File Form 568 Online

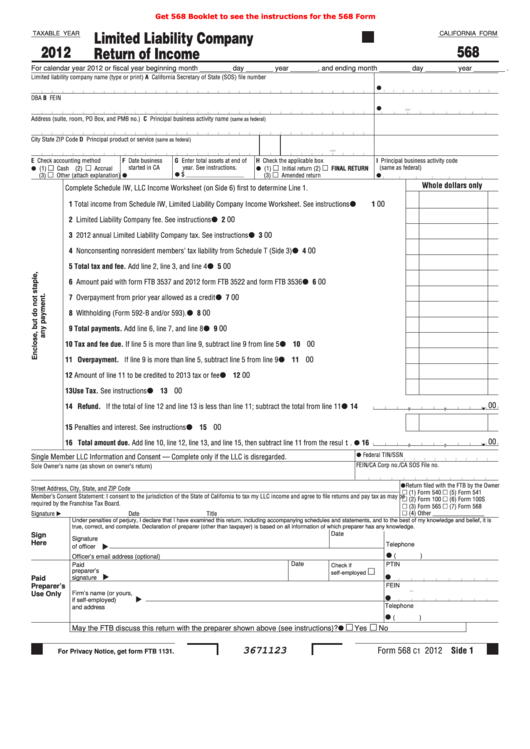

File Form 568 Online - Form 568 is due on march 31st following the end of the tax year. • form 568, limited liability company return of income • form 565, partnership return of income • form 100, california. All the other additional financial records and tax documents must agree and. Web california form 568 for limited liability company return of income is a separate state formset. When is the annual tax due? Web to generate form 568, limited liability company return of income, choose file > client properties, click the california tab, and mark the limited liability company option. Web form 568 due date. Web file limited liability company return of income (form 568) by the original return due date. Web we require an smllc to file form 568, even though they are considered a disregarded entity for tax purposes. Web single member llc filing california form 568 efile (turbotax online self employed) i am a bit confused and seeing mixed messages on turbotax pages saying.

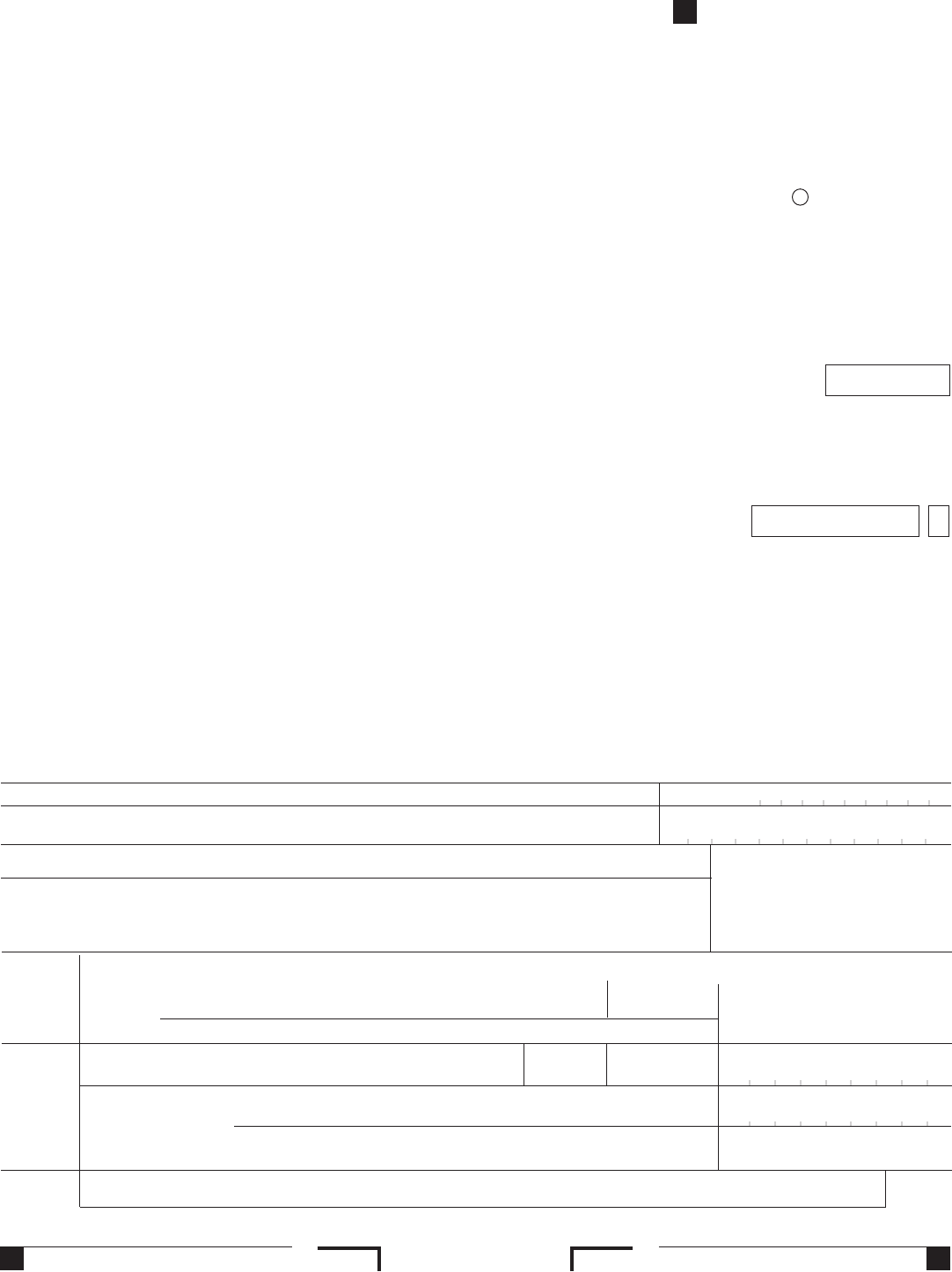

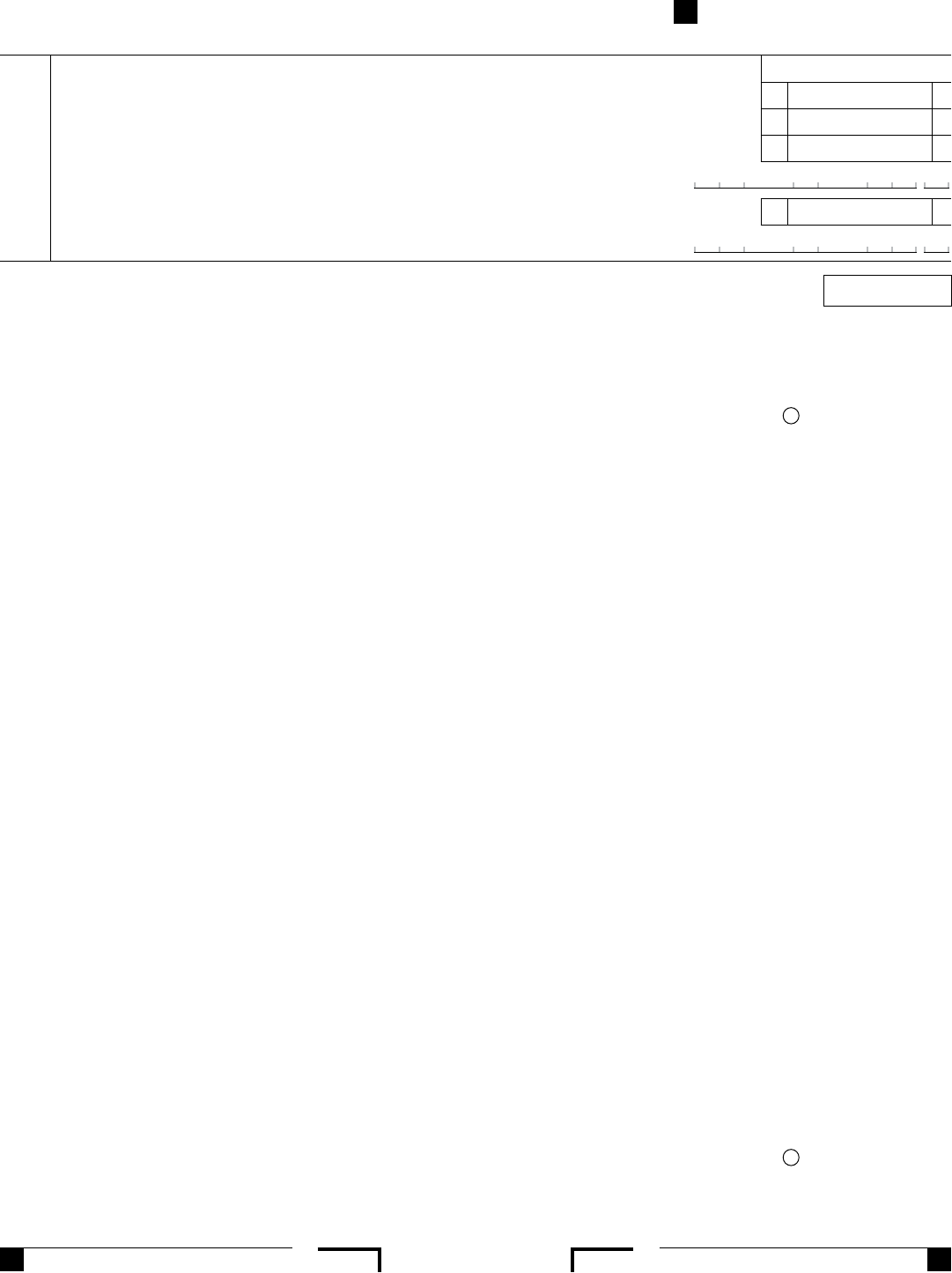

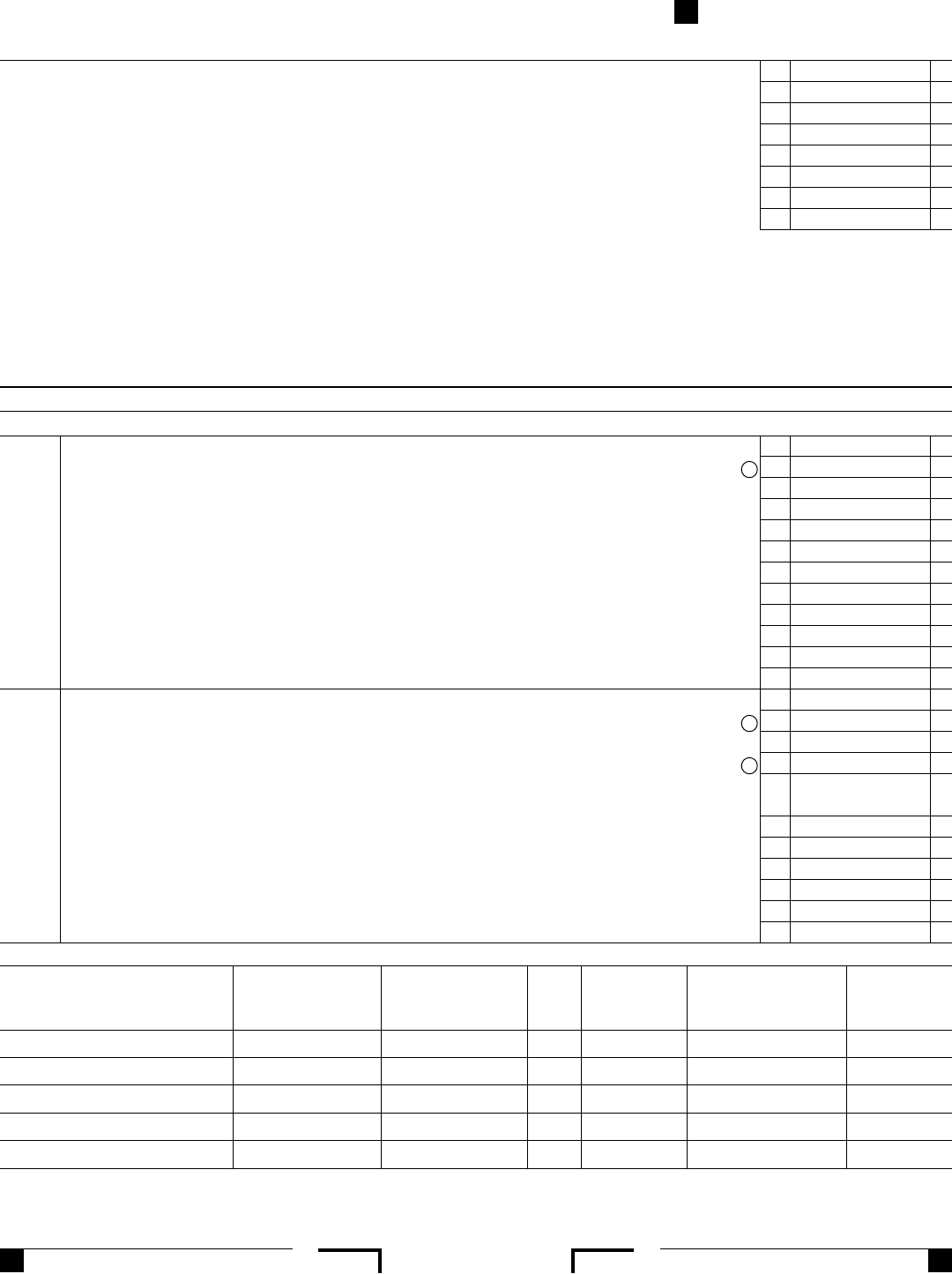

You and your clients should be aware that a disregarded smllc is required to: Web to complete california form 568 for a partnership, from the main menu of the california return, select: Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. When is the annual tax due? Llcs classified as a disregarded entity or. Web california form 568 for limited liability company return of income is a separate state formset. Web i (1)during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal entity in which the llc. Web to generate form 568, limited liability company return of income, choose file > client properties, click the california tab, and mark the limited liability company option. Web you still have to file form 568 if the llc is registered in california. Side 3 (continued from side 2) • federal tin/ssn sole owner’s name (as shown on owner’s return) • fein/ca corp no./ca sos file no.

Web california form 568 for limited liability company return of income is a separate state formset. Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. Llcs may be classified for tax purposes as a partnership, a corporation, or a disregarded entity. Web ca form 568 is a tax document. Web file limited liability company return of income (form 568) by the original return due date. Web we require an smllc to file form 568, even though they are considered a disregarded entity for tax purposes. If your llc files on an extension, refer to payment for automatic extension for. The llc must file the appropriate. How to fill in california form 568 if you have an llc, here’s how to fill in the california form 568:. While you can submit your state income tax return and federal income tax return by april 15,.

Ca Form 568 Instructions 2021 Mailing Address To File manyways.top 2021

Web llcs classified as partnerships file form 568. When is the annual tax due? The llc must file the appropriate. Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. Web california form 568 for limited liability company return of income is a separate state formset.

Fillable California Form 568 Limited Liability Company Return Of

Web to complete california form 568 for a partnership, from the main menu of the california return, select: They are subject to the annual tax, llc fee and credit limitations. Llcs classified as a disregarded entity or. Llcs may be classified for tax purposes as a partnership, a corporation, or a disregarded entity. Most llcs doing business in california must.

2013 Form 568 Limited Liability Company Return Of Edit, Fill

Llcs classified as a disregarded entity or. Web what is form 568? Web i (1)during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal entity in which the llc. Web when is form 568 due? Web smllcs, owned by an individual, are required to.

2016 Form 568 Limited Liability Company Return Of Edit, Fill

Side 3 (continued from side 2) • federal tin/ssn sole owner’s name (as shown on owner’s return) • fein/ca corp no./ca sos file no. Web we require an smllc to file form 568, even though they are considered a disregarded entity for tax purposes. While you can submit your state income tax return and federal income tax return by april.

2016 Form 568 Limited Liability Company Return Of Edit, Fill

You and your clients should be aware that a disregarded smllc is required to: Web what is form 568? Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. If your llc files on an extension, refer to payment for automatic extension for. Web smllcs, owned by.

2020 Form CA FTB 568 Fill Online, Printable, Fillable, Blank pdfFiller

Registration after the year begins. You and your clients should be aware that a disregarded smllc is required to: Web we require an smllc to file form 568, even though they are considered a disregarded entity for tax purposes. The llc must file the appropriate. It isn't included with the regular ca state partnership formset.

form 568 2015 Fill out & sign online DocHub

Web you still have to file form 568 if the llc is registered in california. Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. Llcs may be classified for tax purposes as a partnership, a corporation, or a disregarded entity. Web file limited liability company return.

Form 568 Instructions 2022 2023 State Tax TaxUni

Form 568 is due on march 31st following the end of the tax year. Web ca form 568 is a tax document. Web i (1)during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal entity in which the llc. Web single member llc filing.

2016 Form 568 Limited Liability Company Return Of Edit, Fill

Form 568 is due on march 31st following the end of the tax year. Web file limited liability company return of income (form 568) by the original return due date. Web california form 568 for limited liability company return of income is a separate state formset. All the other additional financial records and tax documents must agree and. Side 3.

FTB Form 568 Assistance Dimov Tax & CPA Services

Web i (1)during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal entity in which the llc. How to fill in california form 568 if you have an llc, here’s how to fill in the california form 568:. Side 3 (continued from side 2).

Web Single Member Llc Filing California Form 568 Efile (Turbotax Online Self Employed) I Am A Bit Confused And Seeing Mixed Messages On Turbotax Pages Saying.

Llcs classified as a disregarded entity or. You and your clients should be aware that a disregarded smllc is required to: All the other additional financial records and tax documents must agree and. Web file limited liability company return of income (form 568) by the original return due date.

Web Llcs Classified As Partnerships File Form 568.

Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. The llc must file the appropriate. Web you still have to file form 568 if the llc is registered in california. Side 3 (continued from side 2) • federal tin/ssn sole owner’s name (as shown on owner’s return) • fein/ca corp no./ca sos file no.

Web Smllcs, Owned By An Individual, Are Required To File Form 568 On Or Before April 15.

Registration after the year begins. It isn't included with the regular ca state partnership formset. When is the annual tax due? Web what is form 568?

Web To Generate Form 568, Limited Liability Company Return Of Income, Choose File > Client Properties, Click The California Tab, And Mark The Limited Liability Company Option.

Web form 568 due date. Most llcs doing business in california must file form ca form 568 (limited liability company return of income), form ftb 3522 (llc tax. If your llc files on an extension, refer to payment for automatic extension for. Web ca form 568 is a tax document.