Farm Tax Exempt Form Texas

Farm Tax Exempt Form Texas - And proof of eligibility to your local county tax assessor. Use schedule f (form 1040) to. Web the form used to apply for a texas agricultural and timber exemption registration number that can be used to claim an exemption may be downloaded below. How much can an ag exemption save you in taxes? Web application for texas agricultural and timber exemption registration number. Web information about schedule f (form 1040), profit or loss from farming, including recent updates, related forms, and instructions on how to file. This page provides information on both resources and. Web this publication explains the tax exemptions and special provisions available to texas farmers, ranchers, and agribusiness managers and the effect of those. Sign in to your account. Web farm trailers are exempt from the certificate of title act.

Payment in the form of a personal check, money order, or cashier’s check; Use schedule f (form 1040) to. Dba (doing business as)/farm, ranch or timber operation name (for example, abc ranch). Web taxes texas applications for tax exemption the forms listed below are pdf files. How many cows do you need? Find information on key laws and resources for texans with disabilities who qualify for tax exemptions. Web this certificate is used to claim an exemption from sales and use tax in texas when people conducting business need to purchase, lease, or rent any type of agricultural item that. They include graphics, fillable form fields, scripts and functionality that work best with the free. Sign in to your account. Web application for texas agricultural and timber exemption registration number.

Regardless of the evidence of ownership presented, you should retain such evidence and it should not be surrendered. They include graphics, fillable form fields, scripts and functionality that work best with the free. Web follow the instructions below to complete texas ag exemption form online quickly and easily: Find information on key laws and resources for texans with disabilities who qualify for tax exemptions. Web information about schedule f (form 1040), profit or loss from farming, including recent updates, related forms, and instructions on how to file. Dba (doing business as)/farm, ranch or timber operation name (for example, abc ranch). Web what qualifies as ag exemption? Web taxes texas applications for tax exemption the forms listed below are pdf files. Web how it works browse for the exemption texas i customize and esign exemption exempt farm send out signed agricultural exempt texas or print it rate the texas agricultural. Web the form used to apply for a texas agricultural and timber exemption registration number that can be used to claim an exemption may be downloaded below.

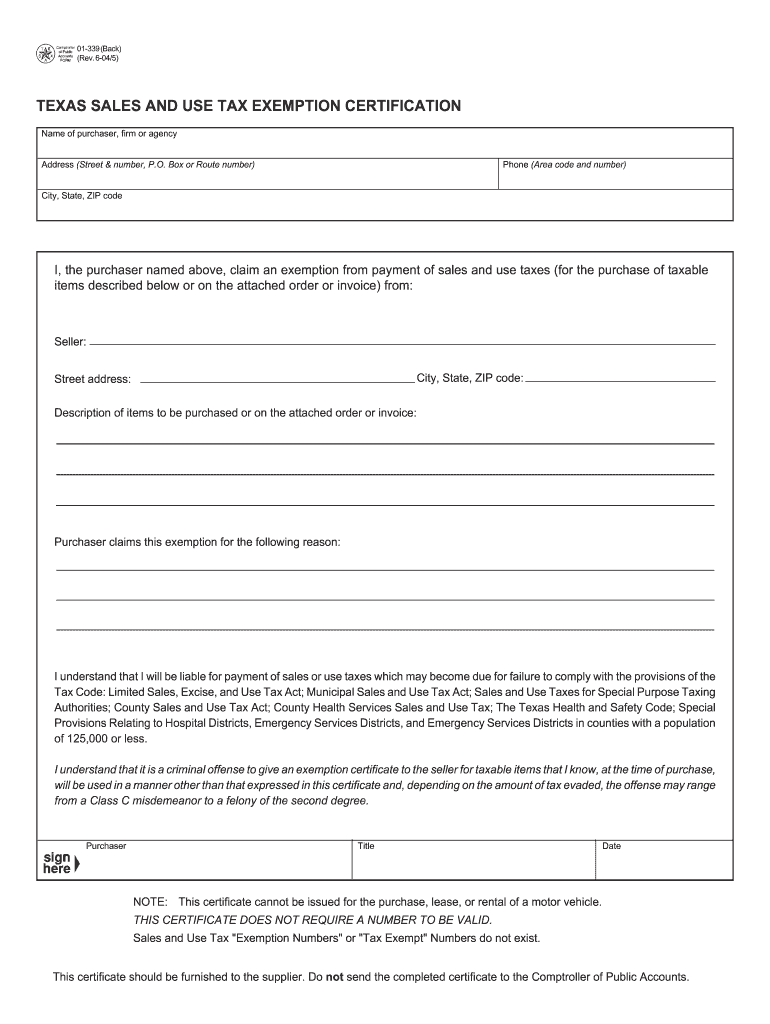

Fillableform 01 339 Fill Online, Printable, Fillable, Blank pdfFiller

They include graphics, fillable form fields, scripts and functionality that work best with the free. Sign up with your email and password or register a free. Web taxes texas applications for tax exemption the forms listed below are pdf files. Web motor vehicle related forms. Web how it works browse for the exemption texas i customize and esign exemption exempt.

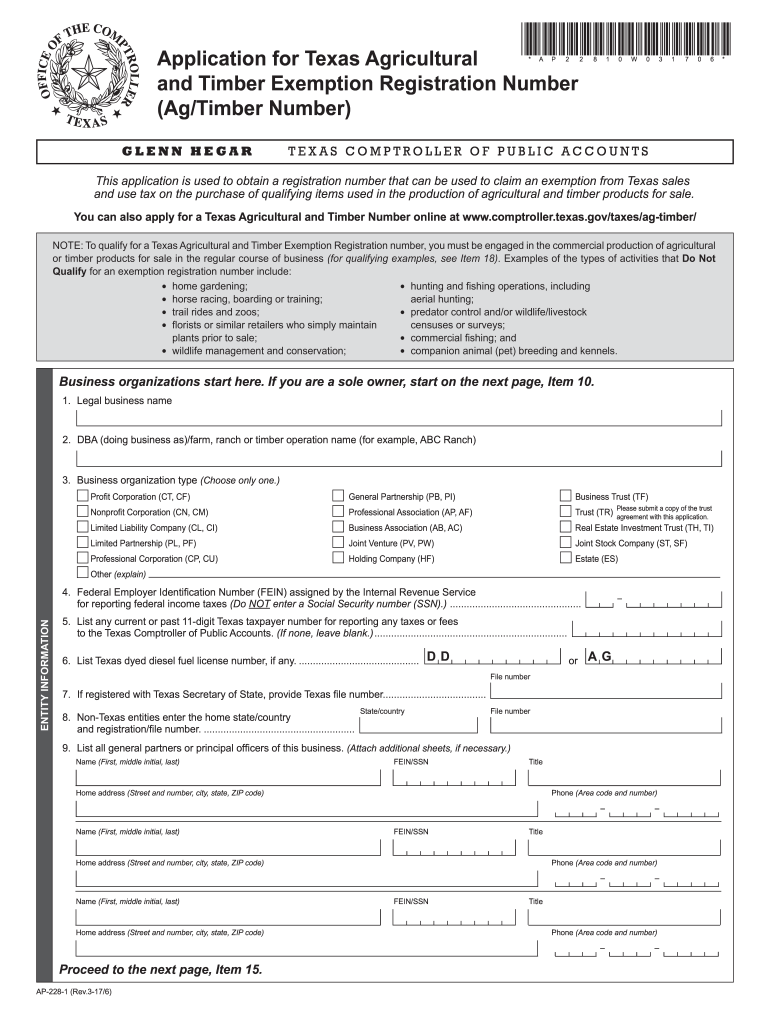

Texas agriculture or timber registration Fill out & sign online DocHub

Web information about schedule f (form 1040), profit or loss from farming, including recent updates, related forms, and instructions on how to file. Payment in the form of a personal check, money order, or cashier’s check; Sign in to your account. Find information on key laws and resources for texans with disabilities who qualify for tax exemptions. Sign up with.

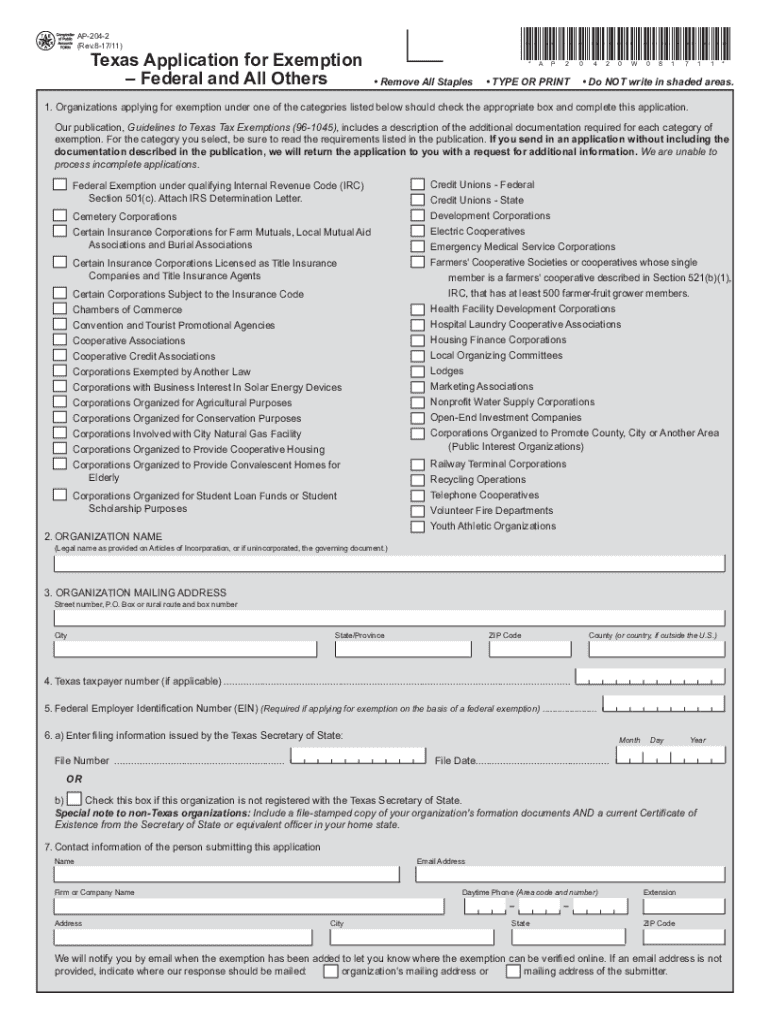

FREE 10+ Sample Tax Exemption Forms in PDF

Regardless of the evidence of ownership presented, you should retain such evidence and it should not be surrendered. Web this publication explains the tax exemptions and special provisions available to texas farmers, ranchers, and agribusiness managers and the effect of those. Web instructions submit the completed application; Use schedule f (form 1040) to. This page provides information on both resources.

Tax Exempt Forms San Patricio Electric Cooperative

Use schedule f (form 1040) to. Web farm trailers are exempt from the certificate of title act. Web how it works browse for the exemption texas i customize and esign exemption exempt farm send out signed agricultural exempt texas or print it rate the texas agricultural. This page provides information on both resources and. Web this publication explains the tax.

2012 Form PA REV72 Fill Online, Printable, Fillable, Blank pdfFiller

And proof of eligibility to your local county tax assessor. Web information about schedule f (form 1040), profit or loss from farming, including recent updates, related forms, and instructions on how to file. Web this publication explains the tax exemptions and special provisions available to texas farmers, ranchers, and agribusiness managers and the effect of those. Web how it works.

Homestead Exemption Texas Form 2019 Splendora Tx Fill Out and Sign

Web motor vehicle related forms. Web what qualifies as ag exemption? Payment in the form of a personal check, money order, or cashier’s check; Web information about schedule f (form 1040), profit or loss from farming, including recent updates, related forms, and instructions on how to file. Dba (doing business as)/farm, ranch or timber operation name (for example, abc ranch).

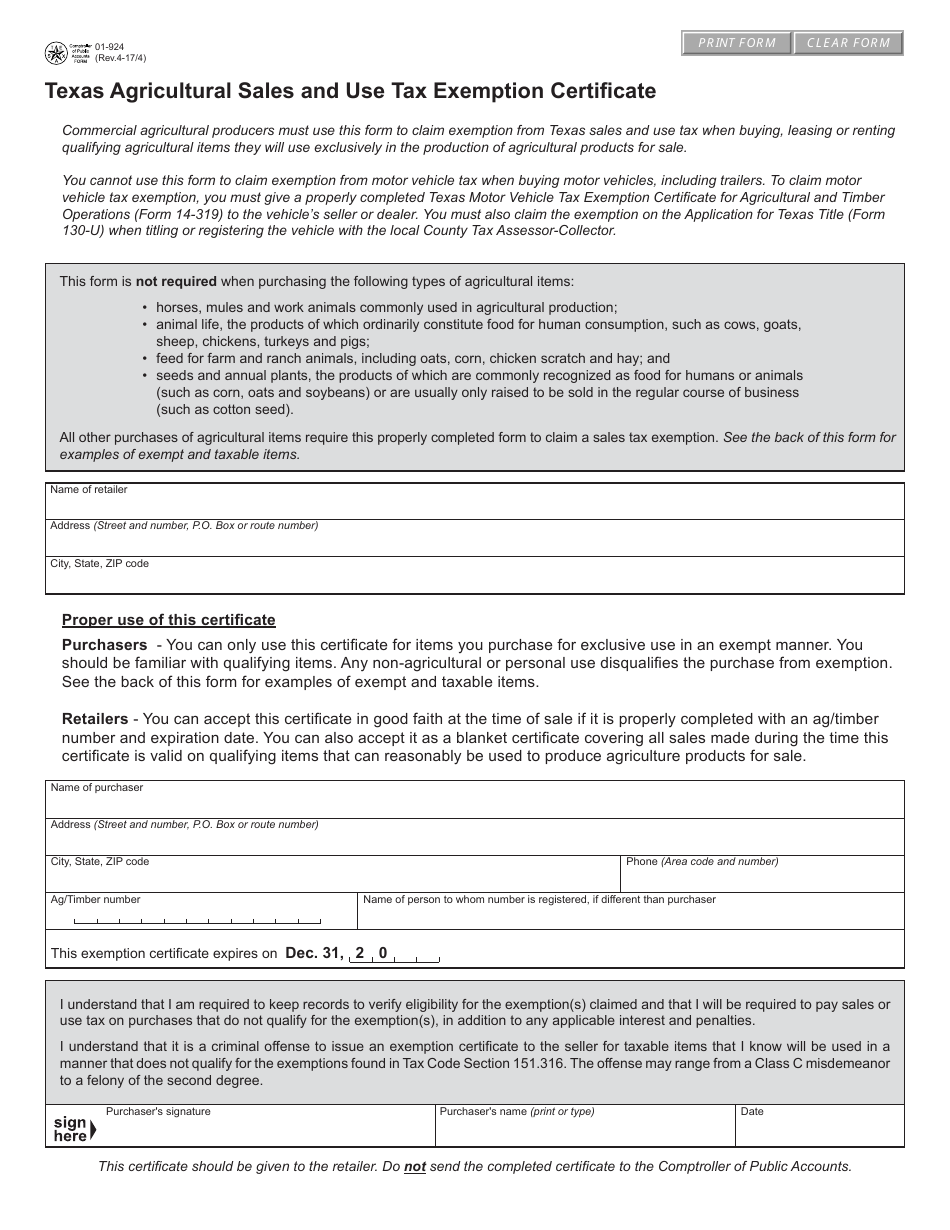

Form 01924 Download Fillable PDF or Fill Online Texas Agricultural

And proof of eligibility to your local county tax assessor. Web information about schedule f (form 1040), profit or loss from farming, including recent updates, related forms, and instructions on how to file. They include graphics, fillable form fields, scripts and functionality that work best with the free. Payment in the form of a personal check, money order, or cashier’s.

Tax Exempt Form 2020 Fill Online, Printable, Fillable, Blank pdfFiller

Web motor vehicle related forms. Web this certificate is used to claim an exemption from sales and use tax in texas when people conducting business need to purchase, lease, or rent any type of agricultural item that. Web the form used to apply for a texas agricultural and timber exemption registration number that can be used to claim an exemption.

Forms Texas Crushed Stone Co.

Sign in to your account. Web the form used to apply for a texas agricultural and timber exemption registration number that can be used to claim an exemption may be downloaded below. Use schedule f (form 1040) to. Web instructions submit the completed application; Dba (doing business as)/farm, ranch or timber operation name (for example, abc ranch).

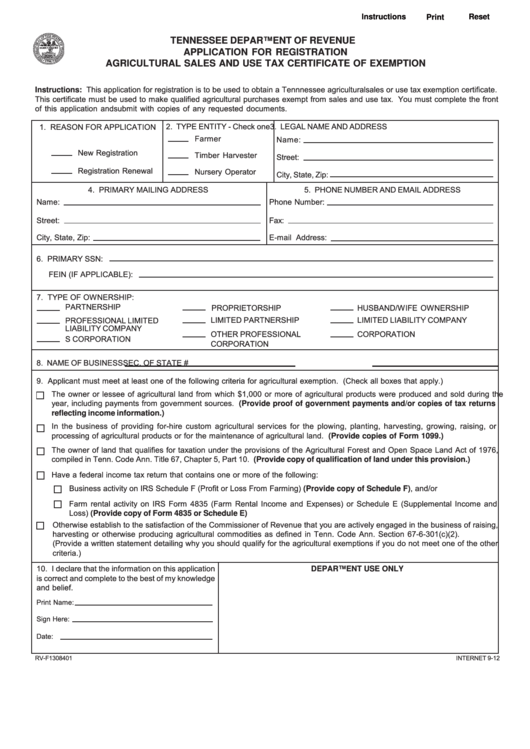

Fillable Agricultural Sales And Use Tax Certificate Of Exemption

Use schedule f (form 1040) to. Web this certificate is used to claim an exemption from sales and use tax in texas when people conducting business need to purchase, lease, or rent any type of agricultural item that. Web information about schedule f (form 1040), profit or loss from farming, including recent updates, related forms, and instructions on how to.

Find Information On Key Laws And Resources For Texans With Disabilities Who Qualify For Tax Exemptions.

Web information about schedule f (form 1040), profit or loss from farming, including recent updates, related forms, and instructions on how to file. Sign in to your account. This page provides information on both resources and. And proof of eligibility to your local county tax assessor.

Web This Certificate Is Used To Claim An Exemption From Sales And Use Tax In Texas When People Conducting Business Need To Purchase, Lease, Or Rent Any Type Of Agricultural Item That.

Use schedule f (form 1040) to. Dba (doing business as)/farm, ranch or timber operation name (for example, abc ranch). Sign up with your email and password or register a free. How many cows do you need?

Payment In The Form Of A Personal Check, Money Order, Or Cashier’s Check;

Web motor vehicle related forms. Web application for texas agricultural and timber exemption registration number. They include graphics, fillable form fields, scripts and functionality that work best with the free. Web farm trailers are exempt from the certificate of title act.

Regardless Of The Evidence Of Ownership Presented, You Should Retain Such Evidence And It Should Not Be Surrendered.

Web this publication explains the tax exemptions and special provisions available to texas farmers, ranchers, and agribusiness managers and the effect of those. Web what qualifies as ag exemption? How much can an ag exemption save you in taxes? Web follow the instructions below to complete texas ag exemption form online quickly and easily: