Employer Wage Verification Form

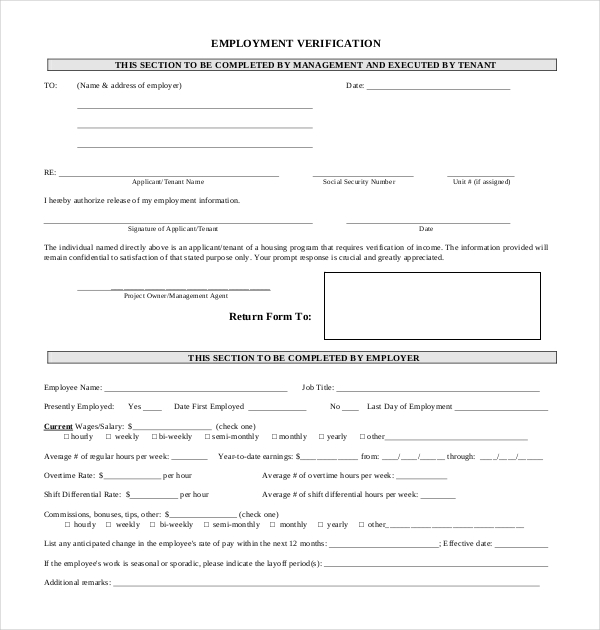

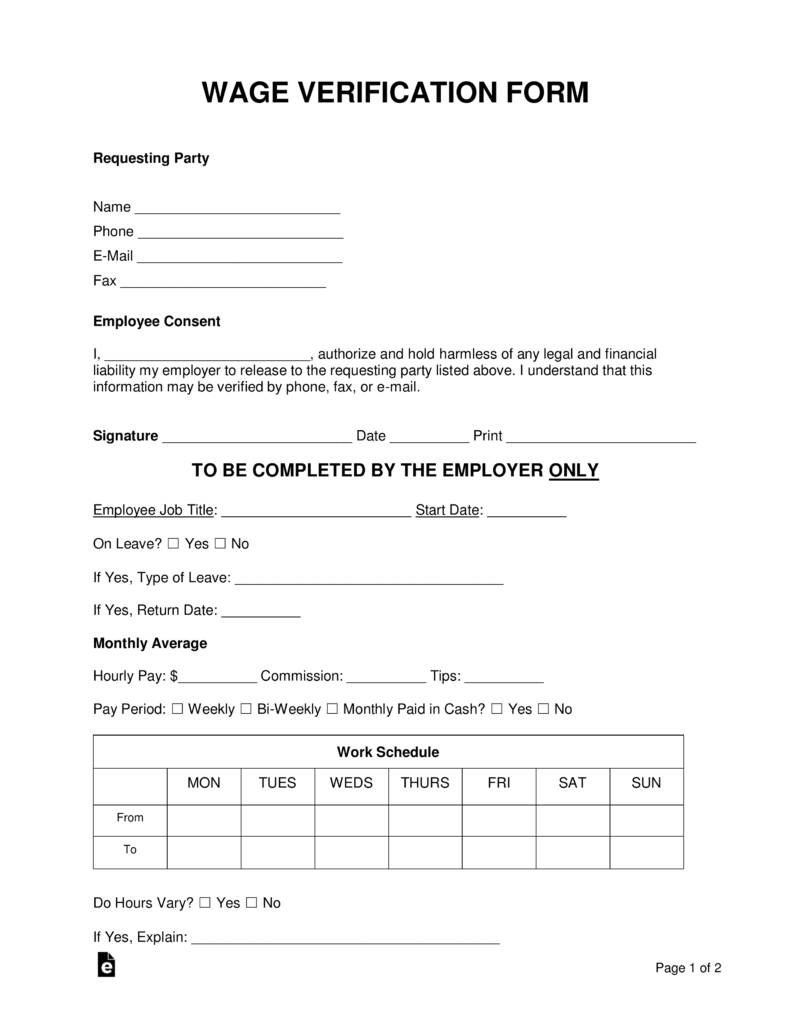

Employer Wage Verification Form - 280 (mcl 400.60, 400.8 and 400.83), employers are required to provide the michigan department of human services with copies of certain papers, records, and documents relevant to an inquiry or investigation conducted by the department. Social services (dss) form effective date: The information is needed so that the amount of disability compensation to which your employee is entitled may be calculated. Ask a subject matter expert about employer unemployment insurance responsibilities. Web this form must be completed by youremployer and returned to the addressat the right within 10 business days. How to submit wage reports and payments. Web in accordance with the provisions of 1939 p.a. Web notice and acknowledgement of pay rate and payday under section 195.1 of the new york state labor law notice for hourly rate employees ls 54 is a blank work agreement that contains all of the fields that employers must include to notify each employee in writing of conditions of employment at time of commitment to hire. The document must be filled in by the employer providing information related to the employee’s work schedule, hours worked per week (on average), hourly rate ($/hr). Quarterly wage report requirements and due dates.

The information is needed so that the amount of disability compensation to which your employee is entitled may be calculated. Web notice and acknowledgement of pay rate and payday under section 195.1 of the new york state labor law notice for hourly rate employees ls 54 is a blank work agreement that contains all of the fields that employers must include to notify each employee in writing of conditions of employment at time of commitment to hire. Web employer's wage verification form (pursuant to nrs 616c.045(2)(d)) please provide the following information for the employee named below by completing this form. His/her signature below authorizes the release of wage information requested on this form and the release of any information regarding his/her employment or termination of. Web in accordance with the provisions of 1939 p.a. A wage verification form may be used by any private or public organization seeking the confirmation of income by an individual. The following individual is an applicant for or recipient of public assistance. How to submit wage reports and payments. Web this form must be completed by youremployer and returned to the addressat the right within 10 business days. 280 (mcl 400.60, 400.8 and 400.83), employers are required to provide the michigan department of human services with copies of certain papers, records, and documents relevant to an inquiry or investigation conducted by the department.

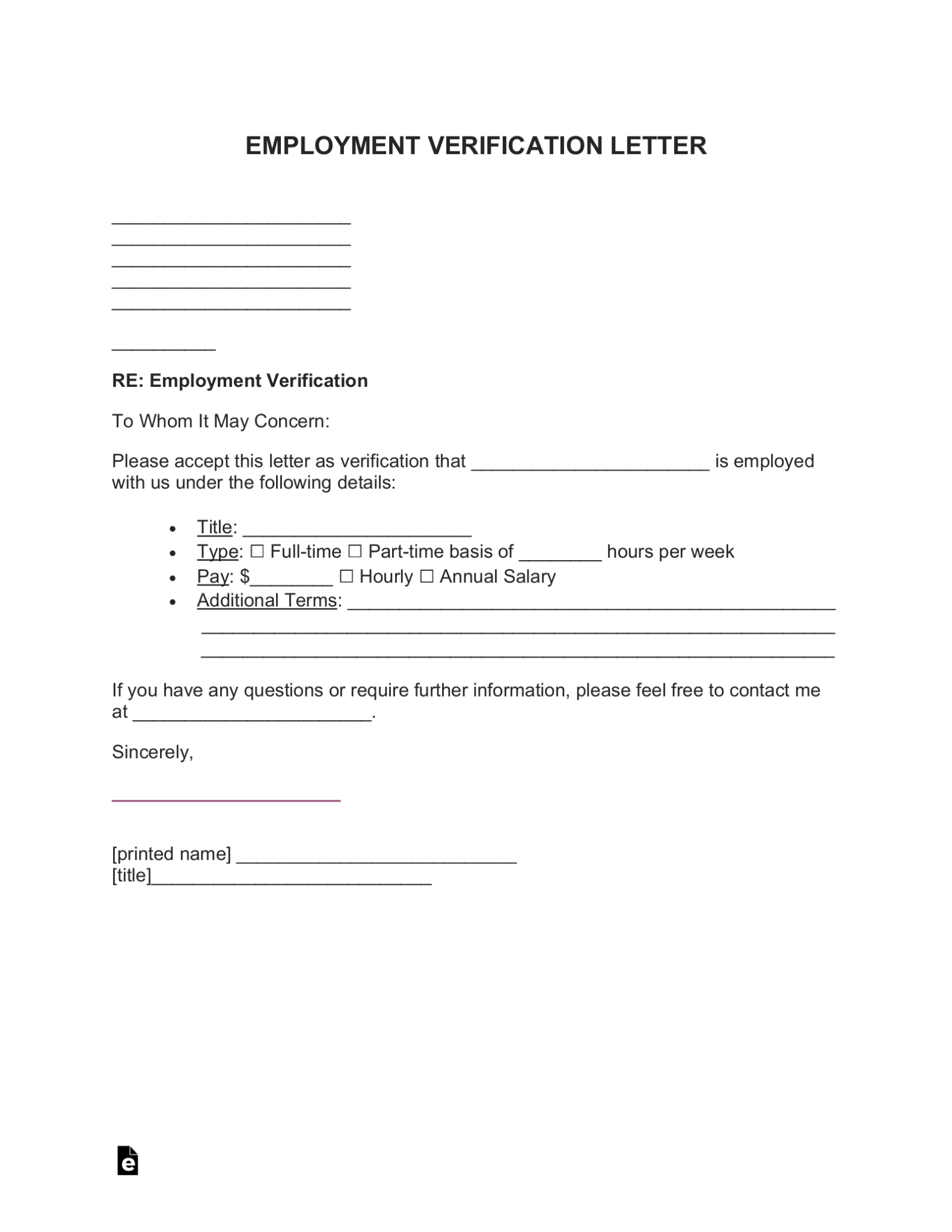

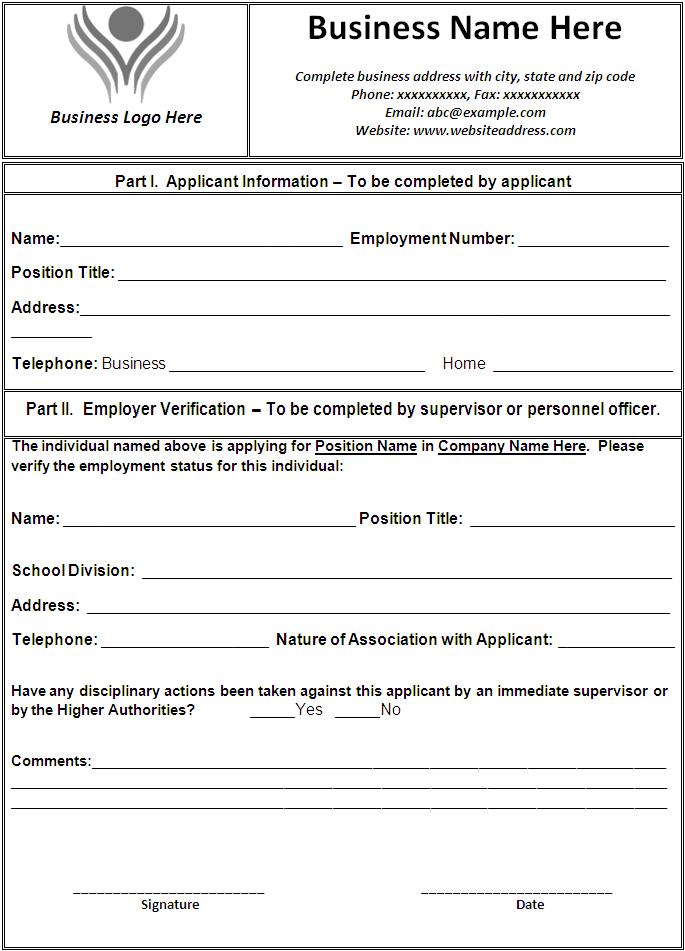

Web employer's wage verification form (pursuant to nrs 616c.045(2)(d)) please provide the following information for the employee named below by completing this form. How to submit wage reports and payments. Social services (dss) form effective date: Web this form must be completed by youremployer and returned to the addressat the right within 10 business days. The document must be filled in by the employer providing information related to the employee’s work schedule, hours worked per week (on average), hourly rate ($/hr). Web notice and acknowledgement of pay rate and payday under section 195.1 of the new york state labor law notice for hourly rate employees ls 54 is a blank work agreement that contains all of the fields that employers must include to notify each employee in writing of conditions of employment at time of commitment to hire. Ask a subject matter expert about employer unemployment insurance responsibilities. His/her signature below authorizes the release of wage information requested on this form and the release of any information regarding his/her employment or termination of. An employment verification letter, or proof of income, verifies the income or salary earned by an employed individual. The information is needed so that the amount of disability compensation to which your employee is entitled may be calculated.

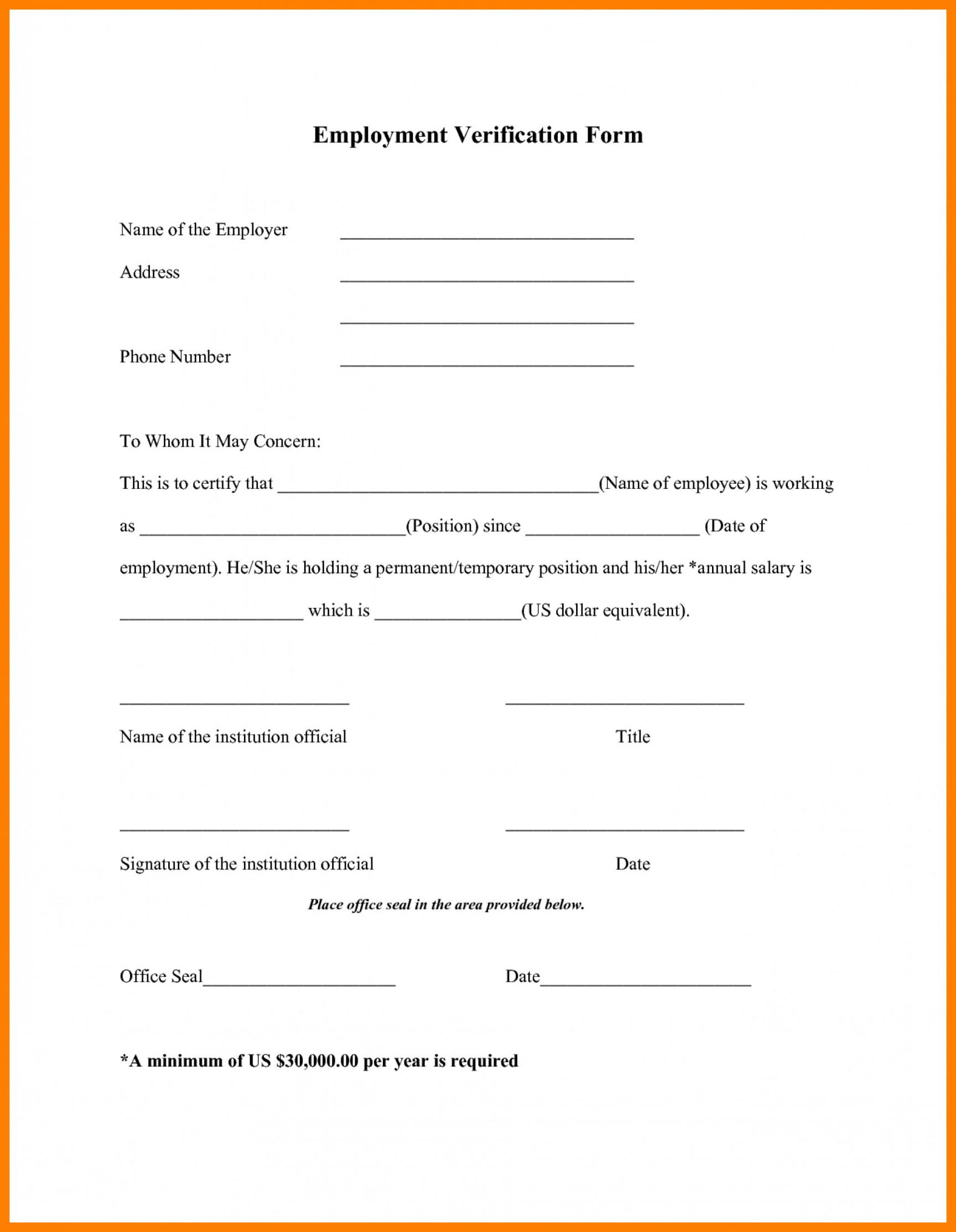

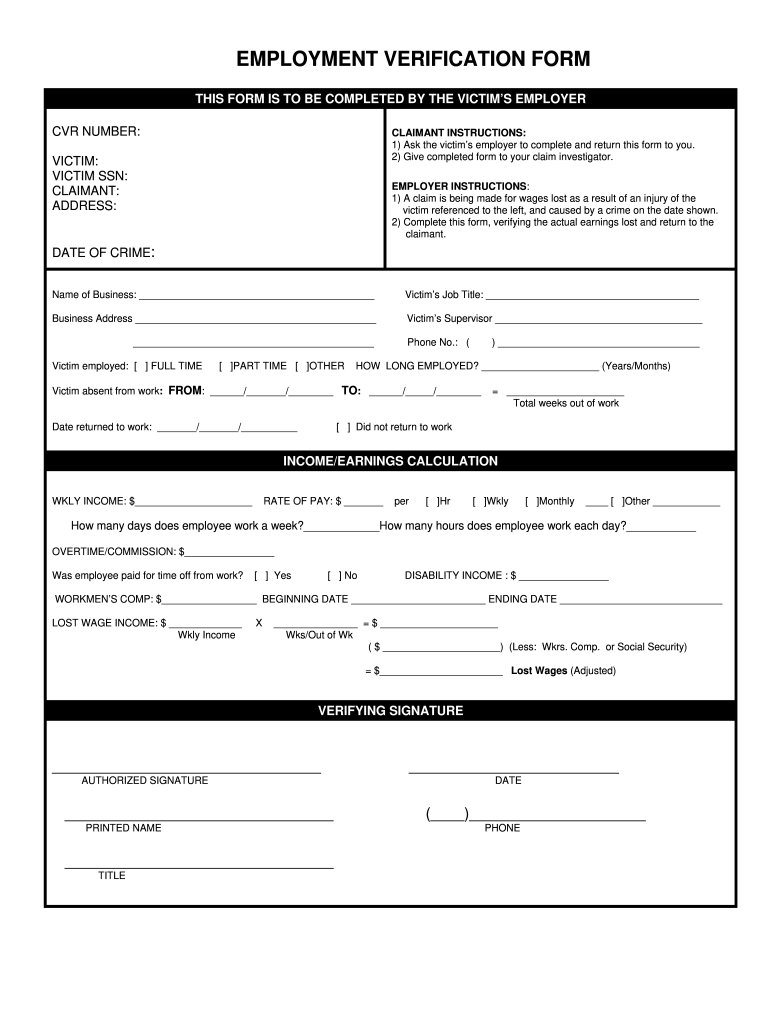

Employment Verification Template Free Word's Templates

The document must be filled in by the employer providing information related to the employee’s work schedule, hours worked per week (on average), hourly rate ($/hr). His/her signature below authorizes the release of wage information requested on this form and the release of any information regarding his/her employment or termination of. Web notice and acknowledgement of pay rate and payday.

FREE 12+ Sample Employment Verification Forms in PDF MS Word Excel

An employment verification letter, or proof of income, verifies the income or salary earned by an employed individual. Ask a subject matter expert about employer unemployment insurance responsibilities. The following individual is an applicant for or recipient of public assistance. Web this form must be completed by youremployer and returned to the addressat the right within 10 business days. Web.

Free Wage Verification Form PDF Word eForms

Web this form must be completed by youremployer and returned to the addressat the right within 10 business days. The document must be filled in by the employer providing information related to the employee’s work schedule, hours worked per week (on average), hourly rate ($/hr). An employment verification letter, or proof of income, verifies the income or salary earned by.

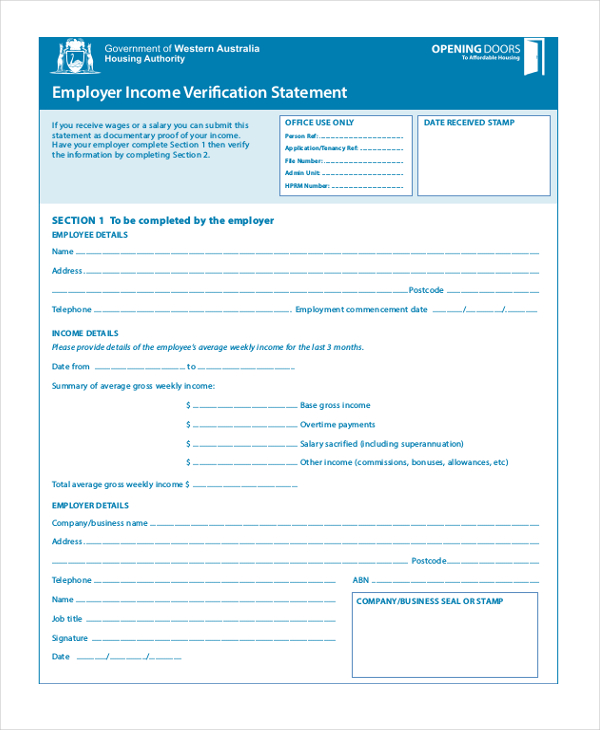

FREE 10+ Sample Employer Verification Forms in PDF MS Word

How to submit wage reports and payments. The information is needed so that the amount of disability compensation to which your employee is entitled may be calculated. His/her signature below authorizes the release of wage information requested on this form and the release of any information regarding his/her employment or termination of. Ask a subject matter expert about employer unemployment.

Employment Verification Form Fill Online, Printable, Fillable, Blank

Quarterly wage report requirements and due dates. Web employer's wage verification form (pursuant to nrs 616c.045(2)(d)) please provide the following information for the employee named below by completing this form. His/her signature below authorizes the release of wage information requested on this form and the release of any information regarding his/her employment or termination of. Ask a subject matter expert.

FREE 10+ Sample Employer Verification Forms in PDF MS Word

How to submit wage reports and payments. Web this form must be completed by youremployer and returned to the addressat the right within 10 business days. Web employer's wage verification form (pursuant to nrs 616c.045(2)(d)) please provide the following information for the employee named below by completing this form. The following individual is an applicant for or recipient of public.

What Is a Wage Verification? [ importance, Tips, Steps ]

280 (mcl 400.60, 400.8 and 400.83), employers are required to provide the michigan department of human services with copies of certain papers, records, and documents relevant to an inquiry or investigation conducted by the department. An employment verification letter, or proof of income, verifies the income or salary earned by an employed individual. Web this form must be completed by.

What Is a Wage Verification? [ importance, Tips, Steps ]

Social services (dss) form effective date: Web notice and acknowledgement of pay rate and payday under section 195.1 of the new york state labor law notice for hourly rate employees ls 54 is a blank work agreement that contains all of the fields that employers must include to notify each employee in writing of conditions of employment at time of.

Printable Employment Verification Forms Pdf Example Calendar Printable

Web this form must be completed by youremployer and returned to the addressat the right within 10 business days. Social services (dss) form effective date: Web in accordance with the provisions of 1939 p.a. This type of verification is commonly used when someone is. The following individual is an applicant for or recipient of public assistance.

Free Employment Verification Letter PDF Word eForms

An employment verification letter, or proof of income, verifies the income or salary earned by an employed individual. Quarterly wage report requirements and due dates. Web in accordance with the provisions of 1939 p.a. The document must be filled in by the employer providing information related to the employee’s work schedule, hours worked per week (on average), hourly rate ($/hr)..

His/Her Signature Below Authorizes The Release Of Wage Information Requested On This Form And The Release Of Any Information Regarding His/Her Employment Or Termination Of.

The following individual is an applicant for or recipient of public assistance. Social services (dss) form effective date: Ask a subject matter expert about employer unemployment insurance responsibilities. How to submit wage reports and payments.

An Employment Verification Letter, Or Proof Of Income, Verifies The Income Or Salary Earned By An Employed Individual.

This type of verification is commonly used when someone is. Web employer's wage verification form (pursuant to nrs 616c.045(2)(d)) please provide the following information for the employee named below by completing this form. A wage verification form may be used by any private or public organization seeking the confirmation of income by an individual. The document must be filled in by the employer providing information related to the employee’s work schedule, hours worked per week (on average), hourly rate ($/hr).

Web This Form Must Be Completed By Youremployer And Returned To The Addressat The Right Within 10 Business Days.

Web in accordance with the provisions of 1939 p.a. Web notice and acknowledgement of pay rate and payday under section 195.1 of the new york state labor law notice for hourly rate employees ls 54 is a blank work agreement that contains all of the fields that employers must include to notify each employee in writing of conditions of employment at time of commitment to hire. The information is needed so that the amount of disability compensation to which your employee is entitled may be calculated. Quarterly wage report requirements and due dates.

![What Is a Wage Verification? [ importance, Tips, Steps ]](https://images.sampleforms.com/wp-content/uploads/2017/08/employee-wage-verification-form-1.jpg)

![What Is a Wage Verification? [ importance, Tips, Steps ]](https://images.sampleforms.com/wp-content/uploads/2017/08/wage-and-salary-verification-form-2.jpg)