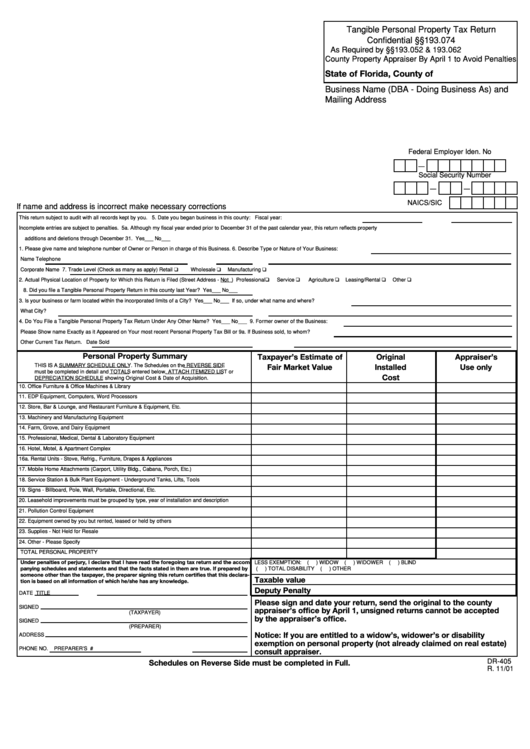

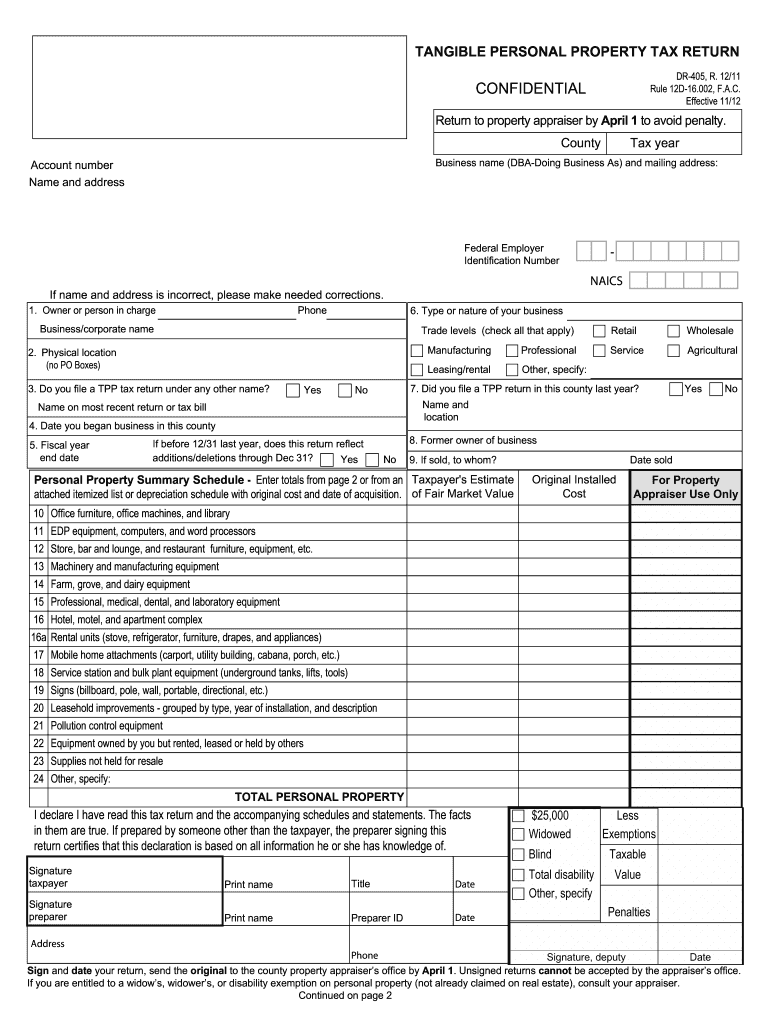

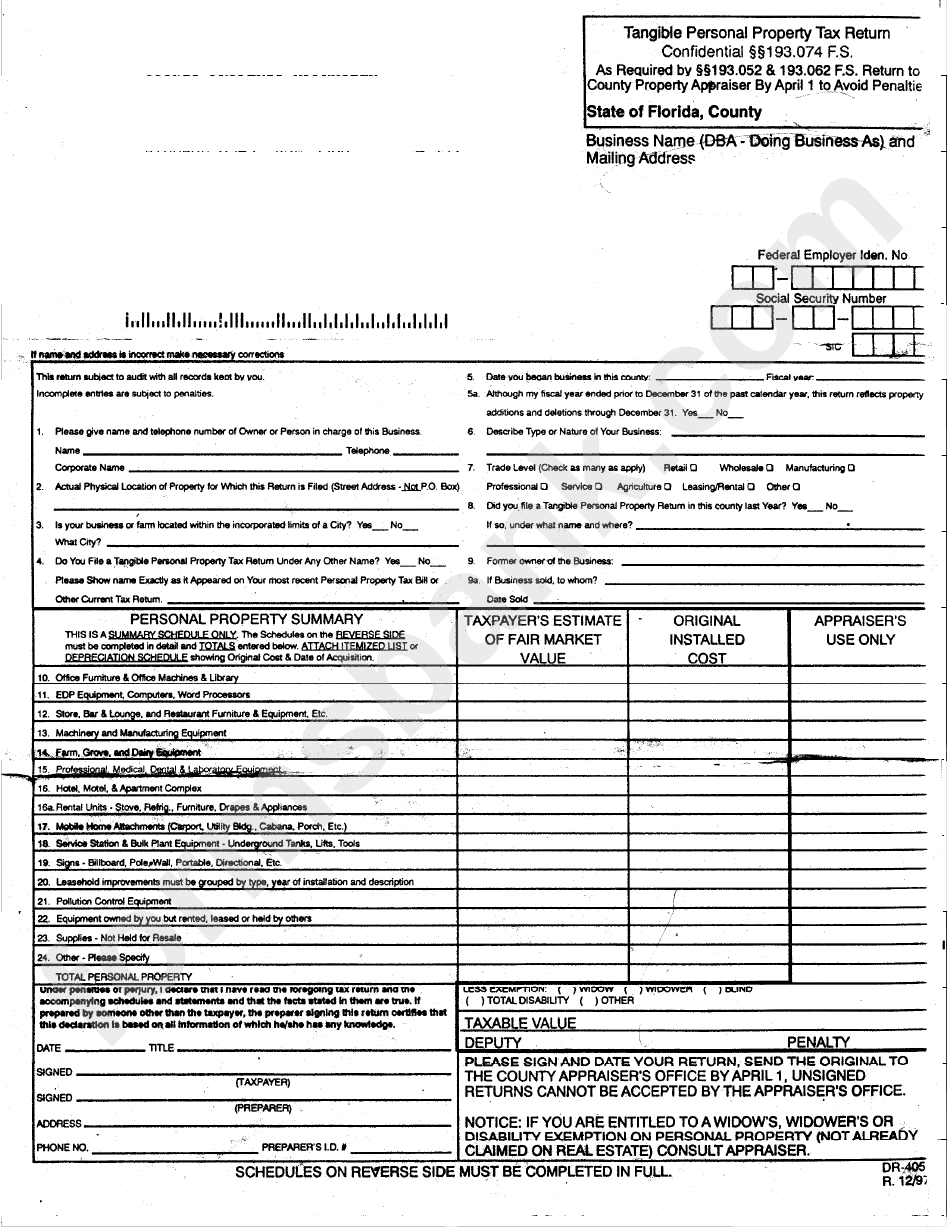

Florida Form Dr 405

Florida Form Dr 405 - Untrended depreciation schedule (for use on replacement cost new) equipment index. Tangible personal property tax return, r. If you were required to file a return in the previous year but did not, you may have to pay a. Notice to taxpayer whose personal property return was waived in the previous year:. Edit your tangible personal property tax online type text, add images, blackout confidential details, add comments, highlights and more. Web all businesses are required to file a tangible personal property tax return ( form dr 405) annually by april 1st (florida statutes 193.062), unless the value of your tangible. Report all property located in the county on january 1. Account number name and address if name and address is incorrect, please make needed corrections. Report all property located in the county on january 1. If you do not file on time, florida law provides for the loss of the $25,000 exemption.

Untrended depreciation schedule (for use on replacement cost new) equipment index. Report all property located in the county on january 1. Web mail this form to your county property appraiser. Sign it in a few clicks draw. You must file a single return for each site in. You have not added any tangible personal property since january 1 and the value of your. Web all businesses are required to file a tangible personal property tax return ( form dr 405) annually by april 1st (florida statutes 193.062), unless the value of your tangible. Web tpp tax return & instructions: Edit your tangible personal property tax online type text, add images, blackout confidential details, add comments, highlights and more. If you were required to file a return in the previous year but did not, you may have to pay a.

Report all property located in the county on january 1. In fact, at least one county requires the form to be filed online from the county's web site. Please use this form to file your return, or attach it to your computer prepared form. Account number name and address if name and address is incorrect, please make needed corrections. Web all businesses are required to file a tangible personal property tax return ( form dr 405) annually by april 1st (florida statutes 193.062), unless the value of your tangible. Web tpp tax return & instructions: Edit your tangible personal property tax online type text, add images, blackout confidential details, add comments, highlights and more. Web mail this form to your county property appraiser. Complete, sign, print and send your tax documents easily with us legal forms. Web each return is eligible for an exemption up to $25,000.

Form Dr405 Tangible Personal Property Tax Return 2001 printable pdf

Web all businesses are required to file a tangible personal property tax return ( form dr 405) annually by april 1st (florida statutes 193.062), unless the value of your tangible. Edit your tangible personal property tax online type text, add images, blackout confidential details, add comments, highlights and more. Notice to taxpayer whose personal property return was waived in the.

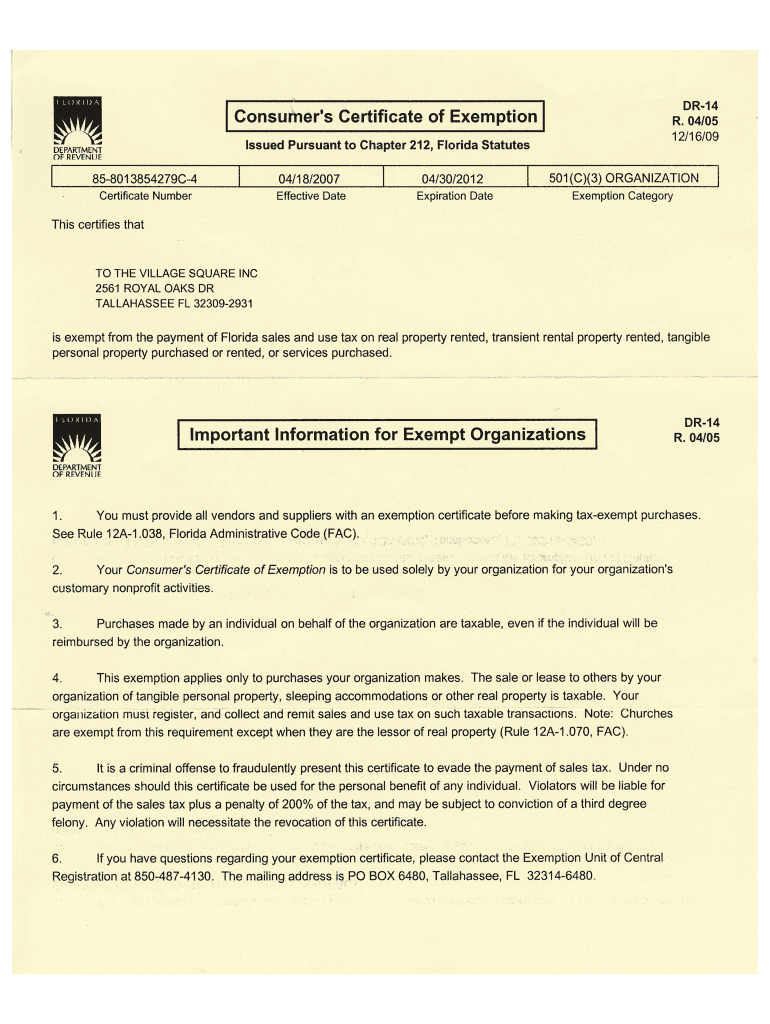

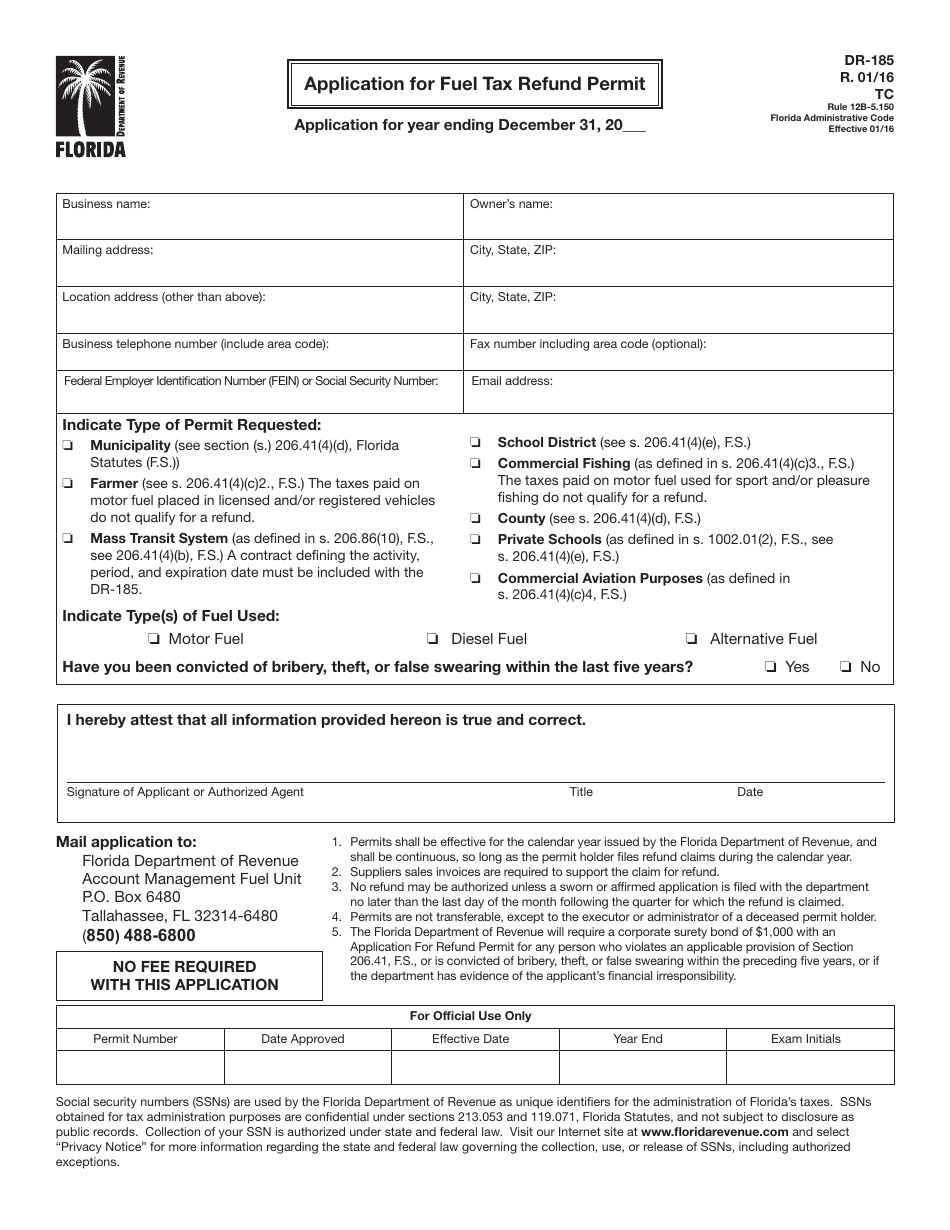

Dr 14 Form Fill Out and Sign Printable PDF Template signNow

Web each return is eligible for an exemption up to $25,000. If you were required to file a return in the previous year but did not, you may have to pay a. Tangible personal property tax return, r. You have not added any tangible personal property since january 1 and the value of your. Account number name and address if.

form dr 405 florida Fill out & sign online DocHub

If you were required to file a return in the previous year but did not, you may have to pay a. You must file a single return for each site in. Complete, sign, print and send your tax documents easily with us legal forms. You have not added any tangible personal property since january 1 and the value of your..

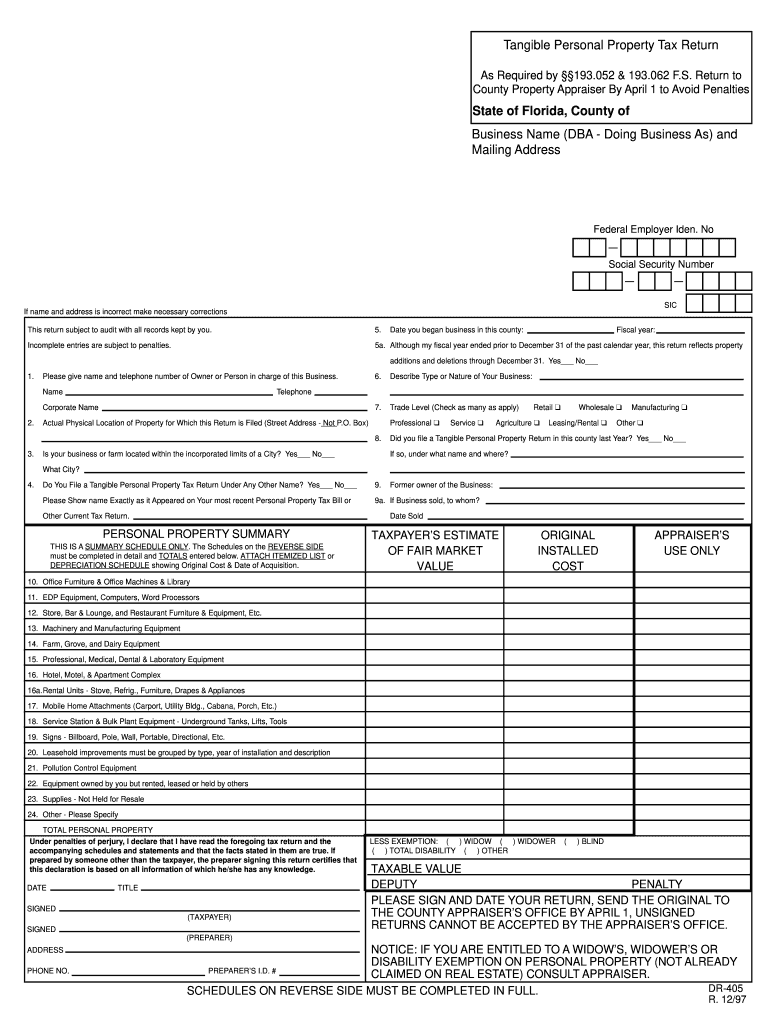

1997 Form FL DoR DR405 Fill Online, Printable, Fillable, Blank PDFfiller

You have not added any tangible personal property since january 1 and the value of your. Untrended depreciation schedule (for use on replacement cost new) equipment index. In fact, at least one county requires the form to be filed online from the county's web site. If you do not file on time, florida law. Edit your tangible personal property tax.

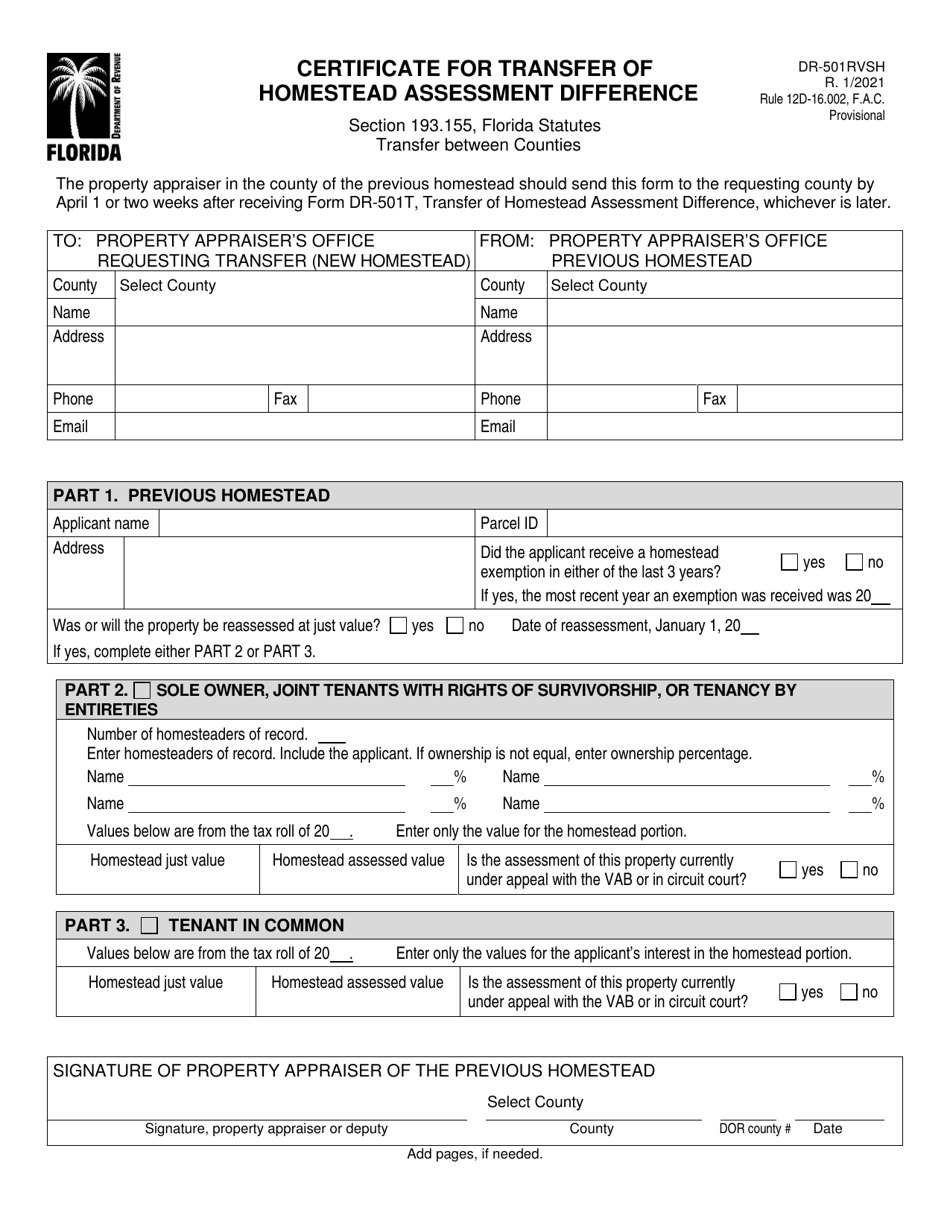

Form DR501RVSH Download Fillable PDF or Fill Online Certificate for

Web tpp tax return & instructions: Account number name and address if name and address is incorrect, please make needed corrections. Tangible personal property tax return, r. You have not added any tangible personal property since january 1 and the value of your. You must file a single return for each site in.

20162021 Form FL DR15AIR Fill Online, Printable, Fillable, Blank

Notice to taxpayer whose personal property return was waived in the previous year:. Please use this form to file your return, or attach it to your computer prepared form. Report all property located in the county on january 1. In fact, at least one county requires the form to be filed online from the county's web site. Sign it in.

Dr 405 instructions Fill Out and Sign Printable PDF Template signNow

You have not added any tangible personal property since january 1 and the value of your. Untrended depreciation schedule (for use on replacement cost new) equipment index. Please use this form to file your return, or attach it to your computer prepared form. Report all property located in the county on january 1. In fact, at least one county requires.

Fillable Form Dr405 Tangible Personal Property Tax Return printable

Web mail this form to your county property appraiser. If you do not file on time, florida law. Edit your tangible personal property tax online type text, add images, blackout confidential details, add comments, highlights and more. In fact, at least one county requires the form to be filed online from the county's web site. Notice to taxpayer whose personal.

Form DR185 Download Printable PDF or Fill Online Application for Fuel

You have not added any tangible personal property since january 1 and the value of your. Notice to taxpayer whose personal property return was waived in the previous year:. Web each return is eligible for an exemption up to $25,000. Sign it in a few clicks draw. Tangible personal property tax return, r.

Form DR157WT Download Printable PDF or Fill Online Additional Fuel

Tangible personal property tax return, r. Complete, sign, print and send your tax documents easily with us legal forms. Please use this form to file your return, or attach it to your computer prepared form. Report all property located in the county on january 1. Web all businesses are required to file a tangible personal property tax return ( form.

Report All Property Located In The County On January 1.

Notice to taxpayer whose personal property return was waived in the previous year:. Web each return is eligible for an exemption up to $25,000. Untrended depreciation schedule (for use on replacement cost new) equipment index. If you were required to file a return in the previous year but did not, you may have to pay a.

If You Do Not File On Time, Florida Law Provides For The Loss Of The $25,000 Exemption.

Web tpp tax return & instructions: Tangible personal property tax return, r. You must file a single return for each site in. Download blank or fill out online in pdf format.

Complete, Sign, Print And Send Your Tax Documents Easily With Us Legal Forms.

Report all property located in the county on january 1. Web mail this form to your county property appraiser. If you do not file on time, florida law. You have not added any tangible personal property since january 1 and the value of your.

Please Use This Form To File Your Return, Or Attach It To Your Computer Prepared Form.

In fact, at least one county requires the form to be filed online from the county's web site. Account number name and address if name and address is incorrect, please make needed corrections. Sign it in a few clicks draw. Edit your tangible personal property tax online type text, add images, blackout confidential details, add comments, highlights and more.