Firpta Withholding Form

Firpta Withholding Form - Or suite no., or rural route. Web by kunal patel firpta witholding rules may apply to a disposition of a u.s. Withholding of the funds is required at the time of sale, and. Issues, and sends you, a final tax slip. This form is intended for use only by individual buyers (not by corporations, partnerships, or other entities). What firpta is and how it works. The withholding rate is generally 15% (10% for dispositions. Real property interest by a foreign person. Use this address if you are not enclosing a payment use this. This form does not need to be.

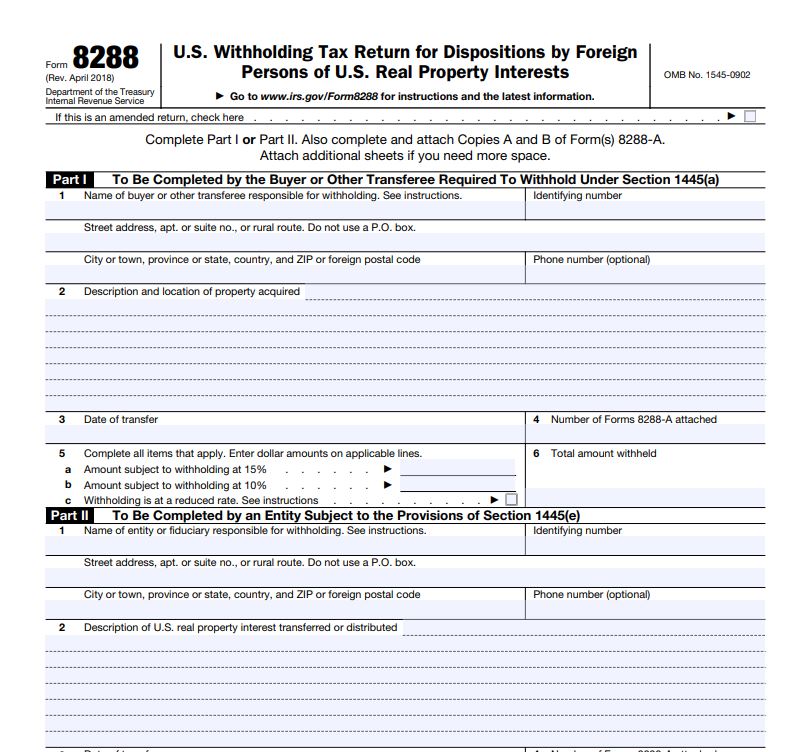

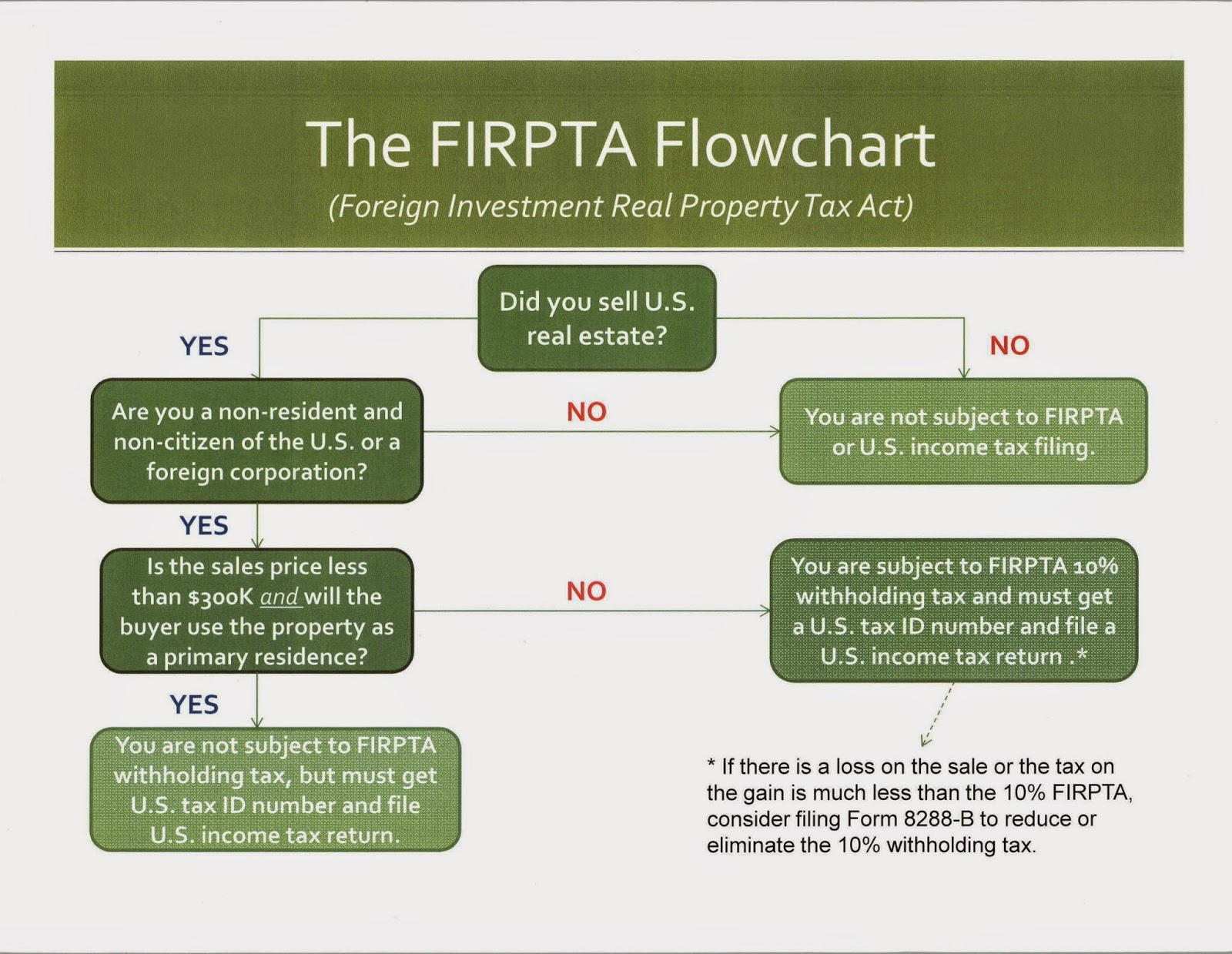

The withholding rate is generally 15% (10% for dispositions. Employers engaged in a trade or business who. Web firpta is a tax law that imposes u.s. Web firpta withholding is required to be submitted to the irs within 20 days of the closing together with irs form 8288, u.s. Real property interest by a foreign person. Web complete the firpta forms. Real estate from a foreign person, you may be. Employee's withholding certificate form 941; Income tax on foreign persons selling u.s. Or suite no., or rural route.

Taxpayer identification number (tin) street address, apt. Form 8288 also serves as the transmittal form for. It is based on the actual gain of a sale instead of the selling price. A withholding certificate is an application for a reduced withholding. Under firpta, if you buy u.s. Real property interest by a foreign person. This form is intended for use only by individual buyers (not by corporations, partnerships, or other entities). Or suite no., or rural route. Web by kunal patel firpta witholding rules may apply to a disposition of a u.s. What firpta is and how it works.

Why Oregon Realtors® Have No Business Being Involved in FIRPTA

Web information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to file. Such transactions are subject to the foreign. Withholding tax return for disposition by foreign. This form is intended for use only by individual buyers (not by corporations, partnerships, or other entities). Web complete the firpta forms.

Firpta withholding certificate 90 days Fill online, Printable

Taxpayer identification number (tin) street address, apt. Web the tax withheld on the acquisition of a u.s. Employers engaged in a trade or business who. Web firpta withholding is required to be submitted to the irs within 20 days of the closing together with irs form 8288, u.s. Web generally, the transferee must withhold a tax on the total amount.

What Realtors Need to Know About the FIRPTA Withholding Certificate

Use this address if you are not enclosing a payment use this. Employers engaged in a trade or business who. Web however, you should not file the firpta form until the 20 th day, unless the irs emails you the copy of the notice of denial or withholding certificate. Withholding tax return for disposition by foreign. Web information about form.

FIRPTA Withholdings and Exceptions First Integrity Title Company

Use this address if you are not enclosing a payment use this. Withholding tax return for disposition by foreign. Employee's withholding certificate form 941; Withholding of the funds is required at the time of sale, and. Web firpta withholding is required to be submitted to the irs within 20 days of the closing together with irs form 8288, u.s.

What is FIRPTA and how do I avoid it? Sarasota/Manatee Area Real

Taxpayer identification number (tin) street address, apt. What firpta is and how it works. Web however, you should not file the firpta form until the 20 th day, unless the irs emails you the copy of the notice of denial or withholding certificate. Web firpta withholding is required to be submitted to the irs within 20 days of the closing.

What is FIRPTA and How to Avoid It

Employers engaged in a trade or business who. Real estate from a foreign person, you may be. Web firpta withholding is required to be submitted to the irs within 20 days of the closing together with irs form 8288, u.s. Real property interest by a foreign person. The buyer must fill out the firpta form 8288, which is the “u.s.

FIRPTA Rules

Withholding tax return for disposition by foreign. Web firpta is a tax law that imposes u.s. Real property interest from a foreign person is reported and paid using form 8288. Web 1a name of buyer or other party responsible for withholding. Firpta imposes a tax on capital gains derived by foreign persons from the disposition of u.s.

Buyer's Affidavit FIRPTA Withholding Exemption PRINTABLES

Web firpta withholding is required to be submitted to the irs within 20 days of the closing together with irs form 8288, u.s. Real property interest from a foreign person is reported and paid using form 8288. Employers engaged in a trade or business who. Taxpayer identification number (tin) street address, apt. Web the withholding obligation also applies to foreign.

FIRPTA Update Advanced American Tax

Web information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to file. This form is intended for use only by individual buyers (not by corporations, partnerships, or other entities). Web by kunal patel firpta witholding rules may apply to a disposition of a u.s. It is based on the.

What the Change to FIRPTA Withholding Means for You IPX1031

Web generally, the transferee must withhold a tax on the total amount that the foreign person realizes on the disposition. Real property interest by a foreign person. Web however, you should not file the firpta form until the 20 th day, unless the irs emails you the copy of the notice of denial or withholding certificate. Form 8288 also serves.

A Withholding Certificate Is An Application For A Reduced Withholding.

The buyer must fill out the firpta form 8288, which is the “u.s. Or suite no., or rural route. Withholding tax return for dispositions by foreign persons of u.s. Web information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to file.

What Firpta Is And How It Works.

This form is intended for use only by individual buyers (not by corporations, partnerships, or other entities). Web the withholding obligation also applies to foreign and domestic corporations, qualified investment entities, and the fiduciary of certain trusts and estates. This form does not need to be. Web however, you should not file the firpta form until the 20 th day, unless the irs emails you the copy of the notice of denial or withholding certificate.

Under Firpta, If You Buy U.s.

Employee's withholding certificate form 941; Web the tax withheld on the acquisition of a u.s. Real property interest from a foreign person is reported and paid using form 8288. Web firpta withholding is required to be submitted to the irs within 20 days of the closing together with irs form 8288, u.s.

Employers Engaged In A Trade Or Business Who.

Web complete the firpta forms. Web applies the withholding tax to your existing itin. Issues, and sends you, a final tax slip. The withholding rate is generally 15% (10% for dispositions.