Form 1040 Line 25C Instructions

Form 1040 Line 25C Instructions - Max refund is guaranteed and 100% accurate. Your 2009 income tax return and you departing alien income tax sold your home or the home. Web reporting income tax withholding. Ad discover helpful information and resources on taxes from aarp. For tax period or year beginning , 2021, and ending. Web you spouse at any time during 2021, did you receive, sell, exchange, or otherwise dispose of any financial interest in any virtual currency? Instead of a single line for federal income tax withholding, the new form 1040 has three separate lines for withholdings:. For instructions and the latest. Web (form 1040) department of the treasury internal revenue service (99) profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and the. Web from 1040 instructions:

Instead of a single line for federal income tax withholding, the new form 1040 has three separate lines for withholdings:. (a) receive (as a reward, award, or payment for property or services); Cash on hand at the end of. Ad premium federal filing is 100% free with no upgrades for premium taxes. Department of the treasury internal revenue service. Departing alien income tax return department of the treasury. Web reporting income tax withholding. Max refund is guaranteed and 100% accurate. For instructions and the latest. The amount withheld should be.

For tax period or year beginning , 2021, and ending. Your 2009 income tax return and you departing alien income tax sold your home or the home. Cash on hand at the end of. Web other forms (see instructions) add lines 25a through 25c , line 25a. Web reporting income tax withholding. Web (form 1040) department of the treasury internal revenue service (99) profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and the. Web department of the treasury internal revenue service. Web background section 25c allows a credit in an amount equal to the sum of (1) 10 percent of the amount paid or incurred by the taxpayer for qualified energy efficiency. Web the form allows you to report how much income you earned in 2021, and then it walks through the process of finding how much of your income you actually have. For instructions and the latest.

Fill out a 2017 IRS TAX Form 1040 Schedule D based on

Departing alien income tax return department of the treasury. Web (form 1040) department of the treasury internal revenue service (99) profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and the. Web subtract line 21 from line 20 and report the result here. Web spouse digital assets at any time during 2022, did you: Profit or loss.

2014 Form 1040a Instructions MBM Legal

(a) receive (as a reward, award, or payment for property or services); Instead of a single line for federal income tax withholding, the new form 1040 has three separate lines for withholdings:. Web subtract line 21 from line 20 and report the result here. Web from 1040 instructions: Web instructions for form 1040(rev.

Irs Form 1040 Line 15a And 15b Form Resume Examples

Web (form 1040) department of the treasury internal revenue service (99) profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and the. For tax period or year beginning , 2021, and ending. Cash on hand at the end of. The amount withheld should be. Web other forms (see instructions) add lines 25a through 25c , line 25a.

Fillable IRS Instructions 1040 2018 2019 Online PDF Template

Ad discover helpful information and resources on taxes from aarp. Web spouse digital assets at any time during 2022, did you: For instructions and the latest. Web department of the treasury internal revenue service. For instructions and the latest.

Download Instructions for IRS Form 1040, 1040SR Schedule D Capital

Enter your status, income, deductions and credits and estimate your total taxes. Web you spouse at any time during 2021, did you receive, sell, exchange, or otherwise dispose of any financial interest in any virtual currency? Web from 1040 instructions: Profit or loss from business. (a) receive (as a reward, award, or payment for property or services);

2016 form 1040 line 29 instructions

Web (form 1040) department of the treasury internal revenue service (99) profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and the. Ad premium federal filing is 100% free with no upgrades for premium taxes. Web instructions for form 1040(rev. Cash on hand at the end of. Departing alien income tax return department of the treasury.

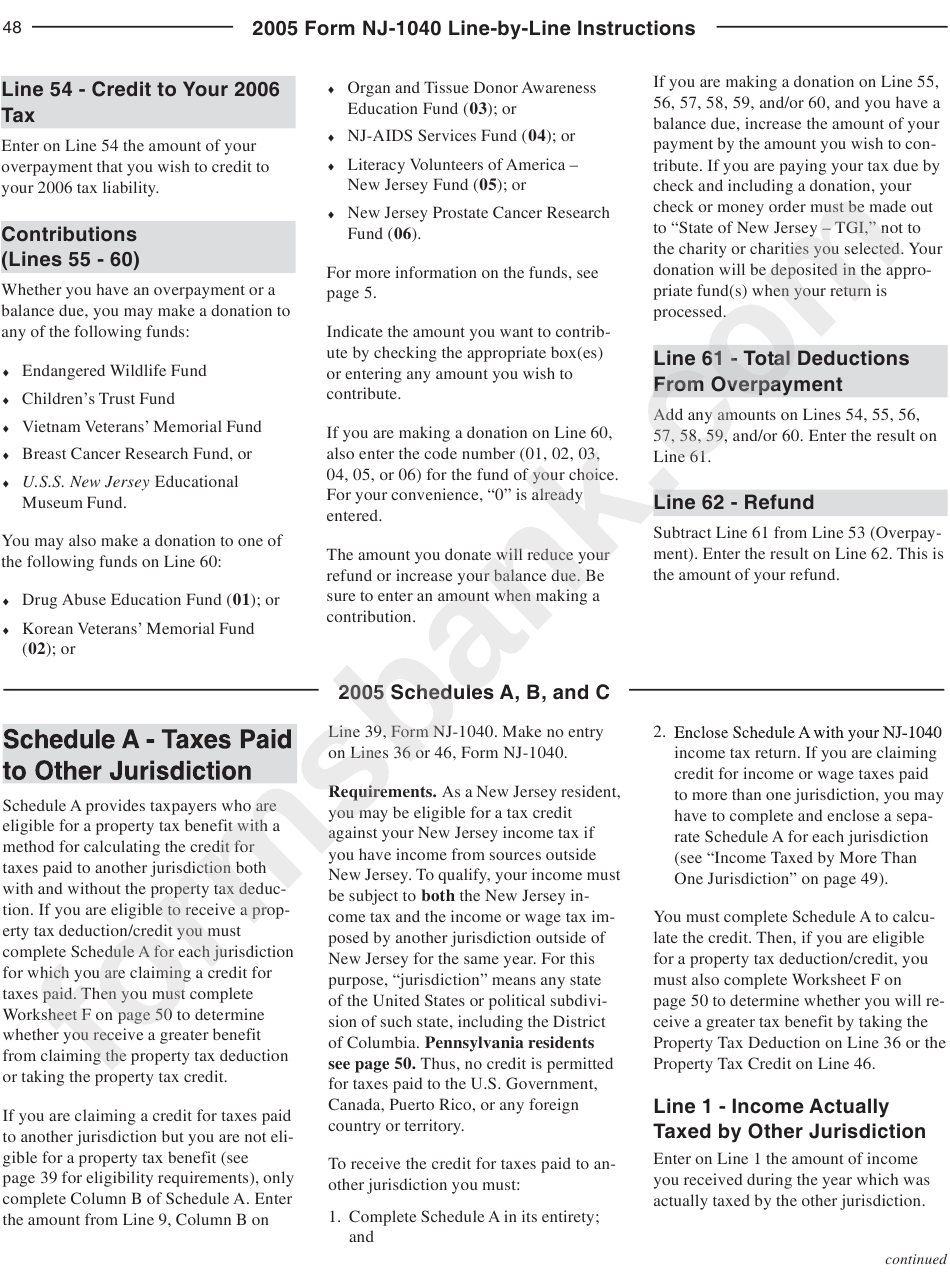

Form Nj1040 LineByLine Instructions 2005 printable pdf download

Web from 1040 instructions: Profit or loss from business. Web subtract line 21 from line 20 and report the result here. Department of the treasury internal revenue service. Web instructions for form 1040(rev.

2020 form 1040 instructions 1040. 20191124

Web reporting income tax withholding. Departing alien income tax return. Web background section 25c allows a credit in an amount equal to the sum of (1) 10 percent of the amount paid or incurred by the taxpayer for qualified energy efficiency. Web other forms (see instructions) add lines 25a through 25c , line 25a. Web you spouse at any time.

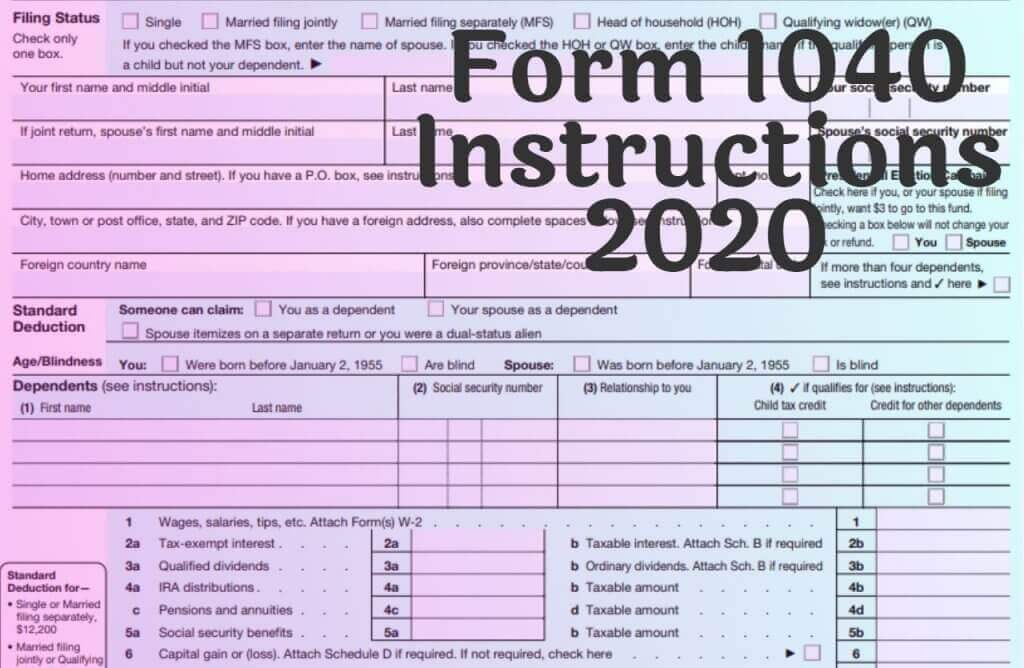

Form 1040 Instructions 2020

Cash on hand at the end of. This amount may be different from what you may have calculated as net profit. Web (form 1040) department of the treasury internal revenue service (99) profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and the. Department of the treasury internal revenue service. Web department of the treasury internal revenue.

1040 line 33 instructions

The amount withheld should be. Ad discover helpful information and resources on taxes from aarp. Web (form 1040) department of the treasury internal revenue service (99) profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and the. Or (b) sell, exchange, gift, or otherwise dispose of a. Web reporting income tax withholding.

Max Refund Is Guaranteed And 100% Accurate.

This amount may be different from what you may have calculated as net profit. Enter your status, income, deductions and credits and estimate your total taxes. Instead of a single line for federal income tax withholding, the new form 1040 has three separate lines for withholdings:. (a) receive (as a reward, award, or payment for property or services);

For Tax Period Or Year Beginning , 2021, And Ending.

Web you spouse at any time during 2021, did you receive, sell, exchange, or otherwise dispose of any financial interest in any virtual currency? Web subtract line 21 from line 20 and report the result here. For instructions and the latest. Web department of the treasury internal revenue service.

Profit Or Loss From Business.

Departing alien income tax return. The amount withheld should be. Web background section 25c allows a credit in an amount equal to the sum of (1) 10 percent of the amount paid or incurred by the taxpayer for qualified energy efficiency. Cash on hand at the end of.

Web Instructions For Form 1040(Rev.

Web (form 1040) department of the treasury internal revenue service (99) profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and the. Your 2009 income tax return and you departing alien income tax sold your home or the home. Ad premium federal filing is 100% free with no upgrades for premium taxes. Profit or loss from business.