Form 1065 K-1 Box 20 Codes

Form 1065 K-1 Box 20 Codes - Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. For calendar year 2021, or tax year beginning / / 2021. The taxact® program has entry. Ending / / partner’s share of income,. Web nothing to report on the return. Department of the treasury internal revenue service. Field order field name description length format comments; (1) initial return (2) final. To enter or review your. A description of the income items.

The taxact® program has entry. Ending / / partner’s share of income,. Lacerte only has direct input fields for line 20, codes a, b, t, v, and z on screen 20.1,. For calendar year 2021, or tax year beginning / / 2021. Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. Department of the treasury internal revenue service. Field order field name description length format comments; If you have amounts within this box, please refer to the irs instructions for form 1116, foreign. To enter or review your. This code will let you know if you should.

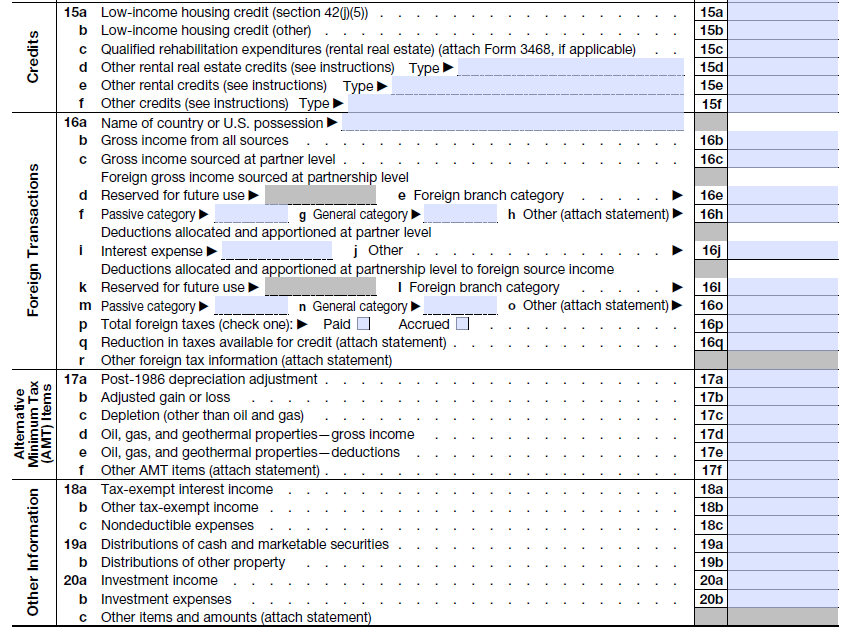

Field order field name description length format comments; Ending / / partner’s share of income,. Business interest expense limitation information: Web box 16 the program does not support the entries for line 16 (foreign transactions). This code will let you know if you should. Lacerte only has direct input fields for line 20, codes a, b, t, v, and z on screen 20.1,. (1) initial return (2) final. Department of the treasury internal revenue service. Total assets (see instructions) $ g. Web nothing to report on the return.

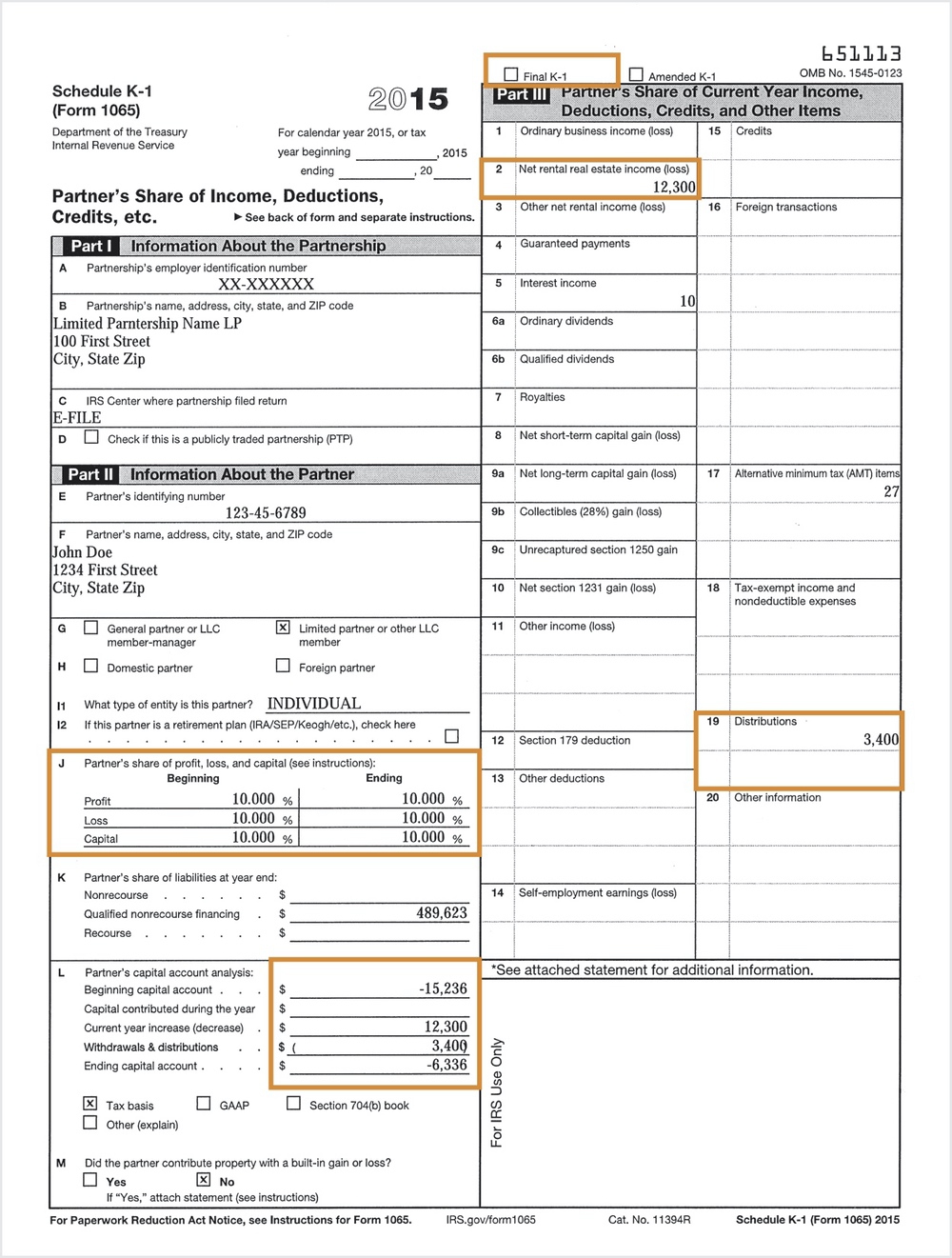

Schedule K1 / 1065 Tax Form Guide LP Equity

To enter or review your. If you have amounts within this box, please refer to the irs instructions for form 1116, foreign. The partnership will report any information. A description of the income items. Total assets (see instructions) $ g.

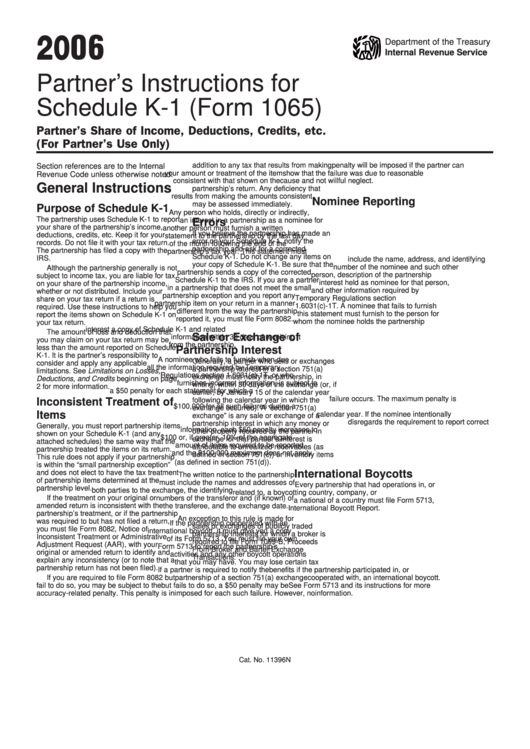

Instructions For Schedule K1 (Form 1065) Partner'S Share Of

Lacerte only has direct input fields for line 20, codes a, b, t, v, and z on screen 20.1,. To enter or review your. The taxact® program has entry. Ending / / partner’s share of income,. For calendar year 2021, or tax year beginning / / 2021.

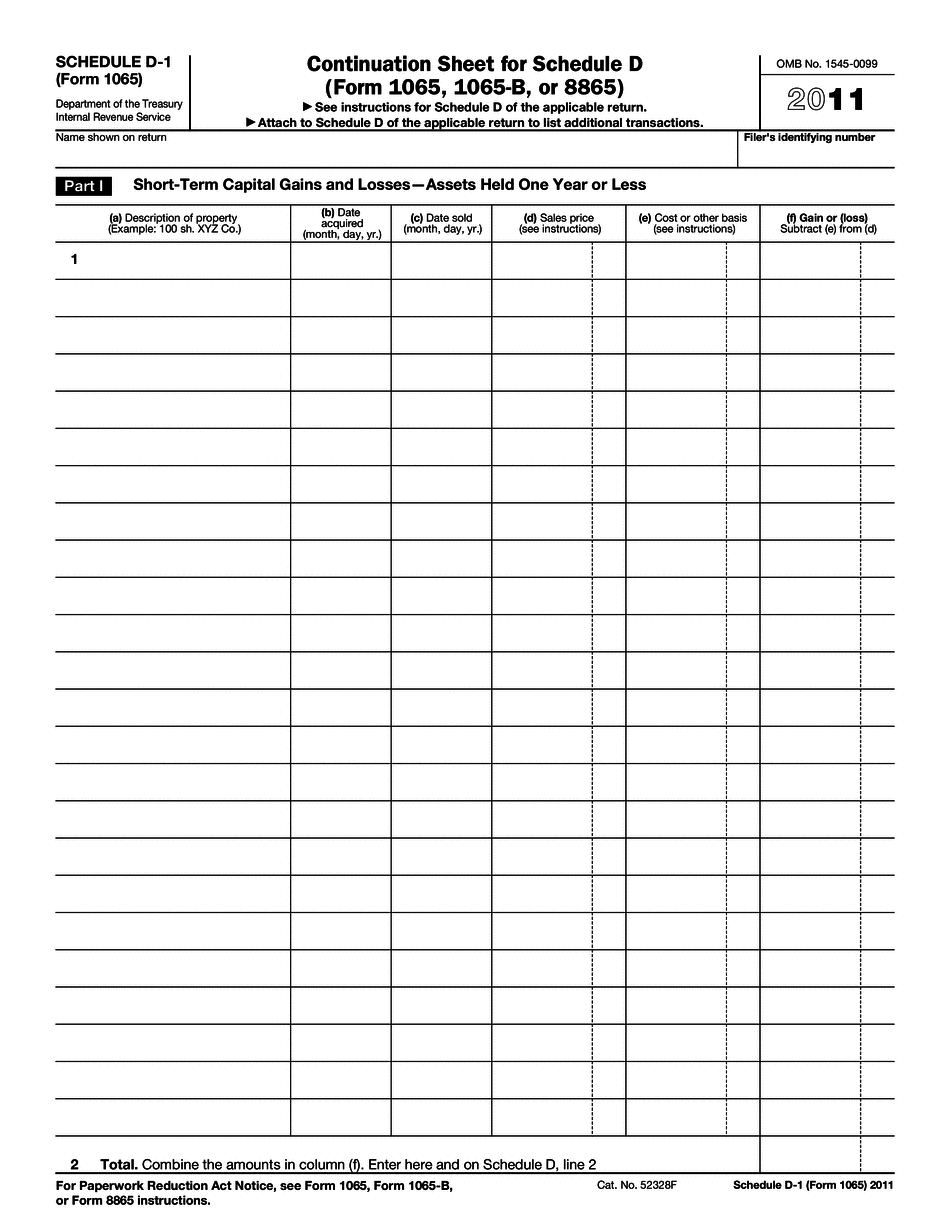

Form 1065 Instructions in 8 Steps (+ Free Checklist)

If you have amounts within this box, please refer to the irs instructions for form 1116, foreign. Ending / / partner’s share of income,. Field order field name description length format comments; This code will let you know if you should. For detailed reporting and filing.

Form 1065 U.S. Return of Partnership (2014) Free Download

Department of the treasury internal revenue service. Code y is used to report information related to the net investment income tax. The partnership will report any information. Lacerte only has direct input fields for line 20, codes a, b, t, v, and z on screen 20.1,. Web box 16 the program does not support the entries for line 16 (foreign.

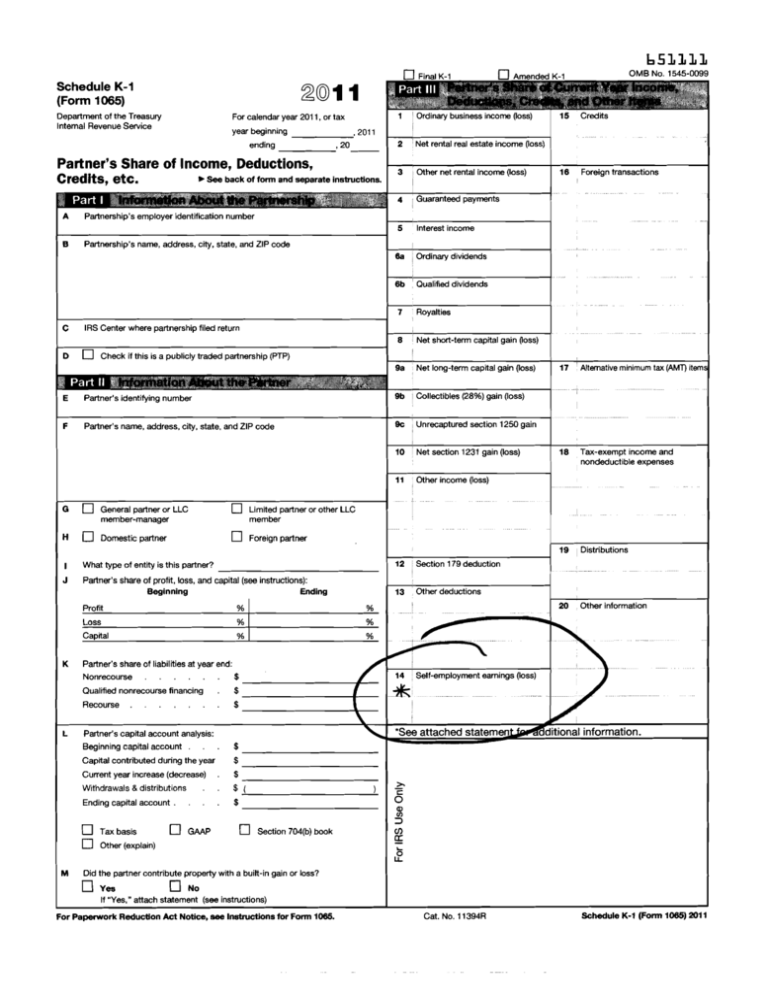

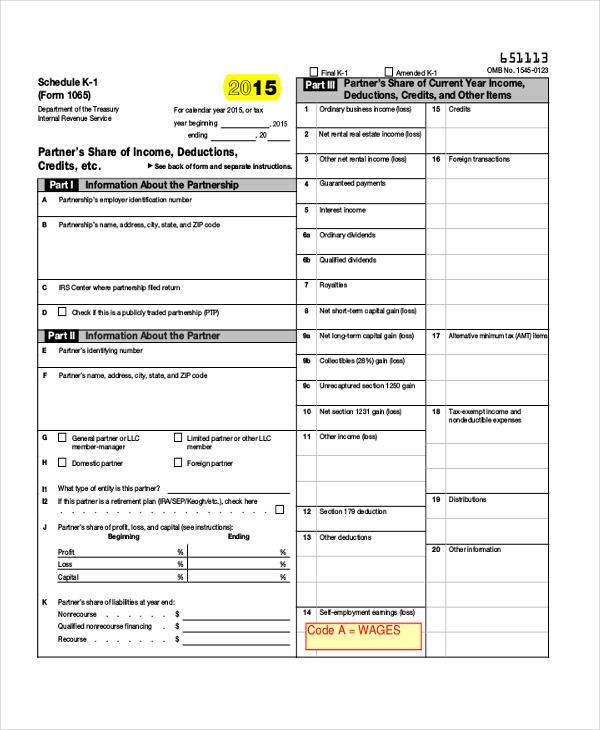

where is box 14 code a of irs schedule k1 (form 1065) Fill Online

(1) initial return (2) final. The taxact® program has entry. The partnership will report any information. This code will let you know if you should. Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments.

What is a Schedule K1 Tax Form, Meru Accounting

For calendar year 2021, or tax year beginning / / 2021. Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. The taxact® program has entry. Web box 16 the program does not support the entries for line 16 (foreign transactions). Ending / / partner’s share.

Schedule K1

A description of the income items. Web box 16 the program does not support the entries for line 16 (foreign transactions). The partnership will report any information. Ending / / partner’s share of income,. Business interest expense limitation information:

FREE 17+ Sample Schedule Forms in PDF MS Word Excel

Business interest expense limitation information: If you have amounts within this box, please refer to the irs instructions for form 1116, foreign. This code will let you know if you should. For calendar year 2021, or tax year beginning / / 2021. The taxact® program has entry.

Form 1065 Line 20 Other Deductions Worksheet

For calendar year 2021, or tax year beginning / / 2021. This code will let you know if you should. Field order field name description length format comments; The taxact® program has entry. A description of the income items.

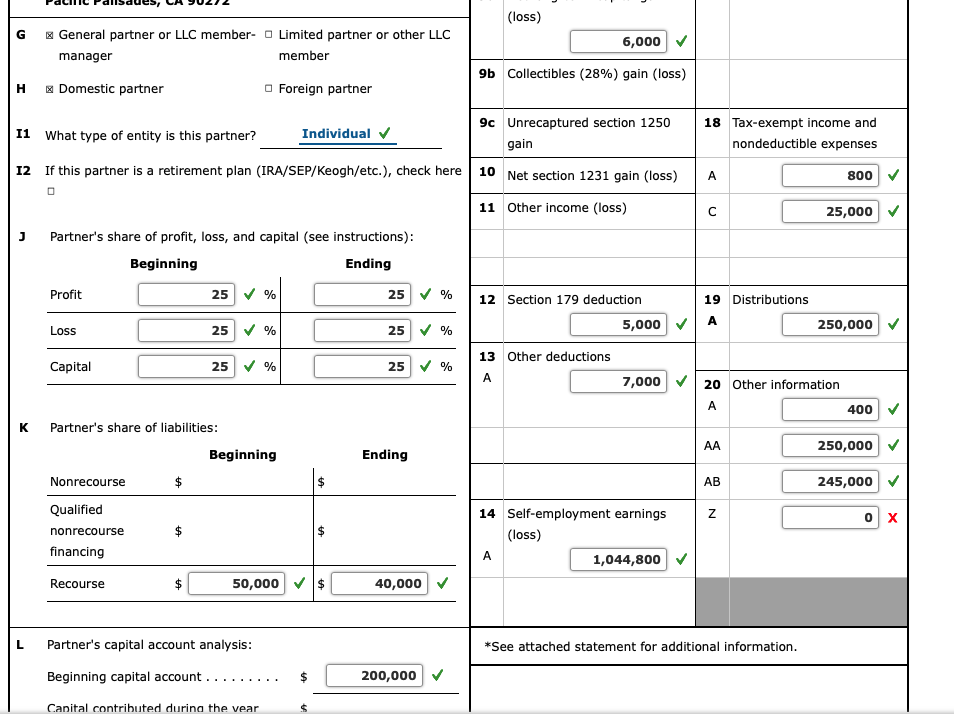

(loss) G General partner or LLC member Limited

Web nothing to report on the return. This code will let you know if you should. Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. The partnership will report any information. Business interest expense limitation information:

The Taxact® Program Has Entry.

(1) initial return (2) final. For detailed reporting and filing. Field order field name description length format comments; The partnership will report any information.

Business Interest Expense Limitation Information:

This code will let you know if you should. Web box 16 the program does not support the entries for line 16 (foreign transactions). Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. Total assets (see instructions) $ g.

Lacerte Only Has Direct Input Fields For Line 20, Codes A, B, T, V, And Z On Screen 20.1,.

Web nothing to report on the return. A description of the income items. For calendar year 2021, or tax year beginning / / 2021. Code y is used to report information related to the net investment income tax.

Ending / / Partner’s Share Of Income,.

To enter or review your. Department of the treasury internal revenue service. If you have amounts within this box, please refer to the irs instructions for form 1116, foreign.