File Form 7004 Online Free

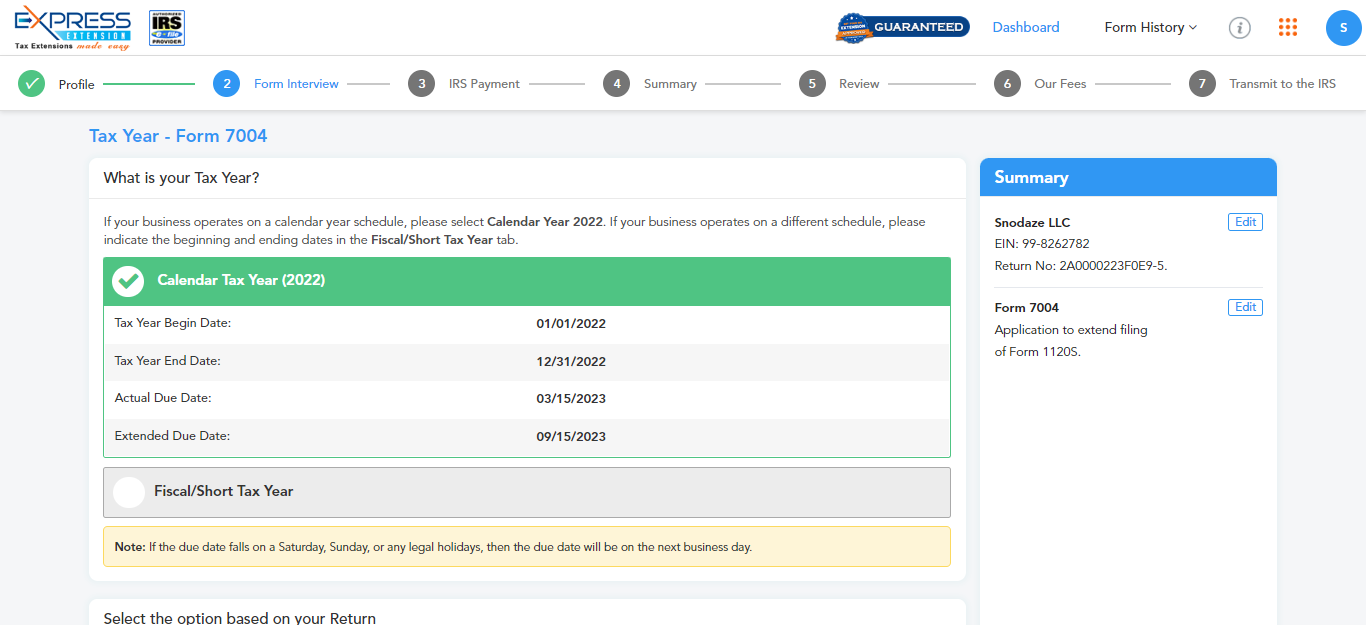

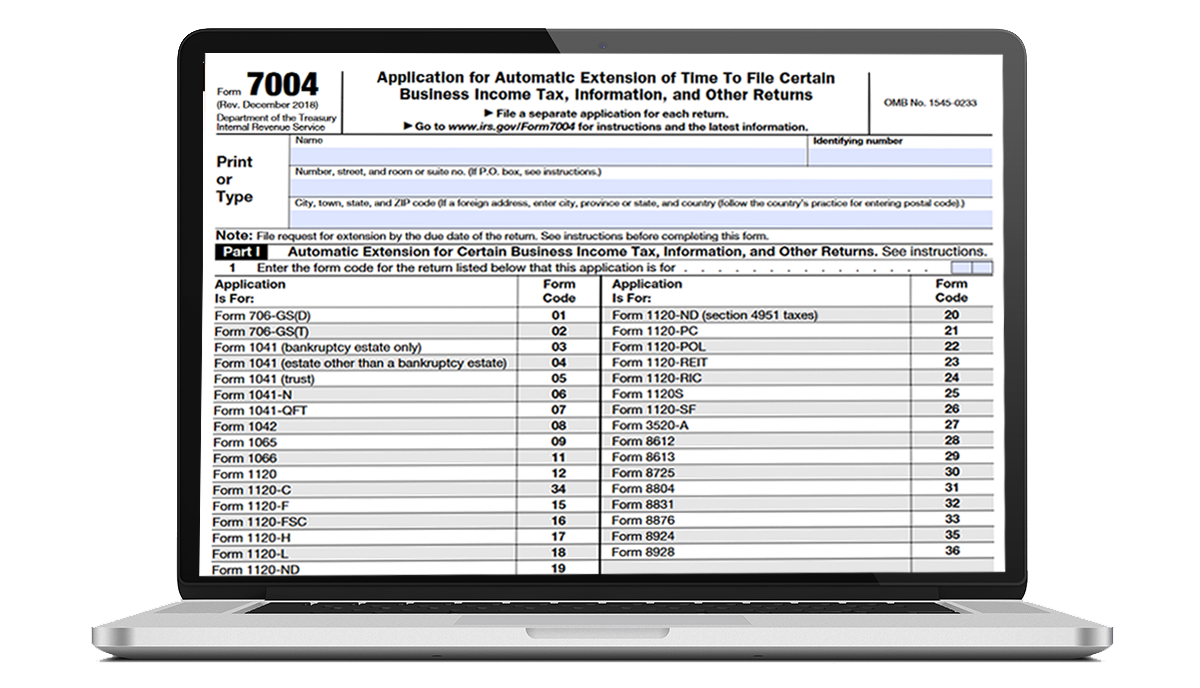

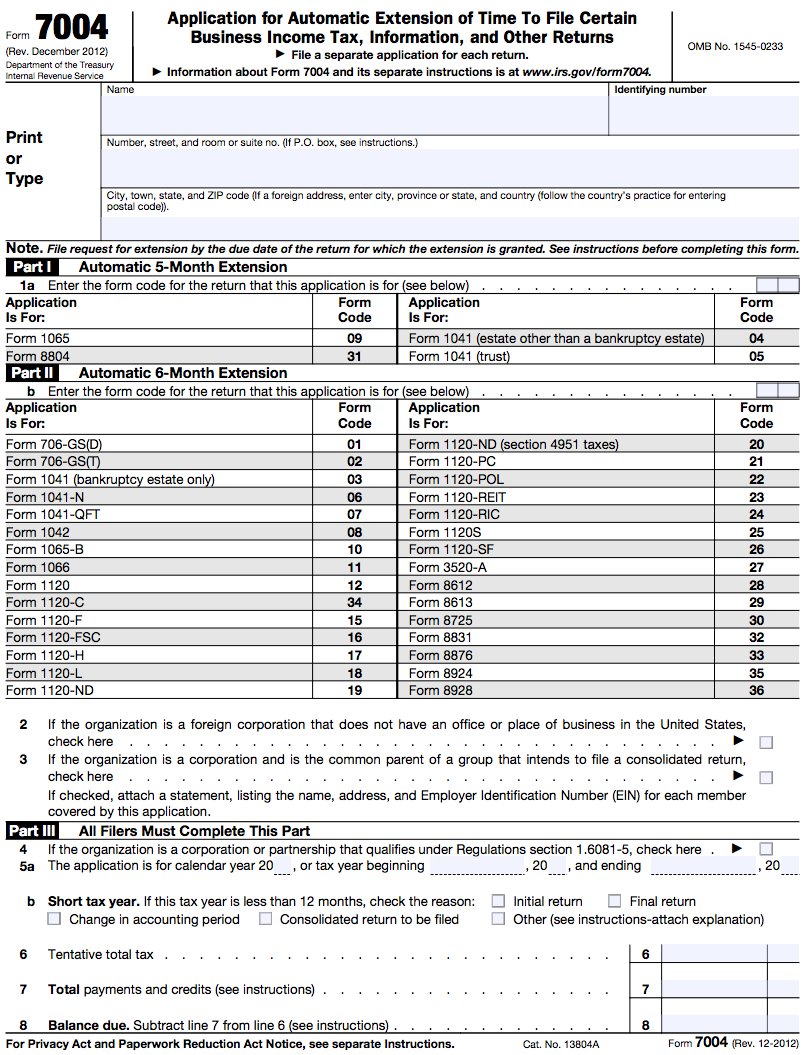

File Form 7004 Online Free - Web filling out irs 7004. Web 1 min read you can extend filing form 1120s when you file form 7004. Application for automatic extension of time to file certain business income tax,. Select business entity & form step 3: Automatic extension, irs requires no explanation. It can also be submitted electronically via the irs website. Enter code 25 in the box on form 7004, line 1. Web about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns. Irs 7004 form must be filled out and sent to the irs. You may obtain a record of your earnings history by establishing an online social security account on the social.

Application for automatic extension of time (irs) form is 1 page long and contains: Web from within your taxact return ( online or desktop), click filing to expand, then click file extension. Select the tax year step 4: Before you start filling out the printable or fillable form. Web select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time to file certain business. Web filing form ssa 7004 is completely optional. Transmit your form to the irs ready to e. Enter tax payment details step 5: Irs 7004 form must be filled out and sent to the irs. Web the form 7004:

Web 1 min read you can extend filing form 1120s when you file form 7004. November 2011) department of the treasury internal revenue service. Import tax data online in no time with our easy to use simple tax software. Payment of tax line 1a—extension date. Turbotax expert does your taxes back expert does your taxes full service for personal taxes full service for. Web file form 7004 by the 15th day of the 6th month following the close of the tax year. The form is easy to fill out. You may obtain a record of your earnings history by establishing an online social security account on the social. Irs 7004 form must be filled out and sent to the irs. Application for automatic extension of time (irs) form is 1 page long and contains:

How to file an LLC extension Form 7004 YouTube

Web form 7004 can be filed electronically for most returns. November 2011) department of the treasury internal revenue service. Select business entity & form step 3: Select the tax year step 4: Enter code 25 in the box on form 7004, line 1.

EFile IRS Form 7004 How to file 7004 Extension Online

Automatic extension, irs requires no explanation. A foreign corporation with an office or place of business. Use form 7004 to request an automatic 6. To electronically file form 7004, application for automatic. Complete, edit or print tax forms instantly.

Last Minute Tips To Help You File Your Form 7004 Blog

Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Web filing form ssa 7004 is completely optional. Web from within your taxact return ( online or desktop), click filing to expand, then click file extension. Use form 7004 to request an automatic 6.

E File Form 7004 Online Universal Network

To electronically file form 7004, application for automatic. It can also be submitted electronically via the irs website. Web from within your taxact return ( online or desktop), click filing to expand, then click file extension. Web how do i file extension form 7004 online for free? Web find the federal tax form either online as a pdf file, or.

File Form 7004 Online 2023 Business Tax Extension Form

Enter business details step 2: In minutes and get 6 months extension to file business income tax returns. Web the form 7004: To electronically file form 7004, application for automatic. Before you start filling out the printable or fillable form.

Where to file Form 7004 Federal Tax TaxUni

Enter code 25 in the box on form 7004, line 1. Web select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time to file certain business. Select business entity & form step 3: Ad filing your taxes just became easier. Web form 7004 can be filed electronically for.

EFile 7004 Online 2022 File Business Tax extension Form

Payment of tax line 1a—extension date. It can also be submitted electronically via the irs website. In minutes and get 6 months extension to file business income tax returns. Web how do i file extension form 7004 online for free? Application for automatic extension of time (irs) form is 1 page long and contains:

How To Fill Out Property Tax Form Property Walls

Select the tax year step 4: Application for automatic extension of time (irs) form is 1 page long and contains: Web filing form ssa 7004 is completely optional. You may obtain a record of your earnings history by establishing an online social security account on the social. Web form 7004 can be filed electronically for most returns.

File Form 7004 Online 2021 Business Tax Extension Form

Complete, edit or print tax forms instantly. Web from within your taxact return ( online or desktop), click filing to expand, then click file extension. Transmit your form to the irs ready to e. Web file form 7004 by the 15th day of the 6th month following the close of the tax year. Web the form 7004:

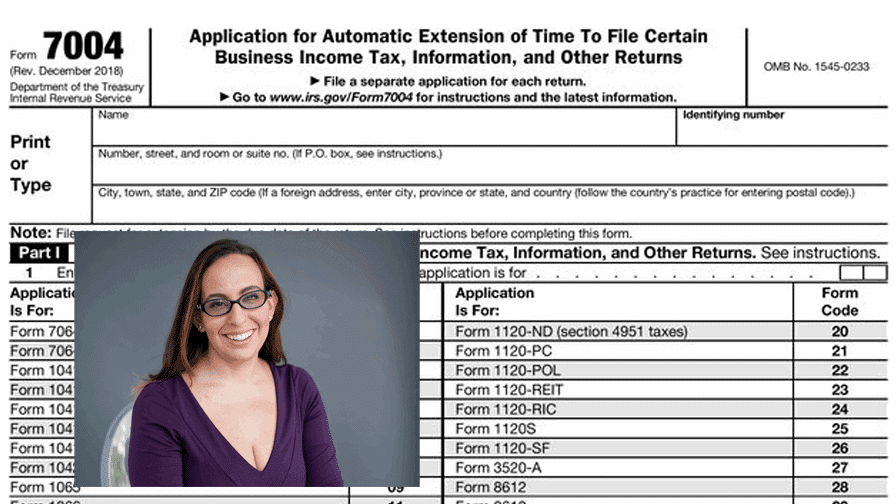

How to file an LLC Tax extension Form 7004 Bette Hochberger, CPA, CGMA

Enter code 25 in the box on form 7004, line 1. Payment of tax line 1a—extension date. In minutes and get 6 months extension to file business income tax returns. A foreign corporation with an office or place of business. Transmit your form to the irs ready to e.

You May Obtain A Record Of Your Earnings History By Establishing An Online Social Security Account On The Social.

Enter tax payment details step 5: Complete, edit or print tax forms instantly. It can also be submitted electronically via the irs website. Web how do i file form 7004, application for automatic extension of time to file certain business income tax, information, and other returns?

Turbotax Expert Does Your Taxes Back Expert Does Your Taxes Full Service For Personal Taxes Full Service For.

Irs 7004 form must be filled out and sent to the irs. Enter your business information & applicable business entity type; Select the tax year step 4: Use form 7004 to request an automatic 6.

Web How Do I File Extension Form 7004 Online For Free?

Web find the federal tax form either online as a pdf file, or you can request a printable blank template from the irs website. Web form 7004 can be filed electronically for most returns. Web 1 min read you can extend filing form 1120s when you file form 7004. November 2011) department of the treasury internal revenue service.

The Form Is Easy To Fill Out.

Enter business details step 2: Application for automatic extension of time (irs) form is 1 page long and contains: Web about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns. In minutes and get 6 months extension to file business income tax returns.