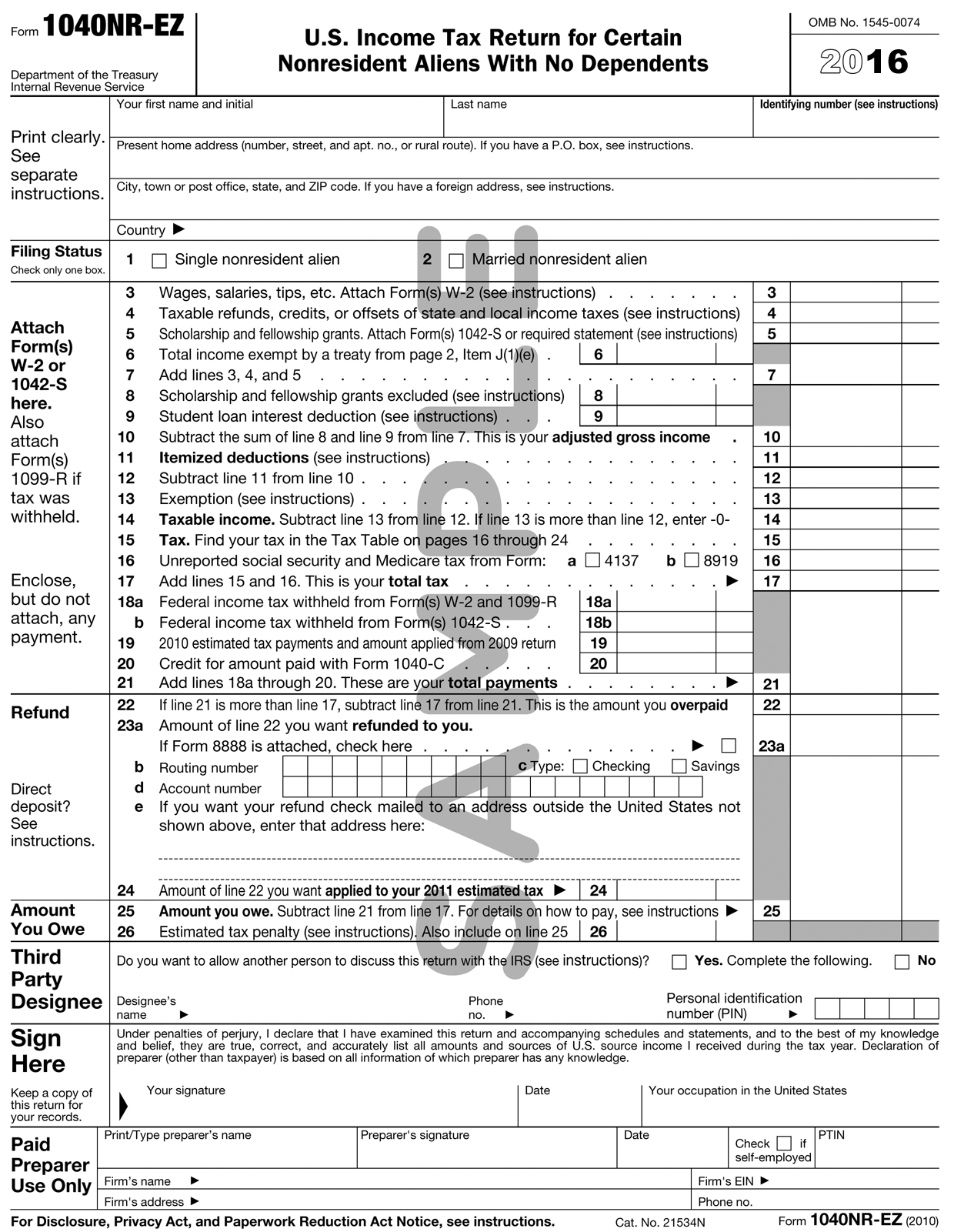

Form 1040Nr-Ez

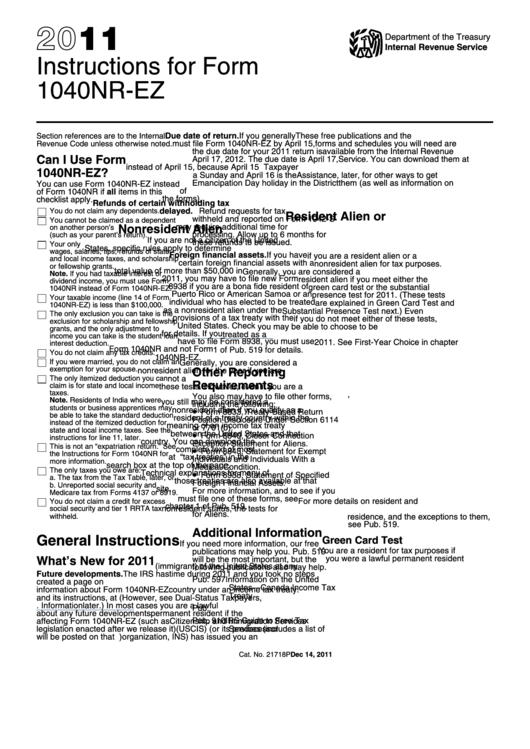

Form 1040Nr-Ez - This is the personal exemption amount. Nras whose total us income for 2015 was more than $4,000. The irs form 1040, u.s. Irs use only—do not write or staple in this space. Nonresidents also do not have a minimum income threshold for filing. Department of the treasury internal revenue service. On the last day of the tax year. Web extensions for form 1040nr can also be filed electronically. If you are claiming a net qualified disaster loss on form 4684, see instructions for line 7. Nonresident alien income tax return.

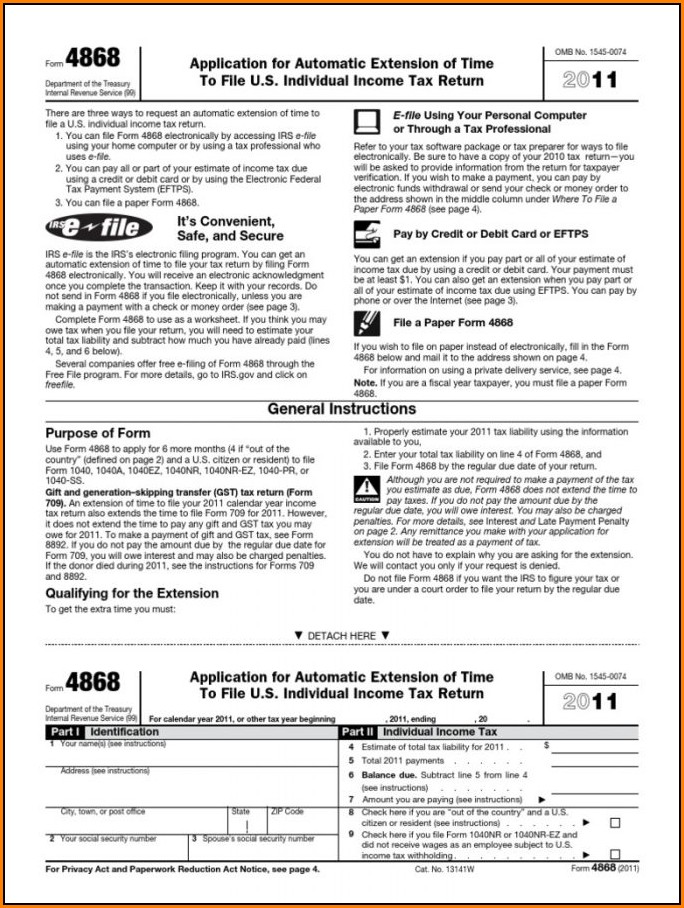

Web only residents should file a form 1040. Department of the treasury—internal revenue service. Income tax return for certain nonresident aliens with no dependents in july 2021, and the latest form we have available is for tax year 2020. On the last day of the tax year. Election to be taxed as a resident alien. Nonresident alien income tax return. Nonresident alien income tax return. Resident during the year and who is a resident of the u.s. Nras whose total us income for 2015 was more than $4,000. Web you must file form 1040, u.s.

Department of the treasury—internal revenue service. You have no income from a trade or business conducted in the united states, Nonresident alien income tax return. If you are claiming a net qualified disaster loss on form 4684, see instructions for line 7. Specifically, the form is used by: This form looks similar to the standard. Nonresidents also do not have a minimum income threshold for filing. Irs use only—do not write or staple in this space. Follow the same procedures for preparing 1040 returns or extensions for electronic filing to prepare form 1040nr for electronic filing. The irs form 1040, u.s.

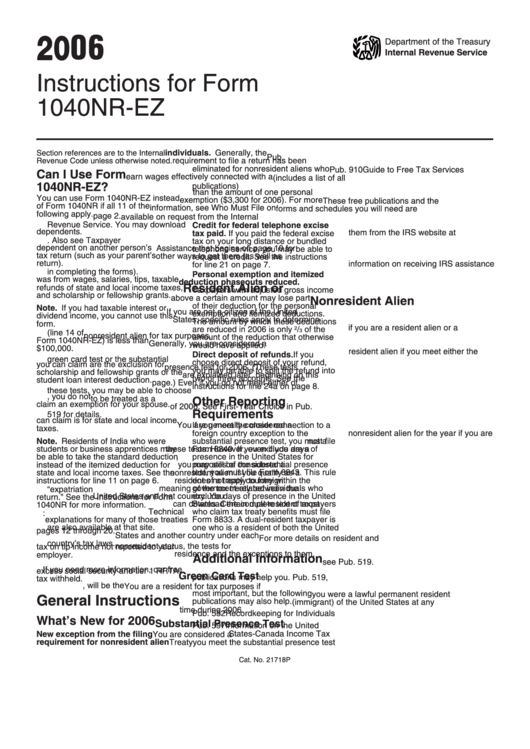

Instructions For Form 1040nrEz U.s. Tax Return 2006 printable

Your name, details on where you live, verification of your filing status, and extensive data about your earnings. You have no income from a trade or business conducted in the united states, Nonresident alien income tax return. On the first page, you’re going to need to indicate your personal details: Nonresident alien income tax return.

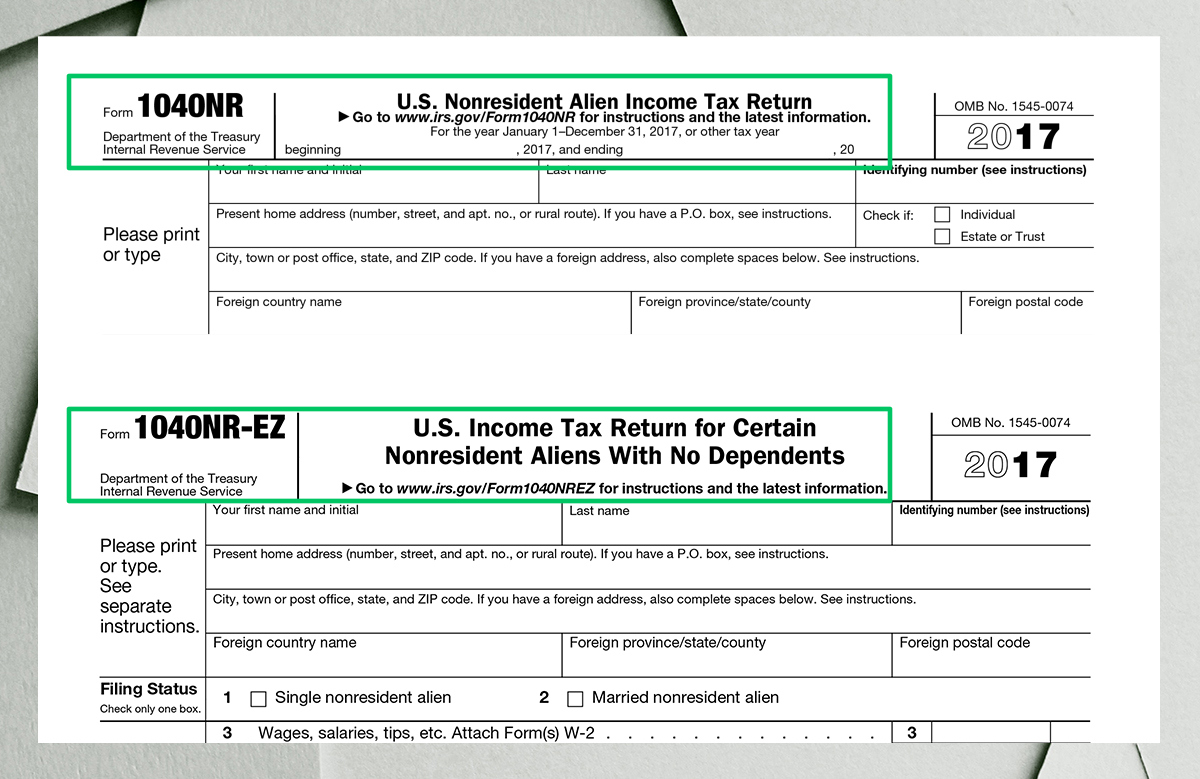

Down To The Smallest Detail Form 1040NR EZ Complete 1040 Form Printable

Follow the same procedures for preparing 1040 returns or extensions for electronic filing to prepare form 1040nr for electronic filing. Nonresident alien income tax return. Attach a statement to your return to show the income for the part of the year you. Those returns must be filed on paper. This form is for income earned in tax year 2022, with.

Form 1040NREZ U.S. Tax Return for Certain Nonresident Aliens

Specifically, the form is used by: Nonresidents also do not have a minimum income threshold for filing. Nonresident if they do not have a green card or do not satisfy the substantial presence test. You have no income from a trade or business conducted in the united states, Attach a statement to your return to show the income for the.

Form 1040NREZ U.S. Tax Return Form for Certain Nonresident

Department of the treasury—internal revenue service. Nonresident alien income tax return. Income tax return for certain nonresident aliens with no dependents. On the last day of the tax year. A taxpayer is considered a u.s.

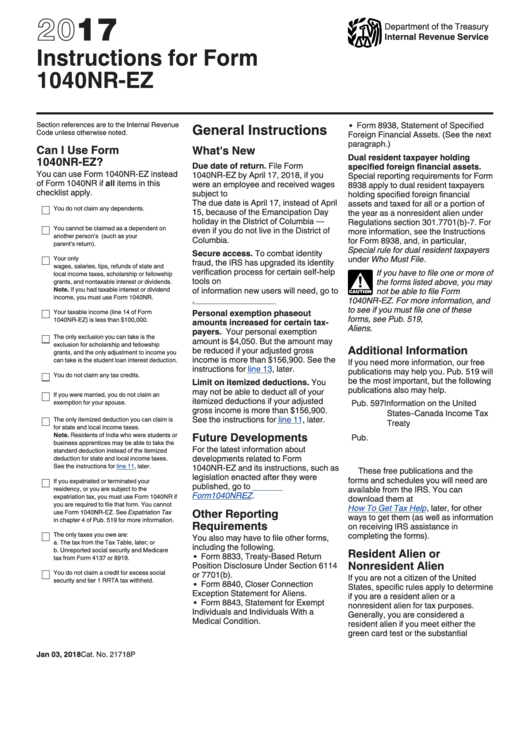

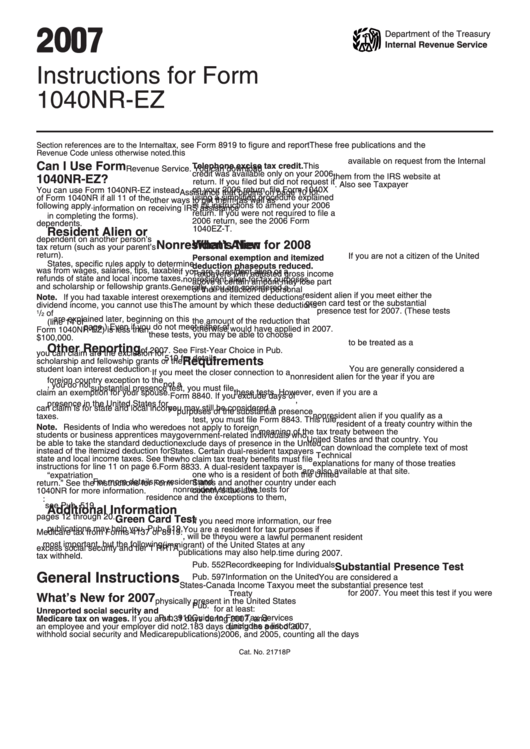

Instructions For Form 1040nrEz U.s. Tax Return For Certain

Irs use only—do not write or staple in this space. Those returns must be filed on paper. Web only residents should file a form 1040. Nonresident alien income tax return. A taxpayer is considered a u.s.

Important Tax Information and Tax Forms · Camp USA · InterExchange

Nras whose total us income for 2015 was more than $4,000. On the first page, you’re going to need to indicate your personal details: Income tax return for certain nonresident aliens with no dependents in july 2021, and the latest form we have available is for tax year 2020. This form is for income earned in tax year 2022, with.

Irs Forms 1040nr Form Resume Examples RQJ9e1x9my

We last updated the u.s. Nras whose total us income for 2015 was more than $4,000. Income tax return for certain nonresident aliens with no dependents in july 2021, and the latest form we have available is for tax year 2020. Nonresident alien income tax return. Those returns must be filed on paper.

Instructions For Form 1040nrEz U.s. Tax Return For Certain

Were a nonresident alien engaged in a trade or business in the united states. Election to be taxed as a resident alien. Web you must file form 1040, u.s. Follow the same procedures for preparing 1040 returns or extensions for electronic filing to prepare form 1040nr for electronic filing. Individual income tax return, is filled in as you work on.

Forms 1040, 1040NR and 1040NREZ Which Form to File? [2021]

On the last day of the tax year. Department of the treasury internal revenue service. We last updated the u.s. Web • form 1040nr ez (the shorter form) is only acceptable when: On the first page, you’re going to need to indicate your personal details:

Instructions For Form 1040nrEz U.s. Tax Return For Certain

Attach a statement to your return to show the income for the part of the year you. On the last day of the tax year. Nonresident alien income tax return. If you are claiming a net qualified disaster loss on form 4684, see instructions for line 7. This form looks similar to the standard.

The Irs Form 1040, U.s.

When and where should you file? Web only residents should file a form 1040. Nras whose total us income for 2015 was more than $4,000. On the first page, you’re going to need to indicate your personal details:

For Instructions And The Latest Information.

Irs use only—do not write or staple in this space. Follow the same procedures for preparing 1040 returns or extensions for electronic filing to prepare form 1040nr for electronic filing. Election to be taxed as a resident alien. 31, 2022, or other tax year beginning, 2022, ending , 20 see separate instructions.

You Have No Income From A Trade Or Business Conducted In The United States,

Specifically, the form is used by: Web • form 1040nr ez (the shorter form) is only acceptable when: Department of the treasury internal revenue service. Irs use only—do not write or staple in this space.

Resident During The Year And Who Is A Resident Of The U.s.

Nonresident alien income tax return. This form looks similar to the standard. Nonresidents also do not have a minimum income threshold for filing. On the last day of the tax year.

:max_bytes(150000):strip_icc()/1040-NR-EZ-NonresidentAlienswithNoDependents-1-992eb3e7ab6d49b782ad46ab42ae00e5.png)

![Forms 1040, 1040NR and 1040NREZ Which Form to File? [2021]](http://blog.sprintax.com/wp-content/uploads/2020/07/image-4.jpg)