Federal Form 4972

Federal Form 4972 - Web this fact sheet explains how seniors (age 65 or older) file and pay minnesota individual income tax. Also, you must meet the conditions explained on page 2 under how often. Web a $5,000 civil penalty for filing a frivolous return or submitting a specified frivolous submission as described by section 6702. To see if you qualify, you must first determine if your distribution is a. Use this form to figure the. Be sure to check box. Complete, edit or print tax forms instantly. (from qualified plans of participants born before january 2,. Form 4972 is an irs form with stipulated terms and conditions that is filled out to reduce the taxes that may be incurred. Ad download or email irs 4972 & more fillable forms, register and subscribe now!

Web the purpose of form 4972 and instructions to fill it. It also covers common programs, deductions, and credits affecting seniors. Or form 1041, schedule g, line 1b. Specific instructions lines 1 through 3. Ad download or email irs 4972 & more fillable forms, register and subscribe now! Who can use the form c. Use this form to figure the. Ad download or email irs 4972 & more fillable forms, register and subscribe now! You can download or print current. Be sure to check box.

Ad download or email irs 4972 & more fillable forms, register and subscribe now! Be sure to check box. To see if you qualify, you must first determine if your distribution is a. It also covers common programs, deductions, and credits affecting seniors. The capital gain portion of the lump. Web the purpose of form 4972 and instructions to fill it. In the case of any qualified employer plan, there is hereby imposed a tax equal to 10 percent of. Use this form to figure the. Or form 1041, schedule g, line 1b. Part i—qualifications—an individual who qualifies to file federal.

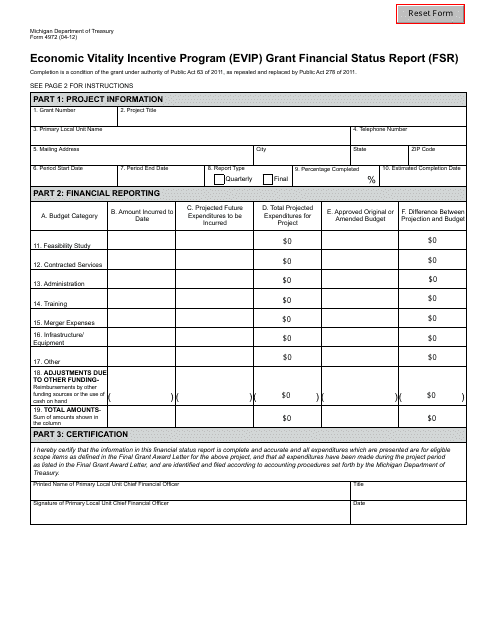

Form 4972 Download Fillable PDF or Fill Online Economic Vitality

Ad download or email irs 4972 & more fillable forms, register and subscribe now! It also covers common programs, deductions, and credits affecting seniors. Be sure to check box. Web a $5,000 civil penalty for filing a frivolous return or submitting a specified frivolous submission as described by section 6702. (from qualified plans of participants born before january 2,.

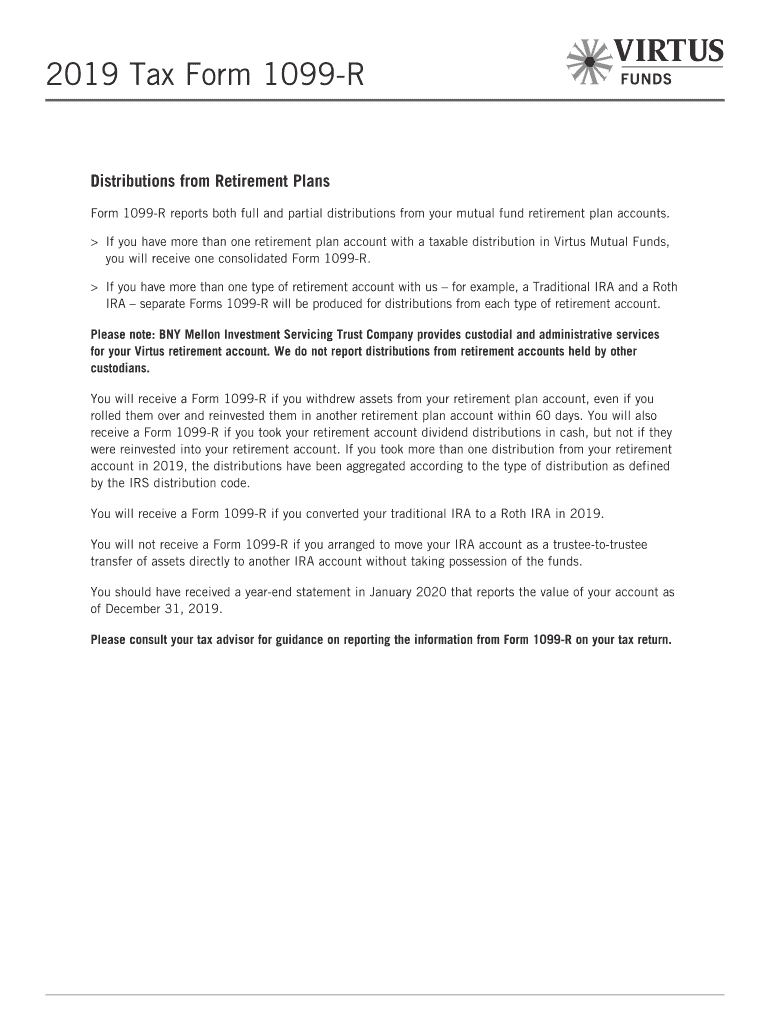

2019 IRS Form 4972 Fill Out Digital PDF Sample

Specific instructions lines 1 through 3. Ad download or email irs 4972 & more fillable forms, register and subscribe now! To see if you qualify, you must first determine if your distribution is a. Be sure to check box. Web a $5,000 civil penalty for filing a frivolous return or submitting a specified frivolous submission as described by section 6702.

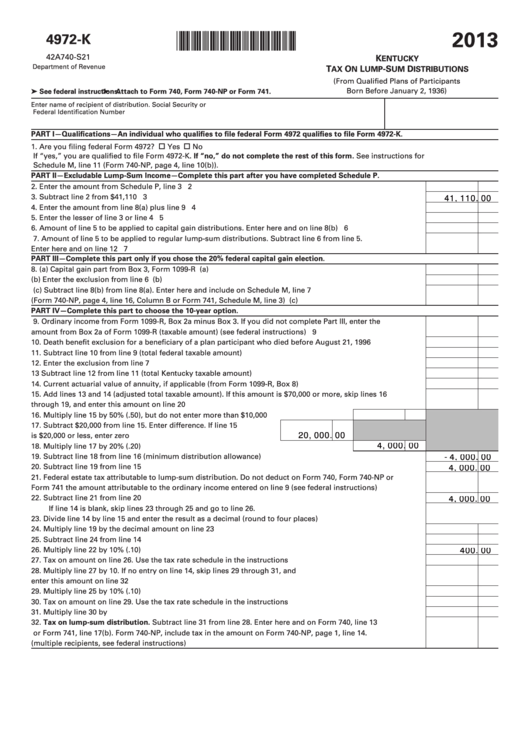

Fillable Form 4972K Kentucky Tax On LumpSum Distributions 2013

Also, you must meet the conditions explained on page 2 under how often. Web the purpose of form 4972 and instructions to fill it. Ad download or email irs 4972 & more fillable forms, register and subscribe now! Be sure to check box. Who can use the form c.

Form 4972 Turbotax Fill Out and Sign Printable PDF Template signNow

Form 4972 is an irs form with stipulated terms and conditions that is filled out to reduce the taxes that may be incurred. Web this fact sheet explains how seniors (age 65 or older) file and pay minnesota individual income tax. In the case of any qualified employer plan, there is hereby imposed a tax equal to 10 percent of..

Form 4972 Tax on LumpSum Distributions (2015) Free Download

Form 4972 is an irs form with stipulated terms and conditions that is filled out to reduce the taxes that may be incurred. (from qualified plans of participants born before january 2,. Complete, edit or print tax forms instantly. In the case of any qualified employer plan, there is hereby imposed a tax equal to 10 percent of. Who can.

Form 4972 Tax on LumpSum Distributions (2015) Free Download

Part i—qualifications—an individual who qualifies to file federal. Or form 1041, schedule g, line 1b. To see if you qualify, you must first determine if your distribution is a. Ad download or email irs 4972 & more fillable forms, register and subscribe now! Web the purpose of form 4972 and instructions to fill it.

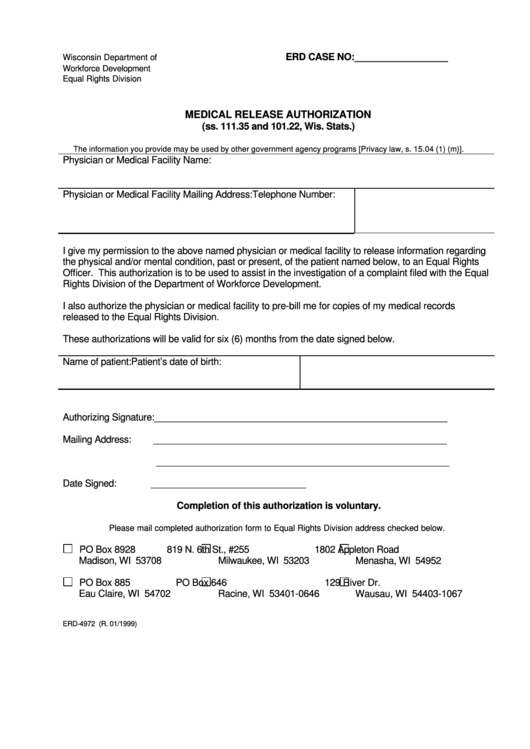

Form Erd4972 Medical Release Authorization printable pdf download

Ad download or email irs 4972 & more fillable forms, register and subscribe now! Form 4972 is an irs form with stipulated terms and conditions that is filled out to reduce the taxes that may be incurred. Web you can use form 4972 if you received a qualifying distribution in 1992 and meet the age requirement. Ad download or email.

Form 4972 Tax on LumpSum Distributions (2015) Free Download

Specific instructions lines 1 through 3. (from qualified plans of participants born before january 2,. The capital gain portion of the lump. Form 4972 is an irs form with stipulated terms and conditions that is filled out to reduce the taxes that may be incurred. Also, you must meet the conditions explained on page 2 under how often.

Solved ACCOUNTING 308 TAX RETURN PROJECT 1 Daniel B Butler

Ad download or email irs 4972 & more fillable forms, register and subscribe now! Web a $5,000 civil penalty for filing a frivolous return or submitting a specified frivolous submission as described by section 6702. To see if you qualify, you must first determine if your distribution is a. Who can use the form c. Be sure to check box.

3.11.6 Data Processing (DP) Tax Adjustments Internal Revenue Service

Ad download or email irs 4972 & more fillable forms, register and subscribe now! Specific instructions lines 1 through 3. Web a $5,000 civil penalty for filing a frivolous return or submitting a specified frivolous submission as described by section 6702. Web the purpose of form 4972 and instructions to fill it. Also, you must meet the conditions explained on.

Form 4972 Is An Irs Form With Stipulated Terms And Conditions That Is Filled Out To Reduce The Taxes That May Be Incurred.

Specific instructions lines 1 through 3. Ad download or email irs 4972 & more fillable forms, register and subscribe now! Part i—qualifications—an individual who qualifies to file federal. Web this fact sheet explains how seniors (age 65 or older) file and pay minnesota individual income tax.

Or Form 1041, Schedule G, Line 1B.

The capital gain portion of the lump. Complete, edit or print tax forms instantly. Who can use the form c. In the case of any qualified employer plan, there is hereby imposed a tax equal to 10 percent of.

Use This Form To Figure The.

It also covers common programs, deductions, and credits affecting seniors. Ad download or email irs 4972 & more fillable forms, register and subscribe now! Be sure to check box. Web a $5,000 civil penalty for filing a frivolous return or submitting a specified frivolous submission as described by section 6702.

To See If You Qualify, You Must First Determine If Your Distribution Is A.

(from qualified plans of participants born before january 2,. Web you can use form 4972 if you received a qualifying distribution in 1992 and meet the age requirement. You can download or print current. Also, you must meet the conditions explained on page 2 under how often.