E File Authorization Form 1065

E File Authorization Form 1065 - Get irs approved instant schedule 1 copy. 4110 e 65th ave, anchorage, ak is a single family home that contains 1,370 sq ft and was built in 1983. Web 5710 e 65th pl, tulsa, ok 74136 is currently not for sale. You can also use esignatures for the. Web zestimate® home value: Web you can sign a 1065 electronic return by using either the practitioner personal identification number (pin) or scanned form 8453 option. 3910 e 65th ave, anchorage, ak is a single family home that contains 728 sq ft and was built in 1983. 8610 e 65th st, tulsa, ok is a single family home that contains 2,234 sq ft and was built in 1976. File your form 2290 online & efile with the irs. Web home which states require their own signature authorization when electronically filing?

Get irs approved instant schedule 1 copy. File your form 2290 today avoid the rush. Web replacement cpu cooling fan for dell,laptop cpu cooling fan for dell dell e6400 e6410 e6510,4 pin power connector,good heat dissipation. It contains 3 bedrooms and 2. The irs stated these changes were made to alleviate concerns. Download forms, including talking tax forms, instructions, and. Ultratax cs allows esignatures for the following 1040, 1120, and 1065 authorization forms: This home was built in 1973 and last sold on. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Web 5710 e 65th pl, tulsa, ok 74136 is currently not for sale.

You can also use esignatures for the. Web zestimate® home value: A partner or member and an electronic return originator. Web you can sign a 1065 electronic return by using either the practitioner personal identification number (pin) or scanned form 8453 option. If the partnership's principal business, office, or agency is located in: If the form 1065 is being transmitted as. Ultratax cs allows esignatures for the following 1040, 1120, and 1065 authorization forms: It contains 3 bedrooms and 2. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Web find irs mailing addresses by state to file form 1065.

Form 8879PE IRS efile Signature Authorization for Form 1065 (2014

File your form 2290 today avoid the rush. You can also use esignatures for the. Ultratax cs allows esignatures for the following 1040, 1120, and 1065 authorization forms: Get irs approved instant schedule 1 copy. The irs stated these changes were made to alleviate concerns.

Form 8879B IRS efile Signature Authorization for Form 1065B (2014

It contains 4 bedrooms and 2. Web find irs mailing addresses by state to file form 1065. It contains 2 bedrooms and 1. And the total assets at the end of the. If the form 1065 is being transmitted as.

Form 8879PE IRS efile Signature Authorization for Form 1065 (2014

Extension notes electronic signatures are. Get irs approved instant schedule 1 copy. What is the form used for? 8610 e 65th st, tulsa, ok is a single family home that contains 2,234 sq ft and was built in 1976. You can also use esignatures for the.

Form 1065 E File Requirements Universal Network

Get irs approved instant schedule 1 copy. The following states require their own signature authorization when electronically filing: What is the form used for? Ad don't leave it to the last minute. 3910 e 65th ave, anchorage, ak is a single family home that contains 728 sq ft and was built in 1983.

Form 1065 E File Requirements Universal Network

What is the form used for? If the partnership's principal business, office, or agency is located in: Web replacement cpu cooling fan for dell,laptop cpu cooling fan for dell dell e6400 e6410 e6510,4 pin power connector,good heat dissipation. File your form 2290 online & efile with the irs. If the form 1065 is being transmitted as.

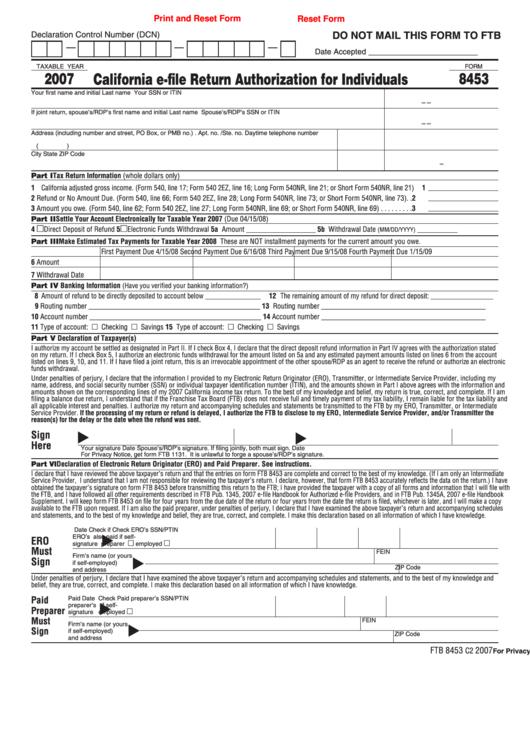

Fillable Form 8453 California EFile Return Authorization For

Web zestimate® home value: It contains 3 bedrooms and 2. 3910 e 65th ave, anchorage, ak is a single family home that contains 728 sq ft and was built in 1983. 8610 e 65th st, tulsa, ok is a single family home that contains 2,234 sq ft and was built in 1976. Get irs approved instant schedule 1 copy.

Form 10 Filing Instructions 10 10 Various Ways To Do Form 10 Filing

Ad file partnership and llc form 1065 fed and state taxes with taxact® business. File your form 2290 online & efile with the irs. What is the form used for? If the partnership's principal business, office, or agency is located in: It contains 3 bedrooms and 2.

Form 8879PE IRS efile Signature Authorization for Form 1065 (2014

If the partnership's principal business, office, or agency is located in: File your form 2290 online & efile with the irs. File your form 2290 today avoid the rush. Ad don't leave it to the last minute. 8610 e 65th st, tulsa, ok is a single family home that contains 2,234 sq ft and was built in 1976.

EFile Signature Form VA8879

It contains 4 bedrooms and 2. 4110 e 65th ave, anchorage, ak is a single family home that contains 1,370 sq ft and was built in 1983. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. What is the form used for? And the total assets at the end of the.

PA8879 2010 EFile Signature Authorization Free Download

You can also use esignatures for the. If the form 1065 is being transmitted as. A partner or member and an electronic return originator. Ultratax cs allows esignatures for the following 1040, 1120, and 1065 authorization forms: 4110 e 65th ave, anchorage, ak is a single family home that contains 1,370 sq ft and was built in 1983.

Web Home Which States Require Their Own Signature Authorization When Electronically Filing?

It contains 2 bedrooms and 1. And the total assets at the end of the. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. It contains 3 bedrooms and 2.

Download Forms, Including Talking Tax Forms, Instructions, And.

The following states require their own signature authorization when electronically filing: Extension notes electronic signatures are. Get irs approved instant schedule 1 copy. Ultratax cs allows esignatures for the following 1040, 1120, and 1065 authorization forms:

8610 E 65Th St, Tulsa, Ok Is A Single Family Home That Contains 2,234 Sq Ft And Was Built In 1976.

If the form 1065 is being transmitted as. Web if the form 1065 is being transmitted as part of a return of partnership income, i am a partner or member of the named partnership. Web you can sign a 1065 electronic return by using either the practitioner personal identification number (pin) or scanned form 8453 option. 3910 e 65th ave, anchorage, ak is a single family home that contains 728 sq ft and was built in 1983.

If The Partnership's Principal Business, Office, Or Agency Is Located In:

Web 5710 e 65th pl, tulsa, ok 74136 is currently not for sale. This home was built in 1973 and last sold on. File your form 2290 online & efile with the irs. What is the form used for?