Form 1099 B Proceeds From Broker And Barter Exchange Transactions

Form 1099 B Proceeds From Broker And Barter Exchange Transactions - For whom the broker has sold (including short sales) stocks, commodities, regulated futures contracts, foreign. Updated 7 months ago by greg hatfield. Reporting is also required when your. See the specific instructions for. This form is more taxpayer. For whom the broker has sold. They automatically flow to schedule d (form 1040). The form reports the sale of stocks, bonds, commodities, and. Complete, edit or print tax forms instantly. This tax form is been used by barter exchanges and.

Updated 7 months ago by greg hatfield. The form reports the sale of stocks, bonds, commodities, and. Reporting is also required when your. They automatically flow to schedule d (form 1040). Web this growth prompts the following reminder: For whom the broker has sold (including short sales) stocks, commodities, regulated futures contracts, foreign. The information is generally reported on a form 8949 and/or a schedule d as a capital gain or loss. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. See the specific instructions for.

Web this growth prompts the following reminder: For whom the broker has sold (including short sales) stocks, commodities, regulated futures contracts, foreign. Ad access irs tax forms. This form is more taxpayer. Updated 7 months ago by greg hatfield. For whom the broker has sold. The form reports the sale of stocks, bonds, commodities, and. They automatically flow to schedule d (form 1040). Reporting is also required when your. For whom the broker has sold (including short sales) stocks, commodities, regulated futures contracts, foreign.

Types of 1099s & Their Meaning

For whom the broker has sold. The form reports the sale of stocks, bonds, commodities, and. Web this growth prompts the following reminder: Get ready for tax season deadlines by completing any required tax forms today. Reporting is also required when your.

Form 1099B Proceeds from Broker and Barter Exchange Transactions

The form reports the sale of stocks, bonds, commodities, and. This form is more taxpayer. The information is generally reported on a form 8949 and/or a schedule d as a capital gain or loss. Ad access irs tax forms. See the specific instructions for.

Pin by Account Ability on W2 and 1099 Software Pinterest

Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms. See the specific instructions for. Complete, edit or print tax forms instantly. Reporting is also required when your.

IRS Form 1099B Proceeds Frim Broker and Barter Exchange Transactions

Reporting is also required when your. This form is more taxpayer. They automatically flow to schedule d (form 1040). Ad access irs tax forms. Reporting is also required when your.

Form 1099BProceeds from Broker and Barter Exchange Transactions

This form is more taxpayer. Updated 7 months ago by greg hatfield. The form reports the sale of stocks, bonds, commodities, and. Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today.

Form 1099B Proceeds From Broker and Barter Exchange Transactions, IRS

For whom the broker has sold (including short sales) stocks, commodities, regulated futures contracts, foreign. Reporting is also required when your. Complete, edit or print tax forms instantly. The information is generally reported on a form 8949 and/or a schedule d as a capital gain or loss. For whom the broker has sold.

EFile Form 1099B 1099Prep

The form reports the sale of stocks, bonds, commodities, and. Reporting is also required when your. See the specific instructions for. For whom the broker has sold (including short sales) stocks, commodities, regulated futures contracts, foreign. The information is generally reported on a form 8949 and/or a schedule d as a capital gain or loss.

Form 1099B Proceeds From Broker and Barter Exchange Transactions

Reporting is also required when your. The information is generally reported on a form 8949 and/or a schedule d as a capital gain or loss. See the specific instructions for. They automatically flow to schedule d (form 1040). This tax form is been used by barter exchanges and.

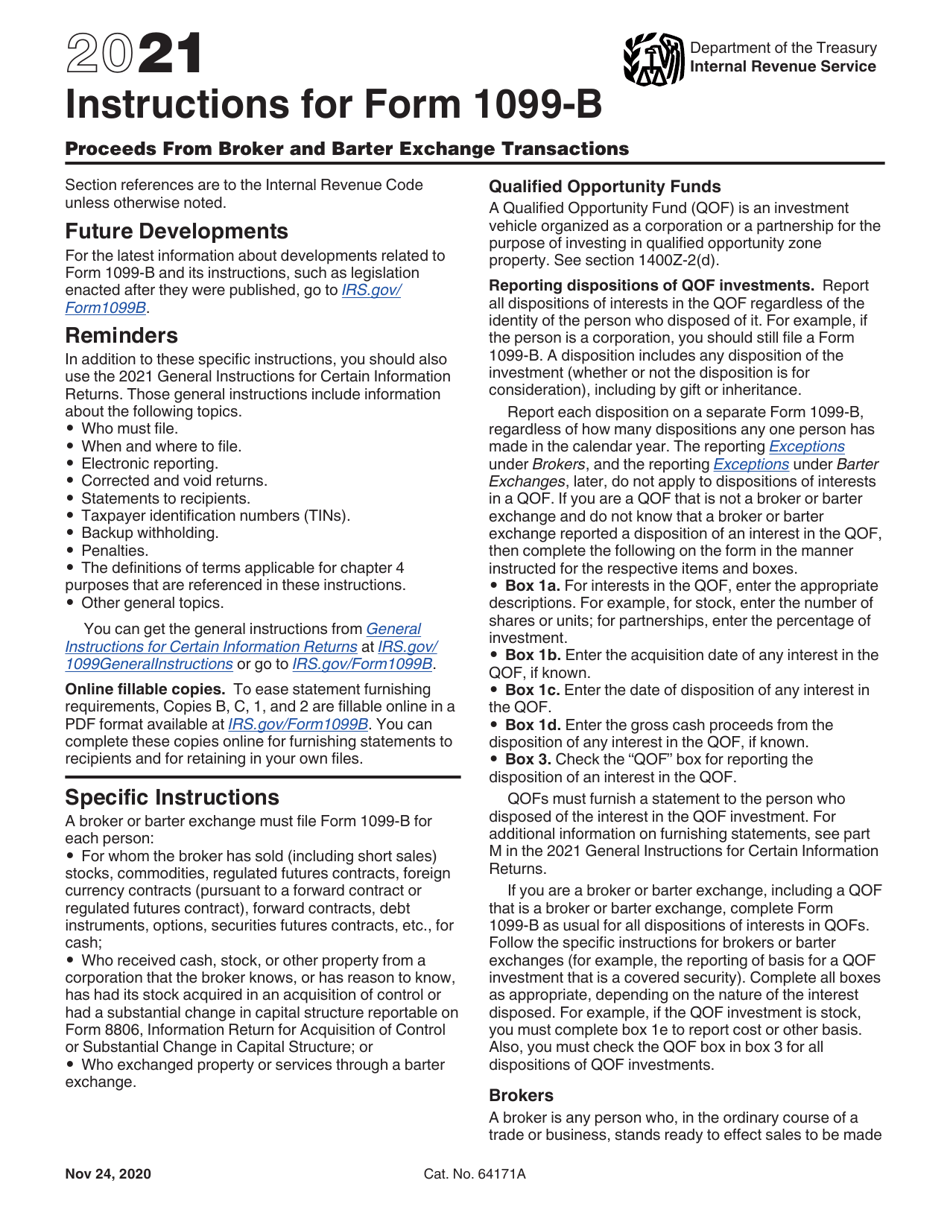

Download Instructions for IRS Form 1099B Proceeds From Broker and

Updated 7 months ago by greg hatfield. Complete, edit or print tax forms instantly. This form is more taxpayer. They automatically flow to schedule d (form 1040). This tax form is been used by barter exchanges and.

1099B Software Printing Electronic Reporting EFile TIN Matching

The form reports the sale of stocks, bonds, commodities, and. See the specific instructions for. Web this growth prompts the following reminder: Complete, edit or print tax forms instantly. This tax form is been used by barter exchanges and.

For Whom The Broker Has Sold.

See the specific instructions for. This form is more taxpayer. Reporting is also required when your. This tax form is been used by barter exchanges and.

Updated 7 Months Ago By Greg Hatfield.

The form reports the sale of stocks, bonds, commodities, and. The information is generally reported on a form 8949 and/or a schedule d as a capital gain or loss. Complete, edit or print tax forms instantly. For whom the broker has sold (including short sales) stocks, commodities, regulated futures contracts, foreign.

They Automatically Flow To Schedule D (Form 1040).

Get ready for tax season deadlines by completing any required tax forms today. Web this growth prompts the following reminder: Ad access irs tax forms. For whom the broker has sold (including short sales) stocks, commodities, regulated futures contracts, foreign.

:max_bytes(150000):strip_icc()/1099B2022-95af0a55817a4b8ea69f159a8c8451c1.jpg)