Form 1023 Vs 1023 Ez

Form 1023 Vs 1023 Ez - Web published sep 2, 2021 + follow (this article originally appeared on sarahsshepard.com ). Web the application your organization is required to submit is specified in publication 557. Web in theory, most nonprofit organizations with gross receipts of $50,000 or less and assets of $250,000 or less are eligible to use the form 1023 ez. When you plan to run an alabama nonprofit organization, you'll. Complete, edit or print tax forms instantly. Ad get ready for tax season deadlines by completing any required tax forms today. The 1023 form is meant for large or complex nonprofits such as schools, hospitals, or established. Note that for some types of organizations no application form is. It has its pros, as well as its significant problems. This does not include churches,.

Web in theory, most nonprofit organizations with gross receipts of $50,000 or less and assets of $250,000 or less are eligible to use the form 1023 ez. It has its pros, as well as its significant problems. Web published sep 2, 2021 + follow (this article originally appeared on sarahsshepard.com ). Complete, edit or print tax forms instantly. Ad get ready for tax season deadlines by completing any required tax forms today. This does not include churches,. Note that for some types of organizations no application form is. 2 to qualify for exemption as a section 501(c)(3) organization, you must be. When you plan to run an alabama nonprofit organization, you'll. The 1023 form is meant for large or complex nonprofits such as schools, hospitals, or established.

Web published sep 2, 2021 + follow (this article originally appeared on sarahsshepard.com ). Complete, edit or print tax forms instantly. When you plan to run an alabama nonprofit organization, you'll. It has its pros, as well as its significant problems. Note that for some types of organizations no application form is. Web in theory, most nonprofit organizations with gross receipts of $50,000 or less and assets of $250,000 or less are eligible to use the form 1023 ez. This does not include churches,. The 1023 form is meant for large or complex nonprofits such as schools, hospitals, or established. Ad get ready for tax season deadlines by completing any required tax forms today. Web the application your organization is required to submit is specified in publication 557.

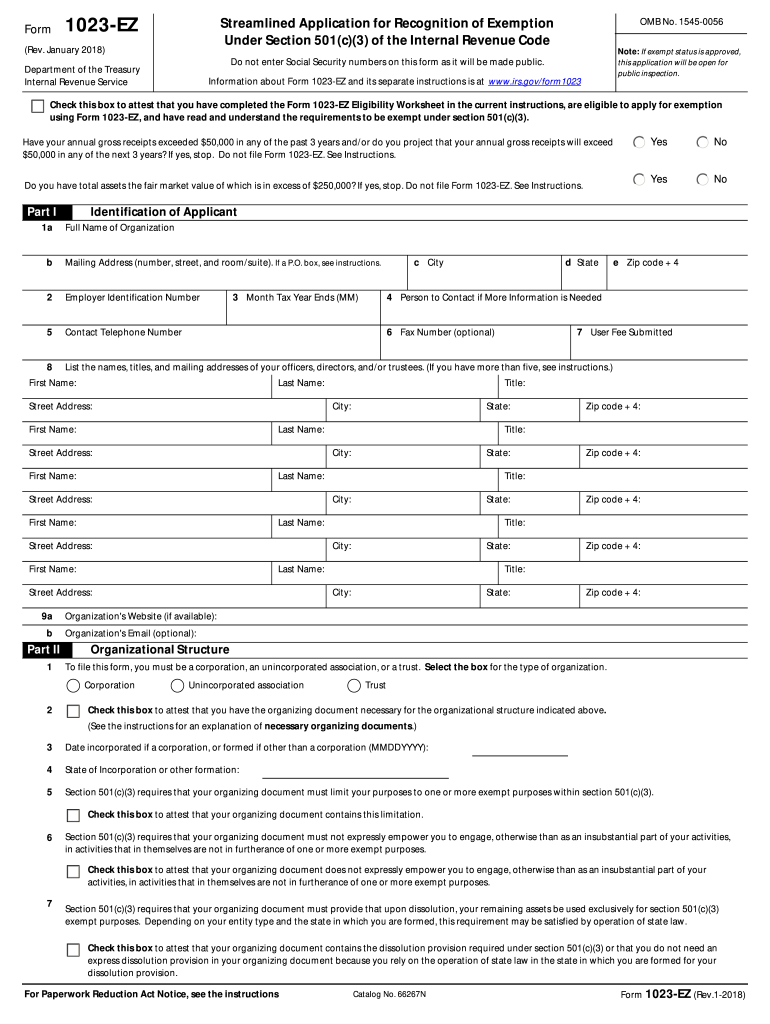

How to Fill Out Form 1023 & Form 1023EZ for Nonprofits Step by Step

Web in theory, most nonprofit organizations with gross receipts of $50,000 or less and assets of $250,000 or less are eligible to use the form 1023 ez. Ad get ready for tax season deadlines by completing any required tax forms today. Web the application your organization is required to submit is specified in publication 557. Complete, edit or print tax.

Form 1023 Ez Fill Out and Sign Printable PDF Template signNow

Web published sep 2, 2021 + follow (this article originally appeared on sarahsshepard.com ). Ad get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. It has its pros, as well as its significant problems. Web in theory, most nonprofit organizations with gross receipts of $50,000 or less and assets.

31 Form 1023 Ez Eligibility Worksheet support worksheet

This does not include churches,. 2 to qualify for exemption as a section 501(c)(3) organization, you must be. Web the application your organization is required to submit is specified in publication 557. It has its pros, as well as its significant problems. Complete, edit or print tax forms instantly.

IRS Proposes Form 1023EZ

Web published sep 2, 2021 + follow (this article originally appeared on sarahsshepard.com ). Web the application your organization is required to submit is specified in publication 557. Note that for some types of organizations no application form is. When you plan to run an alabama nonprofit organization, you'll. The 1023 form is meant for large or complex nonprofits such.

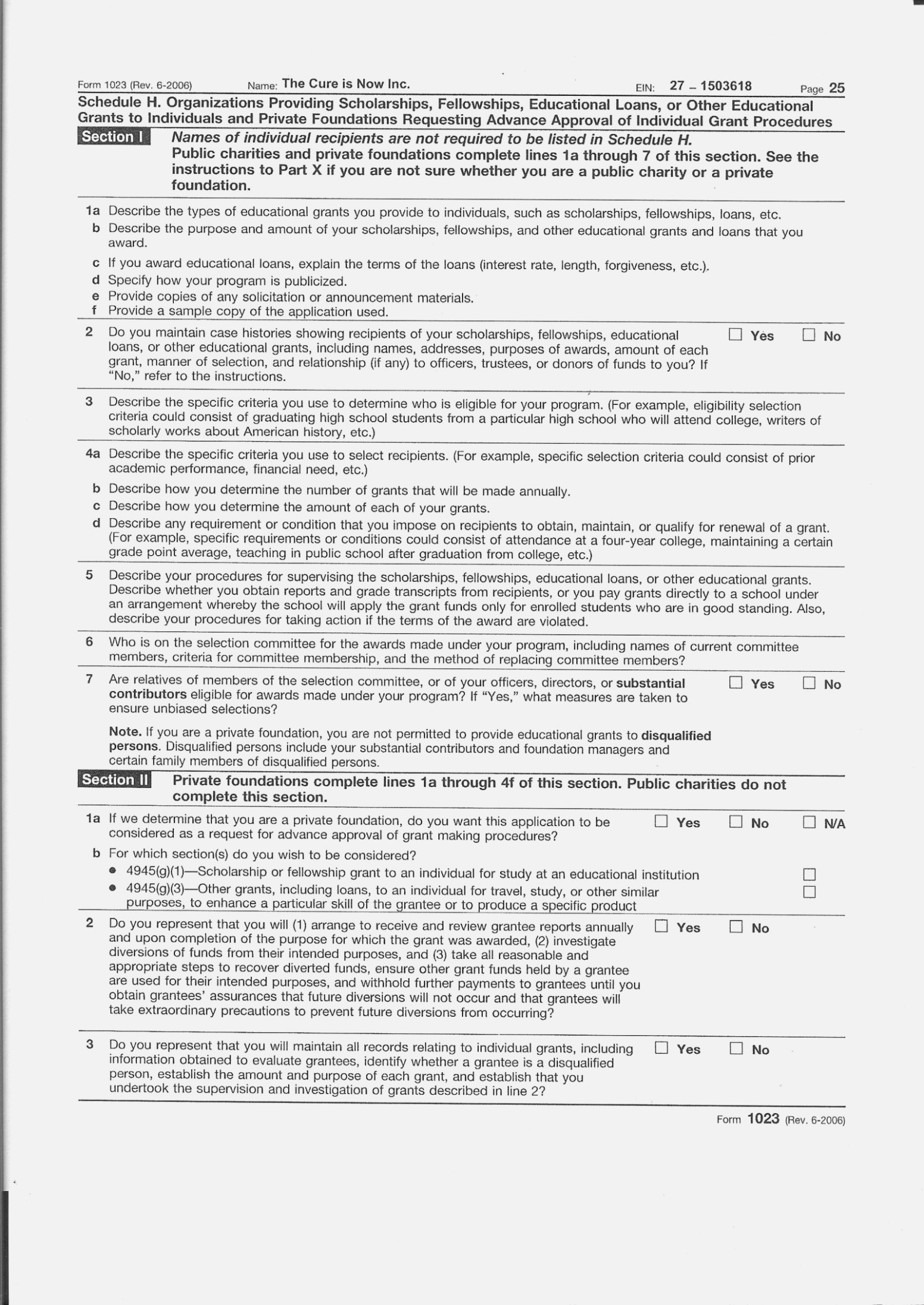

IRS Form 1023 — SSS LAW Huntsville Estate Planning

The 1023 form is meant for large or complex nonprofits such as schools, hospitals, or established. Note that for some types of organizations no application form is. Ad get ready for tax season deadlines by completing any required tax forms today. This does not include churches,. Web published sep 2, 2021 + follow (this article originally appeared on sarahsshepard.com ).

How to Fill Out Form 1023 & Form 1023EZ for Nonprofits Step by Step

Web in theory, most nonprofit organizations with gross receipts of $50,000 or less and assets of $250,000 or less are eligible to use the form 1023 ez. Web published sep 2, 2021 + follow (this article originally appeared on sarahsshepard.com ). This does not include churches,. Ad get ready for tax season deadlines by completing any required tax forms today..

Form 1023 Ez Eligibility Worksheet

Ad get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. The 1023 form is meant for large or complex nonprofits such as schools, hospitals, or established. This does not include churches,. Web the application your organization is required to submit is specified in publication 557.

36 1023 Ez Eligibility Worksheet support worksheet

This does not include churches,. Ad get ready for tax season deadlines by completing any required tax forms today. Note that for some types of organizations no application form is. Web in theory, most nonprofit organizations with gross receipts of $50,000 or less and assets of $250,000 or less are eligible to use the form 1023 ez. Complete, edit or.

Structure examples Form 1023ez pdf

Ad get ready for tax season deadlines by completing any required tax forms today. This does not include churches,. Web published sep 2, 2021 + follow (this article originally appeared on sarahsshepard.com ). Web in theory, most nonprofit organizations with gross receipts of $50,000 or less and assets of $250,000 or less are eligible to use the form 1023 ez..

Form 1023 Ez Eligibility Worksheet —

When you plan to run an alabama nonprofit organization, you'll. Note that for some types of organizations no application form is. Web in theory, most nonprofit organizations with gross receipts of $50,000 or less and assets of $250,000 or less are eligible to use the form 1023 ez. Web the application your organization is required to submit is specified in.

Web In Theory, Most Nonprofit Organizations With Gross Receipts Of $50,000 Or Less And Assets Of $250,000 Or Less Are Eligible To Use The Form 1023 Ez.

Complete, edit or print tax forms instantly. Web the application your organization is required to submit is specified in publication 557. It has its pros, as well as its significant problems. When you plan to run an alabama nonprofit organization, you'll.

Web Published Sep 2, 2021 + Follow (This Article Originally Appeared On Sarahsshepard.com ).

Note that for some types of organizations no application form is. The 1023 form is meant for large or complex nonprofits such as schools, hospitals, or established. 2 to qualify for exemption as a section 501(c)(3) organization, you must be. Ad get ready for tax season deadlines by completing any required tax forms today.