Form 1065 Schedule K-2 Instructions

Form 1065 Schedule K-2 Instructions - This section of the program contains information for part iii of the. Return of partnership income , form 8865, return of u.s. Web schedule k (form 1065) is a summary schedule of all the partners’ share of income, credits, deductions, etc. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. See how to fill out the online and print it. Web the new draft 2021 tax year irs schedules and instructions include: They are extensions of schedule k and are used to report items of. Rental activity income (loss) and portfolio income are not. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. April 14, 2022 · 5 minute read.

(updated january 9, 2023) 2. Web schedule k (form 1065) is a summary schedule of all the partners’ share of income, credits, deductions, etc. For a fiscal year or a short tax year, fill in the tax year. Return of partnership income , form 8865, return of u.s. They are extensions of schedule k and are used to report items of. This section of the program contains information for part iii of the. Web the new draft 2021 tax year irs schedules and instructions include: The forms consist of specific. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023.

Return of partnership income , form 8865, return of u.s. They are extensions of schedule k and are used to report items of. April 14, 2022 · 5 minute read. The forms consist of specific. Return of partnership income, were first required to be filed for the 2021 tax year. Web the new draft 2021 tax year irs schedules and instructions include: For a fiscal year or a short tax year, fill in the tax year. Rental activity income (loss) and portfolio income are not. This section of the program contains information for part iii of the. Line 21 replaces line 16p for foreign taxes paid or accrued with respect to basis adjustments and income reconciliation.

How to Fill out Schedule K1 (IRS Form 1065) YouTube

The forms consist of specific. This section of the program contains information for part iii of the. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. See how to fill out the online and print it. Rental activity income (loss) and portfolio income are not.

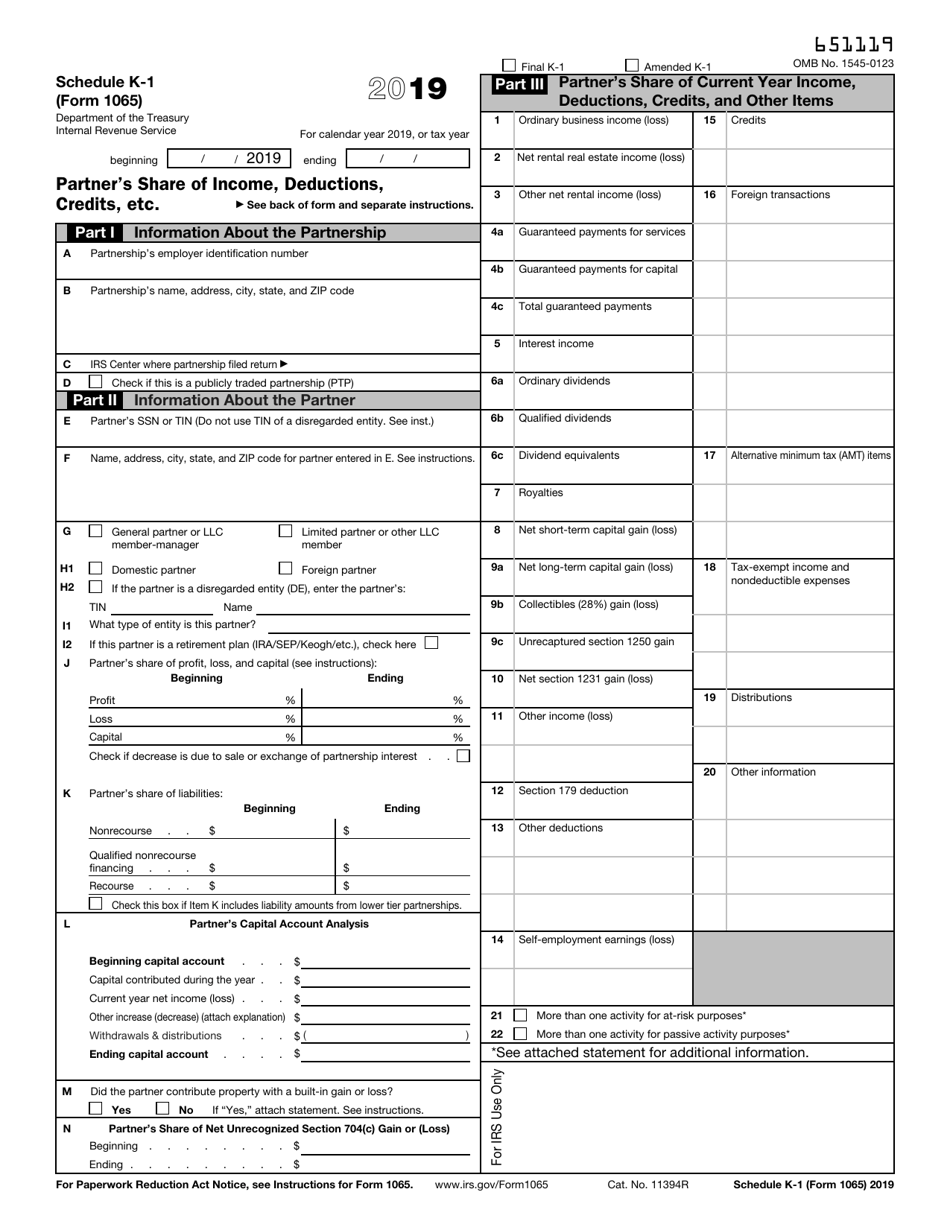

IRS Form 1065 Schedule K1 Download Fillable PDF or Fill Online Partner

Web thomson reuters tax & accounting. (updated january 9, 2023) 2. For a fiscal year or a short tax year, fill in the tax year. Rental activity income (loss) and portfolio income are not. This section of the program contains information for part iii of the.

Form 1065 (Schedule M3) Net (Loss) Reconciliation for Certain

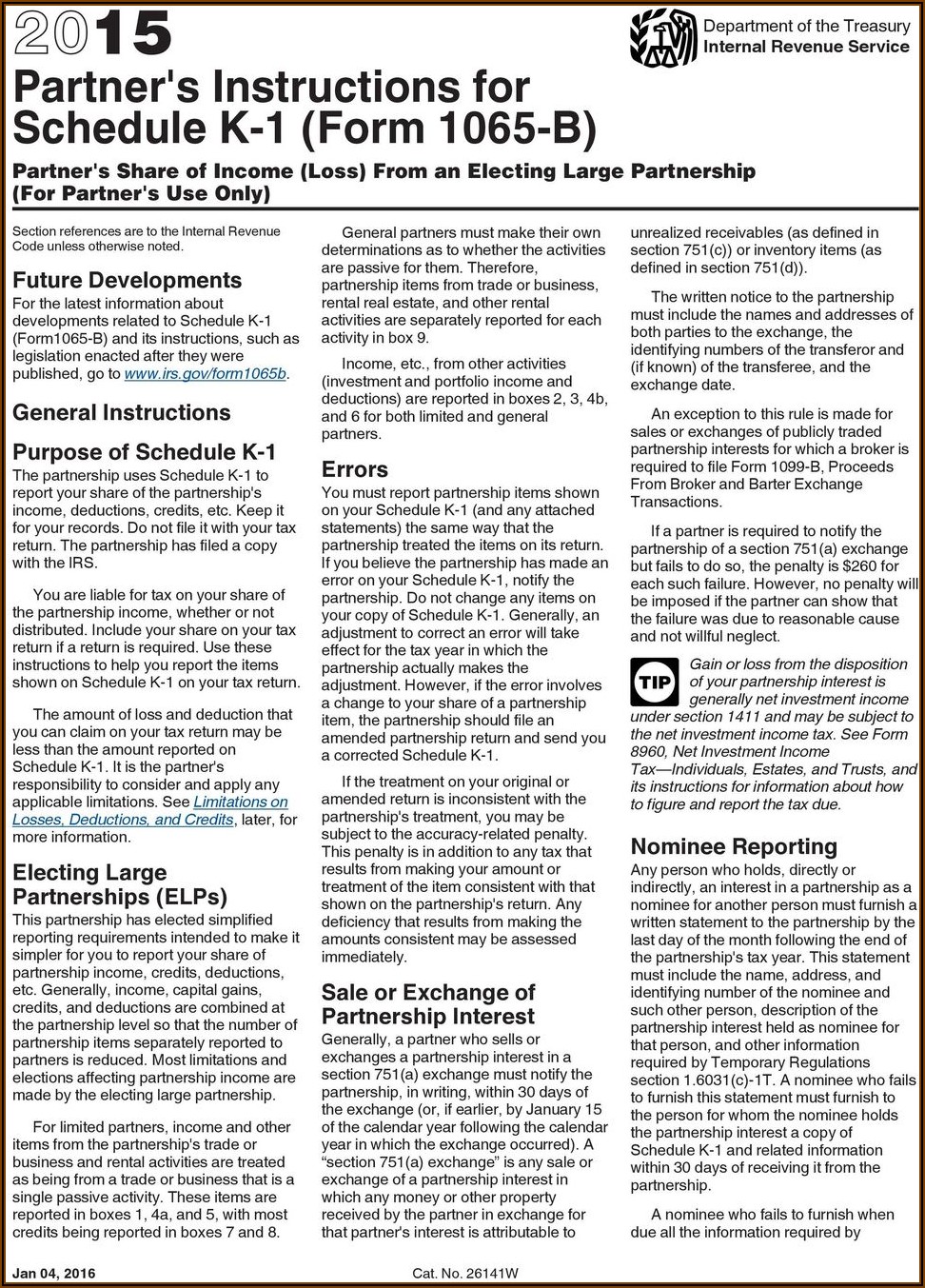

Web the new draft 2021 tax year irs schedules and instructions include: Return of partnership income, were first required to be filed for the 2021 tax year. Web thomson reuters tax & accounting. Web schedule k (form 1065) is a summary schedule of all the partners’ share of income, credits, deductions, etc. This section of the program contains information for.

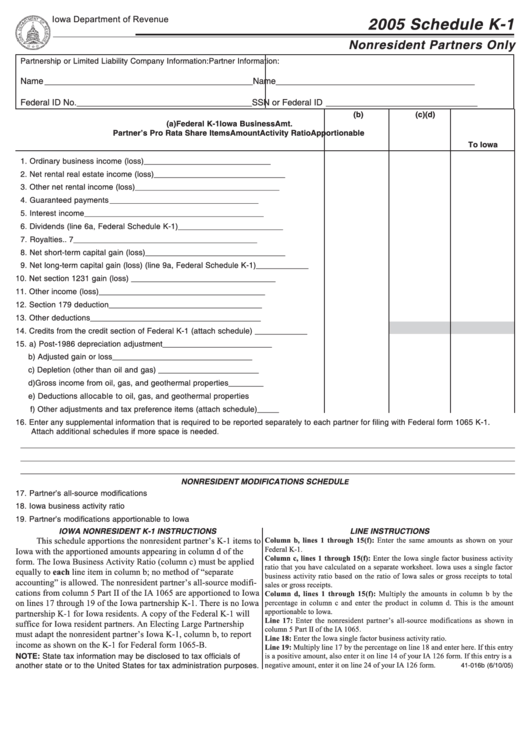

Fillable Form Ia 1065 Schedule K1 Nonresident Partners Only 2005

For a fiscal year or a short tax year, fill in the tax year. Web the new draft 2021 tax year irs schedules and instructions include: Return of partnership income , form 8865, return of u.s. They are extensions of schedule k and are used to report items of. The forms consist of specific.

Irs Form 1065 Year 2014 Form Resume Examples WjYDlz7YKB

Return of partnership income , form 8865, return of u.s. See how to fill out the online and print it. Return of partnership income, were first required to be filed for the 2021 tax year. Web the new draft 2021 tax year irs schedules and instructions include: April 14, 2022 · 5 minute read.

Llc Tax Form 1065 Universal Network

Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. April 14, 2022 · 5 minute read. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. This section of the program contains information for part iii of the. Web schedule k.

Form 1065 (Schedule D) Capital Gains and Losses (2014) Free Download

They are extensions of schedule k and are used to report items of. April 14, 2022 · 5 minute read. Line 21 replaces line 16p for foreign taxes paid or accrued with respect to basis adjustments and income reconciliation. (updated january 9, 2023) 2. Web the new draft 2021 tax year irs schedules and instructions include:

Form 10 Filing Instructions 10 10 Various Ways To Do Form 10 Filing

Rental activity income (loss) and portfolio income are not. Web thomson reuters tax & accounting. Web schedule k (form 1065) is a summary schedule of all the partners’ share of income, credits, deductions, etc. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. Return of.

IRS Instructions 1065 (Schedule K1) 2018 2019 Printable & Fillable

Line 21 replaces line 16p for foreign taxes paid or accrued with respect to basis adjustments and income reconciliation. They are extensions of schedule k and are used to report items of. (updated january 9, 2023) 2. Return of partnership income , form 8865, return of u.s. April 14, 2022 · 5 minute read.

Box 14 Code A Of Irs Schedule K1 (form 1065) Fafsa Armando Friend's

This section of the program contains information for part iii of the. Line 21 replaces line 16p for foreign taxes paid or accrued with respect to basis adjustments and income reconciliation. See how to fill out the online and print it. (updated january 9, 2023) 2. Web schedule k (form 1065) is a summary schedule of all the partners’ share.

April 14, 2022 · 5 Minute Read.

Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. Web the new draft 2021 tax year irs schedules and instructions include: For a fiscal year or a short tax year, fill in the tax year. This section of the program contains information for part iii of the.

See How To Fill Out The Online And Print It.

Return of partnership income , form 8865, return of u.s. They are extensions of schedule k and are used to report items of. Web thomson reuters tax & accounting. Web schedule k (form 1065) is a summary schedule of all the partners’ share of income, credits, deductions, etc.

Line 21 Replaces Line 16P For Foreign Taxes Paid Or Accrued With Respect To Basis Adjustments And Income Reconciliation.

Return of partnership income, were first required to be filed for the 2021 tax year. (updated january 9, 2023) 2. The forms consist of specific. Ad file partnership and llc form 1065 fed and state taxes with taxact® business.