Form 1065 For Rental Properties

Form 1065 For Rental Properties - Web report the rental properties as 'converted to personal use' in the rental section ( property profile and assets/depreciation section). Form 1065 is used to report partnership revenues, expenses,. The total capital gains and losses from transactions reported on form 8949, sales and other dispositions of capital assets. Web up to 25% cash back these must file an annual tax form with the irs (form 1065, u.s. Used by the fiduciary of a domestic decedent’s estate, trust,. In addition to form 1065, partnerships must also. Web the application automatically calculates the net gain or loss from the sale of rental property included as ordinary income on form 4797, enter an amount, including 0 (zero) to. Fill, sign, email irs 1065 & more fillable forms, register and subscribe now! Web use schedule d (form 1065) to report the following. Form 8825 rental real estate income and expenses of a partnership or an s corporation (one for each member) schedule k.

Ad download or email irs 1065 & more fillable forms, register and subscribe now! Web the purpose of this form is to address rental property issues to promote greater compliance with health and safety standards and preserve the quality of kansas city. However, if you and your. Web up to 25% cash back these must file an annual tax form with the irs (form 1065, u.s. Form 8825 rental real estate income and expenses of a partnership or an s corporation (one for each member) schedule k. Web use schedule d (form 1065) to report the following. If the partnership's principal business, office, or agency is located in: Web form 1065 is a tax document used to report the profits, losses and deductions of business partnerships. Get ready for tax season deadlines by completing any required tax forms today. Web partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from.

In addition to form 1065, partnerships must also. Ad download or email irs 1065 & more fillable forms, register and subscribe now! Web irs form 8825 is a special tax form specifically for reporting the rental income and expenses of a partnership or s corporation. Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for instructions and the latest. And the total assets at the end of the tax year. Web up to 25% cash back these must file an annual tax form with the irs (form 1065, u.s. Web where to file your taxes for form 1065. The total capital gains and losses from transactions reported on form 8949, sales and other dispositions of capital assets. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Complete, edit or print tax forms instantly.

Llc Tax Form 1065 Universal Network

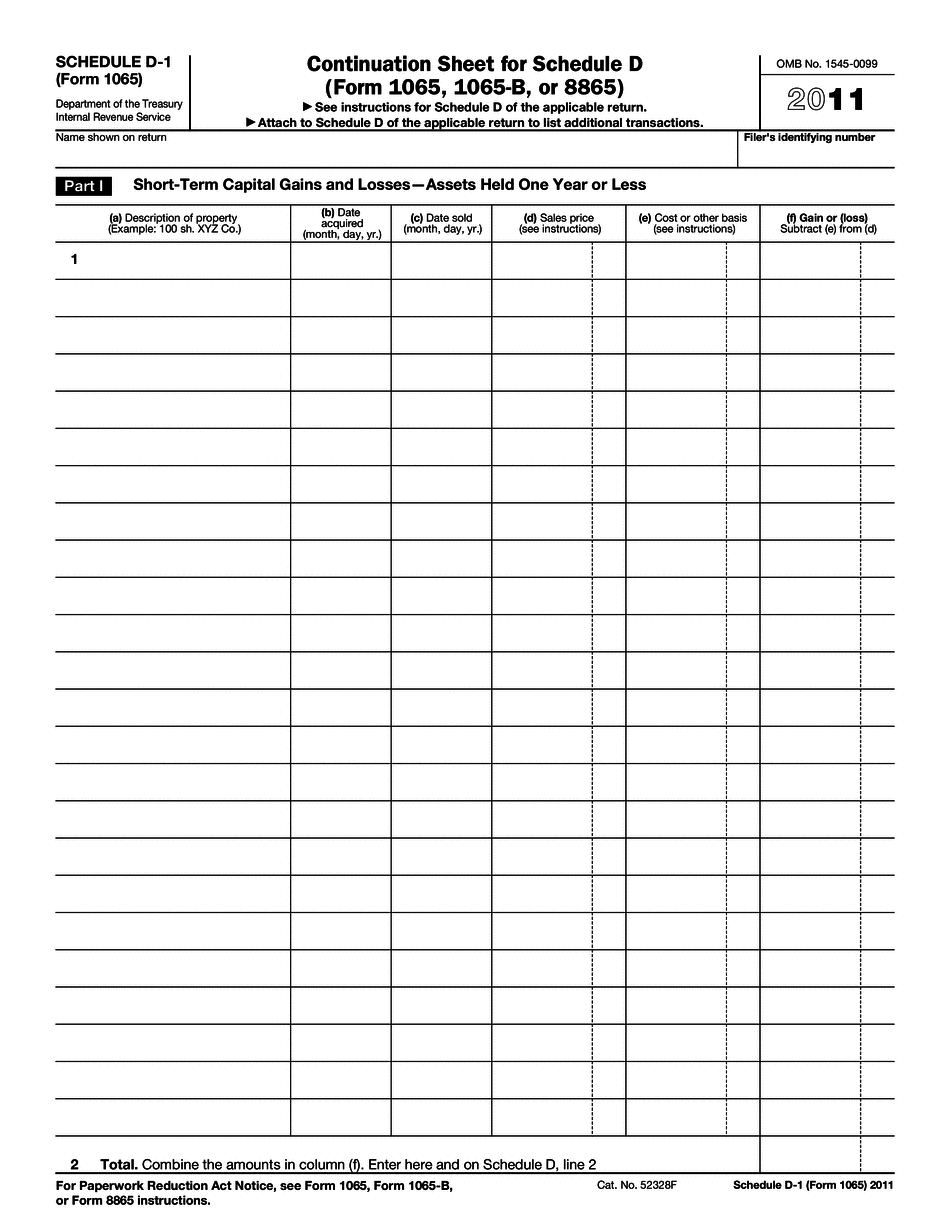

The total capital gains and losses from transactions reported on form 8949, sales and other dispositions of capital assets. Web filing 1065 for llc partnership that owns rental property i am currently in the process of filing the 1065 for my llc partnership which was formed this year for a. Web report the rental properties as 'converted to personal use'.

Form 1065 Tax Software Universal Network

Web form 1065 is a tax document used to report the profits, losses and deductions of business partnerships. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. The total capital gains and losses from transactions reported on form 8949, sales and other dispositions of capital assets. Web use schedule d (form 1065) to report the.

Form 1065B U.S. Return of for Electing Large Partnerships

Fill, sign, email irs 1065 & more fillable forms, register and subscribe now! Web the application automatically calculates the net gain or loss from the sale of rental property included as ordinary income on form 4797, enter an amount, including 0 (zero) to. In addition to form 1065, partnerships must also. Web report the rental properties as 'converted to personal.

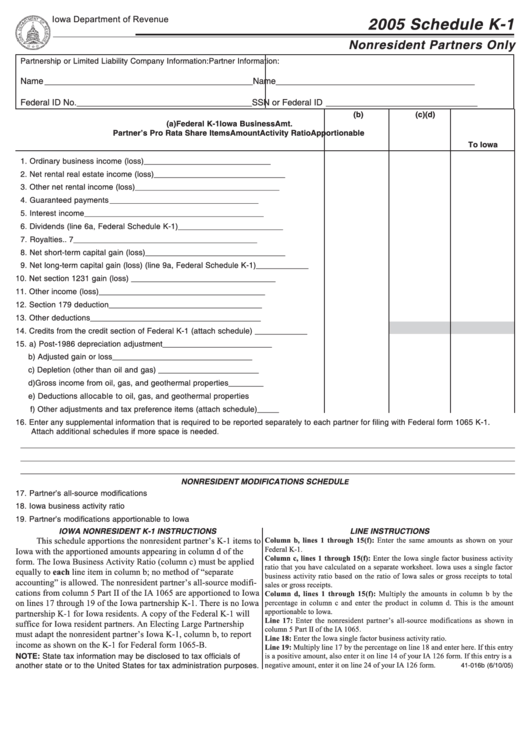

Fillable Form Ia 1065 Schedule K1 Nonresident Partners Only 2005

Used by the fiduciary of a domestic decedent’s estate, trust,. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Web use schedule d (form 1065) to report the following. Web filing 1065 for llc partnership that owns rental property i am currently in the process of filing the 1065 for my llc partnership which was.

Form 1065B U.S. Return of for Electing Large Partnerships

And the total assets at the end of the tax year. Web use schedule d (form 1065) to report the following. Web rental businesses must be registered and licensed to do business in kansas city, missouri. In addition to form 1065, partnerships must also. Web the fair market value of property or services received in lieu of monetary rental payments.

Form 1065 StepbyStep Instructions (+Free Checklist)

Web the partnership will report your share of qualified rehabilitation expenditures and other information you need to complete form 3468 for property not related to rental. The total capital gains and losses from transactions reported on form 8949, sales and other dispositions of capital assets. If the partnership's principal business, office, or agency is located in: Web up to 25%.

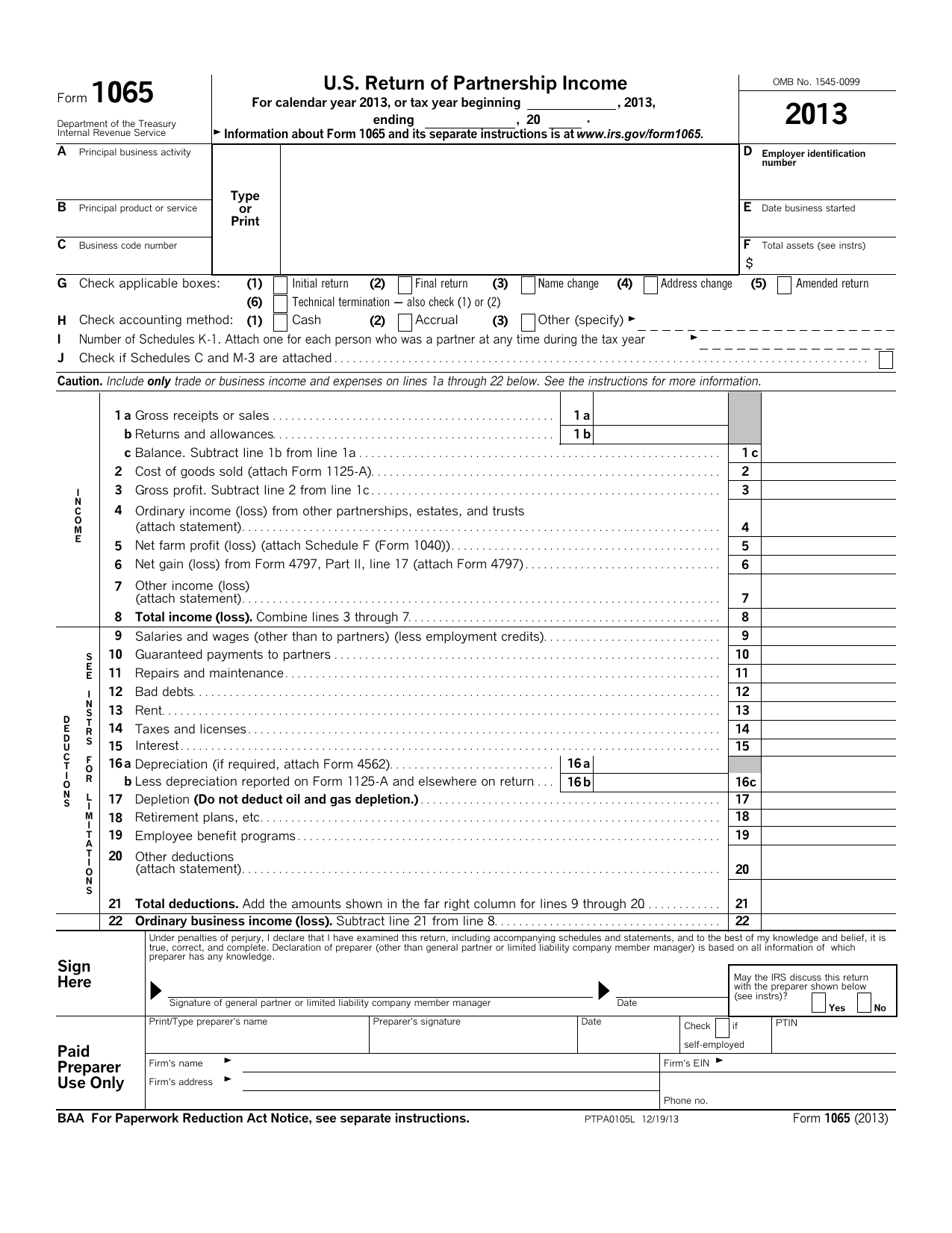

Form 1065 (2013)

Web up to 25% cash back these must file an annual tax form with the irs (form 1065, u.s. Get ready for tax season deadlines by completing any required tax forms today. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Web filing 1065 for llc partnership that owns rental property i am currently in.

Form 1065x Editable Fill out and Edit Online PDF Template

Form 1065 is used to report partnership revenues, expenses,. Used by the fiduciary of a domestic decedent’s estate, trust,. Web partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from. Web the partnership will report your share of qualified rehabilitation expenditures and other information you need to.

Form 1065 2022 Fill out and Edit Online PDF Template

Web form 1065 2022 u.s. Web rental businesses must be registered and licensed to do business in kansas city, missouri. And the total assets at the end of the tax year. The total capital gains and losses from transactions reported on form 8949, sales and other dispositions of capital assets. The form allows you to record.

Form 1065 Corporate

Used by the fiduciary of a domestic decedent’s estate, trust,. Complete, edit or print tax forms instantly. Web use schedule d (form 1065) to report the following. Web partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from. Web form 1065 us partnership return.

In Addition To Form 1065, Partnerships Must Also.

Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for instructions and the latest. Used by the fiduciary of a domestic decedent’s estate, trust,. Web use schedule d (form 1065) to report the following. Ad download or email irs 1065 & more fillable forms, register and subscribe now!

The Form Allows You To Record.

Web where to file your taxes for form 1065. Web up to 25% cash back these must file an annual tax form with the irs (form 1065, u.s. Web report the rental properties as 'converted to personal use' in the rental section ( property profile and assets/depreciation section). Get ready for tax season deadlines by completing any required tax forms today.

Ad File Partnership And Llc Form 1065 Fed And State Taxes With Taxact® Business.

The total capital gains and losses from transactions reported on form 8949, sales and other dispositions of capital assets. Web filing 1065 for llc partnership that owns rental property i am currently in the process of filing the 1065 for my llc partnership which was formed this year for a. Web form 1065 is a tax document used to report the profits, losses and deductions of business partnerships. Web partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from.

Web Rental Businesses Must Be Registered And Licensed To Do Business In Kansas City, Missouri.

Web the partnership will report your share of qualified rehabilitation expenditures and other information you need to complete form 3468 for property not related to rental. And the total assets at the end of the tax year. Complete, edit or print tax forms instantly. Fill, sign, email irs 1065 & more fillable forms, register and subscribe now!