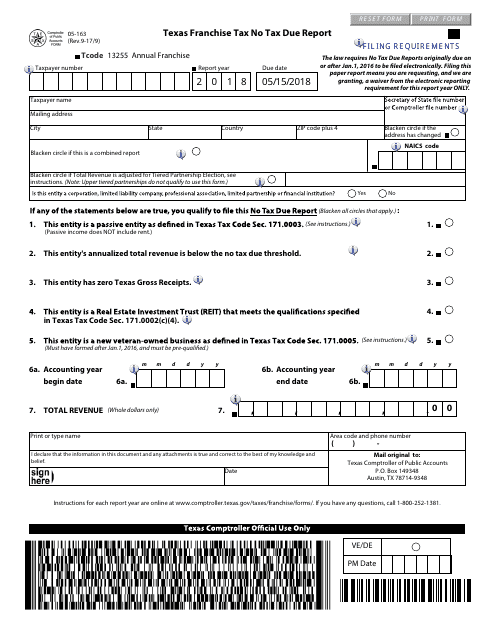

Form 05 163

Form 05 163 - Register for a free account, set a secure password, and go through email verification to. The form can be used to report transactions involving stocks, bonds, options, and other. Taxpayer is a newly established texas veteran owned business. (passive income does not include rent.) (see instructions.) 2. Web instructions for each report year are online at www.comptroller.texas.gov/taxes/franchise/forms/. Easily fill out pdf blank, edit, and sign them. This questionnaire must be completed by any. Web if you don’t owe: Taxpayer is a newly established texas veteran owned business. Sign up and log in.

Easily sign the texas franchise tax no tax due report 2022 with your finger. Web form 05 163 is a form designed to help taxpayers report their capital gains and losses. Box 4047 terminal a toronto on m5w 1l5 your personal chequing account. This entity has zero texas gross. If you have any questions,. Web if you don’t owe: Register for a free account, set a secure password, and go through email verification to. Upper tiered partnerships do not qualify to use this form.) yes no 1. Easily fill out pdf blank, edit, and sign them. Complete all sections that apply.

If you have any questions,. Upper tiered partnerships do not qualify to use this form.) yes no 1. Complete all sections that apply. Register for a free account, set a secure password, and go through email verification to. Box 4047 terminal a toronto on m5w 1l5 your personal chequing account. Easily fill out pdf blank, edit, and sign them. This questionnaire must be completed by any. (passive income does not include rent.) (see instructions.) 2. Taxpayer is a newly established texas veteran owned business. Web follow this simple guide to edit 05 163 in pdf format online at no cost:

05 169 2013 form Fill out & sign online DocHub

If you have any questions,. Taxpayer is a newly established texas veteran owned business. Web if you don’t owe: Register for a free account, set a secure password, and go through email verification to. This questionnaire must be completed by any.

Form 05163 Download Fillable PDF or Fill Online Texas Franchise Tax No

Complete all sections that apply. Web follow this simple guide to edit 05 163 in pdf format online at no cost: Taxpayer is a newly established texas veteran owned business. Box 4047 terminal a toronto on m5w 1l5 your personal chequing account. This entity has zero texas gross.

Texas form 05 163 2016 Fill out & sign online DocHub

If you have any questions,. Box 4047 terminal a toronto on m5w 1l5 your personal chequing account. Web instructions for each report year are online at www.comptroller.texas.gov/taxes/franchise/forms/. Taxpayer is a newly established texas veteran owned business. Sign up and log in.

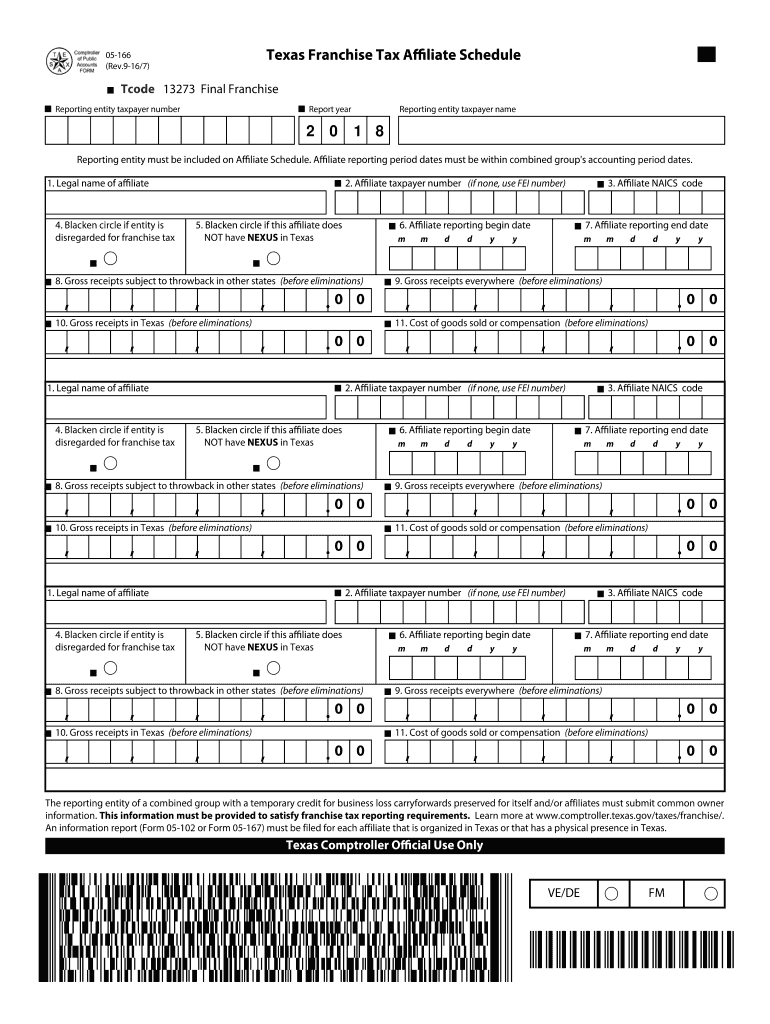

Texas form 05 166 Fill Out and Sign Printable PDF Template SignNow

Taxpayer is a passive entity. Taxpayer is a newly established texas veteran owned business. Taxpayer is a passive entity. This entity has zero texas gross. Complete all sections that apply.

Texas franchise tax instructions

Easily fill out pdf blank, edit, and sign them. Easily sign the texas franchise tax no tax due report 2022 with your finger. Web instructions for each report year are online at www.comptroller.texas.gov/taxes/franchise/forms/. If you have any questions,. Box 4047 terminal a toronto on m5w 1l5 your personal chequing account.

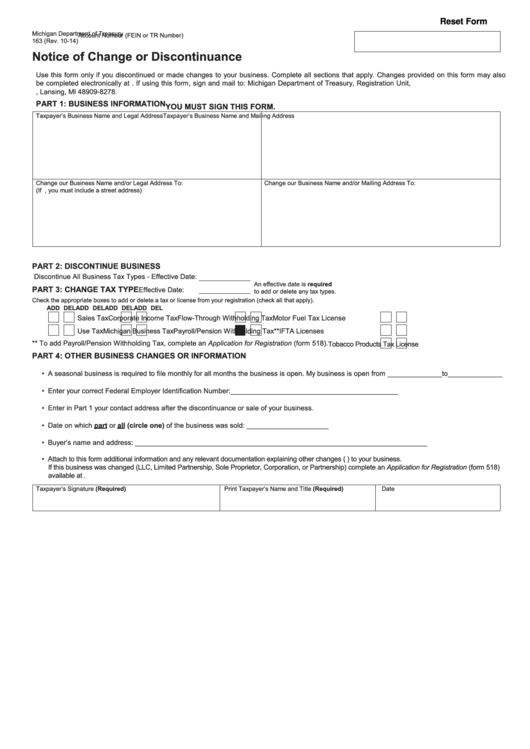

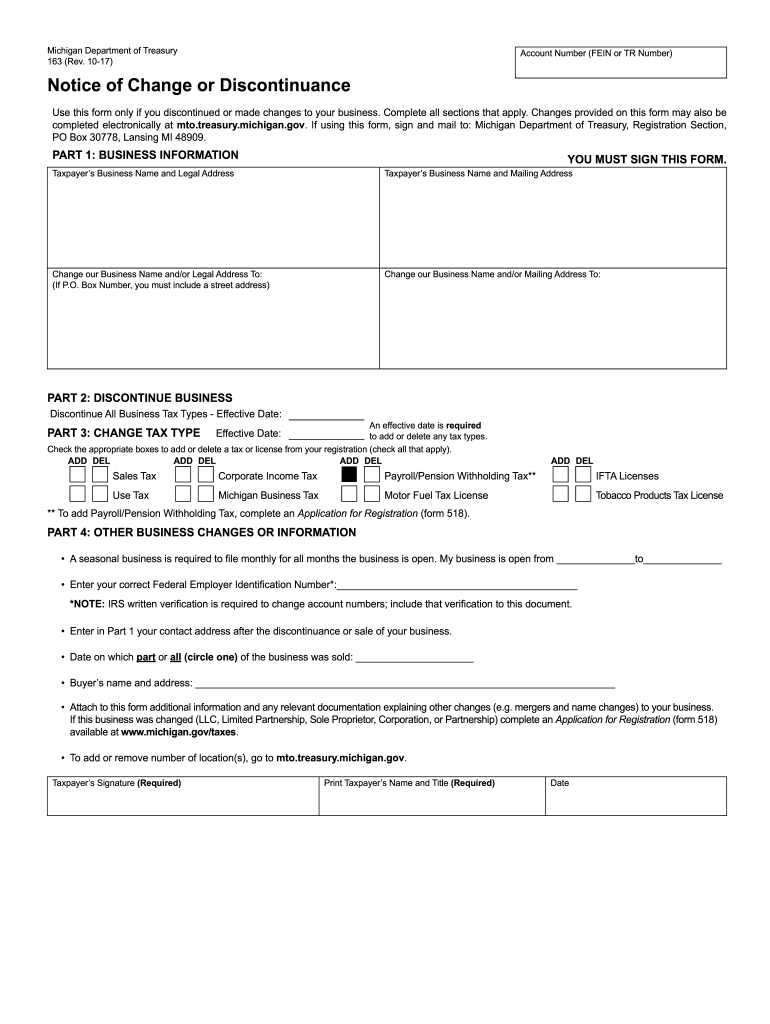

Fillable Form 163 Notice Of Change Or Discontinuance printable pdf

The form can be used to report transactions involving stocks, bonds, options, and other. Box 4047 terminal a toronto on m5w 1l5 your personal chequing account. This entity has zero texas gross. Taxpayer is a newly established texas veteran owned business. Upper tiered partnerships do not qualify to use this form.) yes no 1.

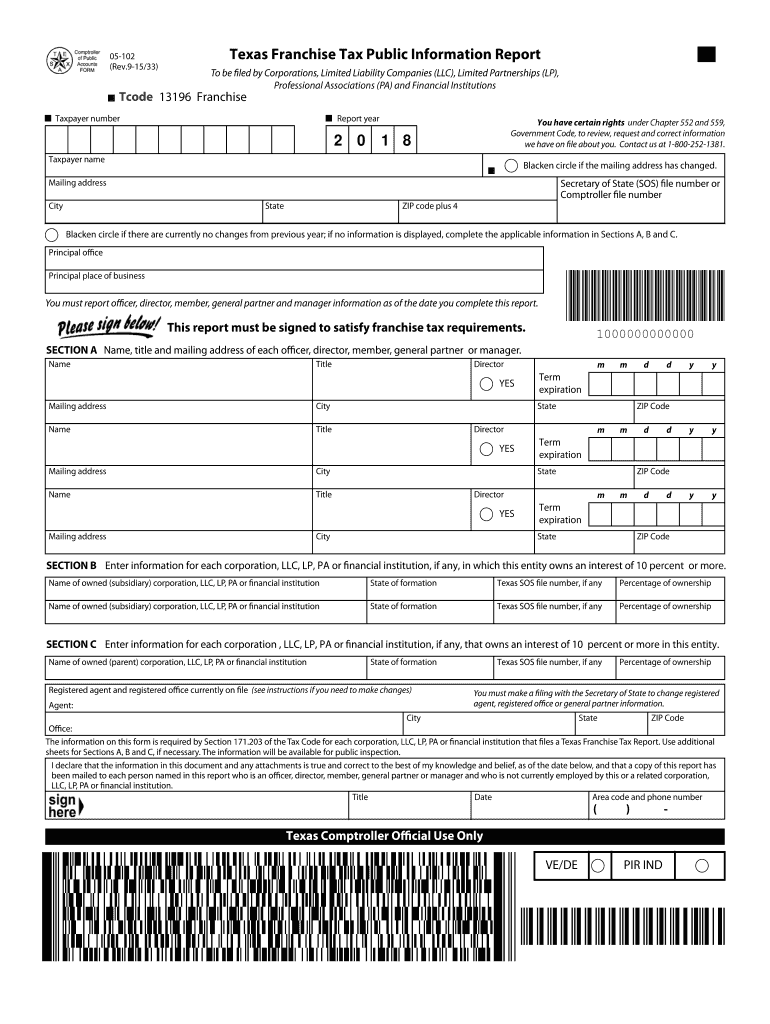

05 102 2018 Fill Out and Sign Printable PDF Template signNow

(passive income does not include rent.) (see instructions.) 2. Register for a free account, set a secure password, and go through email verification to. If you have any questions,. Web form 05 163 is a form designed to help taxpayers report their capital gains and losses. Taxpayer is a newly established texas veteran owned business.

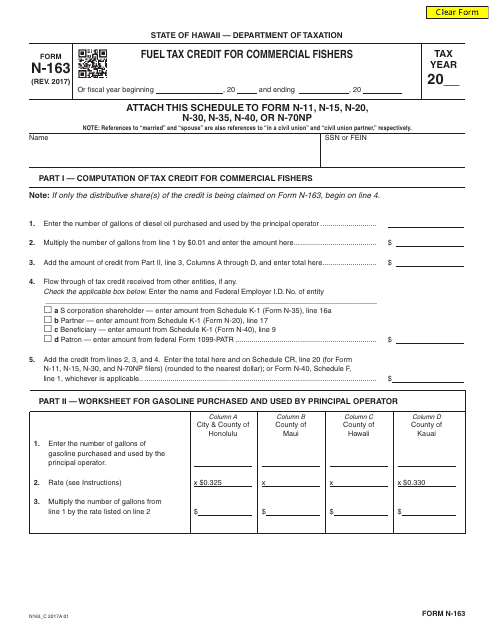

Form N163 Download Fillable PDF or Fill Online Fuel Tax Credit for

The form can be used to report transactions involving stocks, bonds, options, and other. Easily sign the texas franchise tax no tax due report 2022 with your finger. Easily fill out pdf blank, edit, and sign them. (passive income does not include rent.) (see instructions.) 2. Register for a free account, set a secure password, and go through email verification.

2017 Form MI DoT 163 Fill Online, Printable, Fillable, Blank pdfFiller

Web follow this simple guide to edit 05 163 in pdf format online at no cost: If you have any questions,. Open the texas comptroller no tax due report and follow the instructions. Taxpayer is a newly established texas veteran owned business. Complete all sections that apply.

AFCAT Recruitment 2019 For 163 Flying & Ground Duty (Tech & Non Tech

This questionnaire must be completed by any. Register for a free account, set a secure password, and go through email verification to. Easily fill out pdf blank, edit, and sign them. Open the texas comptroller no tax due report and follow the instructions. This entity has zero texas gross.

If You Have Any Questions,.

Taxpayer is a passive entity. Easily sign the texas franchise tax no tax due report 2022 with your finger. Taxpayer is a newly established texas veteran owned business. Upper tiered partnerships do not qualify to use this form.) yes no 1.

This Questionnaire Must Be Completed By Any.

Web instructions for each report year are online at www.comptroller.texas.gov/taxes/franchise/forms/. Complete all sections that apply. (passive income does not include rent.) (see instructions.) 2. Taxpayer is a newly established texas veteran owned business.

Web If You Don’t Owe:

Easily fill out pdf blank, edit, and sign them. Web follow this simple guide to edit 05 163 in pdf format online at no cost: Open the texas comptroller no tax due report and follow the instructions. This entity has zero texas gross.

Web Form 05 163 Is A Form Designed To Help Taxpayers Report Their Capital Gains And Losses.

Box 4047 terminal a toronto on m5w 1l5 your personal chequing account. Register for a free account, set a secure password, and go through email verification to. The form can be used to report transactions involving stocks, bonds, options, and other. Easily fill out pdf blank, edit, and sign them.