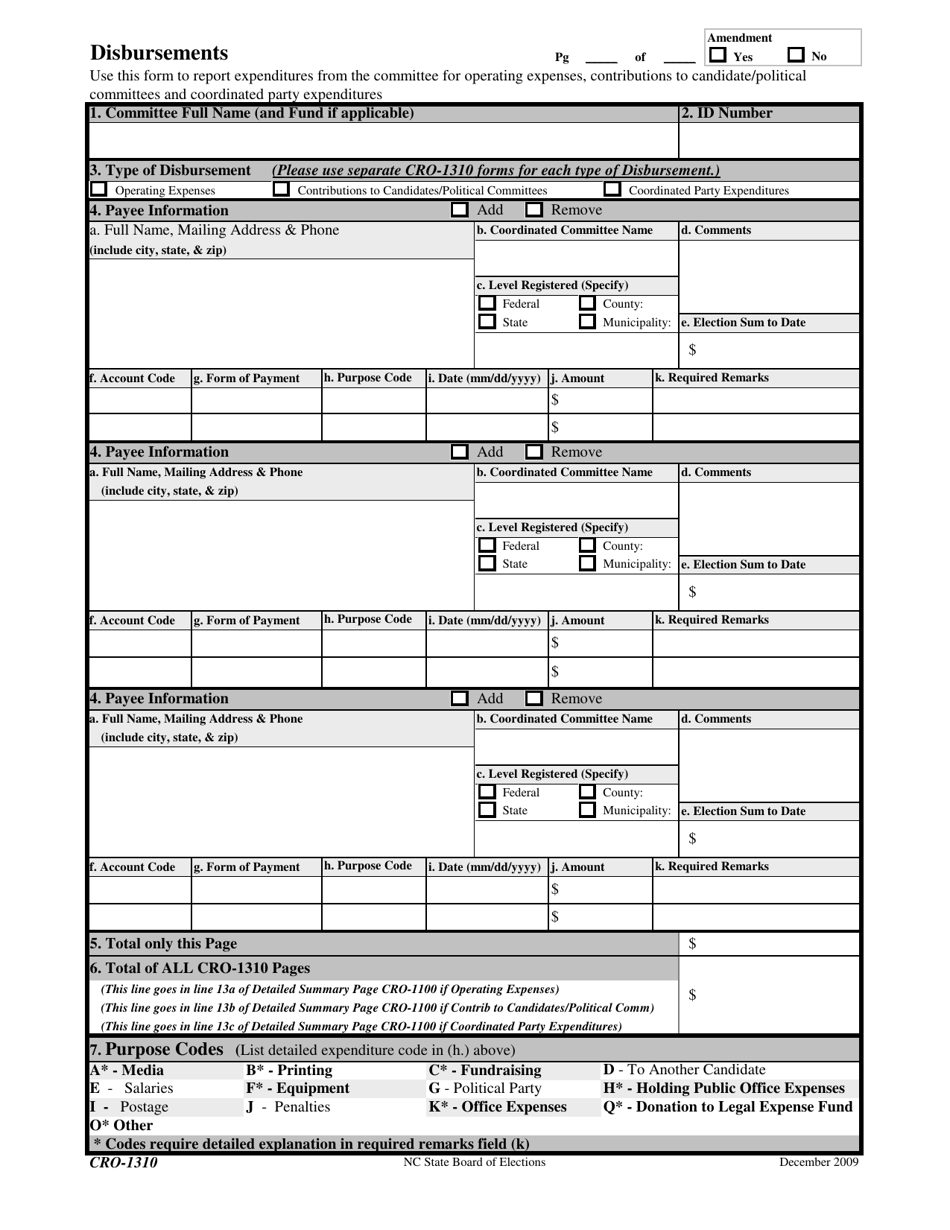

Form CRO1310 Download Printable PDF or Fill Online Disbursements North

It is only necessary for the clerk to execute the form when a person requests that the form be completed. Web information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates, related forms, and instructions on how to file. Employee on the date of injury and on the date of death and died as.

Estimated Tax Payments 2022 Form Latest News Update

Use form 1310 to claim a refund on behalf of a deceased taxpayer. Web however, for exceptions to filing form 1310, see form 1310, statement of person claiming refund due a deceased taxpayer, under refund, earlier. Web information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates, related forms, and instructions on how to.

2020 IRS Gov Forms Fillable, Printable PDF & Forms Handypdf

Use form 1310 to claim a refund on behalf of a deceased taxpayer. You must also attach proof of death that includes a statement that the individual was a u.s. It is suggested, however, that the clerk keep a If you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the.

Printable 1381 Form Printable Word Searches

You are not a surviving spouse who is filing a joint return with the decedent. Use form 1310 to claim a refund on behalf of a deceased taxpayer. Web form 1310 is an irs form used to claim a federal tax refund for the beneficiary of a recently deceased taxpayer. Green died on january 4 before filing his tax return..

If You Are Claiming A Refund On Behalf Of A Deceased Taxpayer, You Must.

Web how do i file form 1310? Use form 1310 to claim a refund on behalf of a deceased taxpayer. Employee on the date of injury and on the date of death and died as the result of a military or terrorist action. You must also attach proof of death that includes a statement that the individual was a u.s.

Where Do I Mail Form 1310?

Web developments related to form 1310 and its instructions, such as legislation enacted after they were published, go to. Web instructions form b1310 ( 12/20) exemplification certificate. On april 3 of the same year, you were appointed You are not a surviving spouse who is filing a joint return with the decedent.

Green Died On January 4 Before Filing His Tax Return.

If you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the following applies: Use form 1310 to claim a refund on behalf of a deceased taxpayer. This form is required by some states when a document is certified by a federal court for filing with a state or local authority. It is only necessary for the clerk to execute the form when a person requests that the form be completed.

It Is Suggested, However, That The Clerk Keep A

Use form 1310 to claim a refund on behalf of a deceased taxpayer. Web according to the tax form, you must file form 1310 both of the following conditions apply: Web information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates, related forms, and instructions on how to file. Web form 1310 is an irs form used to claim a federal tax refund for the beneficiary of a recently deceased taxpayer.