Donation Form For Nonprofit

Donation Form For Nonprofit - Use a quality online fundraising platform to build your donation form. Web donation form best practices for your nonprofit 1. It can also drive donors away if it’s hard to understand. Web updated june 03, 2022. Web boost your online fundraising with tools for nonprofits of every size. Web a donation form can help nonprofits educate and convince donors to give more than they initially planned. In this post, we’ll give you some tips to build a form that works and provide you with examples and templates to get you started on the right track. You may also like item donation forms. Often a receipt detailing the. Web the following donation form examples for nonprofits stand out for their quality and creativity.

You may also like item donation forms. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. A nonprofit mission statement is a powerful marketing tool, but organizations often. Web a donation form can help nonprofits educate and convince donors to give more than they initially planned. Web the following donation form examples for nonprofits stand out for their quality and creativity. A 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. It can also drive donors away if it’s hard to understand. Current revision form 8283 pdf instructions for form 8283 ( print version pdf) recent developments In this post, we’ll give you some tips to build a form that works and provide you with examples and templates to get you started on the right track. First, you must choose the right digital.

Web updated june 03, 2022. In this post, we’ll give you some tips to build a form that works and provide you with examples and templates to get you started on the right track. From adding a donate button to your homepage to creating a customized donation process, we offer a wide range of online fundraising tools to help organizations. Current revision form 8283 pdf instructions for form 8283 ( print version pdf) recent developments First, you must choose the right digital. Web the following donation form examples for nonprofits stand out for their quality and creativity. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. It can also drive donors away if it’s hard to understand. Web donation form best practices for your nonprofit 1. A 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more.

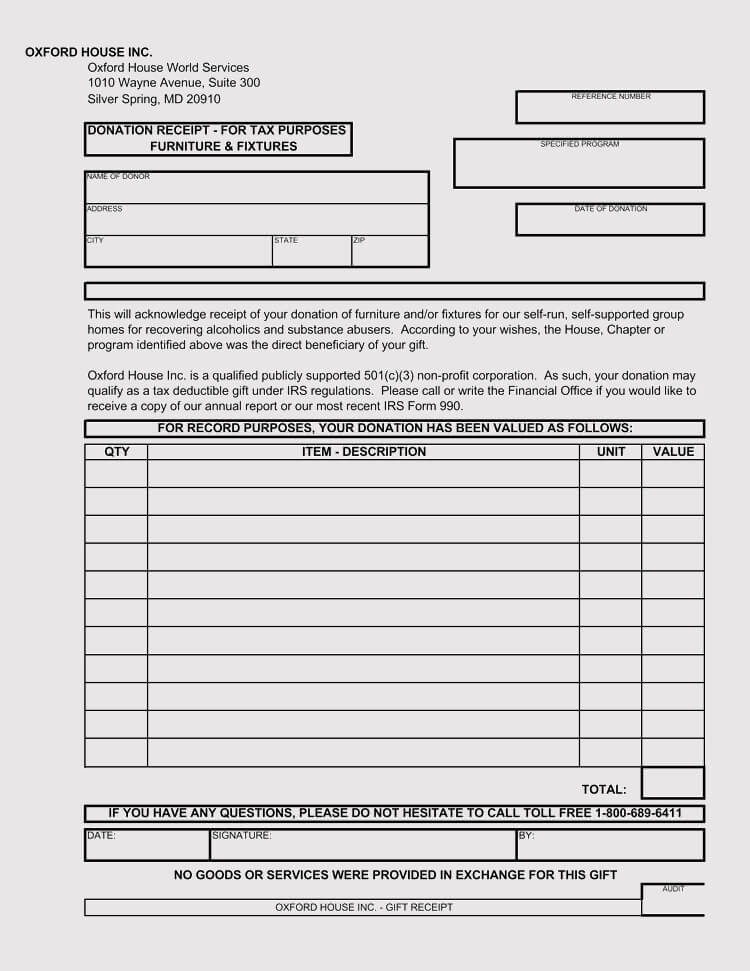

45+ Free Donation Receipt Templates (501c3, NonProfit, Charity)

From adding a donate button to your homepage to creating a customized donation process, we offer a wide range of online fundraising tools to help organizations. In this post, we’ll give you some tips to build a form that works and provide you with examples and templates to get you started on the right track. Web individuals, partnerships, and corporations.

Nonprofit Donation Receipt Template Best Of Non Profit Donation Receipt

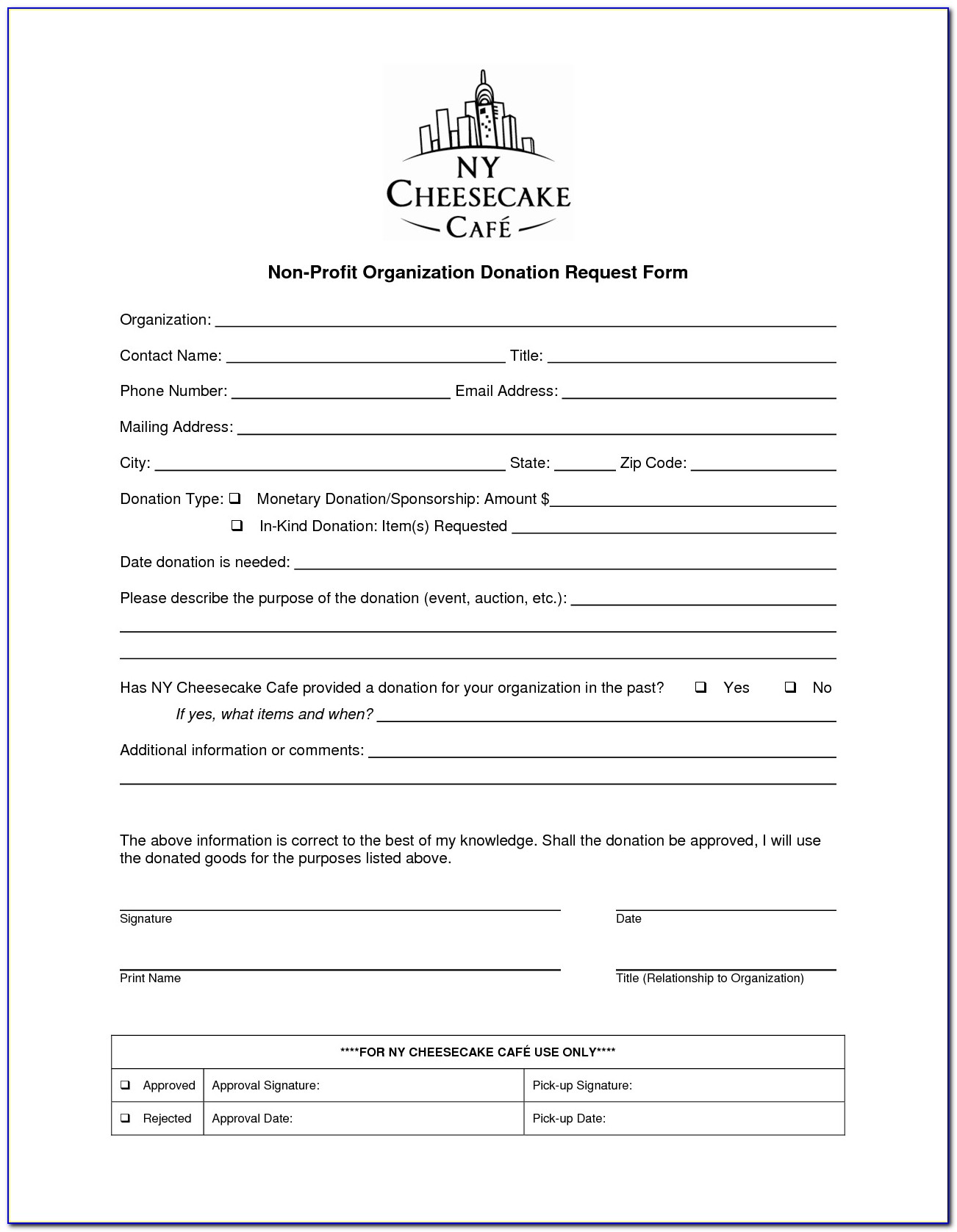

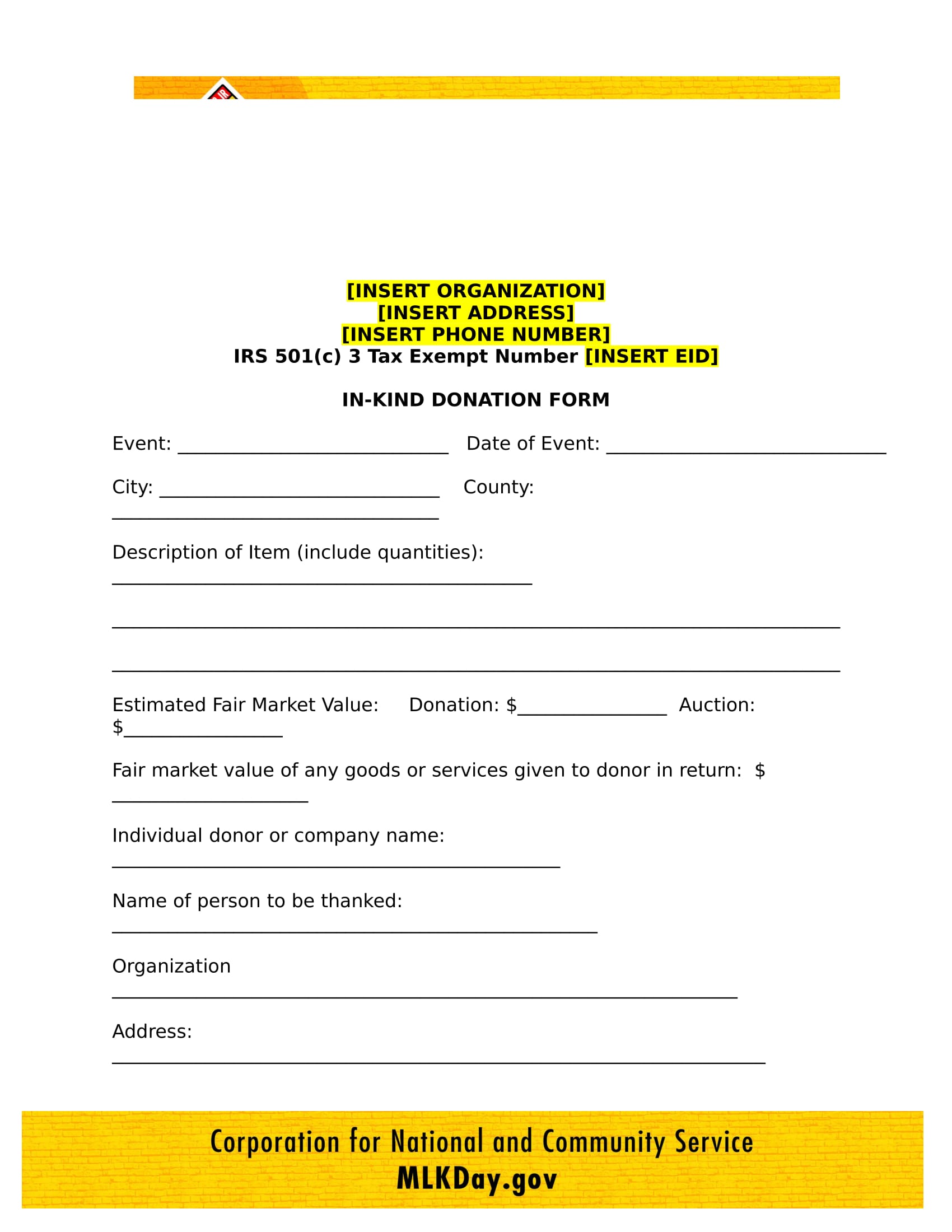

Current revision form 8283 pdf instructions for form 8283 ( print version pdf) recent developments Donors that click on a donation request form are interested in giving, but that doesn’t mean they. The quantity of each item along with its fair market value should also be stated on the form. From adding a donate button to your homepage to creating.

Irs Nonprofit Form Form Resume Examples qlkmR14Daj

Web boost your online fundraising with tools for nonprofits of every size. Web individuals, partnerships, and corporations file form 8283 to report information about noncash charitable contributions when the amount of their deduction for all noncash gifts is more than $500. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to.

FREE 4+ Nonprofit Donation Forms in PDF MS Word

Web individuals, partnerships, and corporations file form 8283 to report information about noncash charitable contributions when the amount of their deduction for all noncash gifts is more than $500. Web a donation form can help nonprofits educate and convince donors to give more than they initially planned. Web boost your online fundraising with tools for nonprofits of every size. Web.

Non Profit Donation Receipt Templates at

It can also drive donors away if it’s hard to understand. Web donation form best practices for your nonprofit 1. In this post, we’ll give you some tips to build a form that works and provide you with examples and templates to get you started on the right track. Donors that click on a donation request form are interested in.

Non Profit Receipt Template Awesome Charitable Donation Receipt

In this post, we’ll give you some tips to build a form that works and provide you with examples and templates to get you started on the right track. Often a receipt detailing the. From adding a donate button to your homepage to creating a customized donation process, we offer a wide range of online fundraising tools to help organizations..

Donor Pledge form Template Inspirational Donation form Template for

Current revision form 8283 pdf instructions for form 8283 ( print version pdf) recent developments Web browse our donation form template examples for charitable requests, nonprofit pledges, donation boards, fundraising packets, proposals + more! Use a quality online fundraising platform to build your donation form. A 501 (c) (3) donation receipt is required to be completed by charitable organizations when.

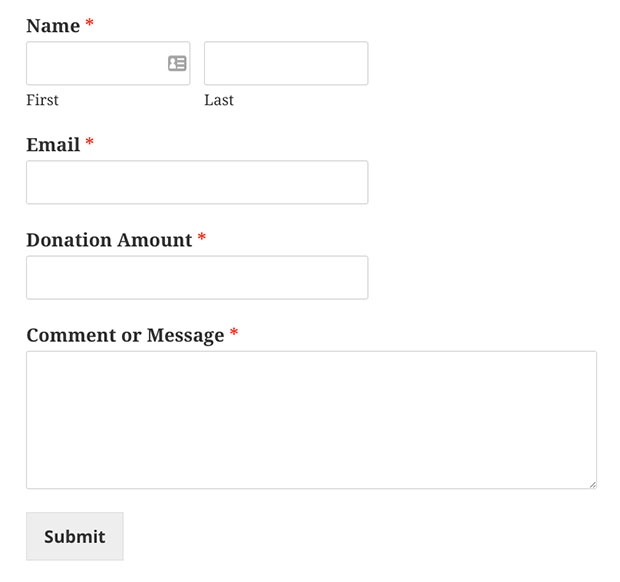

How to Create a Nonprofit Donation Form in WordPress

Web donation form best practices for your nonprofit 1. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. You may also like item donation forms. Web the following donation form examples for nonprofits stand out for their quality and creativity. Often a receipt.

Donation Pledge form Template New Donation Pledge Card Template Sample

The quantity of each item along with its fair market value should also be stated on the form. Web a donation form can help nonprofits educate and convince donors to give more than they initially planned. Current revision form 8283 pdf instructions for form 8283 ( print version pdf) recent developments First, you must choose the right digital. Web donation.

Free Donation Receipt Template 501(c)(3) PDF Word eForms

Web browse our donation form template examples for charitable requests, nonprofit pledges, donation boards, fundraising packets, proposals + more! Use a quality online fundraising platform to build your donation form. Web individuals, partnerships, and corporations file form 8283 to report information about noncash charitable contributions when the amount of their deduction for all noncash gifts is more than $500. Web.

Web Browse Our Donation Form Template Examples For Charitable Requests, Nonprofit Pledges, Donation Boards, Fundraising Packets, Proposals + More!

A 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. Web how to create a donation request form that works 1. You may also like item donation forms. Current revision form 8283 pdf instructions for form 8283 ( print version pdf) recent developments

Web The Following Donation Form Examples For Nonprofits Stand Out For Their Quality And Creativity.

From adding a donate button to your homepage to creating a customized donation process, we offer a wide range of online fundraising tools to help organizations. Web updated june 03, 2022. Web individuals, partnerships, and corporations file form 8283 to report information about noncash charitable contributions when the amount of their deduction for all noncash gifts is more than $500. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction.

A Nonprofit Mission Statement Is A Powerful Marketing Tool, But Organizations Often.

Donors that click on a donation request form are interested in giving, but that doesn’t mean they. Often a receipt detailing the. It can also drive donors away if it’s hard to understand. Web donation form best practices for your nonprofit 1.

Embed Your Donation Page Into Your Website.

When supporters visit your website, your online donation page should be. Use a quality online fundraising platform to build your donation form. In this post, we’ll give you some tips to build a form that works and provide you with examples and templates to get you started on the right track. Web a donation form can help nonprofits educate and convince donors to give more than they initially planned.