Empower Retirement Rollover Form

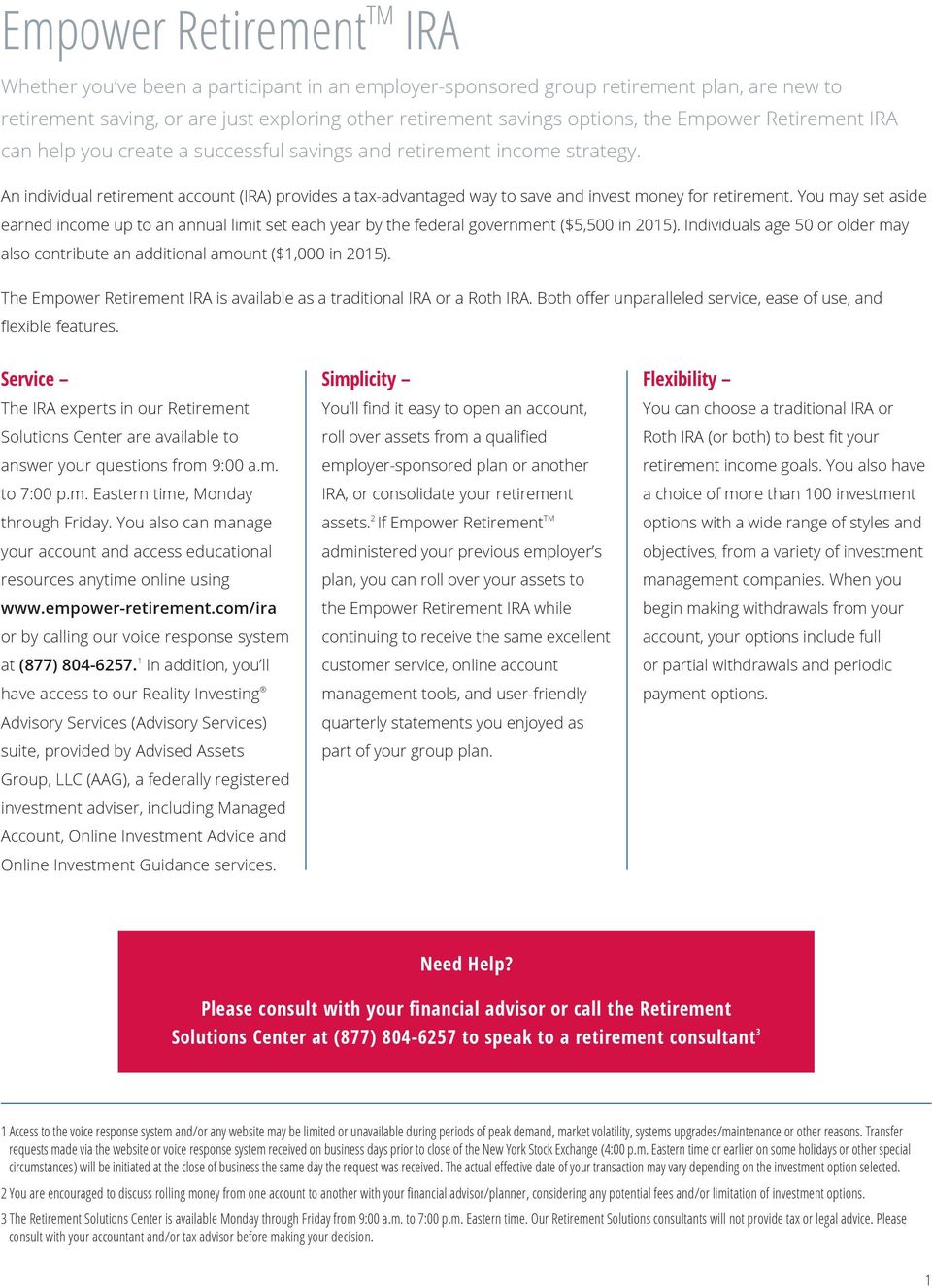

Empower Retirement Rollover Form - Please send a copy of the check stub, showing the amount of the distribution and withholding, from the previous provider. Web complete this form to roll over eligible money from other retirement plans into your account. Roll over your accounts from your prior employers' retirement plans 2. Web the following are funding options for your consideration 1: Web explore the options for rolling over your retirement account to another qualified account or cashing out your retirement savings. Web consolidating your outside retirement accounts into a single qualified retirement plan may save you time and make it easier to achieve the future you want benefits include: A direct rollover is a distribution that is made payable to a retirement plan trustee (or ira) for the benefit of (fbo) the participant (or ira account holder). Determine if a rollover is the right option for you. Originating plan or ira provider Web an empower 401(k) rollover lets you move, or roll, your existing empower retirement funds to a new retirement plan.

Is it worth rolling over a 401(k)? Originating plan or ira provider For an indirect rollover please reach out to your plan administrator for the necessary form. Empower receives approved incoming rollover request and the funds from the originating plan or ira. Determine if a rollover is the right option for you. Web complete this form to roll over eligible money from other retirement plans into your account. Web consolidating your outside retirement accounts into a single qualified retirement plan may save you time and make it easier to achieve the future you want benefits include: Consolidate your other iras into a single ira 3. Web complete the participant information section of the incoming rollover election form. Web a rollover is when you move funds from one eligible retirement plan to another, such as a 401(k) to an ira or another 401(k).

A direct rollover is a distribution that is made payable to a retirement plan trustee (or ira) for the benefit of (fbo) the participant (or ira account holder). Roll over your accounts from your prior employers' retirement plans 2. Is it worth rolling over a 401(k)? Processes the rollover proceeds according to the participant’s direction. Consolidate your other iras into a single ira 3. Web use this form for a direct rollover: Web the following are funding options for your consideration 1: Our online process and team of experts make it easy to roll over your 401(k) fast. Let the experts at capitalize handle your 401(k) rollover, for free! Web complete this form to roll over eligible money from other retirement plans into your account.

Empower Retirement to Acquire FullService Retirement Business of

For an indirect rollover please reach out to your plan administrator for the necessary form. Originating plan or ira provider Web explore the options for rolling over your retirement account to another qualified account or cashing out your retirement savings. Determine if a rollover is the right option for you. Roll over your accounts from your prior employers' retirement plans.

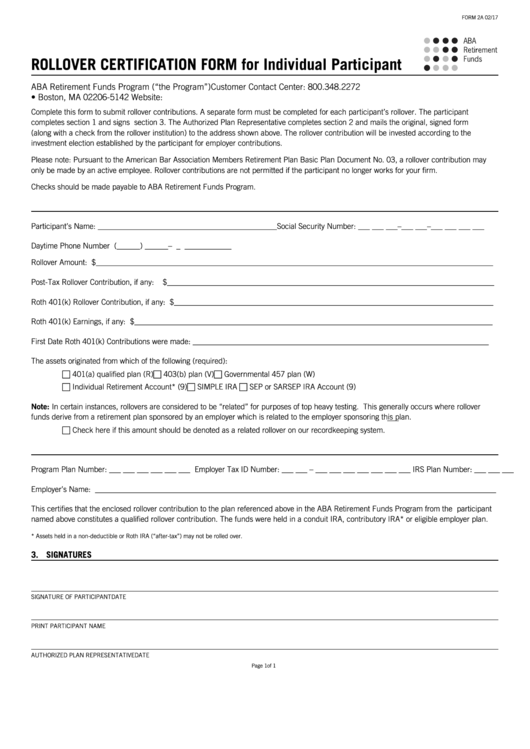

Top 6 Aba Retirement Forms And Templates free to download in PDF format

Web the following are funding options for your consideration 1: Roll over your accounts from your prior employers' retirement plans 2. Processes the rollover proceeds according to the participant’s direction. Web client reviews the incoming rollover request. Please send a copy of the check stub, showing the amount of the distribution and withholding, from the previous provider.

Empower Retirement 401k Rollover Form Fill Online, Printable

Our online process and team of experts make it easy to roll over your 401(k) fast. Is it worth rolling over a 401(k)? Download the allocation change form hardship distribution form experienced an extreme financial hardship? Determine if a rollover is the right option for you. Web complete the participant information section of the incoming rollover election form.

Empower Retirement for iPhone & iPad App Info & Stats iOSnoops

Web client reviews the incoming rollover request. Web an empower 401(k) rollover lets you move, or roll, your existing empower retirement funds to a new retirement plan. Our online process and team of experts make it easy to roll over your 401(k) fast. Web explore the options for rolling over your retirement account to another qualified account or cashing out.

Empower Retirement Plan Forms Form Resume Examples edV16kB2q6

Roll over your accounts from your prior employers' retirement plans 2. Web complete this form to roll over eligible money from other retirement plans into your account. Let the experts at capitalize handle your 401(k) rollover, for free! Web consolidating your outside retirement accounts into a single qualified retirement plan may save you time and make it easier to achieve.

How To Rollover 401k From Empower To Fidelity

Originating plan or ira provider Is it worth rolling over a 401(k)? Web complete the participant information section of the incoming rollover election form. Web client reviews the incoming rollover request. Web use this form for a direct rollover:

Empower Retirement A Few.... The UnRetired Entrepreneur

For an indirect rollover please reach out to your plan administrator for the necessary form. Our online process and team of experts make it easy to roll over your 401(k) fast. Download the allocation change form hardship distribution form experienced an extreme financial hardship? Web a rollover is when you move funds from one eligible retirement plan to another, such.

Empower Retirement to acquire retirement plan business of MassMutual

Please send a copy of the check stub, showing the amount of the distribution and withholding, from the previous provider. Web the following are funding options for your consideration 1: Consolidate your other iras into a single ira 3. For an indirect rollover please reach out to your plan administrator for the necessary form. Empower receives approved incoming rollover request.

401k Rollover Form Fidelity Investments Form Resume Examples

Web an empower 401(k) rollover lets you move, or roll, your existing empower retirement funds to a new retirement plan. Roll over your accounts from your prior employers' retirement plans 2. Download the allocation change form hardship distribution form experienced an extreme financial hardship? Web consolidating your outside retirement accounts into a single qualified retirement plan may save you time.

Empower Retirement Plan Forms Form Resume Examples edV16kB2q6

Web consolidating your outside retirement accounts into a single qualified retirement plan may save you time and make it easier to achieve the future you want benefits include: Empower receives approved incoming rollover request and the funds from the originating plan or ira. In many situations, yes, rolling over your 401(k) into another employer retirement plan or an ira account.

Web Explore The Options For Rolling Over Your Retirement Account To Another Qualified Account Or Cashing Out Your Retirement Savings.

Web use this form for a direct rollover: Web an empower 401(k) rollover lets you move, or roll, your existing empower retirement funds to a new retirement plan. Determine if a rollover is the right option for you. Authorized signer either approves the rollover request or rejects the request.

For An Indirect Rollover Please Reach Out To Your Plan Administrator For The Necessary Form.

Web complete this form to roll over eligible money from other retirement plans into your account. In many situations, yes, rolling over your 401(k) into another employer retirement plan or an ira account can be worth the effort. Web complete the participant information section of the incoming rollover election form. Processes the rollover proceeds according to the participant’s direction.

Web Client Reviews The Incoming Rollover Request.

Web a rollover is when you move funds from one eligible retirement plan to another, such as a 401(k) to an ira or another 401(k). Is it worth rolling over a 401(k)? Our online process and team of experts make it easy to roll over your 401(k) fast. Let the experts at capitalize handle your 401(k) rollover, for free!

Download The Allocation Change Form Hardship Distribution Form Experienced An Extreme Financial Hardship?

Web the following are funding options for your consideration 1: A direct rollover is a distribution that is made payable to a retirement plan trustee (or ira) for the benefit of (fbo) the participant (or ira account holder). Empower receives approved incoming rollover request and the funds from the originating plan or ira. Please send a copy of the check stub, showing the amount of the distribution and withholding, from the previous provider.