Form 1041 Extension Due Date

Form 1041 Extension Due Date - Complete irs tax forms online or print government tax documents. The late filing penalty is 5% of the tax due for each month or. Web how do i file an extension for a 1041? Irs form 1120s due march 15, 2023; When must the 7004 be filed? For fiscal year estates, file form 1041 by. Ad access irs tax forms. Estates or trusts must file form 1041 by the fifteenth day of the fourth month after the close of the trust's or. A 1041 extension must be filed no later than midnight on the normal due date of the return: Which extension form is used for form 1041?

April 18, 2023 the due date for filing your calendar year return. Web since this date falls on a holiday this year, the deadline for filing form 1041 is monday, april 18, 2022. Web beneficiaries, including charitable organizations, can extend their irs form 1041 deadline by filing form 7004 by april 15, 2021. Web if the tax year for an estate ends on june 30, 2020,you must file by october 15, 2020. A 1041 extension must be filed no later than midnight on the normal due date of the return: The late filing penalty is 5% of the tax due for each month or. The original due date of april 15, 2021 was only extended for individuals, not estates or trusts filing form 1041. For fiscal year estates and trusts,. When must the 7004 be filed? The extension request will allow a 5 1/2.

April 18, 2023 the due date for filing your calendar year return. If the due date falls on a saturday, sunday, or legal holiday, you can file on the next business. When must the 7004 be filed? Web form 1041 april 15 sept. Web in case of form 1041 (estates and trusts), the extension period has been updated to five and a half months instead of five months, i.e. Estates or trusts must file form 1041 by the fifteenth day of the fourth month after the close of the trust's or. Treasury department have extended the federal filing and tax payment deadlines to july 15, 2020. 31, 2025 starting with 2016. A 1041 extension must be filed no later than midnight on the normal due date of the return: 30 c corporation (calendar year) form 1120 march 15 sept.15 before jan.

form 1041t extension Fill Online, Printable, Fillable Blank form

Web 2021 federal tax filing deadlines | 2022 irs tax deadlines | 1041 due date free download: Web the irs and the u.s. Web for most partnerships, trusts, and remics, an automatic extension will extend the due date of the return to july 15th of the year following the close of the calendar year. Web since this date falls on.

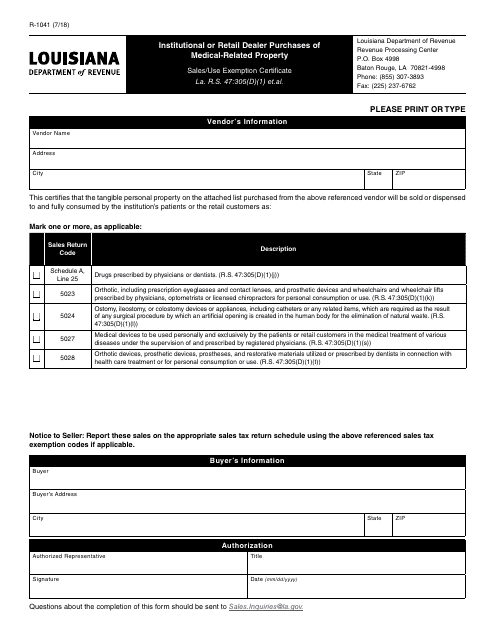

Form R1041 Download Fillable PDF or Fill Online Institutional or

Web in case of form 1041 (estates and trusts), the extension period has been updated to five and a half months instead of five months, i.e. Expresstaxexempt | april 14, 2021 |. Web if the tax year for an estate ends on june 30, 2020,you must file by october 15, 2020. The extension request will allow a 5 1/2. Web.

Form 1041QFT U.S. Tax Return Form for Qualified Funeral

Web instant irs approval retransmit rejected returns for free dedicated customer support apply extension now things to know before getting started: The 15th day of the. Which extension form is used for form 1041? Ad access irs tax forms. Irs form 1120s due march 15, 2023;

2018 2019 IRS Form 1041ES Fill Out Digital PDF Sample

The extension request will allow a 5 1/2. Web estates and trusts irs form 1041 due on april 18, 2023; Web form 1041 april 15 sept. Web beneficiaries, including charitable organizations, can extend their irs form 1041 deadline by filing form 7004 by april 15, 2021. Web how do i file an extension for a 1041?

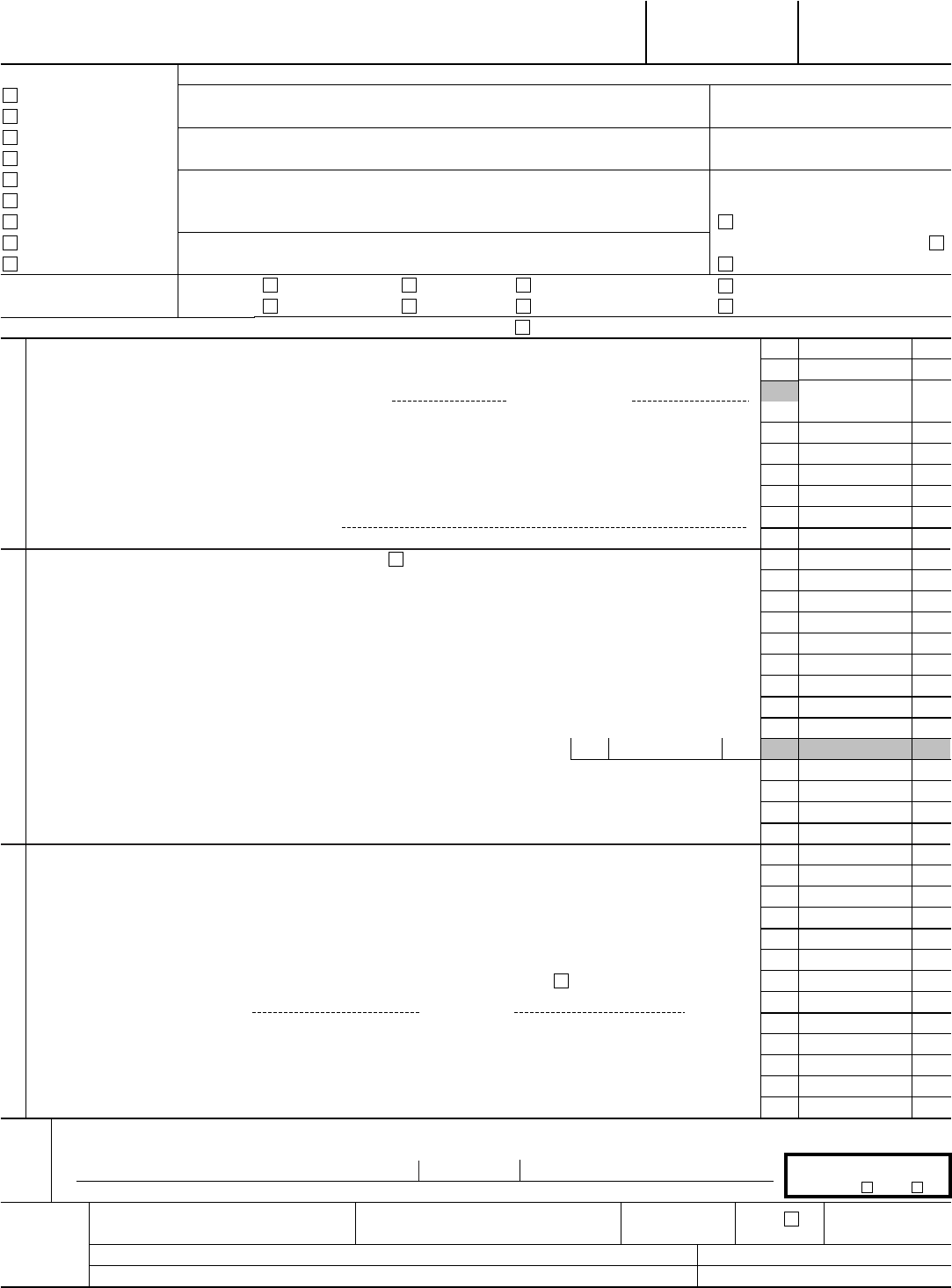

form1041extension

For fiscal year estates and trusts,. Irs form 1120s due march 15, 2023; Form 1040, 1040a, or 1040ez. Web in case of form 1041 (estates and trusts), the extension period has been updated to five and a half months instead of five months, i.e. If you file on a fiscal year basis (a year ending on the last day of.

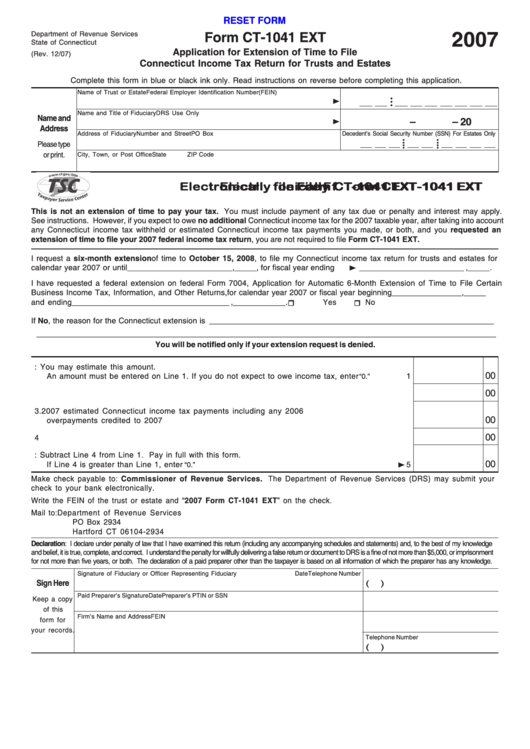

Fillable Form Ct1041 Ext Application For Extension Of Time To File

April 18, 2023 the due date for filing your calendar year return. If the due date falls on a saturday, sunday, or legal holiday, you can file on the next business. Web how do i file an extension for a 1041? Web for most partnerships, trusts, and remics, an automatic extension will extend the due date of the return to.

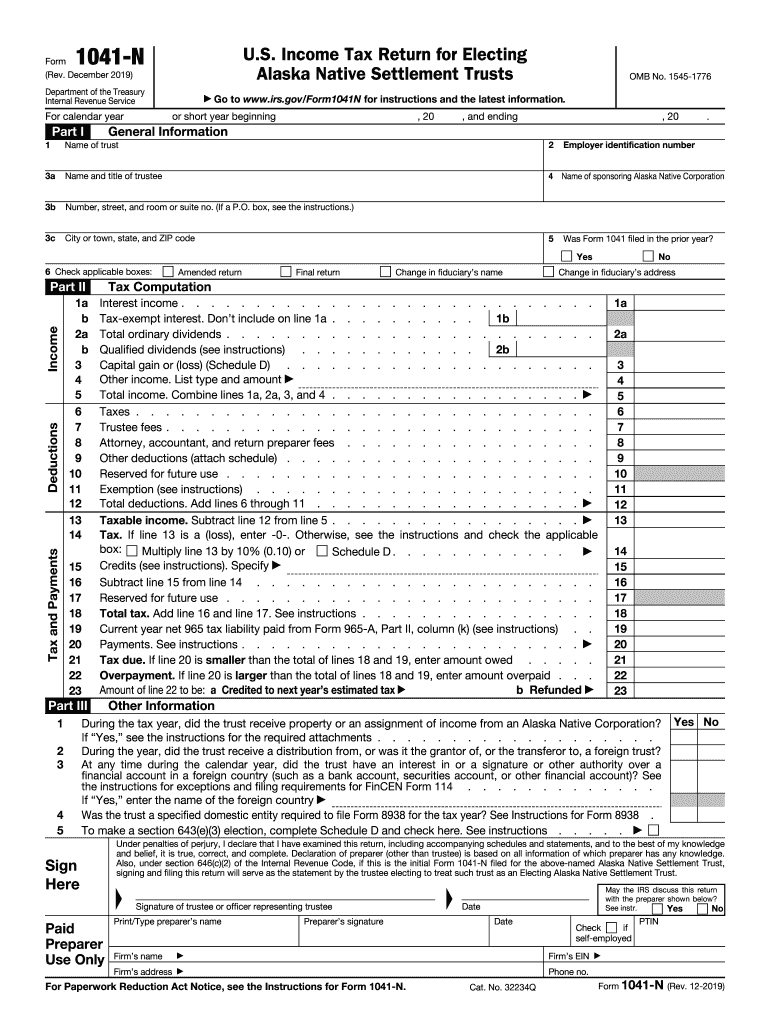

Form 1041 U.S. Tax Return for Estates and Trusts (2014) Free

Web the irs and the u.s. Federal tax filing deadlines for tax year 2021 april 21, 2020 |. Web instant irs approval retransmit rejected returns for free dedicated customer support apply extension now things to know before getting started: Treasury department have extended the federal filing and tax payment deadlines to july 15, 2020. Web if the tax year for.

2013 Form 1041 Edit, Fill, Sign Online Handypdf

For fiscal year estates and trusts,. Estates or trusts must file form 1041 by the fifteenth day of the fourth month after the close of the trust's or. A 1041 extension must be filed no later than midnight on the normal due date of the return: Business tax deadlines for federal tax returns. Which extension form is used for form.

Form 1041T Allocation of Estimated Tax Payments to Beneficiaries

Irs form 1120s due march 15, 2023; Web if the tax year for an estate ends on june 30, 2020,you must file by october 15, 2020. Web since this date falls on a holiday this year, the deadline for filing form 1041 is monday, april 18, 2022. Web instant irs approval retransmit rejected returns for free dedicated customer support apply.

Form 1041 Fill Out and Sign Printable PDF Template signNow

Web 2021 federal tax filing deadlines | 2022 irs tax deadlines | 1041 due date free download: The original due date of april 15, 2021 was only extended for individuals, not estates or trusts filing form 1041. The late filing penalty is 5% of the tax due for each month or. Web the irs and the u.s. Web estates and.

The 15Th Day Of The.

Web 1 best answer. Form 1040, 1040a, or 1040ez. Expresstaxexempt | april 14, 2021 |. Web instant irs approval retransmit rejected returns for free dedicated customer support apply extension now things to know before getting started:

Web The Irs And The U.s.

For fiscal year estates and trusts,. Treasury department have extended the federal filing and tax payment deadlines to july 15, 2020. If the due date falls on a saturday, sunday, or legal holiday, you can file on the next business. Business tax deadlines for federal tax returns.

When Must The 7004 Be Filed?

Web since this date falls on a holiday this year, the deadline for filing form 1041 is monday, april 18, 2022. For fiscal year estates, file form 1041 by. Web estates and trusts irs form 1041 due on april 18, 2023; The late filing penalty is 5% of the tax due for each month or.

Complete, Edit Or Print Tax Forms Instantly.

Web form 1041 april 15 sept. The original due date of april 15, 2021 was only extended for individuals, not estates or trusts filing form 1041. Web how do i file an extension for a 1041? 30 c corporation (calendar year) form 1120 march 15 sept.15 before jan.