Form 1118 Instructions

Form 1118 Instructions - Web schedule l (form 1118) is used to identify foreign tax redeterminations that occur in the current tax year in each separate category, the years to which they relate, and other information that satisfies the taxpayer’s obligation to notify the irs of foreign tax redeterminations related to prior years. That’s because the form is fourteen pages long and requires extensive information about: Category income on page 2 and the corporation’s foreign tax credit for certain • use schedule c to compute taxes instructions for schedule a, on page 5), taxes paid or accrued to foreign countries deemed paid by the domestic corporation or or u.s. In the separate instructions for form 1118. Web see the instructions for form 1118 for the definition of passive income. See taxes eligible for a credit, later. Web general instructions purpose of form use form 1118 to compute a corporation's foreign tax credit for certain taxes paid or accrued to foreign countries or u.s. The irs estimates that it will take about 25 hours to complete. However, if a software program is used, it must be approved by the irs for use in filing substitute forms. This ensures the proper placement of each item appearing on the irs version.

The irs estimates that it will take about 25 hours to complete. When to make the election; For section 863(b) income, leave column 1(a) blank. Category income on page 2 and the corporation’s foreign tax credit for certain • use schedule c to compute taxes instructions for schedule a, on page 5), taxes paid or accrued to foreign countries deemed paid by the domestic corporation or or u.s. For calendar year 20 , or other tax year beginning , 20 , and ending. Web see the instructions for form 1118 for the definition of passive income. Web general instructions purpose of form use form 1118 to compute a corporation's foreign tax credit for certain taxes paid or accrued to foreign countries or u.s. Any income the corporation owes foreign taxes on; Corporations use this form to compute their foreign tax credit for certain taxes paid or. See taxes eligible for a credit, later.

For calendar year 20 , or other tax year beginning , 20 , and ending. Web schedule l (form 1118) is used to identify foreign tax redeterminations that occur in the current tax year in each separate category, the years to which they relate, and other information that satisfies the taxpayer’s obligation to notify the irs of foreign tax redeterminations related to prior years. When to make the election; This ensures the proper placement of each item appearing on the irs version. Web for instructions and the latest information. In the separate instructions for form 1118. However, if a software program is used, it must be approved by the irs for use in filing substitute forms. Category income on page 2 and the corporation’s foreign tax credit for certain • use schedule c to compute taxes instructions for schedule a, on page 5), taxes paid or accrued to foreign countries deemed paid by the domestic corporation or or u.s. Earned income credit worksheet (cp 09) 0323 01/26/2023 form 15111 (sp) Corporations use this form to compute their foreign tax credit for certain taxes paid or.

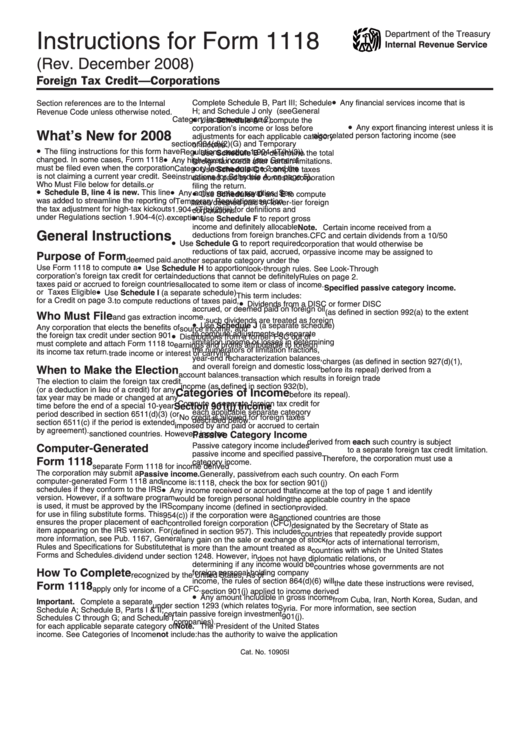

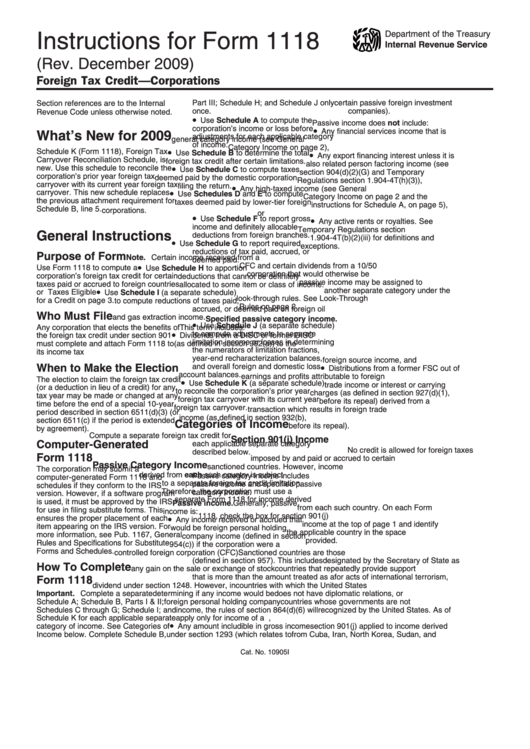

Instructions For Form 1118 Foreign Tax Credit Corporations 2008

That’s because the form is fourteen pages long and requires extensive information about: See taxes eligible for a credit, later. Use a separate form 1118 for each applicable category of income (see instructions). Earned income credit worksheet (cp 09) 0323 01/26/2023 form 15111 (sp) This ensures the proper placement of each item appearing on the irs version.

Demystifying the Form 1118 Part 6. Schedule F1 Determining the Tax

Who must file any corporation that elects the benefits of the foreign tax credit under section 901 must complete and attach form 1118 to Use a separate form 1118 for each applicable category of income (see instructions). When to make the election; Category income on page 2 and the corporation’s foreign tax credit for certain • use schedule c to.

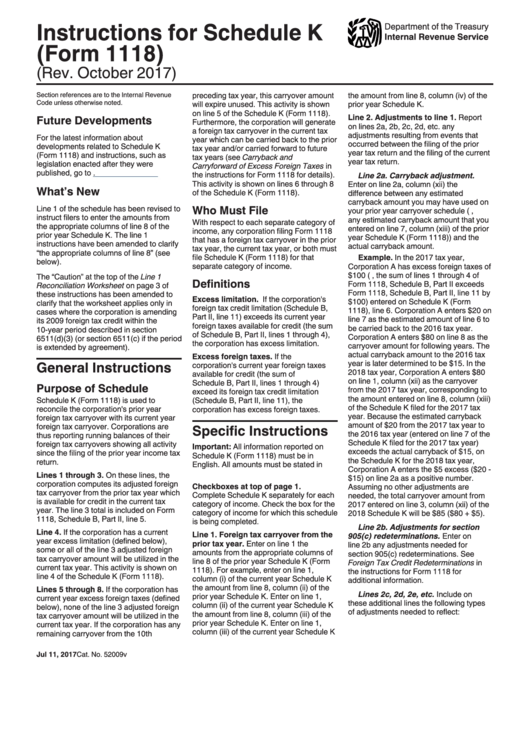

Download Instructions for IRS Form 1118 Schedule J Adjustments to

Web see the instructions for form 1118 for the definition of passive income. Web general instructions purpose of form use form 1118 to compute a corporation's foreign tax credit for certain taxes paid or accrued to foreign countries or u.s. That’s because the form is fourteen pages long and requires extensive information about: Earned income credit worksheet (cp 09) 0323.

Top 26 Form 1118 Templates free to download in PDF format

Web see the instructions for form 1118 for the definition of passive income. Any income the corporation owes foreign taxes on; Web use form 1118 to compute a foreign tax credit after certain limitations. For information pertaining to the entry of eins and reference id numbers, see : For section 863(b) income, leave column 1(a) blank.

Form 1118 Foreign Tax Credit Corporations (2014) Free Download

This ensures the proper placement of each item appearing on the irs version. Web see the instructions for form 1118 for the definition of passive income. Use a separate form 1118 for each applicable category of income (see instructions). Category income on page 2 and the corporation’s foreign tax credit for certain • use schedule c to compute taxes instructions.

Inst 1118Instructions for Form 1118, Foreign Tax Credit Corporatio…

The irs estimates that it will take about 25 hours to complete. When to make the election; Use a separate form 1118 for each applicable category of income (see instructions). For section 863(b) income, leave column 1(a) blank. Web use form 1118 to compute a foreign tax credit after certain limitations.

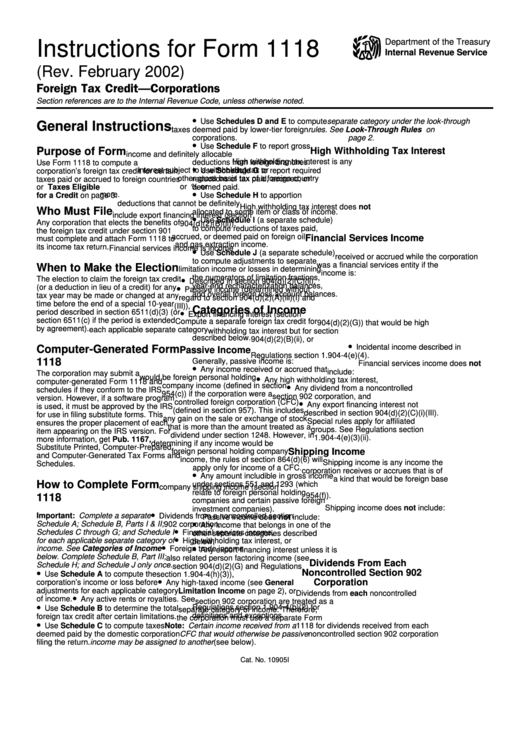

Instructions For Form 1118 Foreign Tax Credit Corporations 2002

Any income the corporation owes foreign taxes on; See taxes eligible for a credit, later. Web general instructions purpose of form use form 1118 to compute a corporation's foreign tax credit for certain taxes paid or accrued to foreign countries or u.s. That’s because the form is fourteen pages long and requires extensive information about: Corporations use this form to.

Form 1118 Foreign Tax Credit Corporations (2014) Free Download

Web for instructions and the latest information. Web see the instructions for form 1118 for the definition of passive income. Any income the corporation owes foreign taxes on; This ensures the proper placement of each item appearing on the irs version. See taxes eligible for a credit, later.

Form 1118 (Schedule J) Adjustments to Separate Limitation

Who must file any corporation that elects the benefits of the foreign tax credit under section 901 must complete and attach form 1118 to See taxes eligible for a credit, later. For calendar year 20 , or other tax year beginning , 20 , and ending. Web schedule l (form 1118) is used to identify foreign tax redeterminations that occur.

Instructions For Form 1118 (Rev. December 2009) printable pdf download

When to make the election; Category income on page 2 and the corporation’s foreign tax credit for certain • use schedule c to compute taxes instructions for schedule a, on page 5), taxes paid or accrued to foreign countries deemed paid by the domestic corporation or or u.s. However, if a software program is used, it must be approved by.

Web Schedule L (Form 1118) Is Used To Identify Foreign Tax Redeterminations That Occur In The Current Tax Year In Each Separate Category, The Years To Which They Relate, And Other Information That Satisfies The Taxpayer’s Obligation To Notify The Irs Of Foreign Tax Redeterminations Related To Prior Years.

However, if a software program is used, it must be approved by the irs for use in filing substitute forms. When to make the election; Corporations use this form to compute their foreign tax credit for certain taxes paid or. For information pertaining to the entry of eins and reference id numbers, see :

See Taxes Eligible For A Credit, Later.

In the separate instructions for form 1118. The irs estimates that it will take about 25 hours to complete. Web use form 1118 to compute a foreign tax credit after certain limitations. That’s because the form is fourteen pages long and requires extensive information about:

Web General Instructions Purpose Of Form Use Form 1118 To Compute A Corporation's Foreign Tax Credit For Certain Taxes Paid Or Accrued To Foreign Countries Or U.s.

Use a separate form 1118 for each applicable category of income (see instructions). Category income on page 2 and the corporation’s foreign tax credit for certain • use schedule c to compute taxes instructions for schedule a, on page 5), taxes paid or accrued to foreign countries deemed paid by the domestic corporation or or u.s. Any income the corporation owes foreign taxes on; Web for instructions and the latest information.

This Ensures The Proper Placement Of Each Item Appearing On The Irs Version.

Earned income credit worksheet (cp 09) 0323 01/26/2023 form 15111 (sp) Who must file any corporation that elects the benefits of the foreign tax credit under section 901 must complete and attach form 1118 to Web see the instructions for form 1118 for the definition of passive income. For section 863(b) income, leave column 1(a) blank.