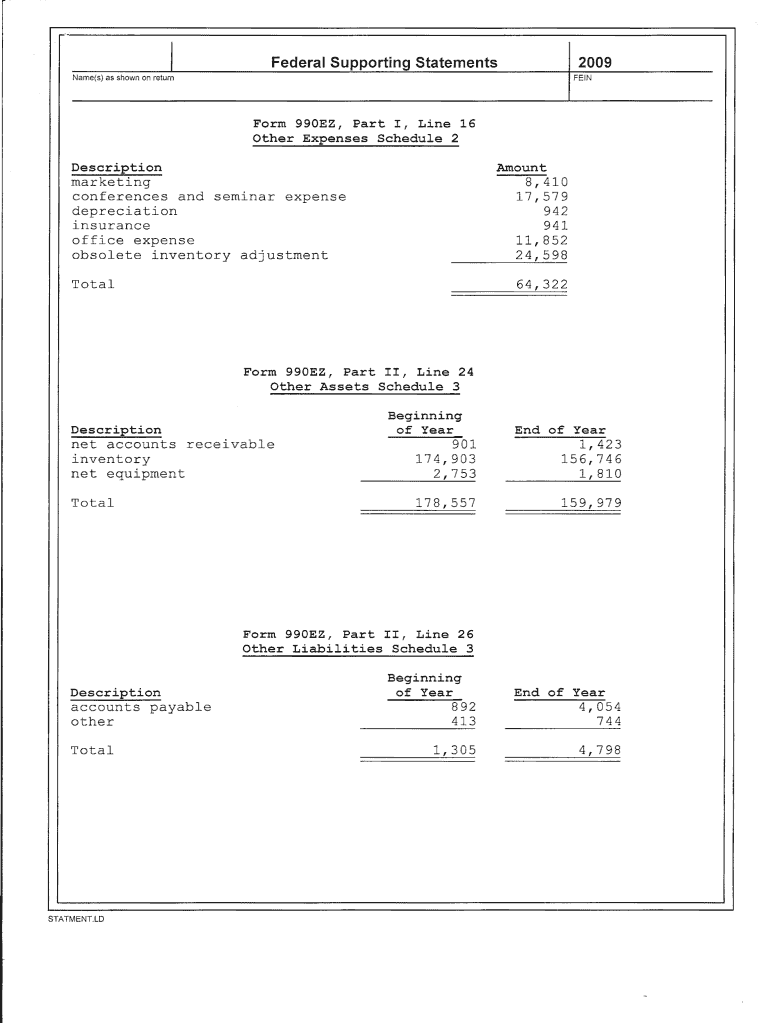

Federal Supporting Statements Form 1120S

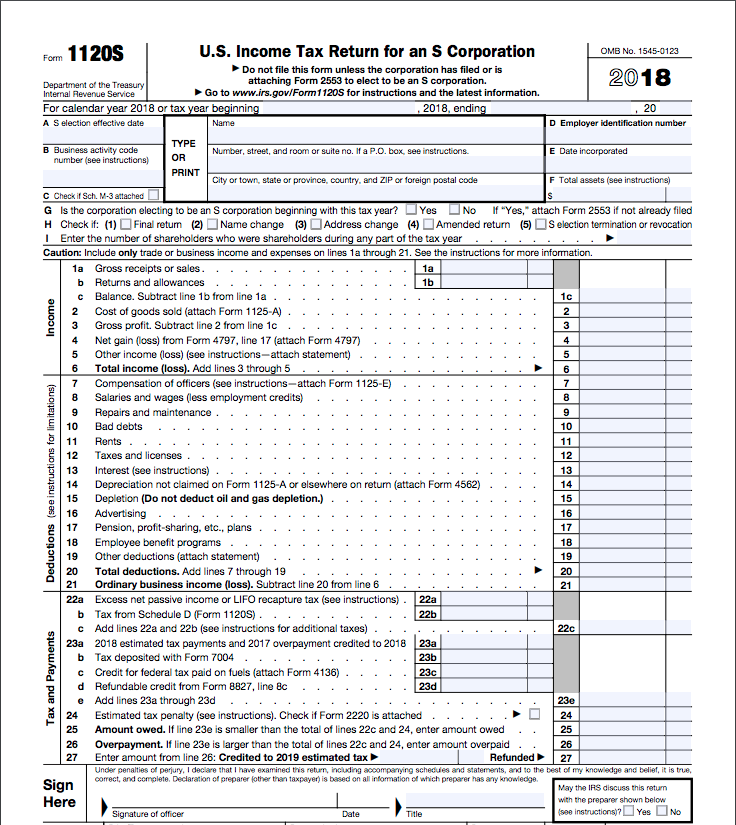

Federal Supporting Statements Form 1120S - Web do not use form 1120 as a supporting statement. Installment agreement request popular for tax pros. Circumstances necessitating collection of information. Or if you use tax software, you can find it there too. Go to www.irs.gov/form1120s for instructions and the latest information. And forms 940, 941, and 944 (employment tax returns). Form 1099 and other information returns can also be electronically filed. You can download form 1120s directly from the irs website. Every s corp needs to file one, including llcs that are taxed as s corps. Web form 1120s is the tax form s corporations use to file their federal income tax return (not to be confused with form 1120 for c corporations).

The return reports income, losses, credits, and deductions before they flow through to shareholders. Web irs form 1120s is the tax return used by domestic corporations that have made an election to be treated as s corporations for that tax year. Form 7004 (automatic extension of time to file); Circumstances necessitating collection of information. Or if you use tax software, you can find it there too. If the corporation's principal business, office, or agency is located in: Every s corp needs to file one, including llcs that are taxed as s corps. Easily sign the federal supporting statements form with your finger. And forms 940, 941, and 944 (employment tax returns). Form 1099 and other information returns can also be electronically filed.

On the supporting statement, use columns to show the following, both before and after adjustments. If the corporation's principal business, office, or agency is located in: And forms 940, 941, and 944 (employment tax returns). Or if you use tax software, you can find it there too. Web do not use form 1120 as a supporting statement. The return reports income, losses, credits, and deductions before they flow through to shareholders. Income tax return for an s corporation, including recent updates, related forms, and instructions on how to file. Circumstances necessitating collection of information. Form 1099 and other information returns can also be electronically filed. You can download form 1120s directly from the irs website.

I need help with a Scorp return

Every s corp needs to file one, including llcs that are taxed as s corps. Employers engaged in a trade or business who pay compensation form 9465; If the corporation's principal business, office, or agency is located in: The return reports income, losses, credits, and deductions before they flow through to shareholders. Web irs form 1120s is the tax return.

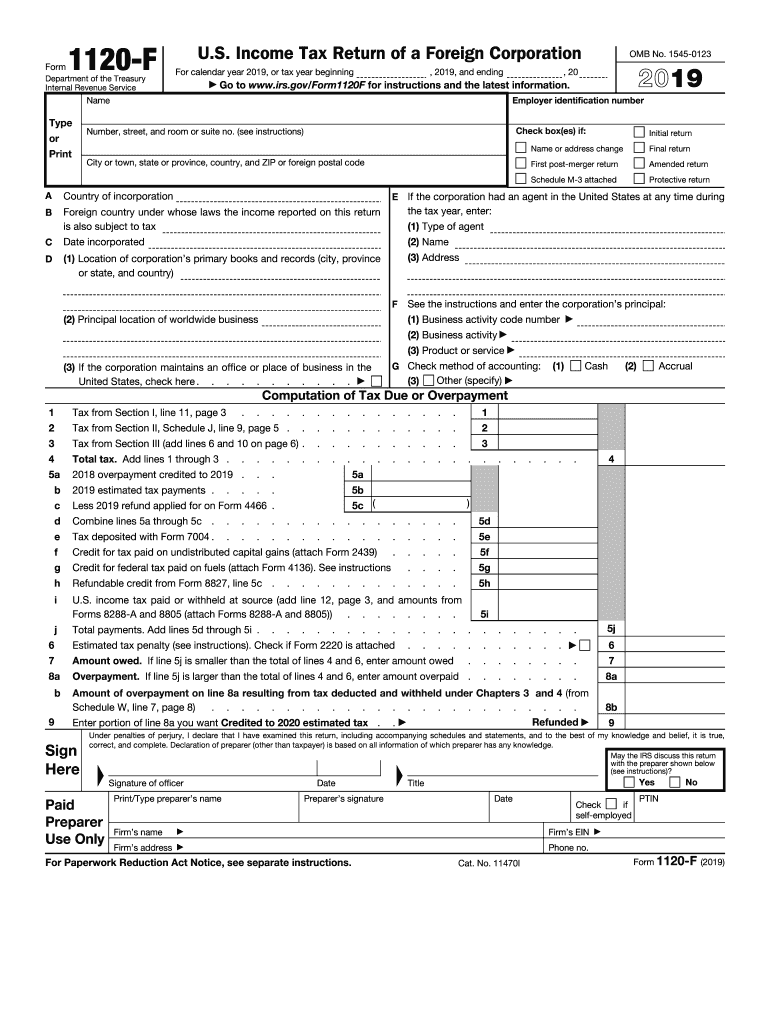

IRS 1120F 2019 Fill and Sign Printable Template Online US Legal Forms

Or if you use tax software, you can find it there too. Send filled & signed federal supporting statements form 1120 or save. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching form 2553 to elect to be an s corporation. Web form 1120s is the tax form s.

Federal Supporting Statements Form Fill Out and Sign Printable PDF

Or if you use tax software, you can find it there too. Easily sign the federal supporting statements form with your finger. On the supporting statement, use columns to show the following, both before and after adjustments. Employers engaged in a trade or business who pay compensation form 9465; Open the federal supporting statements template and follow the instructions.

Drafts of 2019 Forms 1065 and 1120S, As Well As K1s, Issued by IRS

Form 1099 and other information returns can also be electronically filed. Send filled & signed federal supporting statements form 1120 or save. You can download form 1120s directly from the irs website. Underpayment of estimated tax by individuals, estates, and trusts Easily sign the federal supporting statements form with your finger.

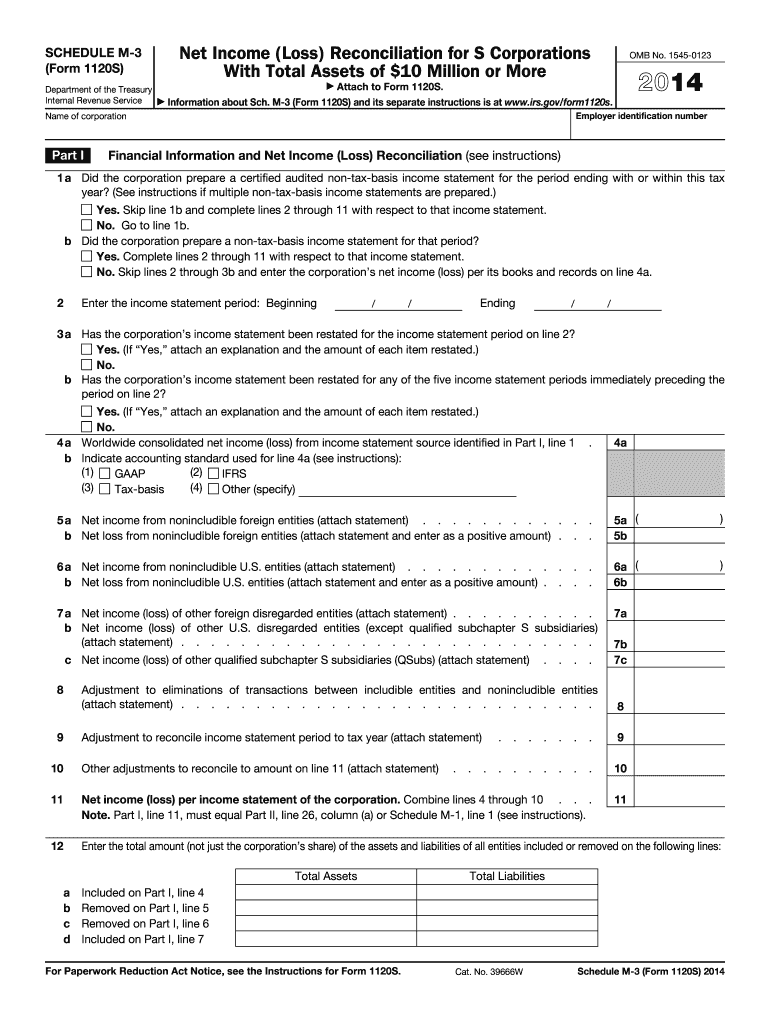

2014 Form IRS 1120S Schedule M3 Fill Online, Printable, Fillable

Employers engaged in a trade or business who pay compensation form 9465; And forms 940, 941, and 944 (employment tax returns). Open the federal supporting statements template and follow the instructions. Income tax return for an s corporation, including recent updates, related forms, and instructions on how to file. Easily sign the federal supporting statements form with your finger.

Supporting Statement Bundle Including Example Job Search Etsy

Web do not use form 1120 as a supporting statement. If the corporation's principal business, office, or agency is located in: Web irs form 1120s is the tax return used by domestic corporations that have made an election to be treated as s corporations for that tax year. Form 1099 and other information returns can also be electronically filed. You.

IRS Form 1120S Definition, Download, & 1120S Instructions

Every s corp needs to file one, including llcs that are taxed as s corps. Web irs form 1120s is the tax return used by domestic corporations that have made an election to be treated as s corporations for that tax year. Open the federal supporting statements template and follow the instructions. If the corporation's principal business, office, or agency.

How To Complete Form 1120s S Corporation Tax Return Bench Accounting

Installment agreement request popular for tax pros. Underpayment of estimated tax by individuals, estates, and trusts The return reports income, losses, credits, and deductions before they flow through to shareholders. On the supporting statement, use columns to show the following, both before and after adjustments. You can download form 1120s directly from the irs website.

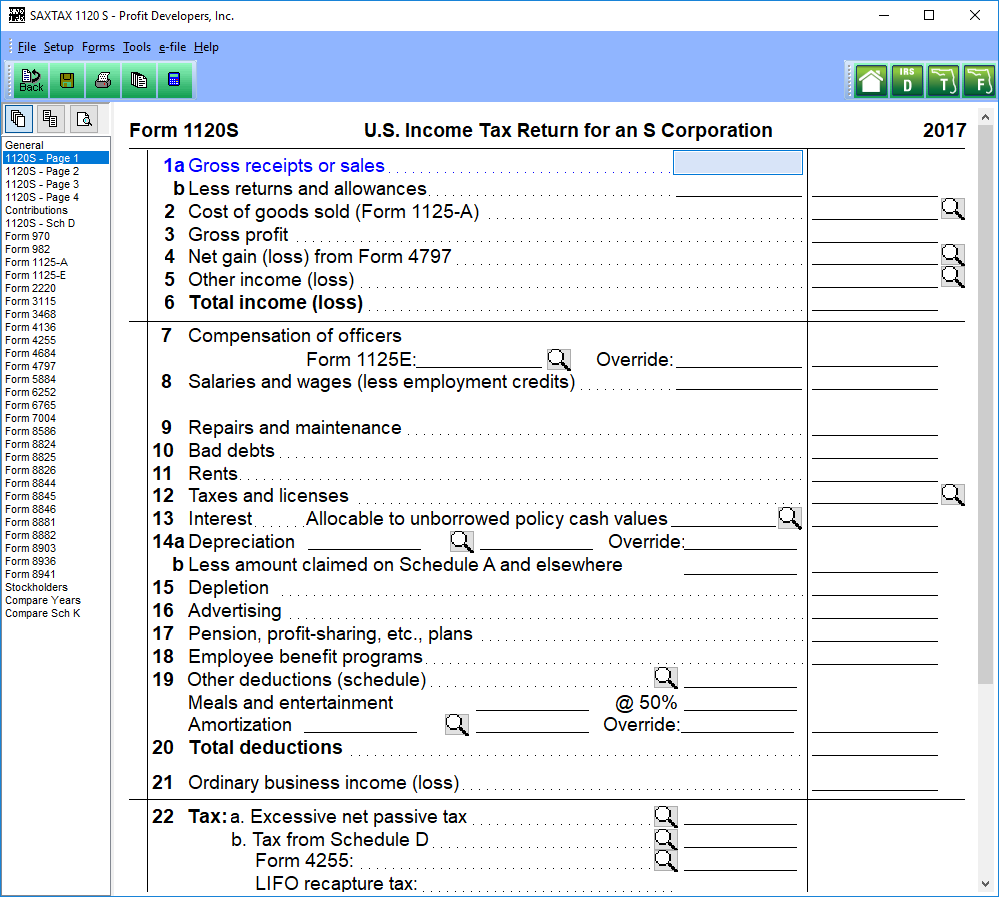

Federal 1120S Profit Developers, Inc.

The return reports income, losses, credits, and deductions before they flow through to shareholders. Go to www.irs.gov/form1120s for instructions and the latest information. Easily sign the federal supporting statements form with your finger. Or if you use tax software, you can find it there too. Web irs form 1120s is the tax return used by domestic corporations that have made.

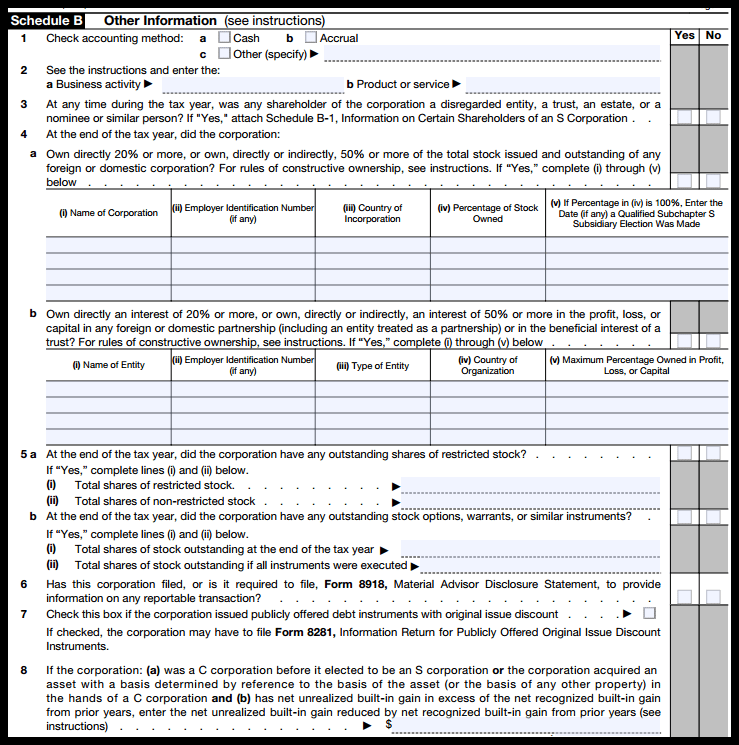

Form 1120S (Schedule K1) Shareholder's Share of Deductions

On the supporting statement, use columns to show the following, both before and after adjustments. If the corporation's principal business, office, or agency is located in: Every s corp needs to file one, including llcs that are taxed as s corps. And forms 940, 941, and 944 (employment tax returns). Go to www.irs.gov/form1120s for instructions and the latest information.

The Return Reports Income, Losses, Credits, And Deductions Before They Flow Through To Shareholders.

Circumstances necessitating collection of information. Form 1099 and other information returns can also be electronically filed. Web form 1120s is the tax form s corporations use to file their federal income tax return (not to be confused with form 1120 for c corporations). Generally, prior to the enactment of legislation on december 22, 1987, that added code section 444, a partnership (files form 1065), an s corporation (files form 1120s), or a personal service corporation (files form 1120) must.

And Forms 940, 941, And 944 (Employment Tax Returns).

Go to www.irs.gov/form1120s for instructions and the latest information. Installment agreement request popular for tax pros. Every s corp needs to file one, including llcs that are taxed as s corps. Web irs form 1120s is the tax return used by domestic corporations that have made an election to be treated as s corporations for that tax year.

Income Tax Return For An S Corporation, Including Recent Updates, Related Forms, And Instructions On How To File.

Easily sign the federal supporting statements form with your finger. Items of gross income and deductions. Form 7004 (automatic extension of time to file); Open the federal supporting statements template and follow the instructions.

You Can Download Form 1120S Directly From The Irs Website.

Employers engaged in a trade or business who pay compensation form 9465; Web do not use form 1120 as a supporting statement. Or if you use tax software, you can find it there too. Underpayment of estimated tax by individuals, estates, and trusts